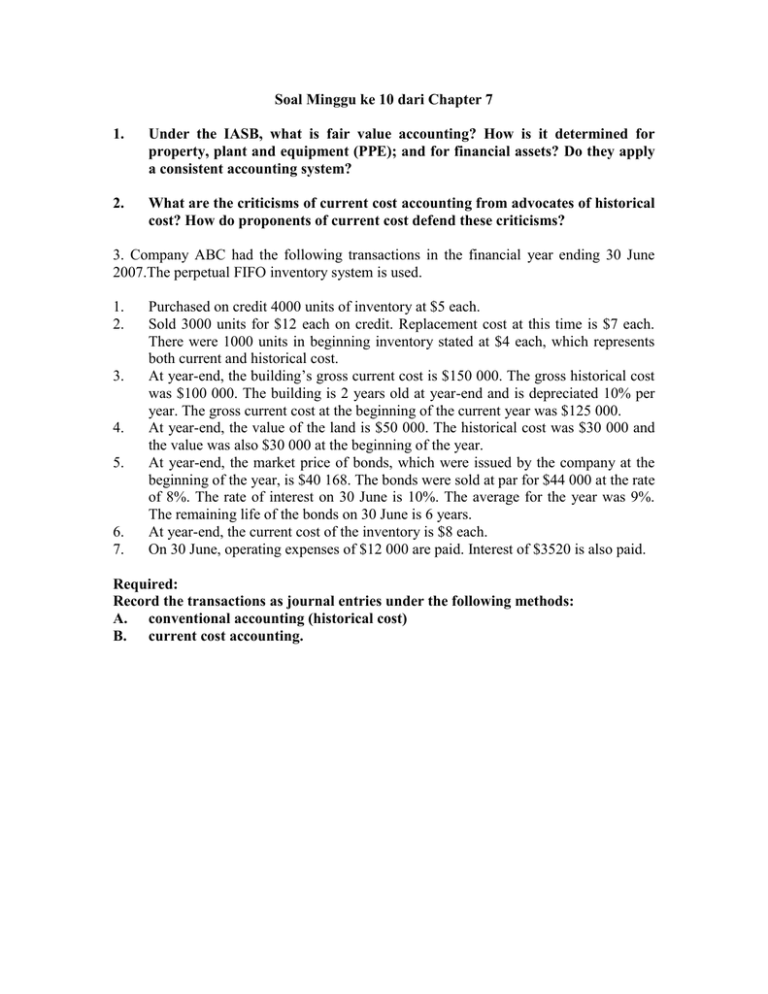

Soal Minggu ke 10 dari Chapter 7 1.

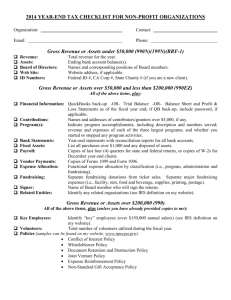

advertisement

Soal Minggu ke 10 dari Chapter 7 1. Under the IASB, what is fair value accounting? How is it determined for property, plant and equipment (PPE); and for financial assets? Do they apply a consistent accounting system? 2. What are the criticisms of current cost accounting from advocates of historical cost? How do proponents of current cost defend these criticisms? 3. Company ABC had the following transactions in the financial year ending 30 June 2007.The perpetual FIFO inventory system is used. 1. 2. 3. 4. 5. 6. 7. Purchased on credit 4000 units of inventory at $5 each. Sold 3000 units for $12 each on credit. Replacement cost at this time is $7 each. There were 1000 units in beginning inventory stated at $4 each, which represents both current and historical cost. At year-end, the building’s gross current cost is $150 000. The gross historical cost was $100 000. The building is 2 years old at year-end and is depreciated 10% per year. The gross current cost at the beginning of the current year was $125 000. At year-end, the value of the land is $50 000. The historical cost was $30 000 and the value was also $30 000 at the beginning of the year. At year-end, the market price of bonds, which were issued by the company at the beginning of the year, is $40 168. The bonds were sold at par for $44 000 at the rate of 8%. The rate of interest on 30 June is 10%. The average for the year was 9%. The remaining life of the bonds on 30 June is 6 years. At year-end, the current cost of the inventory is $8 each. On 30 June, operating expenses of $12 000 are paid. Interest of $3520 is also paid. Required: Record the transactions as journal entries under the following methods: A. conventional accounting (historical cost) B. current cost accounting.