ASP On-Demand versus MOTS In-House Software Solutions Dan Ma Abraham Seidmann

advertisement

ASP On-Demand versus MOTS In-House Software Solutions*

Dan Ma

School of Information Systems

Singapore Management University

Abraham Seidmann

Xerox Professor of Computer and Information Systems and Operations Management

W. E. Simon Graduate School of Business Administration

University of Rochester

Revised:

April 29, 2007

*

The authors gratefully acknowledge useful comments from Professors Rajiv Dewan, Roy Jones, Ravindra

Mantena, Edieal Pinker, Michael Raith, and Anjana Susarla, and from seminar participants at the

Universities of Michigan, Rochester, and Maryland, and the Workshops on Information Systems and

Economics (WISE).

1

ASP On-Demand versus MOTS In-House Software Solutions*

Dan Ma

School of Information Systems

Singapore Management University

Abraham Seidmann

Xerox Professor of Computer and Information Systems and Operations Management

W. E. Simon Graduate School of Business Administration

University of Rochester

Abstract

Application Service Providers (ASPs) deliver on-demand information processing services to user

firms via the Internet. Rapid technological developments in telecommunications in recent years

have made ASPs an attractive alternative to purchasing, installing, and maintaining modifiable

off-the-shelf (MOTS) software solutions. We study several critical aspects of a user firm’s choice

between an ASP and MOTS software. The competitive model considers heterogeneous users that

differ in terms of their expected transaction volumes and volatility, while ASPs and MOTS

vendors differ in terms of their pricing structure, setup cost, system customization ability,

integration and service level arrangement. Our results identify and characterize the equilibrium

conditions under which ASPs and MOTS vendors can coexist in a competitive market, and they

explain which firms could be the primary beneficiaries of each vendor type. Interestingly, we find

that the ASP' entry to the market benefits not only its own clients but also the MOTS users, and

we explain why despite that, the competitive advantage of the MOTS approach decreases

significantly as users’ transaction volatility, or business uncertainty, increases. Hence, the value

added by ASPs comes as much from the efficient pooling of transaction volatility risks as from

the reduction in IT implementation costs. We also look at the competition between MOTS and

ASO vendors in a longer time horizon with possible future changes in software quality, and we

show when the ASP can take over the whole market, even if its quality is still lower than the

MOTS software. Our findings suggest that to stay competitive, ASPs should invest in both

improving software quality and in reducing service prices over time. Surprisingly, the opposite

also holds, and along with any relative quality decreases, the ASP should raise its prices,

providing a relatively an inferior service at a higher charge. This happens because at that case the

ASP will serve mainly those firms who are priced out of the MOTS market, and can behave

monopolistically at that segment. Finally, our model explains when MOTS software users could

be better off despite an increase in transaction volatility in the market, and when they will be less

likely to switch to an ASP even as the relative quality of the ASP’s applications increases over

time. We prove that if they do switch, their primary incentive is abating higher transaction or

business volatility risks rather than reducing transactions’ costs per se.

*

The authors gratefully acknowledge useful comments from Professors Rajiv Dewan, Roy Jones, Ravindra

Mantena, Edieal Pinker, Michael Raith, and Anjana Susarla, and from seminar participants at the

University of Rochester, the University of Maryland, the Workshop on Information Systems and

Economics (WISE) 2004, and WISE 2005.

2

Introduction

Using sophisticated enterprise software such as Enterprise Resource Planning (ERP),

Customer Relationship Management (CRM), or Electronic Medical Records (EMR) systems has

become a competitive necessity. Traditionally, such software has been delivered in the form of

modifiable off-the-shelf (MOTS) products.1 The vendor sells the software application to users

and helps to customize and install it on users’ sites. The users must provide IT infrastructure,

hardware, and support services in order to enable continuous use of the software. In the past few

years, the Internet has given rise to Application Service Providers (ASPs). ASPs offer a bundle of

applications, an IT infrastructure, and all necessary support services to users across a network.

Under the ASP business model, the application and users’ data are stored off-site in a central

location run by the ASP. The ASP is in charge of all IT support services, including daily software

maintenance, data backups, software upgrades, and security.

ASPs represent an on-demand business model, where software is delivered as a service.

Unlike traditional perpetual licensing, the software is priced as a service, and typically users pay a

fee per transaction. Users’ payments are closely tied to the actual utility obtained—they pay only

when they have demand for the software.2 Such pricing shifts expenses from the capital budget to

the operating budget and significantly cuts users’ start-up costs; it also helps users to manage

peak-and-valley transaction-load problems well while keeping costs down. In many cases, using

an ASP may prove cheaper than owning and maintaining an in-house IT system. Users expect to

save money on support and upgrade costs, IT infrastructure, IT personnel, and implementation

(Lacy 2006). A recent survey shows that the top reason firms choose an ASP over traditional

software is the belief that the former is “cheaper to run” (The Economist 2006). Moreover, users

1

A MOTS product is “a commercial software application whose source code can be customized to meet a

customer’s particular requirements ... [It] is designed to be easily installed and to interoperate with existing

system components.” See http://whatis.techtarget.com for more information.

2

In this paper, we use the terms “ASP,” “on-demand software,” and “software as a service”

interchangeably.

3

can reap the benefits of the ASP’s economy of scale, access IT expertise, and gain system

flexibility (Dunn 2005; Murphy 2005; Singh et al. 2004).

ASPs are enjoying prosperous times. According to AMR Research, the on-demand software

market is growing more than 20% a year, compared with single-digit growth in traditional

software (Lacy 2006). ASPs are expected to generate $10 billion in annual revenue by 2009, up

from $1.5 billion in 2006 (Pallatto 2006). An increasing number of software vendors, including

industry giants such as IBM, SAP, Oracle, and Microsoft, are moving to such a business model.

For example, IBM is offering “IBM-on-demand,” which allows corporate users to acquire IBM’s

computing power and software applications as a service.3 Meanwhile, IBM is also providing a

package of services and incentives to help other software companies deploy their products as

hosted applications (Pallatto 2006). Oracle is ranked as one of the top ten ASPs. Its online

offering, “E-business Suite,” has successfully attracted many small companies by charging a low

transaction fee.4 In January 2006, Oracle acquired Seibel, and it now uses its fledgling CRM ondemand software to compete with Salesforce.com, the most successful ASP providing online

CRM, which reports 399,000 paying subscribers (Vara 2006). Bill Gates has proclaimed that the

emergence and rise of on-demand software will be the “next sea-change” in computing (Niccolai

2005). Many observers expect an industry-wide revolution brought on by the ASP model:

“Software as a service is the biggest thing to happen in software in 25 years” (Knorr 2004).

For firms in need of enterprise software, the ASP constitutes a viable alternative to the

traditional MOTS software solution. As an example, we studied the case of Medical Diagnostic

Imaging (MDI), an imaging center conducting about 10,000 studies annually (Martin 2004). It

was looking for a state-of-the-art PACS (Picture Archiving and Communications System) to

manage and deliver patients’ medical images. MDI looked first at a MOTS solution from such

vendors as Cannon, Onyx, and Fusion. All of them would have required MDI to build and

3

4

See http://www-1.ibm.com/services/ondemand/success.html.

See www.oracle.com.

4

maintain the PACS in-house. The bids from these vendors typically exceeded one million dollars

just for the up-front investment in the software. Additionally, MDI identified significant costs

associated with installation, customization, ongoing support, upgrades, data security and aroundthe-clock maintenance. MDI determined that an on-site MOTS system was too expensive. To

reduce the required initial costs, MDI chose an ASP, MedPACS Display, which provides viewer

software for radiologists and physicians, as well as archives, hardware, software, and

maintenance.5 This ASP charges a flat fee of $3.89 per study, including all the necessary ongoing

support (Ma 2005).6 MDI thus was also relieved of the need to hire and manage an internal IT

staff for the radiology department. Moreover, the ASP offers highly scalable processing services.

When MDI faces random fluctuations in patient volume, MedPACS responds accordingly from

the remote site that handles most of the clinical data.

Many businesses face a similar decision problem. In a web survey by ThinkStrategies, fully

one-third of 118 respondents were already using ASPs, and another third were considering using

one within the following 12 months (Kaplan 2005). A research report from Summit Strategies

indicates that small and medium businesses with limited IT resources and constrained budgets are

more likely to use such fee-per-transaction applications (Garner 2004). Some large organizations

are attracted to ASPs as well. Amazon.com, Cisco, Sprint, Morgan Stanley, Nokia, and Target are

all clients of Salesforce.com (The Economist 2006; Ricadela 2006). It is clear that ASPs are

stealing market share from vendors of MOTS software. On-demand software is a powerful trend,

one that is becoming an important disruptive force in the software industry: “It is not the end of

software. It is just another way of deploying it” (Shai Agassi, president of SAP’s product and

technology group).

However, the long-term success of ASPs remains uncertain. In its formative stage, the ASP

market is experiencing significant consolidations. The fear that ASPs could fail is a main obstacle

5

See www.medpacs.com.

Most ASPs in the healthcare industry charge similarly for their PACS systems. Stentor, for example,

offers the image delivery software iSite on a per study basis and charges, on average, $3.50 per delivery.

6

5

to the large-scale adoption of ASPs. Data security and reliability as well as application control are

always among users’ top concerns (Bednarz 2006). In addition, although there is no doubt that the

ASP model does have numerous advantages, the traditional MOTS in-house solution can deliver

superb results. The source code of the MOTS software can be modified to meet a user’s particular

requirements, so the software is well customized and can easily interoperate with the user’s

existing system components. In contrast, the ASP offers a one-to-many solution, with limited

customization.7 Its product is not tailored to fit an individual user’s specific requirements or

unique business environment. As a result, the user may need to pay extra to make the ASP’s

standard software application work smoothly with its existing IT systems. For instance, in the

MDI case, getting the various systems to communicate and work together required some effort.

MDI had to run an additional module that “took the output from its own in-house research

information system and converted the output into an image file for storage in the archive” (Martin

2004). MDI incurs conversion costs for every transaction.

Some researchers have already looked at the ASP business model. For example, Susarla et al.

(2003) use questionnaires in order to identify the determinants of a good ASP contract. Their

work does not, however, touch on the theoretical base of the ASP business model. Cheng and

Koehler (2002) study a monopoly ASP’s pricing problem. They consider the interrelationship

between price and queuing delay and conclude that various pricing policies, such as a fixed fee, a

two-part tariff, or a metered price, are equivalent. These and other previous works, however, only

analyze ASPs in an isolated framework. They do not study a marketplace in which MOTS

vendors also participate. Hence, they overlook the in-house IT option.

Little work has been done on the competition between the ASP and MOTS solutions. It is not

clear what factors play important roles in users’ IT choices. We study a software market in which

corporate users have these two IT options for external sourcing. The software vendors are

differentiated in the following ways. First, they deliver different products: a customized software

application (from the MOTS) versus a bundle of standard software and services (from the ASP).

7

SAP believes that this lack of integration will eventually lead most large corporations that currently are

users of online CRM to move back to an in-house system (Hamm 2006).

6

Second, they adopt distinct pricing modes: an outright purchase (the MOTS) versus a “per

transaction” fee structure (the ASP). Third, they employ different delivery methods: software

installed on a user’s in-house server (the MOTS) versus an interface delivered over the Internet

remotely (the ASP). Users therefore have different cost structures and bear different risks in

dealing with each vendor type.

In practice, choosing and implementing an enterprise software system are highly complex

decisions. CIOs need to compare the two options on multiple points, such as setup costs, pricing

structure, ability to integrate data, scalability, and service level arrangements. Their decisions

involve not only economic but also technological and security issues. We do not attempt to

include all the related factors; instead, we study firms’ choices by focusing on the economics

issues only. In particular, we are interested in estimating the relative economic advantages of

using each vendor type. We assume that the users (they are firms) have made the decision to

install a computerized information system, aiming to improve internal business processes or to

increase value for end customers. The decision investigated in this paper is the choice of delivery

channel: obtaining the system through an ASP or MOTS. Strategic adoption behaviors such as

herding or delaying adoption for a better system or lower price are ignored.

ASPs and MOTS vendors price their offerings differently. The MOTS vendor sells the

software (one-time, fixed-fee pricing), and the ASP rents it (transaction-based pricing). Our work

thus is related to research on selling and renting information goods. Most previous work in this

literature examines a one-firm setting. Varian (2000), for example, considers a monopoly firm’s

choice when both selling and renting are feasible channels. Choudhary et al. (1998) analyze the

possibility of a monopoly firm selling and renting a package of software simultaneously, and

Sundararajan (2004) compares fixed-fee pricing and usage-based pricing for information goods

for a monopoly firm. Fishburn et al. (1997) are among the few who compare selling and renting

in a competitive market. They model a repeated competition game in which one firm charges a

fixed subscription fee and the other charges based on usage. In their paper, the two sellers’

offerings are homogeneous; the only difference between the two sellers is the pricing method.

7

We, however, study the competition between two vendors that are differentiated in both offerings

and pricing structures. We identify several interesting features of such a market.

First, the value added by ASPs comes as much from the efficient pooling of demand

uncertainty risks as from the reduction in significant IT implementation costs. Specifically, when

the volatility of transactions increases, more users opt for the ASP, and the relative advantage of

the ASP approach increases significantly.

Second, we find that the software market may show three different structures. Under fairly

broad conditions, the ASP and MOTS solutions will coexist. The market will be segmented in

such a way that firms with low transaction volumes opt for the ASP model because of the

cheapness and scalability, and firms with high transaction volumes prefer the MOTS model to

enjoy software that fits their specific business needs well. Under certain conditions, however, one

of the providers is unable to survive, and the software market will be dominated by one business

model alone.

Third, our findings suggest that different business models are suited for different types of

software applications. In particular, the ASP model works well for software applications such as

financial trading, electronic medical records, and payroll systems. These applications typically

serve functions with highly volatile demand but a standard process. For complex business

software, such as enterprise resource planning (ERP) systems, we still suggest the traditional inhouse model.

We also study the ASP-MOTS competition in a longer time window with potential real-time

changes. We obtain surprising yet important findings. If users are concerned about future changes

in the business environment, such as hardware upgrades on their side, which decreases the ASP

software quality, ASPs should increase their prices. They should “give up” the competition with

the MOTS vendor for high-volume users and instead focus on attracting small and medium firms.

If users expect the unfit costs of using standard software to decrease due to the advance of web

technologies, which increases the quality of ASP software, ASPs should reduce their prices to

8

compete aggressively with MOTS vendors for large corporate users. These findings help us to

suggest useful competitive strategies to providers of on-demand software.

Finally, we show that competition in a longer window gives advantages to the MOTS

solution. Once the initial implementation costs are sunk, users only need to pay ongoing

maintenance costs. Hence, users of existing in-house systems have little incentive to switch to ondemand software, even if the ASP can promise quality improvement over time. If these users do

switch, they do so in order to abate high capacity risks caused by high transaction volatility rather

than to reduce operating costs.

The rest of the paper is organized as follows. In Section 2, we describe the model. We

analyze the ASP-MOTS competition and identify the key determinants of the future of the ASP

business model in Section 3. Section 4 extends the competition analysis over a longer window.

Section 5 concludes the paper.

2

The Model

We first model the market before the ASP appears, and then the market with both vendors.

2.1 The Pre-ASP Market

Software application users in our model are firms. Before the ASP, firms get access to

software systems by installing them in-house. The MOTS vendor sells the packaged software to

its user. The vendor modifies the source code to fit the user’s specific business needs, which

assures a good integration with the user’s existing IT system. The vendor bears an operating cost

C MOTS to serve one user and receives a one-time payment P from the user. For brevity, we

assume that the MOTS vendor provides only one version of the product and that the licensing fee

is not a function of users’ transaction volumes. The MOTS vendor can monitor the number of

users or installations, but it is difficult to monitor the actual transaction volume, which varies over

time. The user must install hardware and IT infrastructures, hire IT staff, and organize an internal

IT group to provide software maintenance, data backups, and security and capacity management.

9

In order to keep these IT resources in-house, the user incurs a variety of costs. Let c denote the

service costs associated with each use of the software (i.e., the service costs per transaction).

Users face stochastic workload in terms of the number of transactions using the software. Ex

ante, users cannot precisely estimate the actual transaction volume. They therefore determine and

install the proper service capacity in-house based on the anticipated transaction volume. If the

actual volume is more than the installed capacity, the user faces an insufficient capacity problem

and loses some potential utility. If the actual volume is less than the installed capacity, the user

faces an overcapacity problem, and it still pays the costs of holding the excess IT capacity. In

both cases, the user incurs losses. It bears capacity risks caused by demand uncertainty.

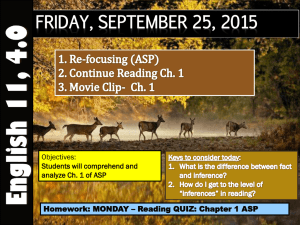

Figure 2. The ASP Solution

Figure 1. The MOTS Software Solution

The ASP

The software vendor

(service cost c per

transaction)

customizes and

installs the

software with an

operating cost

C MOTS per user

pays a one-time

purchasing

price P

A user firm

stochastic

transaction

volume

with in-house

service capacity

(service cost c per

transaction)

a value of u

per

transaction

delivers the

bundle of

“standard”

software

and support

services

stochastic

transaction

volume

pays a price

pa per

transaction

A user firm

Note: The black dot indicates the location of the software system.

Figure 1 shows the MOTS solution. The vendor sells the software at a price P and bears an

operating cost C MOTS per user. The user incurs service costs c per transaction, and each

transaction creates a value of u.

2.2 The Dual Market—The ASP Competes with the MOTS Vendor

In the dual market, users can access software applications through an ASP.

To start doing business with a user, the ASP first moves the user’s data to its own server,

which costs the ASP a one-time setup cost S. The ASP provides IT services to enable the software

10

use, which costs c per transaction. We assume that the ASP’s service capacity is plenty. In reality,

most ASPs have established large data centers and strong network infrastructures. They design

the service systems with ample capacity as a way of reducing the risk of congestion. ASPs

therefore resemble power stations, and users buy software as a service by plugging into the “ASP

grid.”

The ASP employs a “one to many” business structure. To any individual user, the application

offered by the ASP is not well-customized. Each transaction gives the user a total value of u-t.

The parameter t measures the user’s disutility from not using its ideal product. In many cases, it

also represents the cost of extra effort to make the ASP’s product work with the user’s existing IT

components smoothly. In the rest of the paper, we call t a user’s “unfit costs.” The user pays a

price pa per transaction to the ASP. Figure 2 shows the ASP solution.

2.3 Stochastic Transaction Volume

When modeling users, we capture two characteristics. First, they have different IT needs.

Users’ IT needs are measured by the expected volume of their use of the software. Some firms

may use the software application more frequently (in expectation) than others, and these firms

have larger IT needs. Second, each user’s actual transaction volume is random.

As seen in Figure 3, users are uniformly distributed on a unit-length line normalized from 0 to

1. The location of a user on this line represents its expected transaction volume. The actual

transaction volume of a user at location d i is a random variable that is uniformly distributed on

[d i − θ , d i + θ ] , where the user’s location d i

represents its expected use of the software (in

terms of the number of transactions), and the parameter θ measures the volatility of the

transaction volume. To avoid putting any positive probability on a negative transaction volume,

we do not assume the same distribution for firms with d i < θ . In fact, we make no assumption

on the distribution of their transaction volumes. It can be shown that firms with low transaction

11

volumes are “insignificant” because they will be priced out of the market in the pre-ASP scenario

(see the Appendix).

Figure 3. Distribution of Users’ Transaction Volumes

Expected transaction

volume

di + θ

di

0

1

di − θ

We make the following general parameter assumptions:

Assumption 1. 0 ≤ θ < 1 + CMOTS ; Assumption 2. CMOTS ≤ (u − c ) − cθ (u − c ) .

u

4 4( u − c )

Assumption 1 imposes an upper bound on the transaction volatility level. Note that the

maximum expected transaction volume among all firms is 1, so this upper bound is loose.

Assumption 2 imposes an upper bound on the MOTS vendor’s costs for software

implementations. If C MOTS exceeds this upper bound, no user will be served by the MOTS

vendor in the pre-ASP market, which is a case of no interest.

3

Analysis and Results

3.1 The Pre-ASP Market (the Benchmark Case)

The MOTS vendor determines its optimal price P. Given the price, users make two decisions:

whether to buy the software, and, if so, the proper IT service capacity to install in-house.

We solve the problem backward. Denote the actual transaction volume of user i (located at

d i ≥ θ ) as Di . This user’s optimal capacity level, given the software price P and the unit service

capacity cost c (i.e., the service cost per transaction c), is obtained by solving

Max

E [u min{Di , qi }− P − cqi ] = uqi [1 − F (qi )] + uF (qi )E [Di / Di < qi ] − P − cqi ,

qi

where F (.) is the cumulative density function of the transaction volume for user i. With

probability 1 − F (qi ) , the actual transaction volume will be larger than the user’s service

12

capacity. The user runs the software up to its service capacity level and loses excess demand.

With probability F (qi ) , the actual transaction volume will be smaller than the user’s service

capacity. The user processes all transactions and carries the costs of owning excess capacity. The

first two terms in the expression above represent user i’s expected utility from using the software;

the last two terms represent the user’s costs of purchasing the software (P) and costs of

establishing in-house IT service capacity ( cqi ). Following Dewan and Mendelson (1990), we

assume a linear function for capacity costs. In practice, capacity costs could be a step function,

but a linear function is the best first-order approach for a step function, as Zimmerman (1979)

shows.

⎛

⎝

Solving the optimization problem gives qi* = d i + θ ⎜1 −

2c ⎞

⎟.

u ⎠

(1)

The optimal capacity qi* deviates from the expected transaction volume d i by a factor of

⎛

⎝

θ ⎜1 −

2c ⎞ , which may be positive or negative, depending on the relative magnitude of service

⎟

u ⎠

costs (c) and utility (u). When the transaction becomes volatile ( θ increases), the deviation

grows.

The expected total utility for user i is Eu MOTS ( d i ) = d i (u − c ) − P −

c(u − c )

θ.

u

(2)

The first term is the expected value from using the software; the second term is the user’s

one-time payment to the MOTS vendor. The last term represents the user’s direct loss due to

transaction uncertainty; its magnitude increases with the transaction volatility level ( θ ).

Users with non-negative utility choose to purchase the software. The marginal user is at

dM =

P

c

+ θ.

u−c u

(3)

Thus, the vendor’s market share is 1 − d M , and it obtains a profit of P − C MOTS per user. The

selling price P is chosen to maximize the vendor’s profit:

13

Max

∏ MOTS = ( P − CMOTS )(1 − d M ) .

P

C MOTS (u − c ) (u − c )c

+

−

θ.

2

2

2u

Consequently, the indifferent user has an expected transaction volume of

The optimal price is P M =

dM =

1 C MOTS cθ 1

+

+

> .

2 2(u − c ) 2u 2

(4)

(5)

The MOTS vendor leaves most users out of the market. This finding captures the fact that

small and medium firms typically have had no access to in-house enterprise software systems,

because of the high fixed costs of purchasing, installing, and maintaining such software.

In addition, equation (4) indicates that the MOTS vendor will reduce its price when

transaction volatility ( θ ) increases. Plugging this optimal price into equation (2) shows us that

the reduced price can only partially compensate for a user’s direct loss. The user still incurs a

total loss of c(u − c) θ due to uncertain transaction volumes. Moreover, the marginal user’s

2u

location ( d M ) will move toward the right as transaction volatility increases, which means that the

vendor’s market share decreases although its selling price has been reduced. Consequently, the

vendor’s profit decreases. In the pre-ASP market, then, the vendor also incurs losses due to the

demand uncertainty on the user’s side. Hence, when transaction uncertainty ( θ ) increases, every

market participant faces a worse situation.

Proposition 1

In the pre-ASP market, firms with low transaction volumes are not able to afford

the system; when the demand for software becomes more volatile, both users and the MOTS

vendor are worse off.

Regardless of the size of the users’ application, the fundamental challenge they face is always

capacity hedging. Users of MOTS software must set the service capacity in advance based on the

anticipated transaction volume; they therefore are unable to quickly scale their capacity up or

14

down according to changing business needs. We show in the next section that ASPs can better

address this capacity management problem by pooling the risks of many users.

3.2 The Dual Market with Competition

3.2.1

Equilibrium analysis

In the dual market, the ASP and the MOTS vendor simultaneously decide their prices, pa

and P . Given the prices, users decide to use one or the other or to stay out of the market.

Consider user i with expected transaction volume d i . Given ( pa , P ) , user i gains an

expected utility of Eu ASP ( d i ) = (u − pa − t )d i from the ASP, and

EuMOTS (d i ) = d i (u − c) − P −

∂EuMOTS ∂Eu ASP

c (u − c )

≥

≥ 0,

θ from the MOTS vendor. Since

∂d i

∂d i

u

in equilibrium the market is segmented in such a way that users with low transaction volumes

choose the ASP and users with high transaction volumes choose the MOTS software. The

indifferent user’s location, denoted as d * , is given by Eu ASP ( d * ) = Eu MOTS ( d * ) .

d* =

P

c(u − c )θ

.

+

p a − c + t u ( pa + t − c )

(6)

[ ]

The MOTS vendor serves users in d * , 1 , with a market share of 1 − d * , and the ASP serves

[

]

the users in 0, d * , with a market share of d * .

*

The MOTS vendor chooses a selling price P : Max ∏ MOTS = ( P − CMOTS )(1 − d ) . It is

P

easy to show that its profit function is concave in price. The first-order condition is

P=

pa + t − c CMOTS c(u − c)θ

+

−

.

2

2

2u

(7)

The ASP sets a price pa to maximize its profit: Max ∏ ASP =

pa

first-order condition is pa =

1

( pa − c )(d * )2 − Sd * . The

2

B(t + c ) + 2 Su(t − c )

, where B = Pu + c(u − c )θ .

B − 2 Su

(8)

15

It can be shown that the price equilibrium always exists.8

We are interested in exploring the properties of the price equilibrium, and in examining how

the MOTS vendor and users are affected by the ASP’s entry into the market.

Proposition 2

When the unfit cost t from using the ASP’s product is smaller than a threshold

value t * , where t * ≤

u−c

and t * is a decreasing function of the ASP’s setup costs S, the ASP’s

2

entry into the market results in a lower price, a smaller market share, and less profit for the

MOTS vendor. Meanwhile, each user is better off, and the total consumer surplus increases.

<Proof> See the Appendix.

The unfit cost t, which measures users’ disutility (per transaction) from using a lesscustomized software system, plays an important role in the competition. When t is smaller than

the given threshold value, a common competition outcome is reached: the ASP’s entry into the

market has negative effects on its competitor (i.e., the MOTS vendor) and positive effects on

users. The ASP benefits users in different ways: users with low transaction volumes, which

otherwise will be out of the market, are able to afford the software through the “pay-as-you-go”

business scheme; users with medium transaction volumes, which otherwise will install an inhouse system, opt for the ASP because the ASP represents a cheaper solution; users with high

transaction volumes stick to the in-house solution but pay less to the MOTS vendor because of

the ASP’s competition. Therefore, each user is better off, and the total consumer surplus is strictly

improved.

However, such effects appear only when t ≤ t * . As Proposition 3 shows, when t increases

and exceeds the threshold value t * , the competition exhibits totally different features.

8

To see this, note that equation (8) is the only solution to the ASP’s first-order condition. If we plug it into

the second-order condition, we get an expression that is always negative. Thus equation (8) gives us the

unique profit-maximizing price. Besides, there is no better corner solution: for very low prices, the ASP

will take over the entire market, as shown in Proposition 5, and for very high prices, the ASP’s profit

eventually falls to zero, since the ASP will be driven out of the market, as shown in Proposition 6.

16

Proposition 3

When t ≥ t * , the ASP will charge a price pa = u − t . The ASP’s entry into the

market has no effect on either the MOTS vendor or users.

<Proof> See the Appendix.

When t * < t < u − c , the entry of an ASP does not affect the MOTS vendor’s price, market

share, or profit. The MOTS vendor still behaves as if it were the only solution provider in the

market, as the ASP in fact is not competing with it. Although full market coverage is achieved,

the ASP extracts all consumer surplus, so users gain zero utility. In such cases, the ASP enters the

[

]

market, serves “residual” customers (in 0, d M ), and gains non-zero profit, but it otherwise has

no effect. If the unfit cost t increases further, t > u − c , the ASP business model is not able to

survive. The ASP’s revenue from serving residual users is not enough to offset its initial setup

costs. As a result, the ASP can not make a profit. We analyze such cases in detail in Section 3.2.2.

Next we show how the relative competitive power of the two vendors changes with the

transaction volatility level θ . Lemma 1 states that both vendors will reduce prices as θ

increases, and that the lowered prices influence their respective customers in different ways.

All inequalities hold when t < t * , and all equalities hold when t ≥ t * .

<Proof> See the Appendix.

First, we show that the ASP’s users are better off when the transaction volatility level

increases. The on-demand feature of the ASP business model allows users to enjoy full capacity

scalability and to handle possible demand fluctuation at no risk. Hence, the users of ASPs are not

affected negatively by demand volatility. Moreover, the ASP will reduce its price due to the

competition from the MOTS (i.e., dpa* dθ ≤ 0 ), which benefits the users. Second, the MOTS

vendor, when t < t * , is willing to share more uncertainty risks than it would in the pre-ASP

market; i.e., dP * dθ > dP M dθ =

c(u − c )

. In other words, the MOTS vendor’s price elasticity

2u

with regard to demand volatility increases. As a result, the users of the MOTS software are better

17

off in a relative sense: although they still incur total losses due to transaction volatility (implied

by dP * dθ <

c(u − c )

), they are better off because they now bear less uncertainty risk. The ASP

u

not only removes its own users’ uncertainty risks by doing business “on-demand,” but also helps

to reduce the other users’ uncertainty risks through competition. Finally, we find that the

indifferent customer’s position ( d * ) will shift toward the right when θ increases. When

transaction volatility is high, more users tend to choose the ASP.

We reach the following conclusion:

Proposition 4

When the ASP exists, all users are able to abate the risks brought on by uncertain

transaction volumes. When transaction volumes become more volatile, the ASP gains more

market share.

3.2.2 One business model dominates

Here, we investigate whether a single software business model, ASP or MOTS, can dominate

the whole market. We provide answers for questions such as: Is it possible that on-demand

software providers will completely replace MOTS vendors and become the only delivery

channel? Or will ASPs finally fall out of the market and become only a historical footnote?

Propositions 5 and 6 state our findings.

Proposition 5

t1 =

There is a threshold value for the unfit cost parameter t,

c(u − c)θ C MOTS

+

− S . When t ≤ t1 , the ASP serves the whole market using the price

2u

2

pa =

C MOTS u + c (u − c )θ

+c+S .

2u

<Proof> See the Appendix.

When t ≤ t1 , the ASP drives the MOTS vendor out of the market. In this case, all users will

access the software through the ASP. Since S << C MOTS , t1 > 0 always. Hence, in the extreme

case of t=0, the ASP is always able to dominate the whole market.

18

On the other hand, the MOTS vendor can block the ASP’s entry into the market when t is

large enough, as stated in the following proposition.

Proposition 6

t2 = u − c −

There is a threshold value for the unfit cost parameter t,

4u(u − c ) S

. When t ≥ t2 , the ASP is not able to survive.

C MOTS u + (u + cθ )(u − c )

<Proof> See the Appendix.

When t ≥ t2 , at any price the ASP might offer, one of the two constraints—(1) users obtain

nonnegative utility and (2) the ASP obtains a nonnegative profit—must be violated. The ASP

business model therefore is not viable. In this case, only the MOTS solution survives.

Furthermore, we can show that both t1 and t2 increase in θ . As the transaction volatility

increases, it becomes easier for the ASP to dominate the market, and more difficult for the MOTS

vendor to do so.

3.3 The Key Determinant(s) of an ASP’s Competitive Ability

This subsection summarizes and provides a complete view of the ASP-MOTS competition.

t1 ≤ t * ≤ t2 .

Lemma 2

Lemma 2 shows the order of critical values of t. The proof of Lemma 2 is straightforward.

We therefore have four competition regimes, as shown in Figure 4. Our model predicts that in

each regime the price competition will occur as follows.

Figure 4. A Complete Diagram of the Price Competition

1

2

t1

3

t*

4

unfit cost t

t2

Regime 1. t ∈ [0, t1 ] : The ASP serves the whole market. All software is delivered by the ASP.

Regime 2. t ∈ [t1 , t * ] : The ASP and MOTS business models coexist in the software market, and

the competition between the two vendors benefits each user in the market.

19

Regime 3. t ∈ [t * , t2 ] : The ASP and MOTS business models coexist in the software market. The

ASP is not competing with the MOTS but just serves “residual” users. There is no competition,

and the MOTS vendor still acts as a monopolist.

Regime 4. t > u − c : The ASP is not able to survive. The MOTS model is the only software

solution.

In Regimes 1, 2, and 3, full market coverage is achieved, while in Regime 4 (when the MOTS

solution dominates), some users remain out of the market.

In different regimes of t, the competition exhibits different features. When t is low, the ASP

solution dominates, revealing the possibility of “all software in ASPs.” When t is moderate, the

ASP shares the market and competes with the MOTS vendor. When t grows further, the ASP

loses its competitive advantages and even may not be able to survive. Thus, we conclude:

Proposition 7

As users’ unfit costs from using a not fully customized system decrease, the ASP’s

ability to compete increases monotonically.

It is an interesting but not straightforward conclusion. To some extent, our model resembles

the duopoly competition model with vertically differentiated products, with the ASP as the lowquality provider and the MOTS as the high-quality provider. The unfit cost t measures the quality

difference between the MOTS and ASP products. In the vertical differentiation model, when the

quality difference decreases, the low-quality provider initially gets better off because its product

becomes more attractive. But it gets worse off as the quality difference decreases further, because

the competition becomes more intensive and eventually hurts both vendors. However, in our

paper, we find that reducing the value of t benefits the low-quality provider (i.e., the ASP)

monotonically. Moreover, when the two vendors’ products are close enough, the high-quality

provider (i.e., the MOTS vendor) could be squeezed out of the market. Our findings deviate from

traditional vertical differentiation literature because the ASP and the MOTS vendors use different

pricing strategies. What we find here is more like what Varian (2000) showed in a monopoly

20

setting: when the quality difference between selling and renting a product is small enough, the

renting strategy dominates. We show that a similar conclusion holds in duopoly competition.

This result is very important and provides useful managerial implications. It tells us that

ASPs must offer software applications with a lower value of t in order to survive and succeed in

the competitive marketplace. Therefore, not every software application can be delivered through

an ASP. The on-demand business model is not simply a new distribution channel for existing

software; instead, it requires a fundamentally new set of products and technology architectures.

Applications that are suited to the ASP channel are those most compatible with other systems and

programs. On the vendor’s side, ASPs should write their applications using an open language (for

example, XML), in a proper modular structure, and with a loosely coupled interface with other

applications (Dzubeck 2004; Thibodeau 2004). All these strategies would help to reduce users’

unfit costs. In addition, industry-wide adoption of software standards and protocols, once

achieved, would reduce the unfit costs across different applications and therefore affect ASPs

positively. Some efforts already have been made in this direction. Microsoft, Oracle, and Sun

have joined forces with IBM and Hewlett-Packard to facilitate technical standards to govern how

commercial software should be written. The ASP Industry Consortium (ASPIC) and the

Information Technology Association of America (ITAA) are working closely to make ASPs more

standardized. These strategic moves should benefit ASPs’ competitiveness in the future.

Another factor that affects the performance of ASPs is the volatility of demand, θ . A highly

*

∂t

volatile transaction volume enhances the ASP’s competitive advantages: ∂t > 0 , 1 > 0 , and

∂θ

∂θ

∂t2

> 0 . As we have shown above, the ASP’s entry into the market not only allows its own

∂θ

clients to “go on demand” and therefore shift away their uncertainty risks, but it also helps users

of the MOTS software to abate their losses caused by demand uncertainty. The ASP business

arrangement is appreciated by users to a large extent because it offers highly scalable systems.

21

Users can promptly scale their capacity up or down at no additional cost, because there is no fixed

IT investment made on the users’ side.

Moreover, when it becomes expensive to provide on-site IT support services (a large value of

c), user firms will find the ASP solution more attractive. As is shown by

C MOTS

θ [(u − 2c )( pa + t − c ) + c(u − c )]

∂d *

=

+

> 0 , when users face a large c, they prefer to

∂c

2( p a + t − c ) 2

2u ( p a + t − c ) 2

get their IT support services from an outside provider, rather than install a system and maintain it

internally. In such a situation, the ASP is expected to take a significant market share.

3.4 Robustness Check

Although we make some simplifying assumptions to reduce the complexity of the analyses,

our results are robust to these assumptions. For example, we assume that the MOTS software is

highly customized, while the ASP tends to come up with much higher unfit costs because of its

one-to-many structure. Such an assumption does not imply that the MOTS product must be a

perfectly fit system. In practice, an in-house software system could also impose lack-of-fit costs

on users. All that matters for modeling purpose is the marginal disutility for users between the

MOTS solution and the ASP. In fact, our model addresses the case in which the MOTS software

has unusually high unfit costs, i.e., t < 0 . This leads to the trivial outcome that the ASP

dominates the marketplace.

In addition, we assume that both vendors use basic pricing strategies: the ASP charges a fee

per transaction, and the MOTS vendor requires an outright purchase of the system. Admittedly,

there are numerous combinations of pricing strategies in the competitive environment.

Practically, nonlinear pricing can be considered.9 Since our objective is to characterize the nature

of the competition between the ASP and the MOTS vendor, we focus on the most salient

9

An analysis of the “fixed fee + variable charge” by the ASP can be found in the paper by Cheng and

Koehler (2002).

22

differences between the two delivery channels. Assuming complex pricing strategies will not

discredit our findings here.

Our main results can also be extended to the scenario in which the user firm’s transaction

volatility is proportional to its expected transaction volume. For instance, we may assume that the

actual transaction volume of a user located at d i is uniformly distributed on [(1 − θ )d i , (1 + θ )d i ] ,

with θ < 1 . In this case, most of our lemmas and propositions still hold.10

4. Two-Stage Competition with Uncertainty

So far, we have analyzed a market with static unfit costs (t). In practice, however, these costs

could change during an ASP’s contract period, which typically lasts for 3 to 5 years. Unfit costs

could grow over time given software or hardware changes on the users’ side, or decrease over

time due to improvements in the ASP’s software and related technology. For example, if the ASP

uses a browser interface that is dependent on nonstandard aspects of IE6 but business

circumstances faced by users drive a demand for the latest IE or Firefox, or if the ASP’s interface

involves a module built on top of a program that only works in a pre-Vista MS Windows

environment but hardware replacement at the user’s site leads to multiple PCs with the Vista OS,

unfit costs may increase. In such cases, an existing ASP user faces higher unfit costs t in its later

usage. On the other hand, if the ASP vendor continuously invests in improving its system

integration features, users’ unfit costs may be decreasing over time. For instance, Salesforce.com

developed and launched AppExchange in January 2006. AppExchange is an online marketplace

for on-demand business software. Currently it includes over 150 applications, and Adobe, Skype,

and Factiva are among the various partners. AppExchange allows Salesforce.com and other ASPs

to establish across-application integration and therefore provides software users seamless

extension of their existing systems (Cowley 2005; Kuchinskas 2006). In this case, users expect to

have reduced unfit costs because a uniform platform eases collaboration across applications.

10

The only exception is Lemma 1, which can be proven under the special case with negligible setup costs,

but for the more general cases, it gets too complicated mathematically.

23

To capture how competition takes place in a longer window with possible changes in unfit

costs over time, we build a two-stage competition model. In the first stage, the vendors choose

their prices ( pa , P ) simultaneously. We assume that their prices remain unchanged over time.

The ASP’s application imposes unfit costs t1 in the first stage. Users could have certain

expectations about a future change in unfit costs. They may expect unfit costs to increase if they

anticipate changes in demand or hardware upgrades, or to decrease if they anticipate

technological advances that favor the shared software business model. In the second stage, such a

change is realized. Users consider switching from the ASP’s software to the MOTS software or

the reverse.

We make two simplifying assumptions. First, users and vendors weight utilities or profits

obtained from both stages equally. The time discount factor for stage two is 1. Second, the ASP’s

initial setup costs to serve a new client are negligible; i.e., S = 0 . These two assumptions help to

ease the analytical analysis without changing the results qualitatively. Our study on the two-stage

model will only focus on the scenario with both vendors coexisting. Scenarios in which one

vendor fails are of little interest in this context.

4.1 The Two-Stage Model with Increased Unfit Costs

Figure 5a shows the two-stage competition with an (expected) increased t. In the first stage, with

unfit costs t1 , users in [0, d1 ] choose the ASP and in [d1 ,1] use the MOTS software. In the

second stage, users face changing business circumstances, and the unfit costs of using a standard

ASP application increase from the initial t1 to t H > t1 . Existing ASP users may consider

switching to the MOTS solution, which provides customized software with a better fit.

An existing ASP user i compares the utility from the ASP, (u − pa − t H )d i , and the utility

from the MOTS software, (u − c)d i − P − c(u − c)θ . The “marginal” switcher, denoted by d S , is

u

given by

dS =

P

c (u − c )θ .

+

pa + t H − c u ( pa + t H − c )

(9)

24

Figure 5a. Competition with Increased Unfit Costs

dS

Expected transaction

volume

d1

0

1

Users choose the ASP

initially and stay with

the ASP afterward.

Users choose the ASP

initially and switch to the

MOTS software in the second

stage.

Users choose the MOTS vendor

initially and stay with the MOTS

software afterward.

As shown in Figure 5a, the user d1 , which is indifferent between the two solutions in the first

stage, gains the same total utility. If it chooses the ASP and switches to the MOTS software later

on, its total utility is {(u − p a − t1 )d1 } + ⎧⎨(u − c)d1 − P − c(u − c)θ ⎫⎬ . If it chooses the MOTS

u

⎩

⎭

(

)

θ

c

u

−

c

c(u − c)θ ⎫ . Note that

⎧

⎫

⎧

software initially, its total utility is

⎨(u − c)d1 − P −

⎩

u

⎬ + ⎨(u − c)d1 −

⎭ ⎩

u

⎬

⎭

once the user installs the MOTS system in the first stage, it owns the system and only needs to

pay ongoing maintenance costs in the later stage. By equating these two utilities, we get

d1 =

c(u − c)θ

.

u ( p a + t1 − c)

(10)

Equations (9) and (10) imply that the MOTS vendor’s price P only affects d S , not d1 .

When the MOTS vendor’s price increases, all else being equal, the number of users that choose

the in-house system in the first stage remains unchanged. This is because the price P is

cancelled out in the indifferent user d1 ’s utility function (equation (10)). In the second stage,

however, the number of switchers (from the ASP to the MOTS solution) decreases as P

increases. A high MOTS software price, representing the large up-front costs of an internal

system, reduces existing ASP users’ incentive to move the software in-house.

The MOTS vendor gets [d1 ,1] users in the first stage and [d S , d1 ] users in the second stage.

Its profit comes from users’ one-time payment. The optimal price is given by

Max ∏ MOTS = ( P − CMOTS )[1 − d S ] .

(11)

P

The ASP serves [0, d1 ] users in the first stage and [0, d S ] users in the second stage. It gains

profit from users’ every use of the software. The optimal price is given by

25

dS

⎡ d1

⎤ 1

Max ∏ ASP = ( pa − c )⎢ ∫ xdx + ∫ xdx ⎥ = ( pa − c )(d12 + d S2 ) .

pa

0

⎣⎢ 0

⎦⎥ 2

(12)

If users do not anticipate future changes in unfit costs, this reduces to a one-stage static game

with invariant unfit costs t1 , which we have analyzed in Section 3. Here, we take such a case as

the benchmark to investigate how users’ expectation that unfit costs will increase affects the

competition equilibrium outcome.

Let pa

t1 ,t H

and P t ,t be the prices of the ASP and the MOTS vendor when users expect

1 H

unfit costs to increase from t1 to t H , and let d1 t ,t be the indifferent user defined by equation

1 H

(10). Let pa

t1

and P t be the prices when users believe unfit costs t1 will not vary, and let d t*1

1

be the indifferent user defined by equation (6) in that instance.

Proposition 8

When users anticipate a future increase in unfit costs, t1 → t H , both vendors will

increase their prices; i.e., pa t ,t > pa t and P t ,t > P t . More users will choose the MOTS

1 H

1

1 H

1

software initially (i.e., d1 t ,t < d t* ), and the ASP will lose existing clients to the MOTS vendor

1 H

1

once the increase occurs.

<Proof> See the Appendix.

Proposition 8 states three important findings. First, although increased unfit costs imply a

decrease in product quality of u − t , the ASP should nevertheless increase its price:

pa t ,t > pa t . By charging a high price, the ASP gives up competing for high-volume users with

1 H

1

the MOTS vendor; it instead concentrates on exploiting low-volume users that are unable to

afford the MOTS solution anyway.11 Second, the MOTS vendor also raises its price, which is

intuitive because its product becomes more attractive. Interestingly, we find that the MOTS

The ASP’s price cannot exceed the upper bound of u − t H . Otherwise low-end users have no incentive

to use the ASP’s product, and they will opt to stay out of the market.

11

26

seller’s best response function ( P = pa + t H − c + C MOTS − c(u − c)θ , see the proof of Proposition 8

2

2

2u

in the Appendix) is the same as that in a static competition with unfit costs t = t H (equation (7)).

This means that the MOTS vendor in practice will adopt a simple pricing strategy and price its

software as if it were in a one-stage competition with invariant unfit costs. Finally, we conclude

that a belief that unfit costs will increase benefits in-house solution providers but hurts ASPs.

4.2 The Two-Stage Model with Decreased Unfit Costs

Figure 5b shows the two-stage competition when t decreases. In the first stage, with unfit

costs t1 , users in [0, d1 ] choose the ASP and in [d1 ,1] buy from the MOTS vendor. In the second

stage, the unfit costs of using the ASP application decline to t L < t1 . Such a change could be the

result of advances in web technology, adoption of software standards and protocols, or the ASP’s

efforts to create a uniform software platform.

Figure 5b. Competition with Decreased Unfit Costs

d1

Expected transaction

volume

dS

0

1

Users choose the ASP

initially and stay with

the ASP afterward.

Users choose the MOTS

software initially and switch

to the ASP in the second

stage.

Users choose the MOTS

software initially and stay with

it afterward.

When unfit costs decrease in the second stage, an existing MOTS software user i compares

the utility available from the ASP product, (u − pa − t L )d i , and the utility from the MOTS

software, (u − c)d i − c(u − c)θ . Note that because the in-house system has already been installed,

u

the one-time payment to the vendor P has been sunk. This user only needs to pay ongoing

maintenance costs. The “marginal” switcher, denoted by d S , is given by

dS =

c (u − c)θ .

u ( p a + t L − c)

(13)

27

As Figure 5b shows, the user d1 is indifferent between the two solutions at the first stage. If

it chooses the MOTS and then switches to the ASP later on, its total utility is

c(u − c)θ ⎫

⎧

⎨(u − c)d1 − P −

⎬ + {(u − pa − t L )d1 } . If it chooses the ASP initially, its total utility is

u

⎩

⎭

{(u − pa − t1 )d1 }+ {(u − pa − t L )d1 }. Hence, we get d1 =

P

c(u − c)θ .

+

p a + t1 − c u ( p a + t1 − c)

(14)

Equations (13) and (14) show that the MOTS price P only affects d1 but not d S . When the

MOTS price increases, all else equal, the number of users that choose the in-house system in the

first stage decreases. However, the number of switchers (from the MOTS to ASP, in the second

stage) is not affected by the price increase. A high price for the MOTS software does not give

existing users a greater incentive to switch to on-demand software because it is considered a sunk

cost.

The MOTS vendor and the ASP choose the following profit-maximizing prices, respectively:

Max ∏ MOTS = ( P − C MOTS )[1 − d1 ] ;

(15)

P

dS

⎡ d1

⎤ 1

Max ∏ ASP = ( pa − c )⎢ ∫ xdx + ∫ xdx ⎥ = ( pa − c )(d12 + d S2 ) .

pa

0

⎣⎢ 0

⎦⎥ 2

(16)

We take the static competition with invariant unfit costs t1 as the benchmark case. Let

pa

t1 ,t L

and P t ,t be the prices of the ASP and MOTS products when users expect unfit costs to

1 L

decrease from t1 to t L , and let d1 t ,t be the indifferent user defined by equation (14). Let pa

1 L

t1

and P t be the prices when users believe unfit costs t1 will not vary, and let d t*1 be the

1

indifferent user defined by equation (6).

Proposition 9

When users anticipate a decrease in unfit costs, t1 → t L , both vendors will

reduce their price; i.e., p a

t1 ,t L

< p a t , P t ,t < P t . More users will choose the ASP solution

1

1 L

1

initially; i.e., d1 t ,t > d t* . Existing clients of the MOTS vendor have little incentive to switch to

1

L

1

28

on-demand software even if unfit costs decrease, but they may do so if transaction volatility is

high.

<Proof> See the Appendix.

Proposition 9 states three important findings. First, the ASP’s response to users’

anticipation of decreased unfit costs is to reduce its price, despite an increase in the quality of its

product, in order to compete for the more profitable high-volume users.12 Second, the MOTS

vendor once again sticks with a simple pricing strategy. Its best response function

(P =

pa + t1 − c C MOTS c(u − c)θ

, see the proof of Proposition 9 in the Appendix) is the same

+

−

2

2

2u

as that in a static competition with unfit costs t = t1 (equation (7)). The MOTS vendor therefore

can just ignore the expected change in unfit costs on the users’ side and price the software as if it

were in a one-stage competition. Third, our analysis shows that existing users of MOTS software

are unlikely to move to on-demand software. These users have two choices: stay with the MOTS

solution, with a utility of (u − c)d i − c(u − c)θ , or switch, with a utility of (u − pa − t L )d i . Since

u

pa > c always, the user switches only if its transaction volatility ( θ ) is high. Hence, we

conclude that once an in-house system has been installed, users have little incentive to switch to

an ASP unless they need to manage high capacity risks.

5

Discussion and Conclusion

We examine firms’ choices between the ASP and MOTS solutions when they face stochastic

demand for the software. Our findings show that the ASP on-demand model is superior when the

user faces a low transaction volume, high transaction volatility, or expensive in-house IT services,

or when the user’s unfit costs from using the ASP’s standardized product are low. Under broad

market conditions, the ASP and MOTS business models will coexist, so it is likely that the

12

Since the ASP gets paid based per transaction, users with high transaction volumes are

considered more profitable.

29

software industry will not be dominated by just one. The ASP’s entry, at the expense of the

traditional MOTS vendor, may benefit every user firm. It offers small and medium firms costsaving access to software, competitively reduces large firms’ implementation costs, and mitigates

each firm’s transaction uncertainty risks. Although the ASP model has several advantages, its

long-run viability largely depends on the magnitude of users’ unfit costs. As such costs increase,

the ASP’s ability to compete with the MOTS vendor monotonically decreases. This important

finding implies that the ASP model requires a fundamentally new set of products and technology

architectures. To achieve profits, the new generation of ASPs should leverage an open language,

a proper modular structure, and a loosely coupled interface with other applications, and thus offer

products with low unfit costs. Today’s ASPs are developing and delivering their own applications

using pure Web architectures, in a standard XML language, and in discrete units, which will

greatly increase their chance of success. Our work provides a theoretical base for these strategic

moves.

ASPs are actively investing in reducing users’ unfit costs. It is interesting and necessary to

analyze the price competition over a longer horizon in which users’ unfit costs may change over

time. Our findings suggest that investments in improving ASP software quality should be

accompanied with a downward price adjustment. In the future, we expect to see that ASPs offer

better products at lower prices. On the other hand, MOTS vendors should always adopt a simple

pricing strategy: they should price their software as if they were involved in a static competition

with invariant unfit costs. Hence, we predict that no price change will be observed for traditional

packaged software. In addition, our analysis shows that existing MOTS software users switch to

the ASP solution only to eliminate capacity, or business volume risks rather than to reduce

operating costs. These results have direct implications for the kind of businesses that ASP will

target in the future.

There are many possibilities for further ASP studies. It would be interesting to examine

the role of the Service Level Agreement (SLA). When users have demand for different levels of

30

IT service, the SLA constitutes a way to segment the market and improve the ASP’s profit, and

maybe to increase users’ surpluses as well. Another possible research topic is the software

vendor’s choice. Some major software companies have changed their business models to operate

as an ASP as well. For example, Oracle now has more than 400 customers using its ASP

products and a growing share of its revenues from its ASP unit. It is interesting to see that many

software providers are doing business both ways: selling a sophisticated version as a MOTS

product and leasing a simplified version as an ASP. Future research may investigate whether a

software vendor should add the ASP as an additional channel, switch to it exclusively, or eschew

that approach entirely.

31

References

Bednarz, A., “Manufacturers Eye on On-Demand Software,” Network World, Apr 24, 2006

Cheng, H.K. and Koehler, G.J., “Optimal Pricing Policies of Web-enabled Application Services,”

working paper, 2002

Choudhary, V., Tomak, K., and Chaturvedi, A., “Economics Benefits of Software Renting,”

Journal of Organizational Computing and Electronic Commerce 8, 277-305, 1998

Cowley, S., “Salesforce.com Makes Platform Move with AppExchange,” InfoWorld, Sep 2005

Dewan, S., and Mendelson, H., “User Delay Costs and Internal Pricing for a Service Facility,”

Management Science, Vol. 36, No. 12, Dec. 1990

Dunn, D., “Systems Management on Call,” Information Week, Jan 10, 2005

Dzubeck, F., “XML and Management Team up,” Network World, Vol. 21, Iss. 27, Jul 2004

Fishburn, P., Odlyzko, A., and Siders, R., “Fixed Fee versus Unit Pricing for Information Goods:

Competition, Equilibria, and Price Wars,” First Monday 2(7), 1997

Garner, R., “Software for Hire,” CRN, Nov 1, 2004

Hamm, S., “SAP Gets On-Demand Religion,” Business Week, Feb 2, 2006

Kaplan, J., “Sorting Through Software As A Service,” Network World, Nov 21, 2005

Knorr, E., “Software on Demand: the End of IT as We Know It?” InfoWorld, Vol. 26, Iss. 48,

Nov 29, 2004

Kuchinskas, S., “Salesforce Finally Ships AppExchange,” Ecommerce, Jan 17, 2006

Lacy, S., “The On-Demand Software Scrum,” Business Week, April 17, 2006

Ma, D., private communications with the representatives of MedPACS (phone: 262-367-0181),

2005

Martin, C., “Fee-per-Study Approach Can Cut Start-up Costs,” Radiology Today, Vol.5, No. 19,

Sep 2004

Murphy, D., “As Easy as ASP,” Direct Response. London, Jan 2005

Niccolai, J., “Gates Memo Puts Services at the Heart of Microsoft,” Network World, Nov 2005

32

“Proponents of Software as a service say it will wipe out traditional software,” The Economist,

Apr 21, 2006, article available at

http://globaltechforum.eiu.com/index.asp?layout=rich_story&doc_id=8439&title=Universal+serv

ice%3&categoryid=4&channelid=3

Pallatto, J., “IBM Recruiting ISVs, Partners to SAAS,” Channel Insider, Feb 23, 2006

Ricadela, A., “Does Salesforce.com Have the Chops to Become a Billion-Dollar Company?”

Information Week, May 2006

Singh, C., Shelor, R., Jiang, J., and Klein, G., “Rental Software Valuation in IT Investment

Decisions,” Decision Support Systems, Vol. 38, Iss. 1, Oct 2004

Sundararajan, A., “Nonlinear Pricing of Information Goods,” Management Science 50 (12), 2004

Susarla, A., Barua, A., and Whinston, A., “Understanding the Service Component of Application

Service Provision: An Empirical Analysis of Satisfaction with ASP Services,” MIS Quarterly

27(1), 2003

Thibodeau, P., “Tech Standards Set Tone for On-Demand Systems,” Computer World, Vol. 38,

Iss. 44, Nov 1, 2004

Vara, V., “Web Services Face Reliability Challenges,” Wall Street Journal, Feb 23, 2006

Varian, H., “Buying, Selling, and Renting Information Goods,” Journal of Industrial Economics

XLVIII, 473-488, 2000

Zimmerman, J., “The Costs and Benefits of Cost Allocations,” The Accounting Review, Vol. 54,

No. 3., pp. 504-521, Jul., 1979

33

Appendix

Proofs for Lemmas and Propositions

Prove Proposition 1: “users with low transaction volumes ( d i < θ ) are not served by the

MOTS vendor.”

We prove by contradiction. Suppose that the MOTS vendor does serve some users with low

transaction volumes. Let d h , d l be the marginal users in [ θ , 1] and [0, θ ] respectively. First, we

examine the extreme case that users in [0, θ ] face a deterministic transaction volume. The

vendor’s profit-maximization problem is Max ( P − C MOTS )(1 − d h + θ − d l ) , where

P

dl =

cθ

θ cθ

P

1 C

and d h = d l +

. Solving it gives d l0 = + MOTS + −

> θ , which

(u − c )

u

4 2(u − c ) 4 4u

leads to a contradiction. Next, we look at the general distribution case. For users in [0, θ ], we

make no assumption on the distribution of their transaction volumes. Denote a user’s utility loss

due to transaction uncertainty by f (δ ) . It is easy to get P = (u − c )d l − f (δ ) and

d h= d l +

cθ

f (δ )

. The software vendor’s problem is

−

u (u − c )

⎛

cθ

f (δ ) ⎞ . The profit function is concave, and the

Max ((u − c)d l − CMOTS − f (δ ) )⎜⎜1 − 2d l −

+θ +

⎟

dl

u

(

u

− c) ⎟⎠

⎝

first-order condition is ∂ = ⎧⎨(u − c ) − (u − c )cθ − 4(u − c )d l + (u − c )θ + 2C MOTS ⎫⎬ + 3 f (δ ) . The

∂d l ⎩

u

⎭

terms in the parenthesis are just the first-order condition when the transaction volume is

deterministic. Hence, this first-order condition is positive at d l0 . Making use of the concavity, we

conclude that the optimal solution d l* > d l0 > θ , which is again a contradiction.

(

Q.E.D.

)

<Proof of Proposition 2> Denote by P * , pa* the price pair at the intersection point of equations

(7) and (8). Consider the boundary conditions for the vendors’ prices: the MOTS vendor’s price

has a lower bound P ≥ C MOTS , and the ASP’s price has an upper bound pa* ≤ u − t . The ASP

34

must offer a price that gives users enough incentive to use it. A price larger than the upper bound

u − t will attract no users. On the other hand, the ASP’s price must be high enough to cover the

(

ASP’s initial setup cost to give the ASP an incentive to serve the market.i The price pair P * , pa*

)

is an equilibrium outcome if it satisfies all these boundary conditions. In the special case with

S=0, we get (PS*=0 , p a*,S =0 ) = ⎛⎜ max ⎧⎨C MOTS , C MOTS + t − c(u − c )θ ⎫⎬, t + c ⎞⎟ , which is a feasible

2

2u

⎭

⎩

⎝

⎠

outcome if t + c ≤ u − t ⇔ t ≤

∂pa*

u−c *

> 0 . In the general case

≡ ts = 0 . It is easy to show that

∂S

2

with S ≥ 0 , the ASP’s price is pa* = c + t + ∆ ( S ) , where ∆( S ) ≥ 0 , ∂∆( S ) > 0 . Thus, the critical

∂S

value t * must satisfy t * = u − c − ∆( S ) ≤ u − c , and t * is decreasing in S .

2

2

Compare the MOTS vendor’s best response function in the dual market (equation (7)) with its

optimal price P M in the pre-ASP market (equation (4)). Since pa* < u − t , the vendor’s price

decreases after the ASP enters the market: P * < P M .

Plugging equation (7) into equation (6) gives the location of the indifferent user in the dual

market:

d* =

1

C MOTS

cθ ( u − c )

.

+

+

2 2 ( p a + t − c ) 2u ( p a + t − c )

(A1)

Compare this with the marginal user’s location in the pre-ASP market ( d M , equation (5)).

We find that d * > d M : the MOTS vendor’s market share decreases. Together, a lower price and

a decreased market share result in less profit for the MOTS vendor.

Figures A1(a) and (b) show the pre-ASP and dual markets respectively. When the ASP is an

option, full market coverage is achieved. Small users with low transaction volumes, located in

[0, d ] , are able to afford the software through the ASP, because the ASP does not impose high

M

[

]

implementation and maintenance costs on them. Users in d M , d * will purchase the MOTS

35

software in the pre-ASP market but choose to use the ASP in the dual market. For these users, the

ASP represents a cheaper solution than the MOTS option. Since

[

] [

] [

]

E u MOTS ( P = P M ) ≤ E u MOTS ( P = P * ) ≤ E u ASP ( pa = pa* ) , they are better off as well. Finally,

[

]

users in d * ,1 are firms with a high volume of transactions. They choose the MOTS solution in

both markets, but their payments are lower in the dual market because of the ASP’s competition.

The ASP’s entry into the market benefits these firms as well, although they are not its clients.

Each user therefore is better off, and the total consumer surplus is strictly improved.

Figure A1. The Pre-ASP Market and the Dual Markets When t ≤ t *

(a) The pre-ASP market (the MOTS software solution alone)

users purchase the MOTS software at P M

1

0

2

1

dM

users are priced out of the market

(b) The dual market

users purchase the MOTS

software at P * < P M

0

users choose the ASP

d

M

d*

1

Q.E.D.

<Proof of Proposition 3> When t > t * , the ASP’s unrestricted optimal price (from equation (8))

is pa > u − t . This price is too high to attract any user. The ASP will set its price at the restricted

*

optimal pa'' = u − t . The ASP’s users therefore get zero surplus. Plug pa'' into equation (7). The

MOTS vendor’s optimal selling price, denoted by P " , is the same as in the pre-ASP market

( P M , given by equation (4)). Plugging pa'' and P " into equation (6) gives the MOTS vendor’s

market share, 1 − d " =

1 C MOTS cθ

, which again is the same as in the pre-ASP market

−

−

2 (u − c ) 2u

36

( 1 − d M , given by equation (5)). The conclusion that the MOTS vendor’s profit does not change

follows.

When the value of t increases further, and especially when t > u − c , it is easy to see that the

ASP is not able to operate profitably.

Q.E.D.

<Proof of Lemma 1> Using equation (8), we get dp a* dθ =

dB

1

[ −4 Sut ] , where

dθ ( B − 2 Su ) 2

dB dP *

=

u + c (u − c ) .

dθ

dθ

To judge the sign of dpa* dθ , consider two possible cases: (1)

and (2)

dB

< 0 <=> dpa* dθ > 0 ,

dθ

dP *

c(u − c )

dB

.

<−

> 0 <=> dp a* dθ < 0 . If the first case is true, dB < 0 implies

dθ

u

dθ

dθ

However, equation (7) indicates that

dP * 1 dp a* c(u − c )

c(u − c )

. Hence, we eliminate

=

−

>−

dθ

2 dθ

2u

2u

dP *

the possibility of case (1). Consider the second case. If dB > 0 , either

> 0 or

dθ

dθ

−

dpa*

c(u − c ) dP *

< 0 , which means that

<

< 0 . On the other hand, equation (8) implies

dθ

u

dθ

*

dP *

c(u − c ) . It therefore must be the case that dpa

dP *

< 0,

<−

< 0 , and

dθ

dθ

2u

dθ

c(u − c )

c(u − c )

. This proves parts (1) and (2). Use equation (A1):

< dP * dθ <

2u

u

*

dp a* 2uc (u − c )⎛⎜ p * + t − c − dp a θ ⎞⎟