Establishing effective metrics for new product development success

advertisement

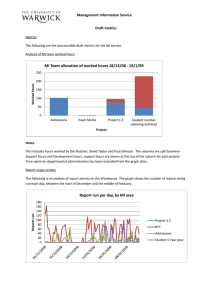

Siemens PLM Software Establishing effective metrics for new product development success www.siemens.com/plm best practice brief Companies that are unable to measure the performance of their product development processes have little or no chance of successfully competing with today’s best-in-class product makers. Metrics-driven improvement programs differentiate industry leaders from the rest of the pack. Companies must be able to understand how well they perform and how this performance affects their financial bottom line if their improvement initiatives are to deliver a meaningful return on investment. PLM Software Answers for industry. Establishing effective metrics Table of contents Overview of effective metrics 1 Challenges 3 Best practice solutions 5 Key Siemens solution capabilities 8 Appendix A – Commonly used program metrics 9 Overview of effective metrics The value of effective metrics. A recent study of 940 executives by The Boston Consulting Group1 found that 51 percent of the respondents expressed dissatisfaction with the financial returns on investment (ROI) they are receiving from their innovation initiatives.Yet they continue to invest, despite additional research showing that “there is no correlation” between R&D spending and sales growth, earnings or shareholder returns.2 As these studies indicate, it is highly important to understand and optimize today’s new product development processes. In essence, “how you spend is far more important than how much you spend.”3 However, as you might expect, it is impossible to optimize a process, if you do not know how to measure it. AMR Research examined this issue in detail and discovered that while 79 percent of the companies it surveyed had formal new product development processes, only 52 percent had actually applied metrics to these processes.4 In brief: Best-in-class companies are far more likely than their competitors to use key performance indicators to regularly measure their new product development projects. Metrics-driven programs enable companies to identify gaps in their new product development capabilities, define how much improvement is still needed and how their improvement initiatives should be prioritized. As the old adage suggests, you can only manage what you can measure. It should come as no surprise that best-in-class companies are three times more likely than their peers to use key performance indicators to measure their new product development projects on a monthly basis.5 In fact, industry leaders generally measure performance more frequently and on a broader scale than their competition. While many companies struggle to measure the results of their R&D spending, the focus on improving this deficiency is evidenced by the popularity of improvement initiatives such as Six Sigma, as well as the rapid growth of copy cat approaches. Many observers believe that today’s biggest challenge is convincing people to get on board with a cross-functional approach to decision making. It is commonly asserted that “we have a good process if only we would follow it.” This complaint is symptomatic of poor organizational commitment. In many ways, use of the right metrics encourages companies to align their functional discontinuities. As The PDMA Handbook of New Product Development indicates, metrics-driven programs enable companies to identify the gaps in their new product development capabilities, as well as to define how much improvement is still needed and how these improvement initiatives should be prioritized.6 In essence, effective, visible metrics that are consistently and constantly measured drive a variety of business benefits. Benefits of using metrics to drive improvement programs7 Benefit Why it matters Assess overall Enables companies to evaluate their product development development performance capabilities, gauge their effectiveness and identify performance gaps Prioritize improvement investment Allows companies to prioritize their improvement initiatives and assess their alignment with established strategies, investment requirements and associated returns Monitor industry best practices Enables companies to establish external benchmarks they can use to evaluate their competitiveness and compare their performance against best-in-class companies 1 Benefits of using metrics to drive improvement programs7 Benefit Why it matters Improve operational reliability Helps companies establish a set of predictive measures they can use to anticipate development-related performance problems and take corrective actions Facilitate behavioral change Allows companies to clearly define their metrics in terms of organizational performance goals; helps individuals understand how personal performance relates to overall business performance; creates a basis for aligning company incentives with performance goals Stakeholders in metrics-driven improvement. Value-chain participants from multiple organizations need to work together as a single team and use metrics to align and drive their daily activities. Value-chain participants benefiting from metrics-driven programs Participant Why metrics matter Executive management The CEO is ultimately responsible for ensuring that R&D investment delivers acceptable revenue returns; the CIO is responsible for making certain that an organizational framework is in place to facilitate effective teamwork across the product development cycle. Product management Product management is responsible for channeling early marketing input (such as forecasts) into specific development projects. Once the product has been launched, the product manager needs to track the product’s level of marketplace success. R&D, design and engineering Since the product development organization represents the major investment for most development projects, its managers are frequently asked to minimize the cost of their operations. Marketing and sales management Marketing and sales organizations represent the sharp end of the new product development process; they are responsible for ensuring that the product’s marketing and sales forecasts are accurate and that product sales meet these expectations. For effective new product development, these value-chain participants need to understand the hierarchical relationships between each program’s drivers and goals. In a seminal study on business management, The Human Side of Enterprise identified two major management styles and labeled them Theory X and Theory Y.8 Theory X represented a classic command-and-control structure that stressed authoritarian principles and exemplified “an underlying belief that management must counteract an inherent human tendency to avoid work”. In contrast,Theory Y “assumes that people will exercise self-direction and self-control in the achievement of organizational objectives to the degree to which they are committed to those objectives.” 2 In brief: Executive management, product managers, marketing and sales management and R&D, design and engineering organizations use metrics management to understand the hierarchical relationships between each program’s business goals and the functional capabilities that drive the program’s development processes. Challenges Falling short of full value. Many companies are not using metrics management to drive improvement programs to their fullest advantage. Recent surveys indicate that even though 70 percent of companies use metrics to review their project results, only 55 percent use metrics for performance and goal setting.9 Equally important, only 41 percent of these companies used metrics for external benchmarking and only 38 percent used them to link their strategies to individual goals. Researchers explain this anomaly by categorizing their respondents’ reasons into four primary categories. Reasons for failing to fully leverage program metrics Reason Underlying causes Wrong metrics Effective performance metrics need to reinforce the organization’s adherence to agreed upon business objectives and practices.These relationships also need to be balanced across multiple dimensions of the business. Metrics need to support fact-based decision making – rather than intuitive decisions – by providing irrefutable evidence that problems exist and improvements can be precisely targeted.These metrics also need to be easily understood, communicated, quantified and recorded. Inadequate tracking mechanisms Companies can only leverage metrics that their current processes are able to support. For example, a company cannot measure budget variance (i.e., planned cost vs. actual project cost) if it does not have project accounting processes in place. In essence, processes must exist to collect and support the required metrics in a meaningful and practical way. In brief: Even today, companies are not using programdriven metrics to their fullest advantage. Effective metrics management is limited by the use the wrong metrics, the failure to track performance, the inability to tie performance to bottom-line results, or the lack of an actionable management process. Generally, it is good practice to leverage data that is a natural byproduct of the organization’s new product development processes. Recent research confirms this view as best-in-class companies measure key performance indicators for new product development at the enterprise level 60 percent of the time – while laggards do not use this measure at all (0 percent).10 No bottom-line implications Successful improvement programs are grounded in hard facts that provide clear linkage to valued business results. Unfortunately, product-related decisions usually are based on data about immediate assets, liabilities and revenues that is not linked to process-based capabilities and competencies.This over reliance on base measures only promotes linear, incremental improvements.To achieve the full benefit of a metrics-driven program, metrics performance needs to be targeted as directly as possible to the company’s income statement or balance sheet. Recent research by the Aberdeen Group indicates that 80 percent of the best practice companies they surveyed coordinated their innovations strategies with their operational organization.11 3 Section name Reasons for failing to fully leverage program metrics Reason Underlying causes Missing management process While it is important to tie metrics to clearly understood processes and to have supporting tracking mechanisms in place, it is also crucial to implement project-level processes that identify major milestones, timings, assigned actions and ownership responsibilities. Companies with portfolio and project-level processes have a framework and common language that is critical for effective metrics management.The active participation of senior management in product innovation is a key differentiator for best-in-class companies. Avoiding common pitfalls. Metrics-driven improvement programs should abide by the following guidelines to ensure their real-world success: • Make certain that major stakeholders agree upon the program’s metric measurements • Tie the program’s metric measurements to clear goals, assigned actions and defined consequences • Develop the program’s metrics so that they measure the right performance and cause people to act in their company’s best interest (in contrast with simply “making their numbers”) • Develop program metrics that can be accurately, completely and efficiently collected • Avoid developing excessive metrics that promote bureaucracy at the expense of innovation • Focus on gathering fewer, more meaningful metrics, such as measurements that drive best-in-class performance, productivity and time, cost and quality improvement • Ensure that the program’s metrics are clearly visible by using management dashboards • Make certain that the metrics’ details can be benchmarked for comparative purposes • Tie individual, group, project and enterprise metrics together to reflect the best interest of the organization • Make certain that the cause and effect of the program’s metrics are understood and that a business-driven balance is achieved among the program’s participating groups • Avoid developing complex metrics that are difficult to explain • Understand the difference between performance metrics (which define what is going on in a process) and diagnostic metrics (which explain why a process performs the way it does) 4 In brief: To avoid common metrics management pitfalls, companies need to secure agreement on the program’s metrics, tie their metrics to clear business goals, develop easily understandable measurements, provide highly visible dashboads, establish competitive benchmarks, and understand the cause and effect relationships that drive each metric. Best practice solutions Successful metrics programs. A successful metrics-driven program comprehensively defines the decision-making structure, organizational responsibilities, business processes, program metrics, tracking mechanisms and reporting templates that are used to analyze, improve and control the product development process. The PDMA Handbook of New Product Development outlines a 10-step, three-phased approach for addressing the challenges facing companies that want to implement successful metrics-driven programs. PDMA 10-step performance measurement approach Phase Step Objectives 1. Define metrics program Define metrics program charter and work plan In brief: PDMA’s 10-step approach to performance measurement provides companies with a best practice tool for defining, implementing and deploying a metricsdriven program for improving their product development processes. Phase 1 Define detail definitions 2. Define strategy and high-level objectives 3. Define balanced performance metrics 4. Determine current process capabilities Define metrics program objectives to articulate how the organization benefits from these metrics Link organizational strategy and high-level objectives to performance metrics Measure the right metrics Assess current metrics and leverage where possible Phase 2 Implementation 5. Define decision-making structure 6. Establish data collection and reporting process 7. Define metrics tracking systems Define who will review current performance and identify improvement opportunities Ensure timely, fact-based operational decisions Define tasks and responsibilities for data analysis and reporting (facilitates efficient metrics tracking) Ensure appropriate tracking Phase 3 Rollout 8. Establish pilot metric process 9. Conduct ongoing performance reviews Identify first set of improvement targets and test new performance measurement process 10. Implement continuous improvement Identify improvement opportunities; take corrective actions Review and improve metrics and their measurement processes as necessary Track bottom-line impact of improvement program 5 Phase 1 identifies the metrics needed to evaluate current performance and establish targets that will drive the product development organization. Successful companies typically choose metrics that balance four key dimensions: quality, time, productivity and cost.These metrics should extend beyond traditional performance measurements and include key predictive measures. Similarly, organizations need to differentiate between performance and diagnostic metrics. Phase 2 defines the program’s data collection mechanisms and the management responsibilities that need to be in place to collect, support and track the program’s metrics. During this phase, organizations decide: • Who will collect their data? • Who will prepare and distribute the program’s periodic reports? • What systems will be used to facilitate these tasks? • Who will review the data? • Who will communicate the conclusions drawn after the data has been analyzed? Phase 3 identifies key opportunities for performance improvement and establishes new processes that can be implemented in targeted operational units. It is important to establish a balance between metrics that apply to different groups and understand how these metrics interact with each other. Two highly respected business advisors leverage a hierarchy of metric measurements that organizations can use to tie their metrics together to foster better overall business behavior. PDMA has outlined a ladder of abstraction to define four levels of business metrics.12 DMR Associates broadly matches the same approach.13 PDMA’s ladder of abstraction14 4th order metrics 3rd order metrics 2nd order metrics 1st order metrics Enterprise metrics/capabilities (e.g. stock price, core competencies, growth, break even time, percent of revenue from new products, proposal win percent, development cycle time trend) Portfolio/product metrics (e.g. unit production costs, weight, range, mean time between faliures, vintage NPD process metrics) Integrated project/program metrics (e.g. schedule performance, cost of delay, time-to-market, program/project cost performance, balanced team scorecards) Functional departmental and process metrics (e.g. milestones, throughput, patents, sales, product quality, product cost, efficiency, staffing vs. plan, turnover rate, errors per 1000 lines of code). The function’s mission can be used to derive individual measurements. Both approaches identify a hierarchy of drivers for different parts of organization that can be used to coordinate the actions of an entire enterprise to meet today’s business needs.These methodologies alleviate many of the communications issues that occur when individuals use different business languages with different levels of detail. Common program metrics. A variety of formal program execution management techniques – including the stage gate process – require that key decisions be made throughout the product lifecycle.The complexity of this requirement is compounded by the need to incorporate an increasing number of engineering and development disciplines within the product development cycle.The table in Appendix A provides a list of program metrics commonly used by today’s product development organizations. 6 In brief: Effective metrics management requires that companies understand how different metrics influence the actions of different business functions. PDMA’s ladder of abstraction uses four levels of metrics to address the unique needs of company executives, portfolio and product managers, project and program managers, and functional unit managers. Effective metrics. Developing effective metrics may appear to be simple and easy at first. However, few companies have succeeded in using these practices to make a substantial business difference day in and day out.The Business Process Reengineering website uses the following outline to define the SMART approach to metrics management. Specific – ensure that program metrics are specific and targeted to the area being measured Measurable – make certain that collected data is accurate and complete Actionable – make the program’s metrics easy to understand and clearly chart performance over time so that decision makers know which direction is “good” and which direction is “bad” In brief: Using metrics only for their own sake is not an effective form of metrics management.Two best practices help companies develop effective metrics to measure product development performance: • Business Process Reengineering’s SMART method for metrics management • PDMA’s eight principles for effective metrics Relevant – measure what is important and avoid metrics that are not Timely – ensure that program metrics produce data when it is needed The PDMA Handbook of New Product Development takes this advice even further by making the following suggestions: • Align metrics with the organization’s success criteria – so that everyone from the CEO to individual engineers understand how their personal performance can effect the organization’s overall performance • Define a manageable set of metrics – so that the organization can balance quality, productivity, time and cost in a manner that enables each metric to have a positive impact on the business as a whole • Create simple, explicit and understandable metric definitions – so that everyone in the organization can easily communicate by using the same business language • Define program objectives up front – so that the organization can align these objectives with the needs of the business and clearly identify what the program is trying to achieve • Identify ongoing improvement opportunities using program metrics – so that the organization can monitor the program’s bottom-line impact, maintain the program’s momentum and reestablish performance targets whenever necessary • Increase visibility into the program’s operational metrics – so that the organization has a complete solution for improving its decision-making structure, organization structure, business processes, tracking mechanisms and reporting templates • Benchmark regularly – so that the organization can establish internal standards and predictively measure external success • Review metric results regularly – so that senior management is able to review organizational performance and rapidly correct rising dysfunctions 7 Key Siemens solution capabilities Basic Siemens PLM Softare capabilities. Siemens PLM Software is the leading global provider of product lifecycle management (PLM) software and services with 5.5 million licensed seats and 51,000 worldwide customers. Siemens’ vision is to enable organizations and their partners to collaborate using global innovation networks to deliver products that meet today’s most compelling business imperatives. Siemens’ digital lifecycle management, digital product development and digital manufacturing solutions allow organizations to manage all of the product lifecycle’s diverse processes, including processes that pertain to the planning, development, manufacturing and service/support functions in today’s extended enterprises. Individual Siemens solutions help organizations outline their operational structures and develop best practices to maximize enterprise effectiveness. Once is foundation is in place, organizations can optimize formal processes around these best practices. At this point, each of these solutions can extract, summarize and report key performance indices on a process-specific and customer-specific basis. Equally important, these indices can be applied across multiple processes to improve the organization’s overall business performance. These Siemens solutions are bolstered by Teamcenter® software – the industry’s de facto standard for deploying PLM on an enterprise basis.Teamcenter is able to bring all Siemens solutions into a cohesive framework that organizations can use to manage all of their planning, development, manufacturing and service/support processes. Using Teamcenter to measure performance. As part of this framework, Teamcenter provides program execution management capabilities that executives, product managers and program managers can use to increase their visibility into program performance and broaden their control over program execution. Organizations can use these capabilities to automate the extraction and reporting of performance metrics and treat them as an intrinsic component of their work.To facilitate this unique approach,Teamcenter combines its knowledge management, process orchestration and project management capabilities with real-time dashboard functionality. This approach enables organizations to extract key process information from individual groups and gain visibility into their enterprise’s up-to-date and comprehensive program information. In addition to providing key process information, these techniques provide access to the program’s rolled-up performance metrics, process metrics, customized strategy-specific KPI and risk analysis metrics. Organizations also leverage Teamcenter capabilities to make certain that all product lifecycle participants are fully aware of organization’s business goals and the individual roles they play in meeting these objectives.Teamcenter can roll up the day-to-day activities of these participants into dashboards that summarize the most important metrics in the organization’s metrics hierarchy. Teamcenter’s dashboard capabilities. As part of these capabilities,Teamcenter dashboards provide executives and managers with extensive reporting and tracking capabilities. Executives can receive summary updates that highlight the status of all of their organization’s teams and projects.All entitled stakeholders can request big picture views to multiple project schedules in easy-to-read Gantt format.They can also access cross-project management reports that present organization-wide project information. Executive dashboards facilitate visibility into consolidated resource and cost information, as well as to best practice analyses. By being able to view numerous reports in dashboard format, executive management has access to all of the vital 8 In brief: At a basic level, Siemens solutions enable companies to implement digital product development, digital lifecycle management and digital manfacturing solutions to transform and improve all of the stages in today's product lifecycle. Siemens’ Teamcenter software enables companies to establish a PLM foundation, where they can inject best practices into their metrics-driven product development processes.Teamcenter enables companies to extract, summarize and report on key performance-related indicators. Teamcenter excels at enabling individuals and groups to understand how their performance affects a given project, as well as the company’s strategic business goals. Teamcenter dashboards allow executives and managers to track team performance, generate project summaries, request big picture business views, consolidate resource/cost data and perform best practice analyses. product development metrics required to assess the performance of their most costly investment – including custom views uniquely oriented for executive decision-making. In essence,Teamcenter makes it easier to determine which processes are on track, which are missing their targets and where improvements can be made.This crucial functionality enables companies to use highly favored closed loop processes to manage the product lifecycle’s entire set of processes. Siemens solutions help support numerous continuous improvement initiatives that focus on improving customer value, including six sigma, kaizen and lean projects. Together, these capabilities provide deeper visibility and control into the activities that comprise most product development and manufacturing processes while maintaining a holistic view that covers the entirety of both processes. The following table lists program metrics commonly used by today’s product development organizations.This list was originally outlined by DRM Associates’ Product Development Forum. Appendix A – Commonly used program metrics Commonly used program metrics Product development function Requirements and specifications Common metrics • Number of customer needs identified • Number of discrete requirements identified (overall system and by subsystem) • Number of requirements/specification changes (cumulative or per unit of time) • Requirements creep (new requirements/ total number of requirements) • Requirements change rate (requirements changes accepted/total number of requirements) • Percent of requirement deficiencies at qualification testing • Number of to-be-determined requirements/ total requirements • Verification percentage (number of requirements verified/total number of requirements) Mechanical design In brief: Different functions within the product development organization use unique metrics to measure and compare their performance.The following functional groups employ their own commonly used metrics. Requirement and specification Mechanical design Electrical design Program management Enterprise management Product assurance Software engineering Parts procurement Product definition Organizational/team management Technology management • Number of in-process design changes/number of parts • Number of design review deficiencies/number of parts • Number of drafting errors/number of sheets • Number of print changes/total print features 9 Product development function Common metrics Mechanical design continued • Drawing growth (unplanned drawings/total planned drawings) • Producibility rating or assembly efficiency • Number of prototype iterations • Percent of parts modeled in solids Electrical design • Number of design review changes/total terminations or connections • Number of post-design release changes/total terminations or connections • Percent fault coverage or number of faults detectable/total number of possible faults • Percent fault isolation • Percent hand assembled parts • Transistors or gates designed per engineering man-month • Number of prototype iterations • First silicon success rate Portfolio and pipeline • Number of approved projects ongoing development work-in-progress (non-recurring, cumulative investment in approved development projects, including internal labor and overhead and external development expenditures and capital investment, such as tooling and prototypes) • Development turnover (annual sales divided by annual average development work-in-progress) • Pipeline throughput rate • New products completed/released to production last 12 months • Cancelled projects and/or wasted spending last 12 months • Percent R&D resources/investment devoted to new products (versus total of new products plus sustaining and administrative) • Portfolio balance by project/development type (percent of each type of project: new platform/new market, new product, product upgrade) • Percent of projects approved at each gate review • Number of ideas/proposed product in pipeline or investigation phase (prior to formal approval) Program management • Actual staffing (hours or headcount) vs. plan personnel turnover rate • Percent of milestone dates met • Schedule performance • Personnel ratios 10 Product development function Program management continued Common metrics • Cost performance • Milestone or task completion vs. plan • On-schedule task start rate • Phase cycle time vs. plan • Time-to-market or time-to-volume Enterprise • Breakeven time or time-to-profitability • Development cycle time trend (normalized to program complexity) • Current year percent of revenue from products developed in the last “x” years (where “x” is typically the normal development cycle time or the average product lifecycle period) • Percent of products capturing 50 percent or more of the market • Percent of R&D expense as a percent of revenue • Average engineering change cycle time • Proposal win rate • Total patents filed/pending/awarded per year • R&D headcount and percent increase/decrease in R&D headcount Product assurance • Actual MTBF/predicted MTBF • Percent of build-to-packages released without errors • Percent of testable requirements • Process capability (Cp or Cpk) • Product yield • Field failure rate • Design review cycle time • Open action items • System availability • Percent of parts with no engineering change orders Software engineering • Man-hours per 1,000 software lines of code (KSLOC) • Man-hours per function point • Software problem reports (SPRs) before release per 1,000 software lines of code (KSLOC) • SPRs after release per KSLOC • Design review errors per KSLOC • Code review errors per KSLOC • Number of software defects per week • SPR fix response time 11 Product development function Common metrics Parts procurement • Number of suppliers • Parts per supplier (number of parts/number of suppliers) • Percent of standard or preferred parts • Percent of certified suppliers • Percent of suppliers engaged in collaborative design Product • Unit production cost/target cost • Labor hours or labor hours/target labor hours • Material cost or material cost/target material cost • Product performance or product performance/target product performance or technical performance measures (e.g., power output, mileage, weight, power consumption, mileage, range, payload, sensitivity, noise, CPU frequency) • Mean time between failures (MTBF) • Mean time to repair (MTTR) • System availability • Number of parts or number of parts/number of parts for last generation product • Defects per million opportunities or per unit • Production yield • Field failure rates or failure rates per unit of time or hours of operation • Engineering changes after release by time period • Design/build/test iterations • Production ramp-up time • Product ship date vs. announced ship date or planned ship date • Product general availability (GA) date vs. announced GA date or planned GA date • Percent of parts or part characteristics analyzed/simulated • Net present value of cash outflows for development and commercialization and the inflows from sales • Breakeven time • Expected commercial value (equals the net present value of product cash flows multiplied by the probability of commercial success minus the commercialization cost; this is multiplied by the probability of technical success minus the development costs) • Percent of parts that can be recycled • Percent of parts used in multiple products • Average number of components per product 12 Product development function Common metrics Organization/team • Balanced team scorecard • Percent project personnel receiving team building/team launch training/facilitation • Average training hours per person per year or percent of payroll cost for annual training • IPT/PDT turnover rate or average IPT/PDT turnover rate • Percent core team members physically co-located • Staffing ratios (ratio of each discipline’s headcount on project to number of design engineers) Technology • Percent team members with full access to product data and product models • CAD workstation ratio (CAD workstations/number of team members) • Analysis/simulation intensity (analysis/simulation runs per model) • Percent of team members with video-conferencing/ desktop collaboration access/tools Footnotes Innovation 2005,The Boston Consulting Group. “Money Isn’t Everything,” The Booz Allen Hamilton Global Innovation 1000, Barry Jaruzelski, Kevin Dehoff, Rakesh Bordia, 2005. 3 Ibid. 4 Unmanaged R&D Spending is the Leak that Shareholders Want Plugged, Kevin O’Marah, Laura Carrillo, AMR Research, 2004. 5 Ibid. 6 The PDMA Handbook of New Product Development, Kenneth B. Kahn, George Castellion, Abbie Griffin, 2005. 7 Ibid. 8 The Human Side of Enterprise, Douglas MacGregor, 1960. 9 The Performance Measurement Group, 2002. 10 Op. cit. Brown, Aberdeen Group. 11 Ibid. 12 Op. cit., PDMA Handbook 13 Product Development Metrics, Kenneth Crow, DMR Associates, 2001. 14 The originator of the ladder of abstraction is S.I. Hayakawa, who presented it in his famous book Language in Thought and Action, Fourth Edition 1990. 1 2 13 About Siemens PLM Software Siemens PLM Software, a business unit of the Siemens Industry Automation Division, is a leading global provider of product lifecycle management (PLM) software and services with nearly six million licensed seats and 56,000 customers worldwide. Headquartered in Plano, Texas, Siemens PLM Software works collaboratively with companies to deliver open solutions that help them turn more ideas into successful products. For more information on Siemens PLM Software products and services, visit www.siemens.com/plm. Siemens PLM Software Headquarters Granite Park One 5800 Granite Parkway Suite 600 Plano, TX 75024 USA 972 987 3000 Fax 972 987 3398 Americas Granite Park One 5800 Granite Parkway Suite 600 Plano, TX 75024 USA 800 498 5351 Fax 972 987 3398 Europe 3 Knoll Road Camberley Surrey GU15 3SY United Kingdom 44 (0) 1276 702000 Fax 44 (0) 1276 702130 Asia-Pacific Suites 6804-8, 68/F Central Plaza 18 Harbour Road WanChai Hong Kong 852 2230 3333 Fax 852 2230 3210 © 2009 Siemens Product Lifecycle Management Software Inc. All rights reserved. Siemens and the Siemens logo are registered trademarks of Siemens AG. Teamcenter, NX, Solid Edge, Tecnomatix, Parasolid, Femap, I-deas and Velocity Series are trademarks or registered trademarks of Siemens Product Lifecycle Management Software Inc. or its subsidiaries in the United States and in other countries. All other logos, trademarks, registered trademarks or service marks used herein are the property of their respective holders. www.siemens.com/plm 8/09