Abstract:

advertisement

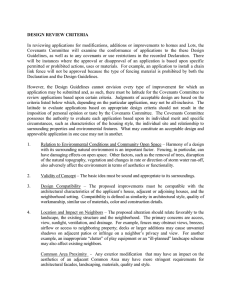

Abstract: We study the interplay between the design of financial covenants and the operational decisions of a retailer that obtains financing through secured (asset-based) lending contracts. While it is widely held that covenants serve to protect lenders, the ways in which a retailer adapts his operations in response have not been studied. We characterize the market conditions (involving demand distribution, growth potential, profit margin, inventory depreciation rate or competition in the lending market) under which covenants are (not) superfluous, and discuss how retailers and lenders can ``operationalize'' financial covenants, i.e., think about their effectiveness, design, and implementation, in light of these considerations. Under a monopolistic lender, we show that a retailing firm responds in surprising ways to stricter covenants, making use of all operational levers -- such as inventory investment or partial liquidation -- to circumvent or diminish their impact. By endogenizing this effect, we show that covenants can be complementary to other contractual terms (such as interest rates or loan limits), that stricter covenants may result in non-monotonic profits for the lender, and that covenant effectiveness critically depends on the retailer's operational flexibility, in a surprising (non-monotonic) way.