Returns to Talent and the Finance Wage Premium ∗ Claire C´

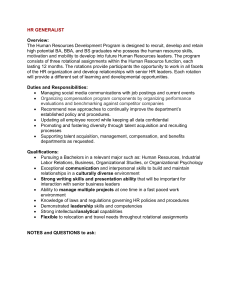

advertisement