Table T10-0145 Tax Qualified Dividends like Long-Term Capital Gains

advertisement

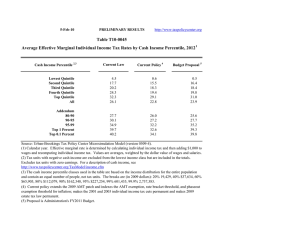

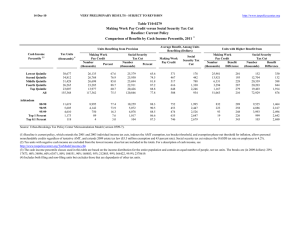

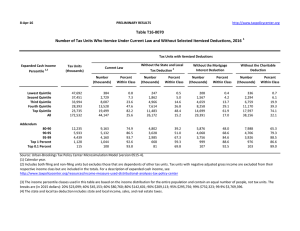

21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile, 2012 Summary Table Percent of Tax Units4 Cash Income Percentile 2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change ($) 1 Average Federal Tax Rate6 Change (% Points) Under the Proposal 0.0 2.5 7.7 19.6 43.6 11.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 0.2 0.0 0.3 1.1 3.8 94.8 100.0 0 -1 -6 -25 -720 -112 0.0 0.0 0.0 0.0 -0.3 -0.2 4.6 10.3 16.6 19.6 26.4 21.6 31.7 44.5 63.3 79.4 85.2 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.9 1.2 4.2 4.8 15.4 70.4 42.9 -64 -148 -586 -10,460 -63,247 -0.1 -0.1 -0.2 -0.6 -0.8 22.1 23.3 25.8 31.8 34.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 3.7 Proposal: 3.8 ** This table is part of a series of tables showing the distributional effects of moving incrementally from current law to current policy. For definitions and further information, see “Related Tables: Moving Incrementally from Current Law to Current Policy” at http://taxpolicycenter.org/numbers/displayatab.cfm?template=simulation&SimID=366 (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,356, 40% $37,493, 60% $65,656, 80% $111,659, 90% $161,739, 95% $226,402, 99% $599,181, 99.9% $2,727,123. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile, 2012 Detail Table Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent 1 Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 2.5 7.7 19.6 43.6 11.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 0.2 0.0 0.3 1.1 3.8 94.8 100.0 0 -1 -6 -25 -720 -112 0.0 -0.1 -0.1 -0.1 -1.0 -0.7 0.0 0.0 0.1 0.1 -0.2 0.0 0.8 4.0 10.6 17.9 66.6 100.0 0.0 0.0 0.0 0.0 -0.3 -0.2 4.6 10.3 16.6 19.6 26.4 21.6 31.7 44.5 63.3 79.4 85.2 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.9 1.2 4.2 4.8 15.4 70.4 42.9 -64 -148 -586 -10,460 -63,247 -0.2 -0.3 -0.7 -1.8 -2.1 0.1 0.0 0.0 -0.3 -0.2 13.8 10.1 16.0 26.6 13.5 -0.1 -0.1 -0.2 -0.6 -0.8 22.1 23.3 25.8 31.8 34.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2012 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 38,450 34,947 31,868 26,646 23,298 157,348 24.4 22.2 20.3 16.9 14.8 100.0 11,600 28,852 52,224 88,978 280,229 76,169 537 2,982 8,651 17,417 74,770 16,589 11,063 25,871 43,572 71,561 205,459 59,580 4.6 10.3 16.6 19.6 26.7 21.8 3.7 8.4 13.9 19.8 54.5 100.0 4.5 9.6 14.8 20.3 51.1 100.0 0.8 4.0 10.6 17.8 66.7 100.0 11,720 5,734 4,655 1,190 120 7.5 3.6 3.0 0.8 0.1 138,385 196,549 345,574 1,825,188 8,367,274 30,601 45,977 89,576 590,725 2,973,779 107,784 150,571 255,998 1,234,463 5,393,495 22.1 23.4 25.9 32.4 35.5 13.5 9.4 13.4 18.1 8.4 13.5 9.2 12.7 15.7 6.9 13.7 10.1 16.0 26.9 13.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 3.7 Proposal: 3.8 (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,356, 40% $37,493, 60% $65,656, 80% $111,659, 90% $161,739, 95% $226,402, 99% $599,181, 99.9% $2,727,123. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars 1 Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.7 5.4 16.0 40.1 11.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 0.2 0.0 0.0 0.5 2.3 97.2 100.0 0 0 -3 -13 -574 -112 0.0 0.0 0.0 -0.1 -0.9 -0.7 0.0 0.0 0.1 0.1 -0.2 0.0 0.1 2.8 8.5 17.1 71.4 100.0 0.0 0.0 0.0 0.0 -0.2 -0.2 1.0 8.5 15.2 19.0 26.3 21.6 28.2 41.0 60.1 77.7 84.9 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.8 1.2 3.6 4.6 16.1 72.9 44.9 -42 -107 -480 -8,972 -55,779 -0.2 -0.3 -0.6 -1.8 -2.2 0.1 0.1 0.0 -0.3 -0.2 15.1 11.4 17.2 27.7 14.0 0.0 -0.1 -0.2 -0.6 -0.8 22.2 23.5 25.6 31.6 34.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2012 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 31,706 32,349 31,237 29,980 29,936 157,348 20.2 20.6 19.9 19.1 19.0 100.0 10,935 26,208 46,322 77,565 235,547 76,169 114 2,226 7,022 14,760 62,438 16,589 10,821 23,982 39,300 62,806 173,109 59,580 1.0 8.5 15.2 19.0 26.5 21.8 2.9 7.1 12.1 19.4 58.8 100.0 3.7 8.3 13.1 20.1 55.3 100.0 0.1 2.8 8.4 17.0 71.6 100.0 15,019 7,540 5,940 1,436 142 9.6 4.8 3.8 0.9 0.1 117,658 167,170 294,212 1,584,726 7,360,192 26,101 39,356 75,645 509,004 2,595,249 91,557 127,814 218,567 1,075,721 4,764,944 22.2 23.5 25.7 32.1 35.3 14.7 10.5 14.6 19.0 8.7 14.7 10.3 13.9 16.5 7.2 15.0 11.4 17.2 28.0 14.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 3.7 Proposal: 3.8 (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,219, 40% $24,782, 60% $41,864, 80% $68,188, 90% $97,830, 95% $138,709, 99% $361,983, 99.9% $1,670,467. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Single Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars 1 Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 1.2 6.3 13.9 35.3 8.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 0.2 0.0 0.2 1.5 4.3 94.1 100.0 0 0 -4 -15 -386 -57 0.0 0.0 -0.1 -0.1 -0.9 -0.6 0.0 0.0 0.1 0.1 -0.2 0.0 1.5 5.0 12.5 20.6 60.3 100.0 0.0 0.0 0.0 0.0 -0.3 -0.1 7.1 10.7 17.1 21.1 27.3 21.8 24.7 37.4 55.1 72.7 80.2 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.3 1.0 1.4 5.8 7.8 19.4 61.1 35.9 -45 -129 -425 -6,661 -44,577 -0.2 -0.4 -0.8 -1.8 -2.2 0.1 0.0 0.0 -0.3 -0.2 15.5 10.8 14.5 19.5 9.4 -0.1 -0.1 -0.2 -0.6 -0.9 24.0 25.2 26.1 33.7 37.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2012 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 16,972 15,474 14,005 11,543 9,596 68,932 24.6 22.5 20.3 16.8 13.9 100.0 8,380 19,970 34,261 55,833 151,979 43,878 595 2,143 5,871 11,782 41,868 9,633 7,785 17,828 28,390 44,051 110,111 34,244 5,066 2,373 1,795 361 32 7.4 3.4 2.6 0.5 0.1 84,037 119,032 204,548 1,060,631 5,243,107 20,189 30,125 53,845 363,728 1,996,644 63,848 88,907 150,703 696,903 3,246,463 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 7.1 10.7 17.1 21.1 27.6 22.0 4.7 10.2 15.9 21.3 48.2 100.0 5.6 11.7 16.8 21.5 44.8 100.0 1.5 5.0 12.4 20.5 60.5 100.0 24.0 25.3 26.3 34.3 38.1 14.1 9.3 12.1 12.7 5.5 13.7 8.9 11.5 10.7 4.4 15.4 10.8 14.6 19.8 9.5 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,219, 40% $24,782, 60% $41,864, 80% $68,188, 90% $97,830, 95% $138,709, 99% $361,983, 99.9% $1,670,467. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Married Tax Units Filing Jointly Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars 1 Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.1 5.5 19.3 44.0 19.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 0.2 0.0 0.0 0.2 1.7 98.1 100.0 0 0 -2 -14 -683 -211 0.0 0.0 0.0 -0.1 -0.9 -0.7 0.0 0.0 0.0 0.1 -0.2 0.0 0.0 1.4 5.4 14.7 78.4 100.0 0.0 0.0 0.0 0.0 -0.2 -0.2 0.8 7.9 13.6 17.9 26.0 22.5 31.5 43.6 63.6 79.9 87.2 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.8 1.2 3.0 3.6 15.4 76.2 47.0 -43 -97 -511 -9,720 -59,522 -0.2 -0.2 -0.6 -1.8 -2.2 0.1 0.1 0.0 -0.3 -0.2 15.1 12.3 19.2 31.7 15.8 0.0 -0.1 -0.2 -0.6 -0.8 21.4 22.9 25.4 31.0 34.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2012 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 6,622 8,956 11,470 15,032 18,609 61,357 10.8 14.6 18.7 24.5 30.3 100.0 14,526 33,405 59,671 95,023 281,842 126,020 118 2,631 8,102 17,030 73,821 28,513 14,408 30,774 51,569 77,992 208,021 97,507 8,860 4,843 3,890 1,015 102 14.4 7.9 6.3 1.7 0.2 138,312 192,091 337,723 1,748,464 7,890,377 29,689 44,162 86,390 552,293 2,737,991 108,623 147,928 251,333 1,196,171 5,152,387 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 7.9 13.6 17.9 26.2 22.6 1.2 3.9 8.9 18.5 67.8 100.0 1.6 4.6 9.9 19.6 64.7 100.0 0.0 1.4 5.3 14.6 78.5 100.0 21.5 23.0 25.6 31.6 34.7 15.9 12.0 17.0 23.0 10.5 16.1 12.0 16.3 20.3 8.8 15.0 12.2 19.2 32.1 16.0 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,219, 40% $24,782, 60% $41,864, 80% $68,188, 90% $97,830, 95% $138,709, 99% $361,983, 99.9% $1,670,467. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Head of Household Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars 1 Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.3 3.1 8.3 21.9 2.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.0 0.0 0.1 2.2 5.1 92.7 100.0 0 0 -1 -5 -207 -11 0.0 0.0 0.0 0.0 -0.5 -0.2 0.0 0.0 0.1 0.1 -0.1 0.0 -5.3 9.6 27.4 29.4 38.9 100.0 0.0 0.0 0.0 0.0 -0.1 0.0 -7.2 6.0 15.3 19.7 25.1 14.0 15.1 26.5 38.6 69.7 75.1 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.6 0.7 6.9 6.0 15.8 64.0 34.5 -24 -71 -253 -5,371 -32,862 -0.1 -0.2 -0.4 -1.2 -1.3 0.0 0.0 0.0 -0.1 -0.1 14.5 5.9 8.1 10.4 4.9 0.0 -0.1 -0.1 -0.4 -0.5 22.9 23.5 24.0 31.8 34.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2012 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 7,840 7,497 5,095 2,777 1,242 24,547 31.9 30.5 20.8 11.3 5.1 100.0 13,490 30,617 50,275 76,881 178,521 41,760 -966 1,831 7,687 15,156 45,038 5,844 14,455 28,786 42,588 61,725 133,483 35,916 805 232 173 33 3 3.3 0.9 0.7 0.1 0.0 112,763 154,893 278,418 1,423,600 6,950,503 25,848 36,461 67,017 457,656 2,446,857 86,915 118,432 211,401 965,944 4,503,646 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -7.2 6.0 15.3 19.7 25.2 14.0 10.3 22.4 25.0 20.8 21.6 100.0 12.9 24.5 24.6 19.4 18.8 100.0 -5.3 9.6 27.3 29.3 39.0 100.0 22.9 23.5 24.1 32.2 35.2 8.9 3.5 4.7 4.6 2.0 7.9 3.1 4.1 3.6 1.5 14.5 5.9 8.1 10.5 5.0 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,219, 40% $24,782, 60% $41,864, 80% $68,188, 90% $97,830, 95% $138,709, 99% $361,983, 99.9% $1,670,467. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Tax Units with Children Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars 1 Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 0.3 5.7 15.4 42.2 11.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.1 0.0 0.0 0.5 2.3 97.2 100.0 0 0 -2 -10 -531 -92 0.0 0.0 0.0 -0.1 -0.6 -0.5 0.0 0.0 0.0 0.1 -0.1 0.0 -1.3 2.2 9.9 19.7 69.4 100.0 0.0 0.0 0.0 0.0 -0.2 -0.1 -8.9 6.1 15.4 19.4 27.2 21.2 30.8 44.1 63.0 79.3 85.2 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.7 0.9 2.9 3.4 15.9 75.0 45.5 -30 -78 -459 -9,114 -57,383 -0.1 -0.1 -0.4 -1.3 -1.6 0.1 0.0 0.0 -0.2 -0.2 15.8 10.7 16.9 26.0 12.5 0.0 0.0 -0.1 -0.4 -0.6 22.7 24.0 26.9 33.1 35.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2012 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 10,133 10,359 10,251 9,800 8,315 49,155 20.6 21.1 20.9 19.9 16.9 100.0 14,723 34,672 62,298 103,142 306,063 95,419 -1,303 2,104 9,619 20,050 83,667 20,356 16,026 32,568 52,679 83,091 222,396 75,063 4,398 1,976 1,567 374 36 9.0 4.0 3.2 0.8 0.1 157,496 224,546 400,356 2,088,455 9,839,694 35,785 53,964 108,113 701,144 3,515,082 121,711 170,582 292,243 1,387,310 6,324,612 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -8.9 6.1 15.4 19.4 27.3 21.3 3.2 7.7 13.6 21.6 54.3 100.0 4.4 9.1 14.6 22.1 50.1 100.0 -1.3 2.2 9.9 19.6 69.5 100.0 22.7 24.0 27.0 33.6 35.7 14.8 9.5 13.4 16.7 7.6 14.5 9.1 12.4 14.1 6.2 15.7 10.7 16.9 26.2 12.7 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,219, 40% $24,782, 60% $41,864, 80% $68,188, 90% $97,830, 95% $138,709, 99% $361,983, 99.9% $1,670,467. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0145 Incremental Effects of Extending the 2001 and 2003 Tax Cuts Tax Qualified Dividends like Long-Term Capital Gains Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Elderly Tax Units Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars 1 Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 0.0 1.0 6.7 29.8 62.4 18.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.7 0.4 0.0 0.1 0.4 2.4 97.1 100.0 0 0 -6 -34 -1,320 -250 0.0 -0.1 -0.2 -0.4 -2.0 -1.7 0.0 0.0 0.1 0.1 -0.2 0.0 0.3 1.7 3.5 10.3 84.2 100.0 0.0 0.0 0.0 -0.1 -0.5 -0.3 2.5 3.9 6.2 11.5 25.2 18.7 52.3 63.6 73.3 79.9 86.8 0.0 0.0 0.0 0.0 0.0 0.2 0.3 0.5 1.3 1.8 4.5 5.9 17.8 68.9 40.9 -141 -330 -975 -12,140 -73,727 -0.8 -1.1 -1.5 -2.7 -3.2 0.1 0.1 0.1 -0.4 -0.3 9.9 9.5 20.7 44.1 22.2 -0.1 -0.2 -0.4 -0.9 -1.1 16.8 19.7 24.0 31.5 34.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2012 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 5,016 8,213 5,981 5,495 5,617 30,543 16.4 26.9 19.6 18.0 18.4 100.0 10,899 22,528 41,094 70,238 257,048 75,737 271 871 2,534 8,133 66,183 14,421 10,628 21,657 38,560 62,105 190,865 61,317 2,427 1,362 1,394 434 42 8.0 4.5 4.6 1.4 0.1 105,444 153,103 267,882 1,396,961 6,520,091 17,813 30,408 65,257 452,162 2,334,771 87,631 122,695 202,624 944,799 4,185,320 1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.5 3.9 6.2 11.6 25.8 19.0 2.4 8.0 10.6 16.7 62.4 100.0 2.9 9.5 12.3 18.2 57.2 100.0 0.3 1.6 3.4 10.2 84.4 100.0 16.9 19.9 24.4 32.4 35.8 11.1 9.0 16.1 26.2 12.0 11.4 8.9 15.1 21.9 9.5 9.8 9.4 20.7 44.5 22.5 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law plus a permanent AMT patch at 2009 levels, indexed for inflation; extension of low- and middle-income tax cuts (extend the 10, 25, and 28 percent rates; set the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to double those for singles; raise the EITC phaseout threshold for couples filing jointly; and extend expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is taxation of qualified dividends the same as long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,219, 40% $24,782, 60% $41,864, 80% $68,188, 90% $97,830, 95% $138,709, 99% $361,983, 99.9% $1,670,467. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.