13-Mar-09 PRELIMINARY RESULTS

advertisement

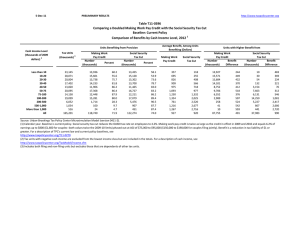

13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 71.9 70.8 74.6 82.4 86.5 87.1 86.0 76.3 26.1 18.7 13.8 76.1 With Tax Increase 0.0 0.5 0.4 0.7 0.3 0.1 0.0 0.0 0.0 0.1 0.0 0.2 Percent Change in After-Tax Income 4 6.3 3.7 2.9 2.3 1.8 1.4 1.0 0.7 0.1 0.1 0.0 1.0 Share of Total Federal Tax Change 5.5 13.2 15.0 11.9 8.9 16.4 11.5 15.7 1.2 0.2 0.1 100.0 Average Federal Tax Change ($) -339 -556 -669 -722 -691 -707 -739 -720 -203 -235 -264 -622 Average Federal Tax Rate5 Change (% Points) -5.9 -3.5 -2.6 -2.0 -1.5 -1.1 -0.8 -0.5 -0.1 0.0 0.0 -0.8 Under the Proposal -0.3 2.3 8.2 13.0 16.0 18.5 20.3 23.7 27.0 28.9 34.0 22.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 19.6 Proposal: 19.0 (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 71.9 70.8 74.6 82.4 86.5 87.1 86.0 76.3 26.1 18.7 13.8 76.1 0.0 0.5 0.4 0.7 0.3 0.1 0.0 0.0 0.0 0.1 0.0 0.2 Percent Change in After-Tax Income 4 6.3 3.7 2.9 2.3 1.8 1.4 1.0 0.7 0.1 0.1 0.0 1.0 Share of Total Federal Tax Change 5.5 13.2 15.0 11.9 8.9 16.4 11.5 15.7 1.2 0.2 0.1 100.0 Average Federal Tax Change Dollars -339 -556 -669 -722 -691 -707 -739 -720 -203 -235 -264 -622 Percent -104.9 -60.7 -23.7 -13.2 -8.4 -5.6 -3.8 -2.1 -0.3 -0.1 0.0 -3.4 Share of Federal Taxes Change (% Points) -0.2 -0.4 -0.5 -0.3 -0.2 -0.2 0.0 0.4 0.6 0.3 0.7 0.0 Under the Proposal 0.0 0.3 1.7 2.8 3.4 9.9 10.3 26.2 17.4 7.6 20.3 100.0 Average Federal Tax Rate5 Change (% Points) -5.9 -3.5 -2.6 -2.0 -1.5 -1.1 -0.8 -0.5 -0.1 0.0 0.0 -0.8 Under the Proposal -0.3 2.3 8.2 13.0 16.0 18.5 20.3 23.7 27.0 28.9 34.0 22.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,013 23,194 22,014 16,088 12,539 22,724 15,284 21,316 5,894 1,021 519 157,316 Percent of Total 10.2 14.7 14.0 10.2 8.0 14.4 9.7 13.6 3.8 0.7 0.3 100.0 Average Income (Dollars) 5,740 15,900 26,173 36,651 47,251 65,018 91,616 142,730 300,152 714,940 3,165,609 77,851 Average Federal Tax Burden (Dollars) 323 916 2,822 5,473 8,240 12,701 19,374 34,519 81,296 206,488 1,075,111 18,131 Average AfterTax Income 4 (Dollars) 5,418 14,984 23,350 31,178 39,011 52,317 72,241 108,211 218,856 508,452 2,090,497 59,720 Average Federal Tax Rate 5 5.6 5.8 10.8 14.9 17.4 19.5 21.2 24.2 27.1 28.9 34.0 23.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.0 4.7 4.8 4.8 12.1 11.4 24.8 14.5 6.0 13.4 100.0 0.9 3.7 5.5 5.3 5.2 12.7 11.8 24.6 13.7 5.5 11.6 100.0 0.2 0.8 2.2 3.1 3.6 10.1 10.4 25.8 16.8 7.4 19.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 19.6 Proposal: 19.0 (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 71.5 62.8 68.0 80.5 86.3 83.3 75.4 21.0 7.1 10.1 4.8 69.6 0.0 0.7 0.2 0.1 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.2 Percent Change in After-Tax Income 4 5.5 2.4 1.7 1.6 1.2 0.9 0.5 0.1 0.0 0.0 0.0 1.0 Share of Total Federal Tax Change 13.3 19.6 18.6 14.8 10.6 16.3 4.9 1.4 0.2 0.0 0.0 100.0 Average Federal Tax Change Dollars -285 -343 -378 -466 -439 -436 -319 -98 -70 -78 -74 -356 Percent -54.4 -21.7 -10.3 -7.1 -4.5 -3.0 -1.4 -0.3 -0.1 0.0 0.0 -3.4 Share of Federal Taxes Change (% Points) -0.4 -0.6 -0.4 -0.3 -0.1 0.1 0.3 0.6 0.3 0.2 0.4 0.0 Under the Proposal 0.4 2.5 5.8 7.0 7.9 18.8 12.5 18.4 10.2 4.5 11.9 100.0 Average Federal Tax Rate 5 Change (% Points) -5.0 -2.2 -1.5 -1.3 -0.9 -0.7 -0.4 -0.1 0.0 0.0 0.0 -0.8 Under the Proposal 4.2 7.8 12.7 16.8 19.6 22.0 25.1 26.8 29.5 32.1 37.2 22.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,322 13,927 12,005 7,758 5,890 9,119 3,769 3,371 777 136 72 68,506 16.5 20.3 17.5 11.3 8.6 13.3 5.5 4.9 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,679 15,797 26,047 36,609 47,203 64,298 90,691 139,363 304,627 706,682 3,061,513 45,237 Average Federal Tax Burden (Dollars) 524 1,581 3,692 6,612 9,670 14,569 23,034 37,396 90,065 226,820 1,138,389 10,354 Average AfterTax Income 4 (Dollars) 5,155 14,216 22,354 29,997 37,533 49,729 67,657 101,967 214,563 479,862 1,923,125 34,883 Average Federal Tax Rate 5 9.2 10.0 14.2 18.1 20.5 22.7 25.4 26.8 29.6 32.1 37.2 22.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.1 7.1 10.1 9.2 9.0 18.9 11.0 15.2 7.6 3.1 7.1 100.0 2.4 8.3 11.2 9.7 9.3 19.0 10.7 14.4 7.0 2.7 5.8 100.0 0.8 3.1 6.3 7.2 8.0 18.7 12.2 17.8 9.9 4.3 11.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 54.9 73.4 71.3 71.8 79.8 87.1 89.1 90.3 29.6 20.4 15.7 77.5 0.0 0.0 0.4 2.1 0.8 0.3 0.1 0.0 0.0 0.0 0.0 0.3 Percent Change in After-Tax Income 4 6.7 5.6 4.9 3.7 2.8 1.8 1.3 0.8 0.1 0.1 0.0 0.9 Share of Total Federal Tax Change 1.2 6.0 10.3 9.1 8.3 17.6 17.1 27.3 2.1 0.4 0.2 100.0 Average Federal Tax Change Dollars Percent -313 -872 -1,181 -1,198 -1,168 -1,005 -937 -876 -226 -261 -303 -885 -115.8 -140.7 -59.8 -30.1 -18.8 -9.3 -5.3 -2.6 -0.3 -0.1 0.0 -2.8 Share of Federal Taxes Change (% Points) 0.0 -0.2 -0.3 -0.2 -0.2 -0.4 -0.2 0.1 0.5 0.3 0.7 0.0 Under the Proposal 0.0 -0.1 0.2 0.6 1.0 5.0 8.9 30.0 21.0 9.3 23.8 100.0 Average Federal Tax Rate 5 Change (% Points) -6.3 -5.3 -4.5 -3.3 -2.5 -1.5 -1.0 -0.6 -0.1 0.0 0.0 -0.7 Under the Proposal -0.9 -1.5 3.0 7.6 10.7 14.9 18.3 23.0 26.6 28.4 33.4 23.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,080 3,744 4,757 4,142 3,865 9,499 9,889 16,942 4,932 852 427 61,400 3.4 6.1 7.8 6.8 6.3 15.5 16.1 27.6 8.0 1.4 0.7 100.0 Average Income (Dollars) 4,968 16,339 26,344 36,758 47,359 66,123 92,185 143,802 299,285 716,602 3,123,239 128,766 Average Federal Tax Burden (Dollars) 271 620 1,974 3,983 6,216 10,841 17,786 33,958 79,894 203,433 1,043,698 31,308 Average AfterTax Income 4 (Dollars) 4,698 15,719 24,370 32,776 41,143 55,282 74,399 109,844 219,391 513,169 2,079,541 97,458 Average Federal Tax Rate 5 5.5 3.8 7.5 10.8 13.1 16.4 19.3 23.6 26.7 28.4 33.4 24.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.6 1.9 2.3 7.9 11.5 30.8 18.7 7.7 16.9 100.0 0.2 1.0 1.9 2.3 2.7 8.8 12.3 31.1 18.1 7.3 14.8 100.0 0.0 0.1 0.5 0.9 1.3 5.4 9.2 29.9 20.5 9.0 23.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 87.7 89.3 92.4 96.5 96.1 96.2 92.4 26.9 10.2 14.0 5.6 89.9 0.0 0.0 0.8 0.3 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 8.4 5.4 3.6 2.3 1.5 1.3 0.8 0.2 0.1 0.1 0.0 2.1 Share of Total Federal Tax Change 8.3 26.0 24.2 15.8 7.8 12.8 4.1 0.8 0.2 0.0 0.0 100.0 Average Federal Tax Change Dollars -610 -904 -899 -749 -581 -651 -546 -177 -192 -248 -99 -732 Percent 104.9 123.3 -66.4 -16.4 -7.5 -5.2 -2.7 -0.5 -0.2 -0.1 0.0 -11.1 Share of Federal Taxes Change (% Points) -1.1 -3.5 -2.5 -0.6 0.5 1.8 1.6 2.0 0.8 0.3 0.8 0.0 Under the Proposal -2.0 -5.9 1.5 10.0 11.9 28.9 18.2 19.3 7.5 3.0 7.6 100.0 Average Federal Tax Rate 5 Change (% Points) -9.1 -5.7 -3.4 -2.1 -1.2 -1.0 -0.6 -0.1 -0.1 0.0 0.0 -1.8 Under the Proposal -17.8 -10.3 1.7 10.5 15.1 18.5 21.7 24.7 26.1 27.4 34.1 14.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,467 5,224 4,903 3,826 2,437 3,581 1,358 845 139 23 11 24,862 9.9 21.0 19.7 15.4 9.8 14.4 5.5 3.4 0.6 0.1 0.0 100.0 Average Income (Dollars) 6,689 15,879 26,283 36,558 47,271 63,957 90,406 135,286 302,335 696,822 2,985,224 41,756 Average Federal Tax Burden (Dollars) -582 -734 1,352 4,569 7,719 12,479 20,145 33,536 79,137 191,073 1,018,822 6,618 Average AfterTax Income 4 (Dollars) 7,271 16,613 24,931 31,989 39,552 51,478 70,262 101,750 223,198 505,749 1,966,402 35,138 Average Federal Tax Rate 5 -8.7 -4.6 5.2 12.5 16.3 19.5 22.3 24.8 26.2 27.4 34.1 15.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 8.0 12.4 13.5 11.1 22.1 11.8 11.0 4.1 1.5 3.1 100.0 2.1 9.9 14.0 14.0 11.0 21.1 10.9 9.8 3.6 1.3 2.4 100.0 -0.9 -2.3 4.0 10.6 11.4 27.2 16.6 17.2 6.7 2.6 6.7 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 86.2 96.9 97.5 98.9 98.6 98.8 98.2 92.8 28.7 17.7 13.5 91.6 0.0 0.0 0.3 0.0 0.1 0.0 0.0 0.0 0.0 0.1 0.0 0.1 Percent Change in After-Tax Income 4 8.8 6.7 5.6 4.0 3.0 2.0 1.5 0.9 0.1 0.1 0.0 1.5 Share of Total Federal Tax Change 3.6 12.9 15.9 12.3 8.7 14.8 12.0 17.8 1.4 0.2 0.1 100.0 Average Federal Tax Change Dollars Percent -637 -1,157 -1,416 -1,304 -1,179 -1,036 -1,062 -1,017 -271 -285 -323 -1,058 82.3 89.6 -157.5 -30.7 -15.8 -8.6 -5.6 -2.9 -0.3 -0.1 0.0 -4.8 Share of Federal Taxes Change (% Points) -0.2 -0.7 -0.8 -0.5 -0.3 -0.3 -0.1 0.6 0.9 0.4 1.0 0.0 Under the Proposal -0.4 -1.4 -0.3 1.4 2.3 7.9 10.2 29.6 20.5 8.9 21.3 100.0 Average Federal Tax Rate5 Change (% Points) -9.9 -7.2 -5.4 -3.6 -2.5 -1.6 -1.2 -0.7 -0.1 0.0 0.0 -1.1 Under the Proposal -21.9 -15.3 -2.0 8.0 13.2 16.9 19.7 23.6 27.2 29.9 34.7 22.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,972 5,814 5,867 4,921 3,825 7,471 5,897 9,105 2,642 433 204 49,293 6.0 11.8 11.9 10.0 7.8 15.2 12.0 18.5 5.4 0.9 0.4 100.0 Average Income (Dollars) 6,433 16,048 26,305 36,655 47,340 65,217 91,884 143,825 298,516 715,609 3,148,106 95,214 Average Federal Tax Burden (Dollars) -774 -1,291 899 4,246 7,445 12,027 19,147 34,928 81,492 214,276 1,090,986 22,259 Average AfterTax Income 4 (Dollars) 7,206 17,339 25,406 32,408 39,895 53,189 72,737 108,897 217,024 501,332 2,057,120 72,956 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -12.0 -8.0 3.4 11.6 15.7 18.4 20.8 24.3 27.3 29.9 34.7 23.4 0.4 2.0 3.3 3.8 3.9 10.4 11.5 27.9 16.8 6.6 13.7 100.0 0.6 2.8 4.2 4.4 4.2 11.1 11.9 27.6 15.9 6.0 11.7 100.0 -0.2 -0.7 0.5 1.9 2.6 8.2 10.3 29.0 19.6 8.5 20.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0157 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 21.2 16.8 20.1 25.0 28.9 40.3 48.0 44.5 19.5 16.9 12.4 29.8 0.0 0.1 0.0 0.3 0.1 0.2 0.1 0.0 0.0 0.0 0.0 0.1 Percent Change in After-Tax Income 4 1.4 0.5 0.5 0.4 0.4 0.4 0.4 0.3 0.1 0.0 0.0 0.3 Share of Total Federal Tax Change 2.6 7.4 10.6 6.7 5.4 19.5 20.1 23.7 2.7 0.7 0.6 100.0 Average Federal Tax Change Dollars -78 -80 -113 -131 -161 -257 -335 -304 -112 -156 -252 -182 Percent -29.2 -14.7 -9.2 -6.1 -4.6 -3.3 -2.3 -1.0 -0.1 -0.1 0.0 -1.1 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 0.0 -0.1 -0.1 0.0 0.2 0.1 0.3 0.0 Under the Proposal 0.1 0.5 1.1 1.1 1.2 6.1 8.9 24.1 20.4 9.7 26.8 100.0 Average Federal Tax Rate5 Change (% Points) -1.3 -0.5 -0.4 -0.4 -0.3 -0.4 -0.4 -0.2 0.0 0.0 0.0 -0.2 Under the Proposal 3.2 2.9 4.3 5.6 7.2 11.5 15.4 20.4 26.0 28.8 34.3 20.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 1,848 5,108 5,158 2,815 1,850 4,184 3,301 4,291 1,343 244 130 30,291 6.1 16.9 17.0 9.3 6.1 13.8 10.9 14.2 4.4 0.8 0.4 100.0 Average Income (Dollars) 5,990 16,184 25,829 36,231 47,206 65,731 91,141 142,313 303,063 717,151 3,111,488 85,420 Average Federal Tax Burden (Dollars) 267 543 1,232 2,152 3,543 7,837 14,370 29,378 78,893 206,720 1,068,635 17,306 Average AfterTax Income 4 (Dollars) 5,722 15,640 24,598 34,079 43,662 57,893 76,771 112,935 224,170 510,431 2,042,853 68,114 Average Federal Tax Rate 5 4.5 3.4 4.8 5.9 7.5 11.9 15.8 20.6 26.0 28.8 34.3 20.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.4 3.2 5.2 3.9 3.4 10.6 11.6 23.6 15.7 6.8 15.7 100.0 0.5 3.9 6.2 4.7 3.9 11.7 12.3 23.5 14.6 6.0 12.9 100.0 0.1 0.5 1.2 1.2 1.3 6.3 9.1 24.1 20.2 9.6 26.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.