The external dimension of the internal market by Peter Holmes [PPT 160.00KB]

advertisement

![The external dimension of the internal market by Peter Holmes [PPT 160.00KB]](http://s2.studylib.net/store/data/014979470_1-cd12fa857c3c9d2d2e5806f1e6d3707d-768x994.png)

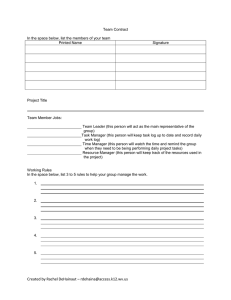

THE EXTERNAL DIMESION OF THE INTERNAL MARKET Peter Holmes Dept of Economics, University of Sussex 1 Outline • Economic concepts • An open outcome Fortress Europe or Liberalism? • Little sign of Fortress Europe • Exporting the IM – WTO – RTAs • limits being reached 2 Economic models of the IM • Economists always modeled the EEC as a full customs union, so transition to internal market not easily handled • Economists uneasy about positive integration • Regulatory barriers very hard to model – Tendency to assume their effects can be measured as tariff equivalent . – “Standards as barriers”, hence big numbers for removal esp W Bank on external impact of EU norms – may be misleading • Problem of counterfactual • Trade diversion less likely from deregulation 3 The external challenge • EU was not even a full customs union in 1986 (Rules of origin applied!) • VERs & MFA quotas set nationally • East German loophole • Art 115 • Technical NTBs differed • Customs classifications not uniform 4 The dilemma • Cockfield White paper set out to remove necessity of intra EU border barriers, but did not declare aim of harmonising all external trade policy. Member States had not agreed to this! • WP stated article 115 could not be enforced same way • But logic was ineluctable if plan should succeed 5 But what sort of common external policy? • Cars, textiles , Consumer electronics etc reflected different national priorities – Would there be a “fortress Europe”/ “reconquete du marche interieur”? – or would liberal logic prevail? • Liberalism was the unspoken default 6 Services? • EU has not yet fully unified its GATS commitments • EC competence only after Nice Treaty • Controversy over Bolkestein suggests some hard work to be done • But some major successes - telecoms Uruguay Round and IMP sustained each other 7 FDI • Inward and outward FDI growing fast • Probably due to globalisation and market size rather than IMP per se • But some FDI linked to illiberal aspects of external policy - anti-dumping, eg consumer electronics. (Cars?) • But no clear EU policy yet 8 Would the EU be more or less open without the IMP? • Communalisation and legalisation of external trade policy • Opportunistic national measures harder • NTBs probably less • Were tariff reductions greater? 9 The impact of the IMP on the Uruguay Round • Impossible to separate the two effects but WTO report positive • “a core element of the Internal Market process was the elimination of trade restrictions maintained by individual member States...The European Union's Uruguay Round commitments include widespread tariff reductions for manufactures, bringing the average rate down by 38 per cent to 3.7 per cent in 2000” 1995 TPR 10 The estimated impact “The liberalisation of external trade has been at least as strong as the intra-EU liberalising effects of the IMP. Concerns about 'fortress Europe' effects of the IMP were unnecessary: the IMP has not in itself closed the EU market to third countries, nor has it been accompanied by protectionist measures.” Allen Gasiorek & Smith 1996 11 External impact of regulatory (positive) integration? • Internal liberalisation/harmonisation less likely to be discriminatory • Regulatory harmonisation probably had positive impact on market access for US & Japanese suppliers • But World Bank criticises levelling up in SPS area. (Contested) estimates of $670m loss to W.Africa due to aflatoxin rules • Chen and Mattoo argue excluded countries lose except from MR. 12 EU trade shares since 1980 intra and extra trade as % of total non oil calcs: J Lopez from TRAINS (NB 3 equivalent graphs!) imports (no oil) 80.00% 70.00% 60.00% 50.00% Intra-EU (1) 40.00% Extra-EU (2) 30.00% (1)-(2) 20.00% 10.00% 20 04 20 02 19 98 20 00 19 96 19 92 19 94 19 90 19 86 19 88 19 84 19 82 19 80 0.00% 13 Exporting Internal Market via RTAs/EPAs - trade offs • improving market access for firms in the export sector already able to comply with EU norms • giving an incentive to firm at the margin of exporting to “upgrade” • raising the quality of output in the domestic market • raising costs to firms and consumers • risking the disappearance of local firms able to supply to local market demands but not to EU norms. • risking loss of export sales in other markets • Sussex research suggests little prospect for EU Egypt FTA “deep integration”; maybe some for India. 14 IMP: a template for the world? • WTO did adopt SPS and TBT regimes not unlike EU - reference to standards with possibility of exceptions • But proving both in EU and WTO to consolidate when national preferences really differ • Singapore issues not welcome • EPAs are discussing WTO + but it’s not the internal market as you and I know it Jim • Can you have positive integration without legitimate political forum? 15 Conclusions • IMP's “negative integration” probably destined to dominate: liberalisation tho' not “neo-liberalism” • But measuring impact depends on having – Clear counterfactual – good model of trade effects of regulation – not just tariff equivalent • Positive integration aspects of IM harder to externalise – WTO beware of getting what you wish for! – IM needed for candidates (but sequencing?) – Other RTAs: insufficient thought about “up grading” vs market access (Conformity assessment?) • External limits match internal, too simple economic 16 approach raises political legitimacy issues