Ch. 16 Partnership Liquidation 1. Liquidation process for a solvent partnership

advertisement

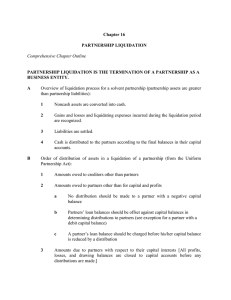

Ch. 16 Partnership Liquidation This chapter deals with the termination of the partnership as a business entity 1. Liquidation process for a solvent partnership (i.e., partnership assets are greater than partnership liabilities): Noncash assets are converted into cash. Gains/losses and liquidation expenses are recognized and allocated to partners’ capital accounts based on profit/loss sharing agreement. Liabilities are settled. Cash is distributed according to partners’ final capital balances. o Partners with debit capital balance are obligated to use their personal assets to settle their partnership obligations. o If the partners with debit balances have inadequate personal assets, the partners with credit balances assume losses based on their loss sharing ratio. o Partners’ loan balances should be offset against capital balances in determining distribution to partners. 2. Partnership Liquidation Statement A summary of transactions and balances during the liquidation stage 3. Safe Payment Schedule The purpose of safe payment schedule is to ensure that cash distributed to partners will NOT have to be returned to the partnership. A safe payment schedule should be prepared whenever cash is distributed to partners after all creditors’ claims are paid and before all partnership assets are liquidated. Advance distribution must be approved by all partners. In preparing the schedule, it is assumed that” o All partners are personally insolvent. o All noncash assets have no cash value and are considered losses. o Some cash may be held to cover liquidation expenses and contingencies. This amount is considered a loss in preparing safe payment schedule. Four steps to prepare a safe payment schedule: Step 1. Determine each partner’s equity, which is each partner’s capital plus loans to the partnership and less loans from the partnership. Step 2. Possible losses from noncash assets and contingency cash are allocated to the partners according to profit/loss sharing ratios. Step 3. Any negative partner equity is viewed as a loss and is allocated to partners with credit equity balance according to their relative profit/loss sharing ratios. Step 4. Repeat step 3 until there are no negative equity balances. At that point, the amount show for partners with credit equity balance will equal the cash available for distribution. o Once all partners are included in the cash distribution, future distribution will be in the profit sharing ratios and no additional safe payment schedules are needed. 4. Cash Distribution Plan o Cash distribution plan is a planning tool, and is usually prepared at the early stage of partnership liquidation. It informs partners at what stage they might expect to receive distributions. Three steps: Step 1. Ranks partners by their vulnerability ranking (each partner’s equity is divided by his/her profit sharing ratio). This is the maximum loss that will wipe a partner’s equity balance. Step 2. Prepare a schedule of assumed loss absorption based on vulnerability rankings. o The schedule begins with partners’ preliquidation equity balances o Charges each partner’s equity with his/her share of the loss that would exactly eliminate the most vulnerable partner’s equity. o Charges the remaining partners’ equity with their share of loss that would eliminate the next most vulnerable partner’s equity. o Repeat this process until the all but the least vulnerable partner’s equity is reduced to zero. Step 3. Prepare a cash distribution plan which distribute cash according to the following order: o The first cash available goes to nonpartner liabilities. o Next, the least vulnerable partner will receive the amount that align his/her equity with next least vulnerable partner. o Repeat this process until all partners are participating in the distribution. o Remaining distribution will be in the profit/loss sharing ratio.