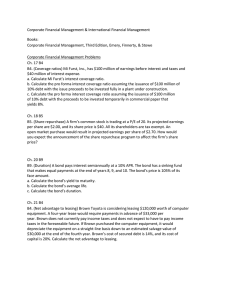

Can the Bond Price Reaction to Earnings Announcements Predict

advertisement