Portfolio Immunization and Duration

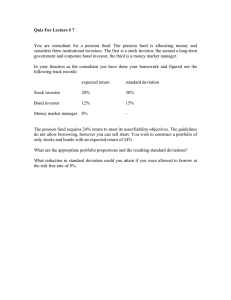

advertisement

Duration and Portfolio Immunization Portfolio Immunization • Portfolio immunization – An investment strategy that tries to protect the expected yield from a security or portfolio of securities by acquiring those securities whose duration equals the length of the investor’s planned holding period. Portfolio Immunization • If the average duration of a portfolio equals the investor’s desired holding period, the effect is to hold the investor’s total return constant regardless of whether interest rates rise or fall. – In the absence of borrower default, the investor’s realized return can be no less than the return he has been promised by the borrower. Example • Assume we are interested in a $1,000 par value bond that will mature in two years. • The bond has a coupon rate of 8 percent and pays $80 in interest at the end of each year. • Interest rates on comparable bonds are also at 8 percent but may fall to as low as 6 percent or rise as high as 10 percent. Example • The buyer knows he will receive $1000 at maturity, but in the meantime he faces the uncertainty of having to reinvest the annual $80 in interest earnings at 6%, 8%, or 10%. Example: Case 1 • Let interest rates fall to 6%. – The bond will earn $80 in interest payments for year one, $80 for year two, and $4.80 ($80 x 0.06) when the $80 interest income received the first year is reinvested at 6% during year 2. Example: Case 1 • How much will the investor earn over the two years? – First year’s interest earnings + Second year’s interest earnings + Interest earned reinvesting the first year’s interest earnings at 6% + Par value of the bond at maturity. – $80 + $80 + $4.80 + $1,000 = $1,164.80 Example: Case 2 • Let interest rates rise to 10%. – The bond will earn $80 in interest payments for year one, $80 for year two, and $8.00 ($80 x 0.10) when the $80 interest income received the first year is reinvested at 10% during year 2. Example: Case 2 • How much will the investor earn over the two years? – First year’s interest earnings + Second year’s interest earnings + Interest earned reinvesting the first year’s interest earnings at 10% + Par value of the bond at maturity. – $80 + $80 + $8 + $1,000 = $1,168.00 Immunization and Duration • The investor’s earnings could drop as low as $1,164.80 or rise as high as $1,168. • But, if the investor can find a bond whose duration matches his or her planned holding period, he or she can avoid this fluctuation in earnings. – The bond will have a maturity that exceeds the investor’s holding period, but its duration will match it. Example: Case 1 • Let interest rates fall to 6%. – The bond will earn $80 in interest payments for year one, $80 for year two, and $4.80 ($80 x 0.06) when the $80 interest income received the first year is reinvested at 6% during year 2. – But, the bond’s market price will rise to $1,001.60 due to the drop in interest rates. Example: Case 1 • How much will the investor earn over the two years? – First year’s interest earnings + Second year’s interest earnings + Interest earned reinvesting the first year’s interest earnings at 6% + Market price of the bond at the end of the investor’s planned holding period. – $80 + $80 + $4.80 + $1,001.60 = $1,166.40 Example: Case 2 • Let interest rates rise to 10%. – The bond will earn $80 in interest payments for year one, $80 for year two, and $8.00 ($80 x 0.10) when the $80 interest income received the first year is reinvested at 10% during year 2. – But, the bond’s market price will fall to $998.40 due to the rise in interest rates. Example: Case 2 • How much will the investor earn over the two years? – First year’s interest earnings + Second year’s interest earnings + Interest earned reinvesting the first year’s interest earnings at 10% + Par value of the bond at maturity. – $80 + $80 + $8 + $998.40 = $1,166.40 Conclusion • The investor earns identical total earnings whether interest rates go up or down. – With duration set equal to the buyer’s planned holding period, a fall (rise) in the reinvestment rate is completely offset by an increase (a decrease) in the bond’s market price. Conclusion • Immunization using duration seems to work reasonably well because the largest single element found in most interest rate movements is a parallel change in all interest rates (explains about 80% of all interest rate movements over time). • So, investors can achieve reasonably effective immunization by approximately matching the duration of their portfolios with their planned holding periods. Opportunity Cost • Duration is not free. There is an opportunity cost. – If the investor had simply bought a bond with a calendar maturity of two years and interest rates rose, he or she would have earned $1,168. • The opportunity cost of immunization is a lower, but more stable, expected return. Limits of Duration • In reality it can be difficult to find a portfolio of securities whose average portfolio duration exactly matches the investor’s planned holding period. – As the investor grows older, his planned holding period grows shorter, as does the average duration of his portfolio, but they may not decline at the same rate. • Portfolio requires constant adjustments. Limits of Duration • Many bonds are callable so bondholders may find themselves with a sudden and unexpected change in their portfolio’s average duration. • The future path of interest rates cannot be perfectly forecast; therefore, immunization with duration cannot be perfect without the use of complicated models.