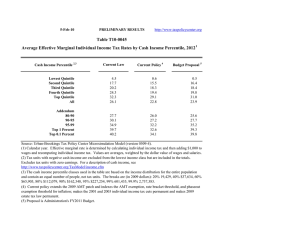

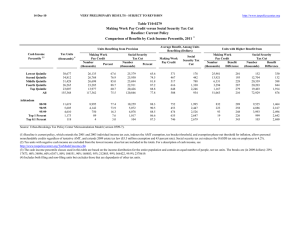

19-Mar-10 PRELIMINARY RESULTS

advertisement

19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) 1 Distribution of Federal Tax Change by Cash Income Percentile, 2013 Summary Table Percent of Tax Units4 2,3 Cash Income Percentile With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax 5 Income Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 18.2 2.7 0.0 0.0 0.0 0.0 -0.7 -0.4 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 1,517 225 0.0 0.0 0.0 0.0 0.5 0.3 5.2 12.2 18.2 21.7 28.8 23.8 0.0 0.0 0.0 0.0 0.0 0.3 2.9 64.2 89.3 98.1 0.0 0.0 -0.4 -1.9 -2.7 0.0 0.2 14.6 85.2 51.8 1 9 1,110 25,474 153,204 0.0 0.0 0.3 1.3 1.7 24.7 25.9 28.1 33.6 36.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 21.0 (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,599, 40% $37,843, 60% $66,647, 80% $113,886, 90% $164,974, 95% $231,179, 99% $624,396, 99.9% $2,875,812. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile, 2013 1 Detail Table Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 18.2 2.7 0.0 0.0 0.0 0.0 -0.7 -0.4 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 1,517 225 0.0 0.0 0.0 0.0 1.8 1.2 0.0 -0.1 -0.1 -0.2 0.4 0.0 0.8 4.3 10.5 18.0 66.3 100.0 0.0 0.0 0.0 0.0 0.5 0.3 5.2 12.2 18.2 21.7 28.8 23.8 0.0 0.0 0.0 0.0 0.0 0.3 2.9 64.2 89.3 98.1 0.0 0.0 -0.4 -1.9 -2.7 0.0 0.2 14.6 85.2 51.8 1 9 1,110 25,474 153,204 0.0 0.0 1.1 4.1 4.9 -0.2 -0.1 0.0 0.7 0.5 14.1 10.2 15.9 26.1 13.2 0.0 0.0 0.3 1.3 1.7 24.7 25.9 28.1 33.6 36.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2013 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 38,935 35,530 32,336 27,082 23,647 159,683 24.4 22.3 20.3 17.0 14.8 100.0 11,951 29,492 53,428 91,635 291,777 78,831 620 3,596 9,740 19,872 82,368 18,515 11,330 25,896 43,688 71,764 209,409 60,316 5.2 12.2 18.2 21.7 28.2 23.5 3.7 8.3 13.7 19.7 54.8 100.0 4.6 9.6 14.7 20.2 51.4 100.0 0.8 4.3 10.7 18.2 65.9 100.0 11,930 5,814 4,704 1,200 121 7.5 3.6 3.0 0.8 0.1 142,602 202,693 359,698 1,939,600 8,825,114 35,258 52,547 99,923 626,199 3,099,584 107,344 150,147 259,775 1,313,400 5,725,530 24.7 25.9 27.8 32.3 35.1 13.5 9.4 13.4 18.5 8.5 13.3 9.1 12.7 16.4 7.2 14.2 10.3 15.9 25.4 12.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 21.0 (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,599, 40% $37,843, 60% $66,647, 80% $113,886, 90% $164,974, 95% $231,179, 99% $624,396, 99.9% $2,875,812. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 14.2 2.7 0.0 0.0 0.0 0.0 -0.7 -0.4 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 1,182 225 0.0 0.0 0.0 0.0 1.7 1.2 0.0 0.0 -0.1 -0.2 0.4 0.0 0.3 3.2 8.6 17.1 70.8 100.0 0.0 0.0 0.0 0.0 0.5 0.3 2.3 10.8 17.0 21.0 28.5 23.8 0.0 0.0 0.0 0.0 0.0 0.1 3.3 46.4 86.7 96.3 0.0 0.0 -0.3 -1.9 -2.6 0.0 0.2 12.4 87.4 53.5 0 10 739 21,719 133,298 0.0 0.0 0.9 4.0 4.9 -0.2 -0.1 -0.1 0.7 0.5 15.2 11.4 17.0 27.2 13.7 0.0 0.0 0.2 1.3 1.7 24.5 25.9 27.8 33.4 36.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 32,029 32,970 31,818 30,385 30,329 159,683 20.1 20.7 19.9 19.0 19.0 100.0 11,281 26,786 47,337 79,916 245,421 78,831 262 2,891 8,047 16,813 68,653 18,515 11,019 23,895 39,289 63,103 176,768 60,316 2.3 10.8 17.0 21.0 28.0 23.5 2.9 7.0 12.0 19.3 59.1 100.0 3.7 8.2 13.0 19.9 55.7 100.0 0.3 3.2 8.7 17.3 70.4 100.0 15,226 7,667 5,993 1,444 144 9.5 4.8 3.8 0.9 0.1 121,507 172,468 306,082 1,687,975 7,770,939 29,768 44,614 84,296 541,506 2,701,780 91,739 127,854 221,786 1,146,469 5,069,158 24.5 25.9 27.5 32.1 34.8 14.7 10.5 14.6 19.4 8.9 14.5 10.2 13.8 17.2 7.6 15.3 11.6 17.1 26.4 13.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 21.0 (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,465, 40% $25,159, 60% $42,626, 80% $69,583, 90% $100,255, 95% $141,875, 99% $375,887, 99.9% $1,773,679. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table - Single Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 7.5 1.0 0.0 0.0 0.0 0.0 -0.5 -0.2 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 576 80 0.0 0.0 0.0 0.0 1.3 0.8 0.0 0.0 -0.1 -0.2 0.3 0.0 1.5 5.2 12.4 20.4 60.5 100.0 0.0 0.0 0.0 0.0 0.4 0.2 7.4 11.5 17.9 22.1 29.0 23.1 0.0 0.0 0.0 0.0 0.0 0.0 0.1 23.3 83.8 96.6 0.0 0.0 -0.2 -1.9 -2.8 0.0 0.0 8.0 91.9 55.1 0 0 248 14,375 97,468 0.0 0.0 0.4 3.7 4.7 -0.1 -0.1 -0.1 0.6 0.4 15.4 11.0 14.6 19.5 9.5 0.0 0.0 0.1 1.3 1.8 25.6 26.8 27.9 35.4 39.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total Number (thousands) Percent of Total 17,074 16,108 14,458 11,774 9,729 70,516 24.2 22.8 20.5 16.7 13.8 100.0 8,651 20,480 35,181 57,507 157,782 45,222 638 2,354 6,293 12,723 45,178 10,352 8,013 18,125 28,888 44,784 112,605 34,870 7.4 11.5 17.9 22.1 28.6 22.9 4.6 10.3 16.0 21.2 48.1 100.0 5.6 11.9 17.0 21.4 44.6 100.0 1.5 5.2 12.5 20.5 60.2 100.0 5,106 2,451 1,813 359 32 7.2 3.5 2.6 0.5 0.0 86,768 123,206 212,186 1,129,741 5,553,373 22,210 33,040 58,843 385,917 2,095,512 64,558 90,166 153,343 743,823 3,457,861 25.6 26.8 27.7 34.2 37.7 13.9 9.5 12.1 12.7 5.5 13.4 9.0 11.3 10.9 4.5 15.5 11.1 14.6 19.0 9.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,465, 40% $25,159, 60% $42,626, 80% $69,583, 90% $100,255, 95% $141,875, 99% $375,887, 99.9% $1,773,679. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table - Married Tax Units Filing Jointly Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 17.5 5.4 0.0 0.0 0.0 0.0 -0.7 -0.5 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 1,491 456 0.0 0.0 0.0 0.0 1.8 1.4 0.0 0.0 -0.1 -0.2 0.3 0.0 0.2 1.6 5.5 15.0 77.6 100.0 0.0 0.0 0.0 0.0 0.5 0.4 3.2 10.8 15.9 20.3 28.3 24.9 0.0 0.0 0.0 0.0 0.0 0.1 4.4 55.5 87.3 96.0 0.0 0.0 -0.4 -1.9 -2.6 0.0 0.2 13.3 86.4 52.3 0 13 955 23,698 141,174 0.0 0.0 1.0 4.0 5.0 -0.2 -0.2 -0.1 0.8 0.5 15.3 12.3 19.0 31.0 15.4 0.0 0.0 0.3 1.3 1.7 24.1 25.6 27.8 32.9 35.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total Number (thousands) Percent of Total 6,646 8,846 11,466 15,133 18,824 61,567 10.8 14.4 18.6 24.6 30.6 100.0 14,997 34,316 61,056 98,062 294,107 131,596 483 3,703 9,682 19,924 81,715 32,310 14,514 30,613 51,375 78,138 212,391 99,285 3.2 10.8 15.9 20.3 27.8 24.6 1.2 3.8 8.6 18.3 68.3 100.0 1.6 4.4 9.6 19.3 65.4 100.0 0.2 1.7 5.6 15.2 77.3 100.0 8,992 4,893 3,916 1,023 104 14.6 8.0 6.4 1.7 0.2 142,741 198,470 351,916 1,860,212 8,301,978 34,347 50,736 96,974 587,667 2,837,441 108,393 147,734 254,942 1,272,545 5,464,537 24.1 25.6 27.6 31.6 34.2 15.8 12.0 17.0 23.5 10.7 15.9 11.8 16.3 21.3 9.3 15.5 12.5 19.1 30.2 14.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,465, 40% $25,159, 60% $42,626, 80% $69,583, 90% $100,255, 95% $141,875, 99% $375,887, 99.9% $1,773,679. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table - Head of Household Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 12.6 0.6 0.0 0.0 0.0 0.0 -0.5 -0.1 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 611 31 0.0 0.0 0.0 0.0 1.2 0.4 0.0 -0.1 -0.1 -0.1 0.3 0.0 -3.4 12.8 27.0 27.9 35.7 100.0 0.0 0.0 0.0 0.0 0.3 0.1 -5.4 9.5 17.8 22.0 26.9 16.5 0.0 0.0 0.0 0.0 0.0 0.1 5.9 63.0 92.5 98.9 0.0 0.0 -0.4 -1.8 -2.4 0.1 0.5 18.3 81.1 43.1 1 17 781 18,562 119,281 0.0 0.0 1.1 3.9 4.6 -0.1 0.0 0.1 0.3 0.2 13.4 5.3 7.5 9.5 4.3 0.0 0.0 0.3 1.3 1.6 24.8 25.7 25.6 33.3 36.4 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total Number (thousands) Percent of Total 8,048 7,608 5,217 2,852 1,277 25,098 32.1 30.3 20.8 11.4 5.1 100.0 13,855 31,521 51,706 79,541 185,233 43,145 -749 2,995 9,221 17,458 49,293 7,081 14,603 28,526 42,486 62,083 135,939 36,064 -5.4 9.5 17.8 22.0 26.6 16.4 10.3 22.2 24.9 21.0 21.9 100.0 13.0 24.0 24.5 19.6 19.2 100.0 -3.4 12.8 27.1 28.0 35.4 100.0 829 231 183 34 3 3.3 0.9 0.7 0.1 0.0 116,286 160,414 286,559 1,486,374 7,504,908 28,884 41,125 72,485 476,410 2,610,763 87,402 119,288 214,074 1,009,965 4,894,145 24.8 25.6 25.3 32.1 34.8 8.9 3.4 4.8 4.7 2.0 8.0 3.0 4.3 3.8 1.5 13.5 5.4 7.5 9.2 4.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,465, 40% $25,159, 60% $42,626, 80% $69,583, 90% $100,255, 95% $141,875, 99% $375,887, 99.9% $1,773,679. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table - Tax Units with Children Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 23.6 4.0 0.0 0.0 0.0 0.0 -0.7 -0.4 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 1,582 268 0.0 0.0 0.0 0.0 1.7 1.1 0.0 0.0 -0.1 -0.2 0.4 0.0 -0.8 3.2 10.3 20.1 67.1 100.0 0.0 0.0 0.0 0.0 0.5 0.3 -6.2 10.3 18.4 22.6 29.6 24.1 0.0 0.0 0.0 0.0 0.0 0.3 12.1 84.7 95.9 99.3 0.0 0.0 -0.5 -1.9 -2.6 0.0 0.6 18.8 80.6 47.9 1 37 1,555 27,838 176,127 0.0 0.1 1.3 3.8 4.8 -0.2 -0.1 0.0 0.6 0.4 15.4 10.4 16.5 24.8 11.8 0.0 0.0 0.4 1.3 1.7 25.5 26.8 29.2 34.8 37.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 10,210 10,390 10,271 9,840 8,341 49,348 20.7 21.1 20.8 19.9 16.9 100.0 15,173 35,594 63,886 106,312 320,674 99,072 -932 3,660 11,783 24,013 93,183 23,595 16,106 31,934 52,104 82,299 227,492 75,477 4,394 1,968 1,596 382 36 8.9 4.0 3.2 0.8 0.1 162,434 232,110 417,786 2,190,996 10,411,968 41,378 62,186 120,265 735,470 3,673,877 121,055 169,924 297,521 1,455,526 6,738,090 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -6.2 10.3 18.4 22.6 29.1 23.8 3.2 7.6 13.4 21.4 54.7 100.0 4.4 8.9 14.4 21.7 50.9 100.0 -0.8 3.3 10.4 20.3 66.8 100.0 25.5 26.8 28.8 33.6 35.3 14.6 9.3 13.6 17.1 7.7 14.3 9.0 12.8 14.9 6.5 15.6 10.5 16.5 24.1 11.3 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,465, 40% $25,159, 60% $42,626, 80% $69,583, 90% $100,255, 95% $141,875, 99% $375,887, 99.9% $1,773,679. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 19-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0103 Medicare Tax as Proposed in H.R. 3590 (Senate Health Bill) and H.R. 4872 (Reconciliation Act of 2010) Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table - Elderly Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 13.2 2.4 0.0 0.0 0.0 0.0 -0.9 -0.5 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 1,848 328 0.0 0.0 0.0 0.0 2.6 2.2 0.0 0.0 -0.1 -0.2 0.4 0.0 0.3 1.8 3.7 10.5 83.7 100.0 0.0 0.0 0.0 0.0 0.7 0.4 2.6 4.3 6.9 12.6 27.4 20.2 0.0 0.0 0.0 0.0 0.0 0.0 0.3 29.1 82.6 97.1 0.0 0.0 -0.3 -2.2 -3.0 0.0 0.0 7.3 92.6 56.1 0 1 560 23,234 132,530 0.0 0.0 0.8 4.6 5.4 -0.2 -0.2 -0.3 1.0 0.7 10.2 9.5 19.8 44.2 22.9 0.0 0.0 0.2 1.5 1.9 18.7 21.3 25.9 34.0 37.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 5,122 8,579 6,256 5,579 5,563 31,333 16.4 27.4 20.0 17.8 17.8 100.0 11,258 22,972 41,671 73,112 268,318 77,032 289 994 2,865 9,205 71,605 15,256 10,969 21,978 38,805 63,907 196,713 61,775 2,423 1,382 1,348 410 44 7.7 4.4 4.3 1.3 0.1 109,937 158,053 276,519 1,548,895 6,915,532 20,581 33,658 71,138 502,549 2,439,382 89,356 124,395 205,381 1,046,345 4,476,149 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.6 4.3 6.9 12.6 26.7 19.8 2.4 8.2 10.8 16.9 61.8 100.0 2.9 9.7 12.5 18.4 56.5 100.0 0.3 1.8 3.8 10.7 83.3 100.0 18.7 21.3 25.7 32.5 35.3 11.0 9.1 15.5 26.3 12.5 11.2 8.9 14.3 22.2 10.1 10.4 9.7 20.1 43.1 22.2 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 3.8% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 3.8% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would not be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,465, 40% $25,159, 60% $42,626, 80% $69,583, 90% $100,255, 95% $141,875, 99% $375,887, 99.9% $1,773,679. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.