EQUITY CARVE-OUT (ECO) AS A FINANCIAL INSTRUMENT FOR CORPORATE RESTRUCTURING, WILL IT

advertisement

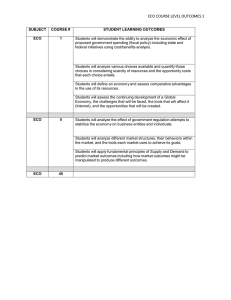

EQUITY CARVE-OUT (ECO) AS A FINANCIAL INSTRUMENT FOR CORPORATE RESTRUCTURING, WILL IT WORK FOR THE PULP AND PAPER INDUSTRY? V.R. (PERRY) PARTHASARATHY, PhD WEYERHAEUSER COMPANY PORT WENTWORTH, GA 31407 2007 TAPPI Engineering, Pulping and Environmental Conference, Jacksonville, Florida, USA October 21 to 24, 2007 BREAKING UP IS GOOD TO DO. Restructuring through spin-offs and equity carve-outs can enhance Shareholder Value Creation (SVC) o Restructuring usually eliminates diffusion of management goals, a problem that goes hand in hand with big, diversified companies. o When the aim is to focus on being the best at one or two things, restructuring make sense. o Spin-Offs (SO) and Equity Carve-Outs (ECO) are used by large corporations for restructuring purposes. Used judiciously, SO and ECO are important financial instruments that help corporations increase value. CORPORATE EQUITY CLAIMS There are three types of corporate equity claims: o o o Tracking (or Targeted) Stock (TS), Majority-owned Equity Carve-Out (ECO) and Spin-offs (SO). CORPORATE EQUITY CLAIMS The Tracking Stock (TS) is a class of common stock that is linked to the performance of a specific business group within the diversified firm. Equity Carve-outs (ECO) are an IPO of a stake in a subsidiary. The parent usually keeps majority ownership. Spin-offs (SO) occur when the entire ownership of a subsidiary is divested as a dividend to shareholders. TRACKING STOCK (TS) o The financial reporting is separate for the TS from the parent but the control remains in the hands of the parent company. o TS is typically distributed as a dividend to shareholders of the parent company and can also take the form of an Initial Public Offering (IPO). o Even during its hay day, only two Pulp and Paper Companies had taken advantage of this instrument but that did not result in the enhancement of their corporate value. o By 2006, the TS as a corporate restructuring tool had disappeared altogether and none was issued between 2001 and 2006. EQUITY CARVE-OUT (ECO) o The ECO is different from TS in that equity partition creates welldefined equity claims on assets. o ECO is the sale of a subsidiary by a publicly traded company by carving out a portion of its outstanding shares through IPO. o While the parent firm usually retains a controlling interest in the partitioned subsidiary, each ECO, however will have its own board, operating CEO, and will issue its own financial statement. o Equity Carve-Outs (ECO) increase the access to capital markets, enabling ECO subsidiary strong growth opportunities while avoiding the negative signaling associated with a seasoned offering (SEO) of parent equity. EQUITY CARVE-OUT (ECO) o o o In a twelve-year period between 1988 and 1999, the US stock market has seen 50 Carveouts, or about 10% of the IPOs issued. While the number of IPOs issued had increased at least three fold between the years 1997 and 2006, the IPOs for ECO were not that many (Exhibit 1). Over the years, ECO as a corporate restructuring vehicle has shifted, for financial gain to strategic realignment. Strategic Reasons Percent Financial Reasons SPIN--OFF SPIN OFF EXHIBIT 1. The Trend in Asset Disaggregation Number of Events Strategic Reasons Financial Reasons - OUT (ECO) EQUITY CARVE -OUT EQUITY CARVE (ECO) 17 26 83 10 15 7 88 50 42 80 44 25 12 50 58 80 20 44 56 25 75 1988-1993 1994-1996 1997-2006 1994-1996 1997-2006 100% 80% 60% 40% 20% 1988-1993 Source:Bloomberg, Bloomberg,Financial FinancialExecutives ExecutivesResearch ResearchFoundation Foundation , Compustat Inc. Compustat SDC, BDCI Source: Inc., SDC,Analysis BDCI Analysis EQUITY CARVE-OUT (ECO) One thing sure about ECO is the inherent assumption that the asset that is being carved-out could not derive its full asset value under the existing corporate structure and a carve-out will accurately value the subsidiary if, part of the equity is carved out and sold in an IPO (Exhibit 2). EXHIBIT 2. Equity Carve-Out (Pros and Cons) EQUITY CARVE-OUT (ECO) o o Common equity is the cheapest yet the largest value distribution in the Enterprise Valuation of a company with multiple business segments. ECO gives a corporate parent an opportunity to get equity and at the same time increase its market capitalization by virtue of restructuring one of the units as a carved-out entity TOTAL = 2000 200 Convertible Securities *all values in million US$ Corporate 250 Overhead 400 250 Operation D Debt 1750 350 EXHIBIT 3. Valuation of an Enterprise with Multi-Business Segments 200 Preferred Operation C Stock 450 1150 Operation B 750* Operation A Value of the Operating Units Enterprise Value Value Distribution Source: “Valuation” – Measuring and Managing the Value of Companies: McKinsey & Company, Inc., Common Equity Stock EQUITY CARVE-OUT (ECO) o o Thermo-Electron (TE) is the most successful company to leverage ECO to deliver high returns to its shareholders. In 1982, TE was just a US $200 million company. By 1997, its market value was $5200 million (a whopping 2500%) through frequent equity partition of business segments and owning controlled interest in the ECO subsidiaries EXHIBIT 4. Thermo Electron’s ECO Examples EQUITY CARVE-OUT (ECO) Equity Carve-Outs (ECO) out performed SO on three financial metrics, Total Shareholder Return (TSR), change in leading P/E ratio and Return on Invested Capital (ROIC). EXHIBIT 5. Comparison of Performance Metrics for ECO and SO EQUITY CARVE-OUT (ECO) The Booz-Allen & Hamilton and SMU/The McKinsey Company studies which compared 78 merger deals between 1997 and 1998 and between 2002 and 2003 and worth more than $1 billion each, concluded that o 48% of the mergers failed to deliver the promised cost savings over the two-year post-merger period. o 52 percent of them had fallen short of achieving the revenue growth. o Almost one-third of the companies delivered less than 40% of the cost-savings that were used as the basis for the mergers. The previous pulp and paper industry mergers (and the premiums paid to acquire the companies) had been justified under potential cost savings rather than revenue growth put a big dent on their chance for success which came out to be true. EQUITY CARVE-OUT (ECO) ECO on average has the strongest TSR or SVC performance of any restructuring vehicle and the track record of ECO on ROIC are far superior to Spin-offs (SO). Positive 4 Slow Down of Solid Performers Great Earners Unfazed EXHIBIT 6. Very Few Companies Achieved Success Through Mergers Pre-Merger Revenue Growth 3 2 1 -2 -1 2 1 0 3 0 -1 -2 Negative Bad Remains Bad Negative -3 Very Few Players Perform Post-Merger Revenue Growth Positive Sample of more than 160 acquisitions by 157 publicly traded companies across 11 industries. Revenue growth calculated for combined entity 5 years before and after mergers (1996-2005) Source: The McKinsey Quarterly 2001, Number 4. EQUITY CARVE-OUT (ECO) o To deliver superior shareholder return, P&P industry can use, ECO as a corporate restructuring vehicle. o For ECO to be successful, the parent company should have multi-segmented businesses and that the subsidiary can be separated easily from the parent without creating huge transfer-pricing issues and also the subsidiary should have good prospects. o Out of the eighteen large U.S. and Canadian pulp and paper companies, only six are truly multi-segmented businesses and only these companies can do an ECO or spin-off. EQUITY CARVE-OUT (ECO) The majority-owned ECO is the most appropriate for P&P industry because: Out of the six P&P companies that are truly multi-segmented businesses, five of them have debt to equity ratio over 1.5 and therefore suffer huge capital constraints. ECO will allow the parent companies to raise capital at a fair-price and to fund projects that might otherwise depress earnings. EQUITY CARVE-OUT (ECO) The majority-owned ECO is the most appropriate for P&P industry because: Certain businesses in pulp and paper companies, woodlands or lumber, for example, can readily be separated without involving transfer price problems. Before the ECO, both the boards need to review contractual agreements, including those establishing transfer prices, and agree on sharing other supports such as R&D, sales and marketing, and certain manufacturing resources, etc. EQUITY CARVE-OUT (ECO) CONCLUSIONS Restructuring of corporations is usually carried-out to improve performance. A majority-owned equity carve-out is one such equity claim that would allow the carved-out business units to improve performance by exposing them to the capital market and attracting new investors. ECO brings a new management team into the organization. This usually results in improvement in operating performance, providing incentives for managers and increasing their strategic flexibility. EQUITY CARVE-OUT (ECO) CONCLUSIONS While mergers can be used as one of the tools to improve the performance of the pulp and paper industry, for companies with multi-segmented businesses, the ECO offers the best valueenhancing proposition If judiciously applied, ECO can help corporate management to increase value of both the parent and the carved-out subsidiary. Thanks.