AIC 2016 Projected Rate Meeting Presentation

advertisement

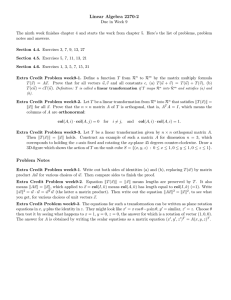

2016 Attachment O Projection Stakeholder Meeting Ameren Illinois Company September 24, 2015 AGENDA Main Purpose is to review AIC 2016 Projected Transmission Rate Calculations • Timeline • AIC 2016 Projected Calculations • • • • Attachment O Attachment GG Attachment MM 2016 AMIL Pricing Zone NITS Charge 2 NEW PROTOCOL TIMELINE Schedule (Forward-Looking Protocols) Date June 1 Posting of annual true-up for prior year September 1 Deadline for annual true-up meeting September 1 Posting of net projected revenue requirement for following year October 15 Deadline for annual projected rate meeting November 1 Deadline for joint meeting on regional cost-shared projects March 15 Transmission Owners submit informational filing to the Commission 3 AIC Revenue Requirement Projected 2015 vs Projected 2016 4 AIC 2016 PROJECTED RATE BASE Page.Line 2.6 2.12 2.18 Total Gross Plant Total Accum Depreciation TOTAL NET PLANT 2.18a 100% CWIP RECOVERY 2.20 2.21 2.22 2.23 2.25 2.26 2.27 2.28 ADJUSTMENTS TO RATE BASE Account No. 282 Account No. 283 Account No. 190 Account No. 255 Land Held for Future Use CWC Materials & Supplies Prepayments TOTAL ADJUSTMENTS 2.30 TOTAL RATE BASE Jan-15 1,597,243,472 480,701,771 1,116,541,701 Jan-16 1,938,342,678 502,413,116 1,435,929,562 Change 341,099,206 21,711,345 319,387,860 Percent 21% 5% 29% 27,739,705 42,507,018 14,767,313 53% -285,677,648 -25,147,591 38,348,097 0 1,209,908 5,525,584 10,110,433 1,538,083 -254,093,135 -368,700,067 -6,071,756 41,586,396 0 2,363,868 5,834,598 12,101,199 1,491,166 -311,394,596 0 -83,022,419 19,075,835 3,238,299 0 1,153,960 309,014 1,990,766 -46,917 -57,301,462 N/A 29% -76% 8% N/A 95% 6% 20% -3% 23% 890,188,272 1,167,041,984 276,853,712 31% 5 AIC 2016 PROJECTED EXPENSES Jan-15 Page.Line Jan-16 Change Percent 3.1 3.1a 3.2 3.3 3.4 3.5 3.5a 3.8 O&M Transmission Less LSE Expenses Less Account 565 A&G Less FERC Annual Fees Less EPRI, ect. Plus Trans. Reg. Comm. Exp TOTAL O&M 41,012,814 1,685,383 9,206,193 14,085,792 0 356,844 354,483 44,204,670 47,078,280 1,495,616 13,231,075 14,176,890 0 362,566 510,870 46,676,783 6,065,466 -189,767 4,024,882 91,098 0 5,722 156,386 2,472,114 15% -11% 44% 1% N/A 2% 44% 6% 3.12 TOTAL DEPRECIATION 28,851,740 35,645,227 6,793,487 24% 3.13 3.16 3.18 3.27 TAXES Payroll Property Other Income Taxes TOTAL TAXES 944,247 1,132,036 378,748 39,706,388 42,161,419 892,102 1,216,554 421,926 50,317,510 52,848,091 -52,145 84,517 43,178 10,611,122 10,686,672 -6% 7% 11% 27% 25% 115,217,829 135,170,102 19,952,273 17% TOTAL EXPENSES 6 AIC 2016 PROJECTED CAPITAL STRUCTURE Capital Structure - 2015 Projection Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total $ 2,210,270,314 61,721,350 2,646,273,821 4,918,265,485 % 44.9% 1.3% 53.8% 100.0% Cost Weighted 0.0594 0.0267 0.0490 0.0006 0.1238 0.0666 0.0939 46.9% 1.2% 51.9% 100.0% Cost Weighted 0.0570 0.0267 0.0490 0.0006 0.1238 0.0643 0.0916 Capital Structure - 2016 Projection Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total Change in Return $ 2,436,021,670 61,721,350 2,698,856,348 5,196,599,368 % -0.2323% 7 AIC 2016 PROJECTED TOTAL REVENUE REQUIREMENT 2.30 4.30 3.28 TOTAL RATE BASE Rate of Return Return Jan-15 890,188,272 9.39% 83,616,156 3.29 Total Expenses TOTAL GROSS REV. REQ. 115,217,829 198,833,985 135,170,102 242,079,969 19,952,273 43,245,984 17% 22% 3.30 3.30a 3.31 Less ATT. GG Adjustment Less ATT. MM Adjustment GROSS REV. REQ. UNDER ATT. O 10,174,129 5,684,131 182,975,725 14,763,974 11,937,011 215,378,985 4,589,845 6,252,879 32,403,260 45% 110% 18% Page.Line Jan-16 1,167,041,984 9.16% 106,909,867 Change 276,853,712 -0.23% 23,293,711 Percent 31% -2% 28% 8 AIC 2016 PROJECTED TRUE UP & NET REVENUE REQUIREMENT 1.1 1.6 Gross Revenue Requirement Total Revenue Credits Jan-15 182,975,725 12,163,781 1.6a 1.6b 1.6c 1.6d 1.6e Historic Year Actual ATRR Projected ATRR from Prior Year Prior Year ATRR True-Up Prior Year Divisor True-Up Interest on Prior Year True-Up 123,689,426 133,507,911 -9,818,485 -822,872 -691,603 153,102,512 143,000,924 10,101,588 -3,254,838 43,217 29,413,086 9,493,013 19,920,073 -2,431,966 734,820 24% 7% -203% 296% -106% 1.7a 1.7b 1.7 NET REVENUE REQUIREMENT Prairie Power AIC Adjusted Revenue Requirement 159,478,984 0 159,478,984 208,895,649 0 208,895,649 49,416,665 0 49,416,665 31% N/A 31% Page.Line Jan-16 215,378,985 13,373,302 Change 32,403,260 1,209,521 Percent 18% 10% 9 AIC 2014 ATTACHMENT O TRUE UP Ameren Illinois Company - AIC Attachment O Revenue Requirement True-Up Year Ended December 31, 2014 Attachment O Net Actual Revenue Requirement (2014 Actual Attachment O, Pg 1, Line 7a) $ 153,102,512 Net Projected Revenue Requirement (2014 Projected Attachment O, Pg 1, Line 7a) $ 143,000,924 Under/(Over) Recovery of Net Revenue Requirement $ 10,101,588 Historic Year Actual Divisor for Pricing Zone (2014 Actual Attachment O, Pg 1, Line 15) Projected Year Divisor for Pricing Zone (2014 Projected Attachment O, Pg 1, Line 15) Difference between Historic & Projected Yr Divisor Prior Year Projected Annual Cost ($ per kw per yr) Prior Year Under/(Over) Divisor True-up $ $ 7,205,351 7,045,000 160,351 20.2982 (3,254,838) Total Under/(Over) Recovery $ 6,846,750 Monthly Interest Rate (updated through July, 2015) Interest For 24 Months $ Total Under/(Over) Recovery Including Interest $ 0.0263% 43,217 6,889,966 10 AIC 2016 PROJECTED ATTACHMENT GG AIC Attachment GG Calculation - Page 1 (1) Line No. 1 Gross Transmission Plant - Total 2 Net Transmission Plant - Total 3 O&M EXPENSE Total O&M Allocated to Transmission 4 Annual Allocation Factor for O&M (2) Attachment O Page, Line, Col. (3) (4) Transmission Allocator Attach O, p 2, line 2 col 5 (Note A) 1,917,040,601 Attach O, p 2, line 14 and 23b col 5 (Note B) 1,436,058,340 Attach O, p 3, line 8 col 5 (line 3 divided by line 1 col 3) 46,676,783 2.43% 2.43% Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) 4,409,668 0.23% 0.23% 2,530,581 0.13% 0.13% GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE 5 6 Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 7 8 TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 9 Annual Allocation Factor for Expense Sum of line 4, 6, and 8 10 11 INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 50,317,510 3.50% 3.50% 12 13 RETURN Return on Rate Base Annual Allocation Factor for Return on Rate Base Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 106,909,867 7.44% 7.44% 14 Annual Allocation Factor for Return Sum of line 11 and 13 2.80% 10.95% 11 AIC 2016 PROJECTED ATTACHMENT GG AIC Attachment GG Calculation - Page 2 (1) Line No. 1a 1b 1c 1d 1e 1f Project Name Wood River-Roxford 1502 138kV line Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line Brokaw - South Bloomington 345/138kV Transformer & line extension Fargo-Mapleridge-20 mile 345kV line & New Sub (1) Line No. 1a 1b 1c 1d 1e 1f Project Name Wood River-Roxford 1502 138kV line Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line Brokaw - South Bloomington 345/138kV Transformer & line extension Fargo-Mapleridge-20 mile 345kV line & New Sub (2) (3) (4) (5) (6) MTEP Project Number Project Gross Plant Annual Allocation Factor for Expense Annual Expense Charge Project Net Plant (Note C) (Page 1 line 9) (Col. 3 * Col. 4) (Note D) 728 870 2829 2068 2069 2472 (2) MTEP Project Number 728 870 2829 2068 2069 2472 $ $ $ $ $ $ 3,424,487 5,994,479 5,592,558 23,567,231 29,776,042 30,285,967 2.80% 2.80% 2.80% 2.80% 2.80% 2.80% $95,778.27 $167,657.47 $156,416.28 $659,143.57 $832,795.62 $847,057.53 $ $ $ $ $ $ 2,941,428 5,095,420 5,046,129 22,559,921 29,271,494 30,149,872 (7) Annual Allocation Factor for Return (8) (9) (10) (11) (12) Annual Return Charge Project Depreciation Expense Annual Revenue Requirement True-Up Adjustment Network Upgrade Charge (Page 1 line 14) (Col. 6 * Col. 7) (Note E) (Sum Col. 5, 8 & 9) (Note F) Sum Col. 10 & 11 (Note G) 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% $322,043.33 $557,873.94 $552,477.30 $2,469,981.27 $3,204,800.32 $3,300,969.87 $52,500 $99,720 $98,904 $398,220 $477,312 $470,323 $470,321.60 $825,251.41 $807,797.58 $3,527,344.85 $4,514,907.94 $4,618,350.76 2 Annual Totals $14,763,974 3 Rev. Req. Adj For Attachment O $14,763,974 $ $ $ $ $ $ (20,657) (45,173) (2,536) 262,869 - $194,503 449,665 780,078 805,262 3,790,214 4,514,908 4,618,351 $14,958,477 12 AIC 2014 ATTACHMENT GG TRUE-UP AIC 2014 Attachment GG True Up (a) (b) (c) (d) (e) Line Project MTEP Project Actual Attachment GG No. Name Number Revenues 1 Actual Attachment GG revenues for True-Up Year 1 2a Wood River-Roxford 1502 138kV line 2b 2c 2d 2e 2f Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line Brokaw-S. Bloom 345/138kV Trans & 345kV line Fargo-Mapleridge-20 mile 345kV line & New Sub 3 Subtotal $ (g) (h) (i) (j) (k) Projected Annual Revenue (f) Actual Attachment GG Revenues Allocated Actual Annual Revenue True-Up Adjustment Principal Applicable Interest Rate on True-Up Adjustment Interest Total True-Up Requirement 1 Projected Attachment GG to Projects 1 [Col. (d), line 1 x (Col. (e), line 2x / Requirement 1 Actual Attachment GG Under/(Over) Under/(Over) Under/(Over) Adjustment p 2 of 2, Col. 102 Col. (e), line 3)]2 p 2 of 2, Col. 102 Col. (g) - Col. (f) Line 5 1 2 x 24 months 2 Col. (h) + Col. (j) 5,755,759 728 527,494 545,315 524,788 (20,527) 0.0263% (130) (20,657) 870 2829 2068 2069 2472 935,340 873,483 3,231,345 - 966,939 902,993 3,340,512 - 922,049 900,473 3,601,732 - (44,890) (2,520) 261,220 - 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% (283) (16) 1,649 - (45,173) (2,536) 262,869 - 5,755,759 $ 5,949,042 1,220 $ 194,503 $ 5,567,662 $ 4 Under/(Over) Recovery 5 Applicable Interest rate per month (expressed to four decimal places) Col. (h) x Col. (i) $ Interest Rate updated through July 2015 193,283 $ 0.0263% Amount excludes True-Up Adjustment, as reported in True-Up Year projected Attachment GG, page 2, column 11. Rounded to whole dollars. 13 AIC 2016 PROJECTED ATTACHMENT MM AIC Attachment MM Calculation - Page 1 (1) Line No. 1 1a 2 Gross Transmission Plant - Total Transmission Accumulated Depreciation Net Transmission Plant - Total 3 3a 3b 3c 3d O&M TRANSMISSION EXPENSE Total O&M Allocated to Transmission Transmission O&M Less: LSE Expenses included in above, if any Less: Account 565 included in above, if any Adjusted Transmission O&M 4 Annual Allocation Factor for Transmission O&M 4a 4b OTHER O&M EXPENSE Other O&M Allocated to Transmission Annual Allocation Factor for Other O&M (2) Attachment O Page, Line, Col. Attach O, p 2, line 2 col 5 (Note A) Attach O, p 2, line 8 col 5 Line 1 minus Line 1a (Note B) Attach O, p 3, line 8 col 5 Attach O, p 3, line 1 col 5 Attach O, p 3, line 1a col 5, if any Attach O, p 3, line 2 col 5, if any Line 3a minus Line 3b minus Line 3c (Line 3d divided by line 1a, col 3) (3) (4) Transmission Allocator 1,917,040,601 480,982,260 1,436,058,340 46,676,783 47,078,280 1,495,616 13,231,075 32,351,589 6.73% 6.73% 14,325,194 0.75% 0.75% Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) 4,409,668 0.23% 0.23% Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 2,530,581 0.13% 0.13% 1.11% 1.11% Line 3 minus Line 3d Line 4a divided by Line 1, col 3 GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE 5 6 Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 7 8 TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes 9 Annual Allocation Factor for Other Expense 10 11 INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 50,317,510 3.50% 3.50% 12 13 RETURN Return on Rate Base Annual Allocation Factor for Return on Rate Base Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 106,909,867 7.44% 7.44% 14 Annual Allocation Factor for Return Sum of line 4b, 6, and 8 Sum of line 11 and 13 10.95% 14 AIC 2016 PROJECTED ATTACHMENT MM AIC Attachment MM Calculation - Page 2 Line No. (1) (2) (3) (4) Project Name MTEP Project Number Project Gross Plant Project Accumulated Depreciation (Note C) Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP 1b Pana-Sugar Creek - Plant in Service 1c Pana-Sugar Creek - Land 1d Sidney-Rising - CWIP 1e Sidney-Rising - Plant in Service 1f Palmyra-Pawnee - CWIP 1g Palmyra-Pawnee - Plant in Service 1h Fargo-Galesburg-Oak Grove - CWIP 1i Fargo-Galesburg-Oak Grove - Plant in Service 1j Pawnee-Pana - CWIP 1k Pawnee-Pana - Plant in Service Line No. 2237 2237 2237 2239 2239 3017 3017 3022 3022 3169 3169 $ $ $ $ $ $ $ $ $ $ $ 18,938,437 20,602,126 15,627 301,094 5,981,345 14,184,258 17,212,417 204,390 3,184,794 8,878,841 3,406,077 (5) (6) Transmission Annual Allocation O&M Annual for Transmission Allocation Factor O&M Expense Page 1 line 4 $ $ $ $ $ $ $ $ $ $ $ 190,724 63,770 337,918 30,923 12,204 6.73% 6.73% 6.73% 6.73% 6.73% 6.73% 6.73% 6.73% 6.73% 6.73% 6.73% (7) Other Expense Annual Allocation Annual Allocation Factor for Other Expense (Col 4 * Col 5) $ $ $ $ $ $ $ $ $ $ $ (8) Page 1 line 9 12,828 4,289 22,729 2,080 821 1.11% 1.11% 1.11% 1.11% 1.11% 1.11% 1.11% 1.11% 1.11% 1.11% 1.11% (Col 3 * Col 7) $ $ $ $ $ $ $ $ $ $ $ 210,081 228,536 173 3,340 66,350 157,344 190,935 2,267 35,328 98,492 37,783 (1) (2) (9) (10) (11) (12) (13) (14) (15) (16) Project Name MTEP Project Number Annual Expense Charge Project Net Plant Annual Allocation Factor for Return Annual Return Charge Project Depreciation Expense Annual Revenue Requirement True-Up Adjustment MVP Annual Adjusted Revenue Requirement (Col 6 + Col 8) (Col 3 - Col 4) (Page 1 line 14) (Col 10 * Col 11) (Note E) (Sum Col. 9, 12 & 13) (Note F) Sum Col. 14 & 15 (Note G) Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP 1b Pana-Sugar Creek - Plant in Service 1c Pana-Sugar Creek - Land 1d Sidney-Rising - CWIP 1e Sidney-Rising - Plant in Service 1f Palmyra-Pawnee - CWIP 1g Palmyra-Pawnee - Plant in Service 1h Fargo-Galesburg-Oak Grove - CWIP 1i Fargo-Galesburg-Oak Grove - Plant in Service 1j Pawnee-Pana - CWIP 1k Pawnee-Pana - Plant in Service 2237 2237 2237 2239 2239 3017 3017 3022 3022 3169 3169 $ $ $ $ $ $ $ $ $ $ $ 210,081 241,365 173 3,340 70,639 157,344 213,664 2,267 37,408 98,492 38,604 $ $ $ $ $ $ $ $ $ $ $ 18,938,437 20,411,401 15,627 301,094 5,917,575 14,184,258 16,874,498 204,390 3,153,872 8,878,841 3,393,874 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% 10.95% $ $ $ $ $ $ $ $ $ $ $ 2,073,482 2,234,750 1,711 32,965 647,888 1,552,969 1,847,511 22,378 345,303 972,103 371,580 $ $ $ $ $ $ $ $ $ $ $ 315,008 107,339 243,379 43,748 51,521 $ $ $ $ $ $ $ $ $ $ $ 2,283,563 2,791,122 1,884 36,305 825,866 1,710,313 2,304,553 24,645 426,459 1,070,595 461,704 2 MVP Total Annual Revenue Requirements $11,937,011 3 Rev. Req. Adj For Attachment O $11,937,011 $ $ $ $ $ $ $ $ $ $ $ 102,017 4,466 1,527 12,200 829,982 263,842 9 3,177 - $1,217,220 $ $ $ $ $ $ $ $ $ $ $ 2,385,580 2,795,588 3,411 48,505 825,866 2,540,295 2,568,395 24,654 426,459 1,073,772 461,704 $13,154,231 15 AIC 2014 ATTACHMENT MM TRUE-UP AIC 2014 Attachment MM True Up (a) Line No. (b) (c) (d) (e) Project Name MTEP Project Number Actual Attachment MM Revenues Projected Annual Revenue Requirement 1 Projected Attachment MM p 2 of 2, Col. 142 (f) Actual Attachment MM Revenues Allocated to Projects 1 [Col. (d), line 1 x (Col. (e), line 2x / Col. (e), line 3)]2 1 Actual Attachment MM revenues for True-Up Year 2a 2b 2c 2d 2e 2f 2g 2h 2i 2j 2k Pana-Sugar Creek - CWIP Pana-Sugar Creek - Plant in Service Pana-Sugar Creek - Land Sidney-Rising - CWIP Sidney-Rising - Plant in Service Palmyra-Pawnee - CWIP Palmyra-Pawnee - Plant in Service Fargo-Galesburg-Oak Grove - CWIP Fargo-Galesburg-Oak Grove - Plant Pawnee-Pana - CWIP Pawnee-Pana - Plant in Service 3 Subtotal 4 Under/(Over) Recovery 5 Applicable Interest rate per month (expressed to four decimal places) 1 Amount excludes True-Up Adjustment, as reported in True-Up Year projected Attachment MM, page 2, column 15. Rounded to whole dollars. 2 1 $ (g) (h) (i) (j) (k) Actual Annual Revenue Requirement 1 Actual Attachment MM p 2 of 2, Col. 142 True-Up Adjustment Principal Under/(Over) Applicable Interest Rate on Under/(Over) True-Up Adjustment Interest Under/(Over) Total True-Up Adjustment Col. (g) - Col. (f) Line 5 Col. (h) x Col. (i) x 24 months 2 Col. (h) + Col. (j) - 2237 2237 2237 2239 2239 3017 3017 3022 3022 3169 3169 - $ - - $ - 101,377 4,438 1,517 12,123 824,776 262,187 9 3,157 - $ 101,377 4,438 1,517 12,123 824,776 262,187 9 3,157 - 640 28 10 77 5,206 1,655 20 - 102,017 4,466 1,527 12,200 829,982 263,842 9 3,177 - 1,209,584 $ Interest Rate updated through July 2015 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 0.0263% 1,209,584 $ 7,636 $ 1,217,220 0.0263% 16 AMIL PRICING ZONE SCHEDULE 9 CHARGE Page.Line 1.7 1.7 1.7 1.15 . . AIC Adjusted Revenue Requirement ATXI Adjusted Revenue Requirement PPI Adjusted Revenue Requirement * Total Revenue Requirement Ameren Illinois Divisor Annual Cost ($/kW/Yr) Network & P-to-P Rate ($/kW/Mo) Jan-15 159,478,984 9,851,594 3,863,036 173,193,614 7,095,335 24.410 2.034 Jan-16 208,895,649 8,495,791 4,421,778 221,813,218 7,118,197 31.161 2.597 Change 49,416,665 -1,355,803 558,742 48,619,604 22,861 6.752 0.563 Percent 31% -14% 14% 28% 0% 28% 28% * PPI uses a historical Attachment O which is updated June 1st each year. The amount shown for 2015 is the ATRR revised in effective 6/1/14. The amount shown for 2016 is the ATRR effective 6/1/15. PPI has filed at FERC to begin using forward looking Attachment O effective 1/1/16. However, the new ATRR is not posted yet. 17 AIC 2016 PROJECTED MVP SPEND Ameren MVPs Ameren Name 2016 CAPEX MTEP #s MTEP Description Illinois Rivers $53.1 million 2237 2239 3017 3169 Pana - Mt. Zion - Kansas - Sugar Creek 345 kV line Sidney to Rising 345 kV line Palmyra-Quincy-Meredosia - Ipava & Meredosia-Pawnee 345 kV Line Pawnee to Pana - 345 kV Line Spoon River $.9 million 3022 Fargo-Galesburg-Oak Grove 345 kV Line 18 2016 PROJECTED SIGNIFICANT TRANSMISSION PROJECTS Project Name Illinois Rivers Fargo - Mapleridge Pinckneyville - West Frankfort Grand Tower - Makanda Cahokia - Buck Knob Sidney - Bunsonville Macomb West Tap Brokaw - Gibson City Jacksonville NW - Meredosia Keemin Substation Effingham - Neoga S. Baldwin - Prairie State Madison Industrial - Madison State S. Belleville - Tilden Gibson City - Paxton Total Cost $68.0 $56.4 $16.6 $15.8 $13.4 $12.0 $11.7 $9.6 $8.0 $7.4 $6.7 $6.0 $5.8 $5.3 $5.1 19 QUESTIONS? Appendix Supplemental Background Information (Not covered during presentation) 21 APPENDIX – AMIL PRICING ZONE • Both AIC and ATXI are transmission owning subsidiaries of Ameren Corporation, as well as a MISO Transmission Owners (TOs) • AIC will continue to build and own traditional reliability projects • ATXI is in the process of building and will own new regional transmission projects • Prairie Power, Inc. became a TO in the AMIL pricing zone effective June 1, 2013. • The sum of all there Attachment O net revenue requirements equals the total revenue requirement for AMIL pricing zone to be collected under Schedule 9 (NITS) 22 APPENDIX - MISO ATTACHMENTS O, GG & MM Calculate rates for Schedules 9, 26 & 26-A • • • • • Attachment GG - Schedule 26 Attachment MM - Schedule 26-A Attachment O - net revenue requirement billed under Schedule 9 Schedules 26 and 26-A are billed by MISO Schedule 9 is billed by Ameren 23 APPENDIX - MISO ATTACHMENT GG • Cost Recovery for certain Network Upgrades • Eligible projects • Market Efficiency • Generator Interconnections • Cost shared based upon project type • MISO-wide based on load • Subregional based on LODF (Line Outage Distribution Factor) • AIC has four Attachment GG projects completed • One additional project is under construction • These projects were approved by MISO under prior Tariff provisions which allowed limited cost sharing for certain reliability projects 24 APPENDIX - MISO ATTACHMENT MM • Cost recovery for Multi-Value Projects (MVPs) • Very similar format as Attachment GG • Criteria for being considered • Developed through planning process and support energy policy • Multiple types of economic value across multiple pricing zones with benefit to costs > 1 • Address at least one: • Projected NERC violation • Economic-based issue • Cost shared across MISO based on load • AMIL Zone is approximately 9% • Ameren MVPs will primarily be built by ATXI • AIC will be responsible for modifications needed to its existing facilities 25 APPENDIX - MISO ATTACHMENT O, GG & MM • All transmission costs included in Attachment O calculation • Schedule 9 based on net revenue requirement – reductions for: • Costs recovered in Schedules 26 & 26-A • Revenue Credits • Point-to-Point revenue in Schedules 7 & 8 • Rental revenue • Revenue from generator interconnections 26 APPENDIX - MISO TRANSMISSION EXPANSION PLAN (MTEP) • Developed on an annual basis building upon previous analysis • • MISO, Transmission Owners & Stakeholders Includes subregional planning meetings • MTEP goals • • • • • • • Ensure the reliability of the transmission system Ensure compliance with NERC Standards Provide economic benefits, such as increased market efficiency Facilitate public policy objectives, such as meeting Renewable Portfolio Standards Address other issues or goals identified through the stakeholder process Multiple future scenarios analyzed End result – comprehensive, cohesive plan for MISO footprint • MTEP approved by MISO Board of Directors 27 MISO MVPS • Brief history of development • Began investigating value added expansion in 2003 • 2008 Regional Generation Outlet Study (RGOS) - formed basis of Candidate MVP portfolio • Portfolio refined due to additional analysis • MISO approved portfolio of 17 Projects • Seven transmission line segments (MTEP proj numbers) in Ameren territory • Ameren identifies these three projects as: • Illinois Rivers (four line segments) • Spoon River • Mark Twain (two line segments) • Broadly cost-shared, AMIL pricing zone allocated 9% of each MVP no matter where project is located or who builds it 28 APPENDIX - MAP OF AMEREN MVPS 29 APPENDIX - RATE INCENTIVES • FERC approved the following rate incentives for Illinois Rivers in Docket No. EL10-80 – CWIP (no AFUDC) – Abandonment (requires additional filing prior to recovery) – Hypothetical capital structure during construction for ATXI • FERC approved similar incentives for Spoon River and Mark Twain Projects in Docket No. ER12-2216 30 APPENDIX - MISO WEB LINKS • Transmission Pricing - Attachments O, GG & MM Information • https://www.misoenergy.org/MarketsOperations/TransmissionSettlement s/Pages/TransmissionPricing.aspx • Ameren OASIS • http://www.oasis.oati.com/AMRN/index.html • MTEP 15 • https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEP15.aspx • Schedule 26 & 26-A Indicative Charges • https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEPStudies.aspx 31 APPENDIX – AIC • Additional questions on these topics can be sent to Ameren at: – MISOFormulaRates@ameren.com 32