Does Purchase Without Search Explain Counter Cyclic Pricing? January 18, 2015

advertisement

Does Purchase Without Search Explain

Counter Cyclic Pricing?

January 18, 2015

Abstract

Basic economic theory tells us to expect that an increase in demand

should lead to an increase in price. However, studies have found the

opposite trend in the prices of seasonal goods, such as canned soup.

I propose an explanation of this phenomenon: consumers are more

likely to purchase without search in low demand periods, reducing the

gains of temporary price reductions, and decreasing estimated price

sensitivity. Purchase without search is consistent with consumers using shopping lists to make their purchase decisions before observing

prices. I test this explanation using a novel dynamic, structural inventory model where consumers make decisions on whether to search,

which reveals price promotions, and which products to purchase given

their search decision.

I find that consumers with no inventory search for soup 39% of

the time in winter, compared to 23% in summer. This causes price

elasticities that are more than 64% larger in winter then they are in

the summer. I find that the dominant cause of seasonal search is

seasonal price variation, rather than seasonal consumption utility.

1

Introduction

Basic economic theory tells us to expect that an increase in demand should

lead to an increase in price. However, studies have found the opposite trend

1

in the prices of seasonal goods, such as beer, cheese, crackers, tuna, and my

focal category of canned condensed soup, where prices have been observed

to decrease in periods of high demand. This phenomenon has been termed

“counter-cyclic pricing”.

In this paper, I propose that counter-cyclic pricing is partially a reaction

to seasonal changes in consumers’ propensity to make purchase decisions

without searching the category. For example, shoppers who use a shopping

list may choose both the variety and quantity of a good to purchase before observing prices at the store. An increase in purchases without search

will increase average prices because non-searching consumers will not react

to discounts, and so holding a sale will simply decrease the price that these

consumers pay. I posit that consumers make a higher proportion of their purchases without search in low demand periods due to two seasonal changes

in search incentives. First, the average purchase size is smaller, and so the

expected savings resulting from finding a lower price are lower. Second, because the depth of discount is smaller in low demand periods, there is less

reason to search for lower prices, which amplifies the first effect. Firms may

react to this change in search behavior by offering larger discounts in high

demand season. If only a portion of consumers search in each period, then

firms can increase profits by offering stochastic discounts. More price sensitive consumers will be more likely to search and buy the cheapest product,

while less price sensitive consumers will be more likely to pay full price. The

cost of holding such promotions are the people who would have bought at

2

full price, but instead received a discount. In the low demand period, there

is less search amongst those who buy, and therefore the relative cost of a

price promotion is higher. Alternatively, an increase in search likelihood

in high demand season could directly lead to larger discounts if firms are

setting prices by measuring local price elasticities. Increasing promotional

depth could result in a feedback loop by increasing search likelihood in turn,

in which case the observed pricing strategy may in equilibrium. This paper

estimates the consumer side of the model, while controlling for firms pricing

strategy.

Studying this phenomenon calls for a dynamic structural consumer inventory model for three reasons. First, the structural model weights the two

seasonal changes in search incentives according to their value to consumers.

This is a more restrictive approach than a reduced form model which might

allow for search to be any combination of these factors. Second, due to the

presence of counter cyclic pricing, the two changes in search incentives are

correlated. A dynamic consumer inventory model can structurally account

for both of these factors, and will discern the impact that each of these factors have on consumer search. Third, many seasonal products, including

canned soup, are storable. Consumers may take advantage of temporary

price reductions by “stocking up” for future consumption. In this case, a

static model would overestimate price sensitivity because it would misinterpret inter-temporal substitution for an overall increase in demand. Studies

have found that static models may overestimate price elasticities by as much

3

as 30% Nevo and Hatzitaskos (2006). Furthermore, consumer inventories

provide useful variation in search incentives because consumers with large

inventories will be less likely to search.

Several other explanations of this phenomenon have been put forward in

the literature. While these explanations are contributors to counter-cyclic

pricing in other contexts, they not fully explain the phenomena in the category of canned soup. Warner and Barsky (1995) first observed counter-cyclic

pricing in retail and apparel stores, and proposed that it was caused by increased increased inter-store competition. However, in the case of consumer

packaged goods, the potential savings are much smaller, which may make

the cost of interstore price comparisons prohibitive. Chevalier et al. (2000)

find counter cyclic pricing trends in consumer packaged goods, and show that

these pricing trends are consistent with a loss-leader strategy, where the retailer lowers the price of goods to attract consumers to their store. However,

in order to induce consumers to visit the store, the store Lal and Matutes

(1994) must inform consumers of the lower prices through advertising, otherwise there is a hold-up problem. As such, loss leadering can explain all the

featured promotions, but none of the non-featured promotions which account

71% of all promotions in my data.

In a re-analysis of the data in Chevalier et al. (2000), Nevo and Hatzitaskos (2006) find a seasonal trend in the aggregate price sensitivity of consumers, and argue that prices are higher during low demand periods because

aggregate price sensitivity is lower. They propose several explanations of

4

this trend in price sensitivity. This paper compliments there findings. Where

Nevo and Hatzitaskos (2006) discover the trend in price sensitivity, this paper

presents a new, search-based explanation of the trend.

One of the explanations provided by Nevo and Hatzitaskos (2006) was

that changes in price sensitivity are caused by consumer heterogeneity, which

was formalized in Guler et al. (2014)1 . In this model, there are consumers

have either a “high” and “low” valuation of the product, and during low

demand season the “low” types drop out of the market, leaving only the

less price sensitive “high” types. This explains both counter-cyclic pricing

and seasonality in estimated price sensitivity. However, the data I analyze

supports the search explanation in three ways. First, I find that the seasonal

trend in estimated price sensitivity does not dissipate when controlling for

consumer heterogeneity using a proxy. Second, I find that consumers making

larger purchases have a higher estimated price sensitivity. In the heterogeneity explanation consumers buying large quantities would be more likely to be

“high” types, and therefore should have a lower estimated price sensitivity.

Finally, I fit a structural dynamic models routed in each explanations, and

find the search model fits the data better despite having fewer parameters.

Consumers strategically purchasing without observing prices has important implications beyond counter-cyclic pricing. Retailers can change the

frequency of consumer search by altering their pricing strategy. For example, rational consumers will respond to a reduction in price variation by

1

Bayot and Caminade (2014) empirically tests a similar model

5

searching less frequently, which may reduce their estimated price sensitivity. Counter-cyclic pricing and seasonality provides a unique opportunity

to study strategic search because it provides exogenous variation in search

incentives throughout the year. This variation allows me to demonstrate

strategic consumer search, which practitioners can account for when designing promotional strategies. The results also provide a structural explanation

to the findings of Mela et al. (1998), who show that over time, consumers

exposed to an increase in promotional depth become more price sensitive.

The structural framework developed here can allow other researchers and

practitioners to control for this effect when designing pricing schemes.

The structural model is motivated by four descriptive analyses of a panel

data on canned soup purchases. First, I find in my data that the concentrated

soup industry, exhibits counter-cyclic pricing. Second, I replicate the findings of Nevo and Hatzitaskos (2006) by showing a significant seasonal trend

in estimated price sensitivity. Third, I find some evidence that consumers

occasionally purchase without search by showing that purchase quantity increases estimated price sensitivity. This may be because consumers who

purchase small quantities are less likely to have searched, and thus more

likely to purchase without search. Fourth, I find that the seasonal trend in

aggregate price sensitivity positively correlates with seasonal trends in both

overall volume sold and price variation. Both seasonality and price variation

serve as proxies for search likelihood if consumers are strategically searching.

Estimating this model using standard dynamic methods presents a com6

putational challenge because seasonal shifts in consumption utility, price expectations, and search probabilities require an expanded state space. The

inclusion of these trends in the model necessitates that I solve for expected

discounted payoffs separately for each seasonal period, which increases the

size of the state space by a factor of 52, one for each week of the year. To

allow the seasonal period to be added to the state space at no additional

computational cost, I use the Cyclic Successive Approximation Algorithm of

Haviv (2015).

This paper fits a dynamic consumer inventory model, following Erdem

et al. (2003), and Hendel and Nevo (2006). By assuming consumers do not

observe prices of all products in each period, I follow the price consideration

model of Ching et al. (2009), and the structural search models presented in

Seiler (2013), and Honka (2012). However, in those models, consumers must

observe prices before making a purchase. In allowing consumers to selectively

ignore price information, I follow the econometric framework of Mehta et al.

(2003), and the descriptive evidence of Ray et al. (2012) and Murthi and Rao

(2012). Specifically, in my model, consumers respond to an increase in price

variation by searching more frequently. Consumers can choose whether to

search, in which case they react to prices, or to purchase without search, in

which case they are not price sensitive. In this respect, the estimated model

can be considered a structural, dynamic implementation of the models in

Bucklin and Lattin (1991) and Katz (1984), that allows for the size of the

“planned” and “opportunistic” segments to endogenously depend on search

7

incentives.

The rest of the paper is organized as follows: in Section 2, I describe the

data set and report summary statistics; in Section 3, I present descriptive

and static evidence consistent with the existence of counter-cyclic pricing and

seasonal trends in purchase without search; in Section 4, I detail the dynamic,

structural inventory model of the concentrated soup industry which allows

consumers to purchase without search; in Section 5, I outline the estimation

procedure; in Section 6, I present the results of the estimation; and in Section

7, I conclude.

2

Data

This project used the panel data in the “IRI Marketing Data Set” Bronnenberg et al. (2008). Panel data on consumers in Eau Claire, Wisconsin and

Pittsfield, Massachusetts is reported for 30 categories over the seven years

from January 1st, 2000 to December, 31st 2006.

I focus on the purchases of concentrated soup to study counter-cyclic

pricing trends for four reasons. First, the concentrated soup category clearly

exhibits strong seasonality, with purchase volume rising dramatically in the

winter. Second, the category exhibits counter-cyclic pricing trends. Third, in

the data I analyze, concentrated soup is highly concentrated, with Campbell’s

having more than a 84% market share, and the remainder being a private

label. This simplifies the pricing problem the retailer and manufacturer face.

8

Fourth, concentrated soup is purchased almost exclusively in 10.75 oz. cans,

which are typically consumed in one sitting. This limits consumer inventories

to a discrete number of cans, which simplifies the construction of the dynamic

model.

The data set initially has 10,157 panelists. I analyze a single store to

ensure that the price distribution is constructed accurately. Accurately estimating the price distribution is important because consumers partially base

their search decision on it. However, I use all purchase data when constructing consumer inventories to ensure that my sample limitation does not bias

the estimated inventories. I choose the store with largest number of concentrated soup purchases in the sample, located in Pittsfield, Massachusetts.

My dataset is comprised of the 3,045 panelists make purchases at this store.

The panel is unbalanced: participants participate for an average of 3.04

years. The data was collected in two ways: For 87% of panelists, purchases

were recorded electronically when the panelist used a loyalty card at check

out. In addition to using the loyalty card, 2% of panelists used a “key”, which

allowed them to electronically scan their own purchases. 10% of panelists

switched from using a key to using a loyalty card over the course of the

sample.

Consumers purchase concentrated soup corresponding to 116 Universal

Product Codes (UPC) in this panel data. I only observe the price of a UPC

in weeks where a purchase is made. To ensure that the price series for each

UPC I analyze can be accurately extracted from the data, I focus on the top

9

ten best selling UPCs, which represent 57% of observed sales.

For each week, I identify the price of each UPC by looking at the dollars

spent and the units purchased by panelists. The non-discounted price of each

UPC is not explicitly observed. I calculate the non-discounted price in two

ways. First, I treat price increases as permanent, which is consistent with

the observed price series. Second, I consider any price that persists for 5

weeks to be the permanent price. The market shares and summary statistics

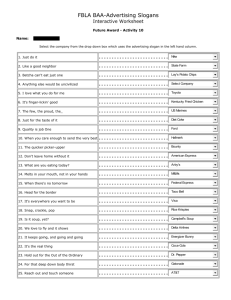

of these UPCs are presented in Table 1.

The week-to-week price of each flavor changes in 22% of weeks. UPCs

tend not to go on sale at the same time: 49% of weeks where discounts are

available have only 2 or fewer UPCs discounted. This variation in prices,

across weeks and across varieties, creates the incentive to search: consumers

who search can purchase one of the few discounted UPCs. Consumers will

buy multiple UPCs in 17% of weeks.

UPC Number

15100000011

15100001251

15100001261

8849999857472

15100001031

15100001541

8849999857432

15100001051

8849999857515

15100001231

Corresponding Flavor

Tomato

Chicken Noodle

Cream of Mushroom (1)

Cream of Mushroom (2)

Cream of Chicken (1)

Chicken and Stars

Cream Of Chicken (2)

Chicken and Rice

Tomato (2)

Vegetable Beef

Market Share

32%

23%

13%

8%

5%

4%

4%

3%

3%

3%

Average Price

0.67

0.81

0.92

0.71

1.17

1.19

0.69

1.22

0.5

1.23

Discount Frequency

13%

13%

10%

45%

15%

12%

39%

5%

33%

2%

Table 1: Flavor Summary Statistics

10

Average Discount

0.15

0.25

0.24

0.14

0.49

0.39

0.18

0.44

0.07

0.42

3

Static Evidence

In this section, I provide some descriptive evidence suggesting that countercyclic pricing is caused by seasonality in purchase without search. This will

highlight trends in the data that allow me to identify the parameters of the

dynamic model, and motivate its structure.

3.1

Seasonality and Counter Cyclic Pricing

Counter-cyclic pricing denotes the simultaneous presence of three patterns

in the category sales data: seasonal demand trends, seasonal pricing trends,

and a negative correlation between these two trends. One might expect soup

to be consumed more often during cold weather, or to help soothe a sore

throat, both of which are more common in the winter months. This trend is

typified by the sales data presented in Figure 7, where the demand for soup

is highest during the winter and lowest during the summer. I found this

trend to be statistically significant by regressing average weekly sales onto a

4-degree polynomial based on the time of year (Table 2, Column 1).

Accurately estimating underlying seasonality requires controlling for price

promotions. Seasonal promotional trends may amplify or cause the observed

seasonal demand trends because increased demand is a natural consequence

of reduced prices. I focus on price promotions, rather than permanent price

changes, because permanent price changes are both rare

2

Permanent price changes occur in less than 2% of periods.

11

2

and highly corre-

lated across UPCs. I treat these price changes as an inflationary factor that

affects both concentrated soup and outside goods.

The seasonal promotional trend in the category is statistically significant

(Table 2, Column 4), and can be seen in Figure 7, which plots the average

discount over the course of the year. In contrast to quantity demanded, the

average discount is lowest during the summer months and highest during the

winter months.

To demonstrate the correlation between underlying demand and prices,

I construct a descriptive estimate of the underlying demand from the polynomial in Table 2, Column 3. The relationship between this measure of

underlying demand and the average discount offered by the retailer in each

week is shown to be positive and significant (Table 2, Column 5), which is

consistent with counter-cyclic pricing.

3.2

Seasonality in Estimated Price Sensitivity

Nevo and Hatzitaskos (2006) found that counter-cyclic pricing is induced by

a simultaneous trend in consumer price sensitivity. They observe a reduction

in aggregate price sensitivity in low demand periods. I find evidence of this

trend in the IRI data by using a logit model to predict consumers’ flavor

decisions over the course of the year. Hendel and Nevo (2006) show that

if a shopper’s consumption does not depend on the flavor purchased, then

the flavor decision in a dynamic inventory model simplifies to a logit model,

which can be estimated by using static maximum likelihood. I use this model

12

Table 2: Descriptive Regression Results

Average Weekly Units Sold

(1)

Week In Year - Linear

Week In Year - Quadratic

Week In Year - Cubic

Week In Year - Quartic

(2)

(3)

(4)

0.005

(0.003)

−0.0005∗∗

(0.0002)

0.00002∗∗

(0.00001)

−0.0000001∗∗

(0.0000001)

1, 277.373∗∗∗

(166.187)

−13.192

(8.790)

−0.408

(0.666)

0.034∗

(0.019)

−0.0004∗∗

(0.0002)

1, 008.639∗∗∗

(153.465)

−8.599

(9.263)

−0.895

(0.700)

0.049∗∗

(0.020)

−0.001∗∗∗

(0.0002)

Discount

Discount

Reduced Form Demand

Constant

R2

369.495∗∗∗

(36.214)

0.234

196.062∗∗∗

(8.173)

0.140

350.319∗∗∗

(34.380)

0.317

0.019

(0.012)

0.058

(5)

0.0001∗∗∗

(0.00004)

0.046∗∗∗

(0.006)

0.034

to identify flavor preferences and estimate price sensitivity over the course of

the year.

Suppose that the utility gained for purchasing a product of flavor ft is

given by:

αst pf t + α2 p2f t + ηf + εf t

where αst is the price sensitivity in seasonal period st , pf t is the price of

flavor f at time t, ηf is the flavor dummy, and εf t is an IID shock with

a type-1 extreme value distribution. Then, assuming consumers are utility

maximizing and comparing the market shares of each flavor in each period,

we have

2

eαst pf t +α2 pf t +ηf

P (f |p, s) = P α p 0 +α p2 +η 0 .

e st f t 2 f 0 t f

f 0 ∈F

13

where P (f |p, s) is the market share of flavor f conditional on purchase. This

equation can be estimated using maximum likelihood. I approximate the

seasonal price coefficient αst with a 4-degree polynomial based on time of

year. Consistent with Nevo and Hatzitaskos (2006), I find a statistically

significant seasonal trend in estimated price sensitivity that is high during

winter and low during summer (Figure 7)(Table 3, Column 1).

I propose that this seasonal trend is caused by seasonal search patterns,

which would cause each consumer to appear more price sensitive when search

incentives are high. This trend is not explained by Warner and Barsky (1995),

because the change in estimated price sensitivity is observed when comparing

the alternatives at a single store, rather than the alternatives between stores.

An alternative explanation of this trend appears in Guler et al. (2014), who

explain the phenomenon by suggesting that the price sensitivity is due to

consumer heterogeneity. That is, during high demand season, price sensitive

consumers enter the market. To test if this would explain the observed

trend in price sensitivity, I split the consumers in my sample into high and

low price sensitivity segments using a median split based on a proxy3 . I

then re-estimated the above analysis while allowing each segment to have a

different baseline price sensitivity. If the dominant cause of seasonality in

price sensitivity was heterogeneity, then controlling for heterogeneity should

mute the observed seasonal trend in estimated price sensitivity. I find that

3

I proxied the price sensitivity of each consumer by calculating how likely they were

to choose the lowest priced can of soup when purchasing. Consumers who are more price

sensitive should be more likely to select the lowest priced can of soup

14

the trend in price sensitivity persists, and is of a similar magnitude when

controlling for this heterogenity: estimated price sensitivity seasonally shifts

by −1.28 when I don’t control for seasonality, and seasonally shifts by −1.236

when I do (Table 3, Column 3).

Alternatively, a seasonal trend in estimated price sensitivity could be due

to a non-linear price response. If consumers become are more price sensitive

when there are larger discounts, then they will be more price sensitive in the

winter when discounts are large. To account for this possibility, I allow the

response to prices to be nonlinear throughout by including a quadratic term

(α2 above). The seasonality in price sensitivity persists when controlling for

a non-linear response to prices.

3.3

Purchase Without Search

Purchase without search cannot be directly identified because I do not observe whether shoppers check prices in any given period. However, I do observe three patterns in the data supporting the existence of purchase without

search. The more frequently consumers purchase without search, the lower

their estimated price sensitivity will be, because consumers need to observe

prices in order to react to them. Therefore, if consumers strategically decide

to sometimes purchase without search, then factors that affect the likelihood

that search occurred, such as search incentives or search costs, will affect

estimated price sensitivity. I find that three such factors have a significant

effect on estimated price sensitivity: aggregate demand, promotional depth,

15

and number of units purchased.

First, if consumers search strategically, they are more likely to choose to

observe prices when there are larger incentives to do so. Consumers would

then be more likely to search when they have a larger expected purchase

size because a lower price would yield greater expected savings. Because the

number of consumers in the panel is constant over the course of the year, this

would induce a correlation between estimated price sensitivity and expected

aggregate demand in that time of year. Using the estimated price sensitivity

in Table 3, Column 2, I estimate this correlation to be -0.592 (p > 0.0001).

Second, consumers who search strategically would also be more likely

to search when there they expect larger promotions, because they want to

take advantage of bigger discounts. This would induce a correlation between

average promotional depth and estimated price sensitivity. Consistent with

purchase without search, I find that the seasonal trend in estimated price

sensitivity is significantly correlated with the trend in average promotion

depth estimated in table 2, Column 4 (cor = −0.326, p < 0.01859).

Third, consumers are more likely to purchase a large quantity of soup

when they’ve found a good discount. If they’ve found a good discount, and

can change their purchase decision based on that discount, they must have

checked prices. This leads to a correlation between search likelihood and

the number of units purchased. Since search likelihood correlates to with

both estimated price sensitivity, and units purchased, if consumers sometimes

purchase without search there should be a relationship between the number of

16

units purchased and estimated price sensitivity. I test for this by separately

calculating market shares for single unit and multiple unit purchases, and

comparing how these market shares react to price changes. I then repeat

the estimation in the previous section, but allow price sensitivity to change

if the consumer purchases multiple units. I find that buying multiple units

increases estimated price sensitivity by 1.58 (Table 3, Column 2). This result

is maintained when I also control for the proxy for price sensitivity (Table 3,

Column 5).

Furthermore, I reran all of these analyses while controlling for seasonal

UPC preferences, and while allowing for a more flexible response to price

changes by using a 4-degree polynomial. All the reported trends hold and

have a similar magnitude.

Table 3: Reduced Form Results

Price

Price×Week

Price×Week2

Price×Week3

Price×Week4

(1)

(2)

(3)

(4)

−7.6853∗∗∗

(0.0001)

−0.2007∗∗∗

(0.0001)

0.0214∗∗∗

(0.0009)

−0.00063∗∗∗

(0.0000)

5.63 × 10−6∗∗∗

(5.14 × 10−7 )

−6.8224∗∗∗

(0.0108)

−0.2031∗∗∗

(0.0259)

0.0195∗∗∗

(0.0031)

−0.0005∗∗∗

(0.0001)

4.67 × 10−6∗∗∗

(1.05 × 10−6 )

−1.5838∗∗∗

(0.0271)

−7.0261∗∗∗

(0.267)

−0.1632∗∗∗

(0.0003)

0.0186∗∗∗

(0.0009)

−0.0006∗∗∗

(0.0000)

5.01 × 10−6∗∗∗

(5.23 × 10−7 )

−5.7127∗∗∗

(0.0000)

−0.1843∗∗∗

(0.0000)

0.200∗∗∗

(0.0007)

−0.0006∗∗∗

(0.0000)

Multi-Unit Purchase×Price

Price Sens Consumer×Price

−1.3732∗∗∗

(0.0000)

−1.5051∗∗∗

(0.0001)

−1.1361∗∗∗

(0.0000)

9.3843∗∗∗

(0.001)

−0.2320∗∗∗

(0.0000)

9.5457∗∗∗

(0.0000)

Price Sens Consumer×

Multi-Unit Purchase

Price2

9.5177∗∗∗

(0.0002)

9.9329∗∗∗

(0.0102)

UPC Fixed Effects Omitted.

17

3.4

Evidence of Stockpiling

Consumers can stockpile canned soup easily because it will not spoil for a long

time (over a year), and because the packaging allows easy stacking. Hendel

and Nevo (2006) shows that if consumers stockpile, then estimating a static

model will lead to biased price elasticities. These storage dynamics are what

necessitate the dynamic model. To confirm that consumers are stockpiling

in this category, I look for a relationship between the number of units a

consumer purchases, and the time until their next purchase. If consumers

are stockpiling, then a consumer buying a large number of units may delay

their next purchase. I find that each additional can of soup purchased delays

the next purchase by 2.3 days4 when controlling for seasonality (Table 4).

4

Model

I model purchases in the concentrated soup industry using a dynamic, structural, inventory model. The model is dynamic because shoppers make decisions while taking into account price expectations, consumption probabilities,

and inventories in the subsequent periods.

Each week, consumers make decisions in four sequential stages: search,

quantity, flavor, and consumption. In the search stage, consumers first exogenously decide whether they will visit the store in the current period. If

4

From the regression in table 4, Column 2 each unit purchased delays the next purchase

by 0.328 weeks.

18

Table 4: Interpurchase Time Regressions

Interpurchase Time (Weeks)

Units Purchased

(1)

(2)

0.345∗∗∗

(0.086)

0.328∗∗∗

(0.086)

Week

0.187

(0.225)

Week2

−0.019

(0.018)

Week3

3.195 × 10−2

(5.08 × 10−4 )

Week4

−1.24 × 10−7

(4.78 × 10−6 )

Constant

Observations

R2

15.557∗∗∗

(0.293)

16.316∗∗∗

(0.866)

27, 325

0.001

27, 325

0.003

consumers don’t visit the store, they go straight to the consumption stage.

If they do visit the store, they then decide whether to search the category

before making their quantity and flavor decisions. If the consumers search,

they incur a search cost but observe the prices of all varieties. If consumers

do not search, they instead make their quantity and flavor decisions while

assuming there are no price promotions.

In the quantity stage, consumers decide on the quantity they want to purchase. When making this decision, consumers take into account the amount

of soup in their inventory, and how likely they are to consume soup in this

seasonal period. Consumers can (and frequently do) choose to purchase no

soup in this stage of the model.

In the flavor stage, consumers sequentially decide which flavors they will

19

purchase. In other frameworks, these decisions are made at the same time

as the quantity decision. However, the formulation used has two important

properties. First, it allows consumers to purchase different varieties in a single

period, which to my knowledge has not been possible in previous inventory

models, and is a feature of the canned soup industry. Second, it allows me

to estimate the flavor fixed effects separately from the dynamic model.

5

Finally, in the consumption stage, soup is consumed from consumer inventories. The probability that the consumer wants a can of soup varies by

time of year because soup is a seasonal good.

I outline the model in the following three steps. First, I define the utility

that a consumer receives in each stage of the model. Second, I define the

expected discounted payoffs and Bellman equation for the problem, which

are used to calculate the likelihood. Third, I formally define the choice that

a consumer makes in each stage, solve for the probability of any particular

choice, and calculate the expected discounted payoffs the consumer receives

during the current stage, any remaining stages, and all subsequent periods.

4.1

Flow Utility

Consumers receive utility based on their decisions in each of the four stages

of the model. For notational convenience, I omit the time subscript t from

5

One additional assumption required here is that consumers observe the prices of the

cans of soup they purchase, and put back any cans that have had a large price increase.

This could happen as they put the can in their cart, or at check out. This does not affect

the estimation because firms are never observed to do this, but it does explain why firms

don’t set arbitrarily high prices if consumers sometimes purchase without checking prices.

20

all variables.

4.1.1

Search Stage

Consumers visit the store with exogenous probability Pv (s), where s is the

seasonal period. If consumers visit the store, then the utility they receive

during the search stage is specified as:

us (r; εs , ε0s ) = 1(r = 1)(−ρ + εs ) + 1(r = 0)(ε0s )

(1)

where r is an indicator variable that equals 1 if the consumer searches and

is 0 otherwise, ρ is the search cost, εs and ε0s are random shocks that have

an IID type-1 extreme value distribution with standard deviation σεs .

4.1.2

Quantity Stage

Consumers receive the following utility for purchasing q cans of soup

−

uq (q, →

εq ) = ηq + εq

(2)

where q is the number of cans of soup purchased, ηq is a quantity fixed effect, and εq is an IID shock a type-1 extreme value distribution with standard

deviation σεq . For each can purchased, the consumer selects a flavor in the

next stage of the model, which is where flavor preference and prices directly

impact utility. As shown in the section on the decision at the quantity stage,

prices will impact the quantity purchased.

21

4.1.3

Flavor Stage

Consumers receive the following utility for purchasing a can of flavor f soup

as their w purchase.

2

uf (fw ; p, −

ε→

fw ) = α1 pfw + α2 pfw + ηfw + εfw

(3)

where fw is the flavor chosen for purchase w, −

ε→

fw is a vector of shocks, α1

and α2 are price sensitivity parameters, p is a vector of prices, pfw is the price

of flavor fw , ηfw is a flavor fixed effect, and εfw is an IID shock with a type-1

extreme value distribution with standard deviation σεf . I use a quadratic

response to prices to account for the possibility that the seasonal variation

in price sensitivity is caused by a non-linear response to price changes, as

discussed previously.

4.1.4

Consumption Stage

In the consumption stage, consumers will attempt to consume soup up to

their randomly distributed desired consumption d, which is assumed to have

a geometric distribution with a probability parameter of Pd (s). Consumers

can only consume soup from their total available inventory after purchases,

which is the sum of their initial inventory i and their purchase quantity q.

Consumers receive the following utility for this consumption:

uc (c) = k × c

22

(4)

where k is the utility received per can of soup consumed, and c is the

quantity of soup consumed. Seasonal variation in consumption is modelled

through variations in Pd (s) throughout the year.

Note that consumption utility only depends on the number of cans consumed, and not the flavor of those cans. Instead, flavor preferences are modelled in the purchase decision with a fixed effect. This assumption allows

me to separate the flavor decision from dynamic considerations because the

flavor decision now only affects the static utility in the purchase stage. This

reduces the size of the state space because only the total number of cans of

soup in inventory need to be tracked from period to period, rather than the

number of cans of each flavor.

4.2

State Variables and Value Functions

The model has two persistent state variables: seasonal period, and inventory

level. In the model, the seasonal period affects the probability of visiting

the store, the probability of consumption, and price expectations. The seasonal period is a cyclic state variable that represents the time of year, which

updates deterministically as follows:

st+1 = s + 1 if s < |S|

= 1 if s = |S|

23

where |S| is the total number of seasonal periods. The deterministic updating

of this state variable allows me to apply the cyclic successive approximation

algorithm of ?, which removes the computational burden of adding this state

variable to the dynamic model. This algorithm reduced the cost of solving

for the value function by a factor of 52.

The inventory levels are increased through purchase, and decreased through

consumption:

it+1 = it + qt − ct

At any point, consumers can have at most imax cans of soup in their inventory. In the model inventory level affects the need for purchase. If a

consumer has canned soup in inventory, they are more likely delay their

purchase until they find a price promotion. Because consumers are forward

looking, they consider how their decisions impact their expected discount future utility. Formally, consumers seek to maximize their expected discounted

utility in each period. Let Ω be a vector of all of the transient state variables

−

εq , −

ε→

Ω = (Pv (s), εs , ε0s , p, →

fw , Pd (s)), and let a be the vector of the actions a

consumer can take a = (r, f, q, c). I define the total utility that a consumer

receives in period t as u(a, s, i, Ω). Note that consumers do not observe all

the state variables simultaneously; each of the IID shocks and the desired

consumption are revealed in their respective stage in the model. Consumers

make their decisions to maximize their total expected discounted payoff given

starting persistent states s and i, which can be conveniently expressed in the

24

following integrated Bellman equation:

V (s, i) = E(max u(aτ , sτ , iτ , Ωτ ) + δE(VΩ (st+1 , it+1 , Ωt+1 )|s, i, Ω))

a

(5)

where δ is the discount factor. This integrated Bellman equation will allow

me to solve for the value function, which is required to estimate the model.

The formal derivation of the consumer decisions at each stage and the overall

likelihood are derived in an online appendix.

5

Estimation

5.1

Identification

I provide an informal discussion of the identification of the parameters of

the model by going backwards through the stages of the model. In the

consumption stage, I identify consumption probability by time of year Pd (s)

by the seasonal variation in overall purchase quantity. Consumers should

try to keep their inventories low because of the discount factor, and because

they want to be able to take advantage of future sales. After controlling

for price variation, consumers should then purchase more soup when their

consumption probability is high. The utility of consuming a can of soup k is

identified by the aggregate number of purchases consumers make. The more

soup consumers purchase, the higher the consumption utility they receive.

In the flavor stage, the flavor fixed effects ηf are identified by comparing

25

the sales of different flavors when they are not discounted. As discussed

in the next section, the relative market shares of undiscounted flavors will

identify the flavor fixed effects. The price sensitivity parameter α can be

identified by investigating flavor choices in purchases that are very likely to

have been searched: for example, consumers who purchase 4 cans of soup

during winter. As search probability goes to 1, the flavor decision becomes a

standard logit choice model, and we can identify the price sensitivity by how

the market share of each flavor reacts to changes in price.

In the quantity stage, the variation in the quantity shock σq is identified

by the relationship between discounts and purchase quantity. If discounts

have a large role in determining purchase quantity, then random shocks play

a relatively smaller role, and so σq will be smaller. The quantity fixed effects

represent consumers’ preference for buying ηq different numbers of cans. This

is identified by the frequency of purchase sizes. For example, this parameter

captures that consumers prefer to buy cans of soup in even numbers.

In the search stage, the parameter ση represents the week to week variation in search costs, and is identified using the correlation of seasonal trends

in price sensitivity with seasonal changes in consumption probability and

price expectations. If price sensitivity has a close relationship with search

incentives, then ση will be small, and if price sensitivity does not react to

changes in search incentives, then the decision is more random and so ση will

be large. The search cost ρ shifts the probability of search across the entire

year, and is identified by comparing each purchase to both an unsearched

26

purchase, and a searched purchase.

Several parameters in the model are not directly identified, and must

be set at fixed levels. Because this is a utility model, the parameters are

only identified to a multiplicative and addititive constant. As a result, I

normalize the standard deviation of the flavor shock σf to 1. Similarly, I

normalize the utility of purchasing one can of the most popular flavor to 0.

Neither the discount factor nor price expectations are not identified in the

dynamic model. I set the weekly discount factor to .99 per week. I set the

largest possible inventory, imax , to be 4. The model is estimated on weekly

data, with seasonal periods |S| numbering 52.

Price expectations are also not identified in the data. I assume that

consumers draw from the empirical distribution of prices within a month of

the current week. That is, a consumer in the first week of July will have

a price distribution based on the observed prices between the first week in

June and the first week in August in any year.

5.2

Estimation Assumptions

To ensure inventories are unbiased, I initialize consumers as starting with 0

inventory, and remove the first year of data as ’burn-in’. I also remove records

where consumers don’t purchase canned soup for a full year. While it is theoretically possible to estimate the desired consumption probability Pd (s) for

each seasonal period s, this would result in a large increase in the parameter

space, and there likely isn’t the data to identify each Pd (s) separately. To

27

accommodate this, I assume a functional form for Pd (s) based on four parameters which represent consumption probability every three months: Pd (1),

Pd (14), Pd (27), and Pd (40). I then assume that Pd (s) is a linear combination

of the two closest parameters. For example, the consumption probability in

week 3 would then be P3 (3) = Pd (1) +

3

(Pd (14)

13

− Pd (1)). The advantage

of this specification is threefold. First, it drastically reduces the number of

consumption probabilities to estimate. Second, the resulting parameter estimates are easily interpretable. Third, it allows for consumption probabilities

to change smoothly across and between years. The weakness of this specification is that it imposes that the largest and smallest consumption probability

will occur in week 1, 14, 27, or 40. The UPC fixed effects are estimated statically by comparing the market shares of products that are not on discount.

The details of this estimation are provided in an online appendix.

6

6.1

Results

Dynamic Estimation Results

The results of the dynamic model are presented in Table 5.

6.1.1

Search Stage

Consumers in the search stage first exogenously decide to visit the store,

which varies based on the seasonal period. I find that the probability of

visiting this store tends to increase over the course of the year, with the

28

exception of a drop in August. One would expect that a decrease in the

probability of visiting a store would lead to an increase in stockpiling behavior because consumers will have to wait longer before they restock their

inventory.

Search costs are found to be positive at 1.6409. In dollar terms, the

search cost is equivalent to a discount of $.0369. Search probability varies

substantially over the course of the year. Search is highest in late November,

when a consumer with no inventory will search 38.8% of the time, and is

at its lowest in mid-summer, when consumers only search 23.1% of the time

(Figure 7). Seasonal changes in the expected gains of search, which vary

between 6.02 in late November and 2.25 in mid-summer for a consumer with

no inventory, drive this variation in search. Changes in price expectations

and in expected purchase size drive the shift in expected gains.

6.1.2

Flavor and Quantity Stage

The variance of the shock in the quantity stage, σq , is estimated to be 9.097,

and is large compared the variance in the flavor stage (which is normalized to

1). The more variant the shock, the smaller the impact of the terms in other

stages. Therefore, the large value of σq reflects that price changes have a

much larger effect on the flavor decision than on the quantity decision. That

is, consumers who observe a sale are much more likely to change the flavor

they buy, than to increase the number of cans they purchase. The large

zero purchase fixed effect η0 reflects that consumers generally do purchase

29

soup on a week to week basis. The fixed effects for multiple cans show that

consumers strongly dislike buying 3 cans of soup as the fixed effect for 3 cans

is near that of 4 cans, possibly because it is an uneven number. the effect of

prices was found to be negative and convex

6.1.3

Consumption Stage

As expected, consumption probability over the course of the year shows

strong seasonality. Consumers are most likely to consume in soup near the

end of the year, where consumption probability reaches 27.5%. Consumption is only half as likely during the summer, bottoming out at 12.8%. This

seasonal trend in consumption probability largely mirrors the seasonal trend

in overall units purchased (cor=.798 , p < .001). However, the consumption

probabilities from the dynamic model give some insights that aggregate purchases alone do not. For example, the dynamic model finds that consumption

probability actually increases over the course of the last quarter, while the

overall units purchased decreases. This is because consumers stockpile soup

during the fall to consume during the winter. The magnitude of the consumption utility k is comparable to the magnitude of the zero purchase fixed

effect η0 . So long as the can is consumed within 4.143 weeks6 , the consumer

will gain utility from the purchase.

6

Calculated as

log(η0 )−log(k))

log(.99)

30

6.1.4

Purchase Without Search and Counter-Cyclic Pricing

The seasonality in consumer search leads to seasonality in price elasticity. For

example, the price elasticity of the most popular UPC varies from −6.34 in

the middle of summer, to −9.20 at the end of November (Figure 7). If firms

partially base their prices on consumer price elasticity, then counter-cyclic

pricing will arise as a reaction to this change in search behavior.

The most prominent alternative explanation of this trend in price elasticity is consumer heterogeneity, as presented in Guler et al. (2014). In this

model, consumers can be segmented into “High” and “Low” types. “High”

types have a higher valuation of soup, and are less price sensitive. During

low demand season, the low types drop out of the market, leaving only the

“High” type consumers. This explains both counter-cyclic pricing and the

seasonality in price elasticity.

This explanation was partially ruled out by the reduced form test in

Section 3.2. To further test the heterogeneity explanation in this data set,

I fit a second dynamic consumer inventory model where consumers always

search (similar to previous inventory models), and price sensitivity varies

seasonally (using the same functional form as consumption probability). This

model is consistent with the heterogeneity explanation, where the consumer

base becomes more price sensitive during the high demand periods.

Comparing the fit of the two models, the search model obtains a substantially better likelihood then the seasonal price sensitivity model, with

fewer parameters. This is noteworthy because the search model is in some

31

sense more restrictive: it can only capture trends in price sensitivity that

correlate with changes in search incentives. However, the search model endogenously captures three price sensitivity trends within each purchase: that

consumers are more price sensitive when they have bought multiple units,

that consumers who have inventory will be less price sensitive in their flavor decision7 , and that the seasonal trend in price sensitivity is muted when

consumers have inventory. In particular, the increase in price sensitivity

when buying multiple units is inconsistent with the heterogeneity explanation, which would predict that those who buy multiple units are more likely

to be “High” types, and so should be less price sensitive.

6.2

6.2.1

Counterfactual Simulation

Determinants of Search

To find out whether seasonality in consumption utility or price variation cause

the seasonal variation in search, I recalculated search probability in two counterfactuals based on the estimated parametrization: one where the consumption probability is constant and set to the average consumption probability,

and another when price expectations are constant over the course of the year.

Figure 7 shows the resulting search probabilities.

I find that seasonal search patterns are still prevalent in both cases. When

7

In previous inventory models, consumers with inventory have a higher price elasticity

in the quantity decision, but would not have a higher elasticity in the variety decision

within purchase as all prices are observed

32

price expectations are constant, the search probabilities for a consumer with

no inventory varies by 54% over the course of the year. When purchase

probabilities are constant, the search probabilities for a consumer with no

inventory varies by 42% over the course of the year. Because more seasonal

variation in search is maintained when price expectations are constant and

consumption probability is seasonal, I conclude that the primary cause of

seasonal search patterns is seasonal consumption utility, though both factors

play a role.

6.2.2

Effect of a Change of Promotional Strategy

In a second counterfactual experiment, I demonstrate how changes in promotional strategy affect consumer search probabilities. To do this, I simulate

consumer search probabilities when a firm increases the overall promotional

depth by 25%. This increase leads to an increase in the probability of consumer searches by as much as 7% during November. This in turn increases

the overall price elasticity by up to 6% (Figure 7).

7

Conclusions

This paper tests whether purchase without search could explain countercyclic pricing. I find that including purchase without search in a structural

model of canned soup purchases will lead to seasonally varying price elasticities. This is due to a seasonal trend in price sensitivity that is significantly

33

Search Cost ρ

Search Stage

log(Search Variation) log(σs )

Seasonal Price Sensitivity

1.6409∗∗∗

(0.547)

1.6230∗∗

(0.724)

-

−42.0534∗∗∗

(6.8252)

Price Sensitivity α

Flavor Stage

Search Model

-

Price Sensitivity Period 1

−8.5074∗∗∗

Price Sensitivity Period 14

−8.6754∗∗∗

Price Sensitivity Period 27

−7.272∗∗∗

Price Sensitivity Period 40

−8.1605∗∗∗

Quadratic Price Sensitivity α2

−67.1986∗∗∗

(13.309)

−11.0442∗∗∗

Zero Purchase Fixed Effect η0

97.4815∗∗∗

(25.683)

−67.3231∗∗∗

(11.820)

−147.3935∗∗∗

(30.459)

−200.5633∗∗∗

(39.819)

2.2079∗∗∗

(0.356)

0.2756∗∗

(0.133)

0.2030

(0.140)

0.1288∗∗∗

(0.051)

0.2401∗∗∗

(0.002)

101.6260∗∗∗

(9.922)

14.7213∗∗∗

Two Can Purchase Fixed Effect η2

Three Can Purchase Fixed Effect η3

Four Can Purchase Fixed Effect η4

Quantity Stage

log(Purchase Variation) log(σq )

Consumption Prob Period 1 Pd (1)

Consumption Prob Period 14 Pd (14)

Consumption Prob Period 27 Pd (27)

Consumption Prob Period 40 Pd (40)

Consumption Stage

Consumption Utility k

−1.2763 × 105

Log-Likelihood

−9.5084∗∗∗

−21.2134∗∗∗

−28.4546∗∗∗

0.4451∗∗∗

0.2822∗∗∗

0.1973∗∗∗

0.1338∗∗∗

0.2344∗∗∗

13.0166∗∗∗

−1.3161 × 105

Table 5: Dynamic Estimation

correlated with both aggregate demand and average promotional depth. If

firms set their prices by measuring the response to sales, then these trends

lead to counter-cyclic pricing. I find that the search model presented here

fits the data better than a traditional inventory model with seasonal price

elasticity. There are limitations to the approach here. First, I did not fit

a firm side model to the data. Second, I did not directly compare the im-

34

pact of purchase without search with the impact of other explanations of

counter-cyclic pricing, such as loss leader pricing, and consumer heterogeneity. Purchase without search could be working in tandem with these other

effects, and future work might compare the relative magnitudes.

The dynamic consumer inventory model presented here has three innovations unique to structural models. First, it allows consumers to make

purchase decisions without observing prices at the store. Second, it allows

consumers to purchase multiple flavors in each period. Third, it maintains

the ability to estimate flavor fixed effects separately from the dynamic model.

Fitting the model required two assumptions because both the discount factor and consumer price expectations are not identified. Though the seasonal

trend in price sensitivity was also found in the static estimation, the results

of the dynamic model could change here if these terms were identified.

The estimated model also provides insight into consumer behavior. I find

that consumers’ probability of search systematically varies throughout the

year, peaking at 27.5% in the winter and bottoming out at 12.9% in the

summer. This variation in search leads to price elasticities that vary by 64%

by season. The dominant cause of seasonal search was found to be seasonal

consumption utility. However, the firms’ own pricing strategy can affect

consumer search probabilities, and hence their price elasticity. For example,

if promotional depth is increased by 25%, consumers with no inventory will

be up to 7% more likely to search in the winter, which leads to price elasticity

increase of 6%.

35

An immediate follow-up to this paper would measure the relative impact

of several possible causes of counter cyclic pricing, including purchase without search, heterogeneity, loss leader pricing, and a non-linear response to

prices. Another follow-up could implement a firm side model. Given the

results presented in this paper, firms would want to reduce the size of their

promotions to limit consumer search. However, this would be balanced by

the desire for price discrimination. Investigating how firms can make this

trade-off, which could be done in the framework presented here, may allow

more effective promotional strategies. The fact that consumers may learn

the firms pricing strategy over time may complicate this question.

References

Bayot, D. and J. Caminade (2014). Popping the cork: Why the price of

champagne falls during the holidays. Available at SSRN 2455962 .

Bronnenberg, B., M. Kruger, and C. Mela (2008). Database paper-The IRI

marketing data set. Marketing Science 27 (4), 745–748.

Bucklin, R. and J. Lattin (1991). A two-state model of purchase incidence

and brand choice. Marketing Science 10 (1), 24–39.

Chevalier, J., A. Kashyap, and P. Rossi (2000). Why don’t prices rise during

periods of peak demand? Evidence from scanner data. American Economic

Review .

36

Ching, A., T. Erdem, and M. Keane (2009). The price consideration model

of brand choice. Journal of Applied Econometrics (4686).

Erdem, T., S. Imai, and M. Keane (2003). Brand and quantity choice dynamics under price uncertainty. Quantitative Marketing and Economics,

5–64.

Guler, A. U., K. Misra, and N. Vilcassim (2014). Countercyclical pricing: A

consumer heterogeneity explanation. Economics Letters 122 (2), 343–347.

Haviv, A. (2015). Removing the Computational Burden of Adding Cyclic

Variable to Structural Dynamic Models.

Hendel, I. and A. Nevo (2006). Measuring the implications of sales and

consumer inventory behavior. Econometrica 74 (6), 1637–1673.

Honka, E. (2012). Quantifying search and switching costs in the us auto

insurance industry. Available at SSRN 2023446 .

Katz, M. L. (1984). Price discrimination and monopolistic competition.

Econometrica: Journal of the Econometric Society, 1453–1471.

Lal, R. and C. Matutes (1994). Retail pricing and advertising strategies.

Journal of Business, 345–370.

Mehta, N., S. Rajiv, and K. Srinivasan (2003). Price uncertainty and consumer search: A structural model of consideration set formation. Marketing science 22 (1), 58–84.

37

Mela, C., K. Jedidi, and D. Bowman (1998). The long-term impact of

promotions on consumer stockpiling behavior. Journal of Marketing Research 35 (2), 250–262.

Murthi, B. and R. C. Rao (2012). Price awareness and consumers use of

deals in brand choice. Journal of Retailing 88 (1), 34–46.

Nevo, A. and K. Hatzitaskos (2006). Why does the average price paid fall

during high demand periods?

Ray, S., C. Wood, and P. Messinger (2012). Multicomponent Systems Pricing: Rational Inattention and Downward Rigidities. Journal of Marketing 76 (September), 1–17.

Seiler, S. (2013, September). The impact of search costs on consumer behavior: A dynamic approach. Quantitative Marketing and Economics,

155–203.

Warner, E. and R. Barsky (1995). The timing and magnitude of retail store

markdowns: evidence from weekends and holidays. The Quarterly Journal

of Economics 110 (2), 321–352.

38

(a) Seasonality in Demand

(b) Seasonality in Pricing

(c) Estimated Price Sensitivity By Time Of (d) Probability of Consumption by Time of

Year

Year

39

(e) Estimated Search Probability

(f) Estimated Price Elasticity

(g) Determinants of Search

(h) Increased Promotional Depth

Figure 1: Counterfactuals

40

8

Online Appendix - Likelihood Derivation

8.1

Decision at the Consumption Stage

To solve the model, I work backwards through the stages in each period. To

make the consumption decision, consumers will try to consume soup up to

their level of desired consumption d, which is stochastic. Therefore,

c = min(d, i + q).

(6)

This leads to the following consumption probabilities

P (d = c) = (1 − Pd (s))Pd (s)c if d < i + q

(7)

c

P (d = c) = Pd (s) if d = i + q.

To solve for the decisions in the previous stages, I need to combine the

expected value of the consumption stage, and the expected discounted payoffs

in all future periods, which I define as Vc (s, i, q):

i+q−1

Vc (s, i, q) =

X

!

c0

(1 − Pd (s))Pd (s) (kc0 + V (s, i + q − c0 )) +Pd (s)i+q (k(i+q)+V (s, 0)).

c0 =0

(8)

8.2

Decision at the Flavor Stage

Because consumers track and make consumption decisions based on how

many cans of soup are in their inventory, and not the flavor of those cans, the

41

flavor decision only affects the payoffs in the current period. This simplifies

the decision at the flavor stage to a static decision. Consumers must decide

on a flavor for each can that they decide to purchase in the quantity stage.

If consumers have searched, they will have observed prices, and so when

choosing which flavor to purchase as can w the consumer solves:

arg maxα1 pfw + α2 p2fw + ηfw + εfw .

fw

(9)

which leads to the following choice probabilities:

e

P (fw |p, r = 1, s) =

α1 pf +α2 p2

fw +ηfw

w

σε

f

P

e

α1 pf 0 +α2 p2 0 +ηf 0

f

σε

f

(10)

f 0 ∈F

where F is the full set of flavors. If consumers do not search, they use the

non-discounted prices, pbfw t , to make their flavor decision:

arg maxα1 pbfw + α2 pb2fw + ηfw + εfw .

fw

(11)

which leads to the following choice probabilities:

2

eα1 pbfw +α2 pbfw +ηfw

P (fw |p, r = 0, s) = P α pb 0 +α pb2 +η 0 .

e 1 f 2 f0 f

(12)

f 0 ∈F

Note that a consumer who is buying two or more cans can choose to

42

purchase multiple flavors, which is observed in the data. The specification

here allows the flavor fixed effects to be estimated in a static way, which is

described in an online appendix.

When making the purchase decision, consumers take into account the

expected utility they will receive during the flavor stage. In the case that the

consumer searches, this expectation is

−→

→ (uf (fw ; p, εfw ))

E−

ε−

fw

= εf × log(

X

e

α1 p

bf +α2 p

b2

fw +ηfw

w

εf

).

(13)

f 0 ∈F

In cases where the consumer does not search,

→ (uf (fw ; p

E−

b, −

ε→

fw )) = log(

ε−

fw

X

e

b2

α1 p

bf +α2 p

fw +ηfw

w

εf

).

(14)

f 0 ∈F

8.3

Decision at the Quantity Stage

During the quantity stage, consumers choose their purchase quantity to maximize the utility in this stage, the expected utility in the flavor and consumption stage, and the expected utility in all future periods.

The εfw are not observed when consumers make their quantity decisions,

so consumers calculate the expected value of the flavor utility for each additional can, conditional on the observed prices if they searched, and the

non-discounted prices if they did not. Consumers who search select their

43

purchase quantity by solving:

arg maxηq + εq + q × Eε−−f→

(uf (fw ; p, −

ε→

fw )) + Vc (s, i, q)

w

(15)

q

In cases where consumers do not search, p is not observed, and so consumers use the most likely prices pb to make their quantity decision.

→ (uf (fw ; p

b, −

ε→

arg maxηq + εq + q × E−

fw )) + Vc (s, i, q)

ε−

fw

(16)

q

−

Integrating over →

εq , I can calculate the probability of the consumer choosing any purchase size as:

→

ε−

ηq +εq +q×E−

→ (u (fw ;p,−

fw ))+Vc (s,i,q)

ε−

fw f

σq

P (q|r, p, s, i) =

e

imax

P−i

e

−−→))+V (s,i,q)

ηq +εq +q×E−

→ (u (fw ;p,ε

c

fw

ε−

fw f

σq

.

(17)

q 0 =0

To solve for the decision in the search stage, I need to combine value of

the purchase stage, consumption stage, and the expected discounted payoffs

in all future periods, which I define as Vq (s, i, q):

imax

X−i

Vq (s, i, r = 1) = log(

→

ηq +εq +q×E−

ε−

→ (u (fw ;p,−

fw ))+Vc (s,i,q)

ε−

fw f

σq

e

)

(18)

q 0 =0

imax

X−i

Vq (s, i, r = 0) = log(

e

−−→))+V (s,i,q)

ηq +q×E−

→ (u (fw ;p,ε

c

fw

ε−

fw f

σq

q 0 =0

44

)

(19)

8.4

Decision at the Search State

When making the search decision, consumers compare the expected discounted value of searching with the expected discounted value of making

their purchase decision without search. Because they make the search decision before observing prices, the expectation is taken over prices to calculate

the expected benefit of search. The search decision is then

max l(r = 1)Vq (s, i, r = 1) − ρ + εs ) + l(r = 0)(Vq (s, i, r = 0)ε0s )

(20)

r∈{0,1}

which leads to the following search probability:

e

P (r = 1|s, i) =

e

Vq (s,i,r=1)−ρ

σs

Vq (s,i,r=1)−ρ

σs

+e

Vq (s,i,r=0)

σs

.

(21)

This gives the overall expected value for the search stage, the purchase

stage, and the consumption stage Vs (s, i):

V (s, i) = ση × Ep (log(e

Vp (s,i,r=1)−ρ

ση

+e

Vp (s,i,r=0)

ση

)).

After calculating the value function V (s, i) using the Bellman equation 5, I

use V (s, i) to solve for Vp (s, i, q), and Vc (s, i, q). With these values in hand,

I calculate the joint probabilities

P (r, f, q, c|s, i) = P (r|s, i)P (f |r, s, i)P (q|f, r, s, i)P (c|q, s, i).

45

Each of these terms can be calculated using 7, 10, 12, 17, 21.

9

Online Appendix: Static Estimation

9.1

Static Estimation

The specification of the flavor utility allows the flavor fixed effects to be

estimated separately from the dynamic model. Consider the flavor choice

probabilities in the case of consumer search 10 and no consumer search 12.

Suppose there are no price promotions in the set of flavor Fnp . Search does

not affect choices between options in this set because there are no price

promotions for search to reveal. In this case, the choice probabilities simplify

to

P (fw |p, r = 0, s, fw ∈ Fnp ) =

eηfw

P η 0.

ef

f 0 ∈Fnp

By comparing the market shares of the non-discounted flavors in each week,

we can estimate the fw by maximizing the following log-likehood:

X X

eηfw

max

Nf 0 ,t × log( P ηf 0 )

fw

e

t∈T f 0 ∈F

np,t

f 0 ∈Fnp,t

where T is the set of all time periods in the data, and Nf,t is the number of

cans of flavor f purchased in week t, and Fnp,t is the set of non-discounted

flavors in week t.

This static estimation reduces the parameter space of the far more bur-

46

densome dynamic model. Estimating this static model takes a few minutes,

whereas estimating an additional 9 parameters in the dynamic model would

take many hours. The cost is that this estimation only uses 80% of the

available data as it removes discounted flavors.

I also estimate the probability of visiting a store in each seasonal period

Pv (s) directly from the data as store visits are each observed.

9.2

Static Results

In the flavor stage, the effect of prices was found to be negative and convex.

The flavor fixed effects were estimated separately from the dynamic model,

and the result of the static estimation of the flavor fixed effects (relative to

the most popular UPC) are presented in Table 6. The magnitude of these

fixed effects generally corresponds to their respective market share. The two

exceptions to this are “Cream of Chicken (2)” and “Tomato (2)”, which were

less popular than their market share would suggest. This is likely due to

their inflated market share from frequent sales.

47

Chicken Noodle

−0.3214∗∗∗

(0.0145)

Cream of Mushroom (1)

−0.9141∗∗∗

(0.0181)

Cream of Mushroom (2)

−1.5913∗∗∗

(0.0233)

Cream of Chicken

−1.7408∗∗∗

(0.0251)

Chicken and Stars

−1.8959∗∗∗

(0.0257)

Cream of Chicken (2)

−2.1591∗∗∗

(0.0301)

Chicken & Rice

−1.9235∗∗∗

(0.0254)

Tomato (2)

−2.4300∗∗∗

(0.0347)

Vegetable Beef

−1.9079∗∗∗

(0.0257)

Table 6: Static Estimation - Flavor Fixed Effects

48