26-Jan-09 PRELIMINARY RESULTS

26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org

Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups.

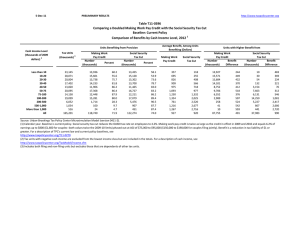

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Summary Table

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

98.8

95.5

88.3

93.6

98.2

89.1

70.2

75.0

90.8

95.7

96.8

98.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent

Change in

After-Tax

Income

4

1.2

0.9

0.5

0.7

1.3

1.4

6.4

4.0

2.9

2.2

1.8

1.4

Share of Total

Federal Tax

Change

9.9

15.9

4.7

2.8

12.3

100.0

4.8

11.3

10.5

8.0

6.7

12.9

Average

Federal Tax

Change ($)

-874

-999

-1,031

-3,467

-29,437

-826

-347

-582

-670

-686

-703

-739

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-1.0

-0.7

-0.4

-0.5

-0.9

-1.1

-6.1

-3.8

-2.7

-1.9

-1.5

-1.2

18.7

22.1

25.7

26.3

29.4

20.6

-0.8

0.8

6.7

11.4

14.4

16.8

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-7).

Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 30.0

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provision include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000

($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000.

The phase-out thresholds are increased to AGI

$80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certai

TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.

26-Jan-09

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

PRELIMINARY RESULTS

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Detail Table

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

70.2

75.0

90.8

95.7

96.8

98.2

98.8

95.5

88.3

93.6

98.2

89.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

4

Share of Total

Federal Tax

Change

1.8

1.4

1.2

0.9

0.5

6.4

4.0

2.9

2.2

0.7

1.3

1.4

4.8

11.3

10.5

8.0

6.7

12.9

9.9

15.9

4.7

2.8

12.3

100.0

Average Federal Tax Change

Dollars Percent

-347

-582

-670

-686

-703

-739

-874

-999

-1,031

-3,467

-29,437

-826

-114.6

-82.3

-28.4

-14.5

-9.6

-6.5

-5.0

-3.2

-1.4

-1.9

-3.0

-5.1

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-0.3

-0.6

-0.5

-0.3

-0.2

-0.2

0.0

0.5

0.7

0.3

0.4

0.0

3.3

9.8

10.1

25.8

18.1

0.0

0.1

1.4

2.5

7.8

21.0

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-6.1

-3.8

-2.7

-1.9

-1.5

-1.2

-1.0

-0.7

-0.4

-0.5

-0.9

-1.1

-0.8

0.8

6.7

11.4

14.4

16.8

18.7

22.1

25.7

26.3

29.4

20.6

Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009

1

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

Number

(thousands)

17,204

24,101

19,493

14,384

11,749

21,662

14,107

19,712

5,636

989

519

150,241

Tax Units

3

Percent of Total

11.5

16.0

13.0

9.6

7.8

14.4

9.4

13.1

3.8

0.7

0.4

100.0

Average

Income

(Dollars)

5,704

15,181

25,314

35,555

45,838

63,039

88,790

138,154

291,886

695,069

3,199,967

75,289

Average

Federal Tax

Burden

(Dollars)

303

707

2,361

4,726

7,290

11,304

17,494

31,466

75,924

186,351

970,745

16,327

Average After-

Tax Income

(Dollars)

5,401

14,474

22,953

30,828

38,547

51,734

71,296

106,688

215,962

508,717

2,229,222

58,962

4

Average

Federal Tax

Rate

5

5.3

4.7

9.3

13.3

15.9

17.9

19.7

22.8

26.0

26.8

30.3

21.7

Share of Pre-

Tax Income

Share of Post-

Tax Income

Share of

Federal Taxes

Percent of Total Percent of Total Percent of Total

4.8

12.1

11.1

24.1

14.5

0.9

3.2

4.4

4.5

6.1

14.7

100.0

5.1

12.7

11.4

23.7

13.7

1.1

3.9

5.1

5.0

5.7

13.1

100.0

3.5

10.0

10.1

25.3

17.4

0.2

0.7

1.9

2.8

7.5

20.6

100.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07).

Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 30.0

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010.

The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to

45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a

5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.

26-Jan-09

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

PRELIMINARY RESULTS

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Detail Table - Single Tax Units

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

69.0

69.0

90.4

96.5

97.1

98.2

98.3

81.6

89.1

94.8

97.8

83.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

4

Share of Total

Federal Tax

Change

1.4

1.1

0.8

0.5

0.8

5.2

2.5

2.1

1.7

1.1

1.7

1.4

11.2

16.4

14.3

10.7

8.8

13.7

5.5

4.8

4.2

2.4

7.9

100.0

Average Federal Tax Change

Dollars Percent

-275

-340

-446

-505

-499

-519

-518

-495

-1,763

-5,591

-35,401

-475

-60.7

-27.2

-12.3

-7.8

-5.6

-3.9

-2.5

-1.5

-2.3

-2.8

-3.3

-5.3

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-0.6

-0.7

-0.5

-0.2

0.0

0.3

0.3

0.7

0.3

0.1

0.3

0.0

8.3

19.2

12.0

17.4

10.1

0.4

2.5

5.7

7.0

4.5

12.9

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-4.8

-2.3

-1.8

-1.4

-1.1

-0.8

-0.6

-0.4

-0.6

-0.8

-1.1

-1.1

3.1

6.1

12.6

16.7

18.5

20.9

23.1

24.2

25.9

27.7

32.9

20.3

Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009

1

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

12,556

14,909

9,879

6,530

5,421

8,162

3,264

2,958

730

130

69

64,958

Tax Units

Number

(thousands)

3

Percent of

Total

19.3

23.0

15.2

10.1

8.4

12.6

5.0

4.6

1.1

0.2

0.1

100.0

Average

Income

(Dollars)

5,704

15,017

25,243

35,566

45,797

62,150

87,974

134,418

295,280

694,203

3,156,727

42,053

Average

Federal Tax

Burden

(Dollars)

452

1,251

3,629

6,456

8,954

13,504

20,826

32,997

78,268

197,542

1,074,887

8,992

Average After-

Tax Income

4

(Dollars)

5,252

13,766

21,614

29,110

36,843

48,646

67,147

101,421

217,012

496,661

2,081,839

33,060

Average

Federal Tax

Rate

5

21.7

23.7

24.6

26.5

28.5

34.1

21.4

7.9

8.3

14.4

18.2

19.6

Share of Pre-

Tax Income

Percent of

Total

2.6

8.2

9.1

8.5

9.1

18.6

10.5

14.6

7.9

3.3

7.9

100.0

Share of Post-

Tax Income

Percent of

Total

3.1

9.6

9.9

8.9

9.3

18.5

10.2

14.0

7.4

3.0

6.7

100.0

Share of

Federal Taxes

Percent of

Total

1.0

3.2

6.1

7.2

8.3

18.9

11.6

16.7

9.8

4.4

12.7

100.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07).

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010.

The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The

HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a

5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.

26-Jan-09

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

PRELIMINARY RESULTS

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Detail Table - Married Tax Units Filing Jointly

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

64.0

76.7

85.6

91.5

94.9

98.0

99.0

99.6

88.6

93.7

98.3

93.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

4

Share of Total

Federal Tax

Change

2.6

1.8

1.4

1.1

0.4

6.5

5.3

4.0

3.1

0.6

1.3

1.3

5.4

12.9

13.5

24.8

5.9

0.9

4.4

6.4

5.5

3.6

16.4

100.0

Average Federal Tax Change

Dollars Percent

-303

-812

-974

-1,011

-1,069

-965

-1,051

-1,139

-907

-3,118

-27,752

-1,221

-115.7

-175.7

-78.1

-35.4

-20.7

-10.3

-6.5

-3.7

-1.2

-1.7

-3.0

-4.3

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

0.0

-0.2

-0.3

-0.2

-0.2

-0.3

-0.2

0.2

0.7

0.3

0.3

0.0

0.0

-0.1

0.1

0.5

0.9

5.1

8.7

29.4

21.9

9.3

24.2

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-6.2

-5.2

-3.8

-2.8

-2.3

-1.5

-1.2

-0.8

-0.3

-0.5

-0.9

-1.0

-0.8

-2.2

1.1

5.2

8.9

13.2

16.8

21.5

25.6

26.1

28.9

21.7

Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009

1

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

2,093

3,937

4,757

3,946

3,659

9,688

9,341

15,817

4,725

827

430

59,479

Tax Units

Number

(thousands)

3

Percent of

Total

16.3

15.7

26.6

7.9

1.4

0.7

100.0

3.5

6.6

8.0

6.6

6.2

Average

Income

(Dollars)

4,904

15,709

25,357

35,641

45,966

64,204

89,292

139,272

291,151

695,396

3,148,057

125,155

Average

Federal Tax

Burden

(Dollars)

262

462

1,248

2,859

5,177

9,420

16,090

31,134

75,559

184,513

936,412

28,353

Average After-

Tax Income

4

(Dollars)

4,642

15,247

24,109

32,782

40,790

54,784

73,202

108,138

215,592

510,883

2,211,645

96,802

Average

Federal Tax

Rate

5

14.7

18.0

22.4

26.0

26.5

29.8

22.7

5.3

2.9

4.9

8.0

11.3

Share of Pre-

Tax Income

Percent of

Total

0.1

0.8

1.6

1.9

2.3

8.4

11.2

29.6

18.5

7.7

18.2

100.0

Share of Post-

Tax Income

Percent of

Total

0.2

1.0

2.0

2.3

2.6

9.2

11.9

29.7

17.7

7.3

16.5

100.0

Share of

Federal Taxes

Percent of

Total

0.0

0.1

0.4

0.7

1.1

5.4

8.9

29.2

21.2

9.1

23.9

100.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07).

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010.

The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The

HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a

5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.

26-Jan-09

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

PRELIMINARY RESULTS

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Detail Table - Head of Household Tax Units

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

81.1

90.2

96.6

98.6

98.9

99.0

98.5

69.9

77.6

82.7

96.2

93.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

4

Share of Total

Federal Tax

Change

11.2

7.0

3.5

2.1

1.6

1.3

0.8

0.2

0.5

0.6

1.3

2.3

9.9

29.9

20.6

12.8

7.8

11.5

3.8

0.9

0.8

0.3

1.6

100.0

Average Federal Tax Change

Dollars Percent

-772

-1,133

-856

-678

-635

-655

-563

-217

-1,080

-3,073

-27,822

-807

169.5

137.8

-142.6

-19.9

-9.8

-6.0

-3.0

-0.7

-1.5

-1.7

-3.0

-14.2

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-1.8

-5.4

-3.1

-0.6

0.6

2.6

2.3

2.9

1.1

0.4

1.0

0.0

-2.6

-8.5

-1.0

8.5

11.8

29.8

19.8

21.6

8.5

3.3

8.8

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-12.0

-7.4

-3.4

-1.9

-1.4

-1.1

-0.6

-0.2

-0.4

-0.5

-0.9

-2.0

-19.2

-12.8

-1.0

7.7

12.7

16.7

20.5

23.9

24.6

26.2

29.5

12.1

Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009

1

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

2,406

4,961

4,512

3,554

2,315

3,290

1,254

786

132

21

11

23,292

Tax Units

Number

(thousands)

3

Percent of

Total

10.3

21.3

19.4

15.3

9.9

14.1

5.4

3.4

0.6

0.1

0.1

100.0

Average

Income

(Dollars)

6,412

15,257

25,403

35,401

45,811

61,934

87,576

130,519

298,070

683,864

3,070,023

40,351

Average

Federal Tax

Burden

(Dollars)

-455

-822

600

3,417

6,460

10,986

18,549

31,459

74,443

182,444

932,848

5,702

Average After-

Tax Income

4

(Dollars)

6,867

16,079

24,803

31,984

39,351

50,948

69,027

99,060

223,627

501,421

2,137,175

34,650

Average

Federal Tax

Rate

5

17.7

21.2

24.1

25.0

26.7

30.4

14.1

-7.1

-5.4

2.4

9.7

14.1

Share of Pre-

Tax Income

Percent of

Total

1.6

8.1

12.2

13.4

11.3

21.7

11.7

10.9

4.2

1.5

3.6

100.0

Share of Post-

Tax Income

Percent of

Total

2.1

9.9

13.9

14.1

11.3

20.8

10.7

9.7

3.7

1.3

2.9

100.0

Share of

Federal Taxes

Percent of

Total

-0.8

-3.1

2.0

9.1

11.3

27.2

17.5

18.6

7.4

2.8

7.8

100.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07).

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010.

The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The

HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a

5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.

26-Jan-09

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

PRELIMINARY RESULTS

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Detail Table - Tax Units with Children

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

83.0

96.9

99.0

99.5

99.5

99.6

99.7

97.6

84.9

90.7

97.5

96.9

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

4

Share of Total

Federal Tax

Change

12.8

8.3

4.7

3.1

2.6

1.8

1.5

1.0

0.3

0.4

1.1

1.6

4.0

13.4

11.8

8.4

6.8

12.6

11.0

17.8

2.9

1.7

9.3

100.0

Average Federal Tax Change

Dollars Percent

-853

-1,396

-1,203

-1,021

-1,032

-971

-1,078

-1,116

-623

-2,191

-25,048

-1,189

125.4

99.6

1,360.8

-36.5

-17.8

-9.6

-6.4

-3.5

-0.8

-1.2

-2.6

-5.8

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-0.3

-0.9

-0.7

-0.4

-0.3

-0.3

-0.1

0.7

1.1

0.4

0.7

0.0

-0.5

-1.7

-0.8

0.9

1.9

7.3

9.9

30.1

22.1

9.0

21.6

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-14.3

-9.0

-4.7

-2.9

-2.3

-1.5

-1.2

-0.8

-0.2

-0.3

-0.8

-1.3

-25.6

-18.1

-5.1

5.0

10.4

14.4

17.6

22.1

26.3

27.1

29.7

20.2

Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009

1

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

Number

(thousands)

2,701

5,494

5,603

4,726

3,756

7,394

5,839

9,103

2,690

442

212

48,094

Tax Units

3

Percent of Total

5.6

11.4

11.7

9.8

7.8

15.4

12.1

18.9

5.6

0.9

0.4

100.0

Average

Income

(Dollars)

5,981

15,478

25,399

35,550

45,850

63,220

89,123

139,015

288,713

693,043

3,179,388

95,281

Average

Federal Tax

Burden

(Dollars)

-680

-1,402

-88

2,801

5,790

10,090

16,800

31,765

76,663

189,988

969,934

20,453

Average After-

Tax Income

(Dollars)

6,662

16,880

25,487

32,748

40,061

53,131

72,323

107,250

212,050

503,055

2,209,454

74,827

4

Average

Federal Tax

Rate

5

-11.4

-9.1

-0.4

7.9

12.6

16.0

18.9

22.9

26.6

27.4

30.5

21.5

Share of Pre-

Tax Income

Share of Post-

Tax Income

Share of

Federal Taxes

Percent of Total Percent of Total Percent of Total

3.8

10.2

11.4

27.6

17.0

0.4

1.9

3.1

3.7

6.7

14.7

100.0

4.2

10.9

11.7

27.1

15.9

0.5

2.6

4.0

4.3

6.2

13.0

100.0

-0.2

-0.8

-0.1

1.4

2.2

7.6

10.0

29.4

21.0

8.5

20.9

100.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07).

Note: Tax units with children are those claiming an exemption for children at home or away from home.

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010.

The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to

45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a

5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.

26-Jan-09

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

PRELIMINARY RESULTS

Table T09-0049

"The American Recovery and Reinvestment Tax Act of 2009"

As Reported by House Ways and Means

Distribution of Federal Tax Change by Cash Income Level, 2009

1

Detail Table - Elderly Tax Units

Percent of Tax Units

3

With Tax Cut

With Tax

Increase

34.9

41.9

69.7

81.6

85.3

93.4

95.6

96.8

97.6

98.8

99.4

71.8

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

4

Share of Total

Federal Tax

Change

0.7

0.9

0.9

1.0

1.0

0.9

0.6

0.8

0.8

1.3

1.8

1.1

2.9

10.8

9.4

18.4

13.3

0.9

2.9

4.2

3.0

8.1

26.1

100.0

Average Federal Tax Change

Dollars Percent

-59

-80

-194

-256

-310

-491

-685

-1,067

-2,275

-6,765

-38,464

-648

-32.6

-20.2

-15.4

-12.2

-8.8

-6.8

-5.3

-4.1

-3.2

-3.6

-4.0

-4.6

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

0.0

-0.1

-0.1

-0.1

-0.1

-0.2

-0.1

0.1

0.3

0.1

0.2

0.0

1.4

7.2

8.0

20.5

19.3

0.1

0.6

1.1

1.0

10.3

30.5

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

5

Change (%

Points)

Under the

Proposal

-0.9

-0.5

-0.8

-0.7

-0.7

-0.8

-0.8

-0.8

-0.8

-1.0

-1.2

-0.9

7.0

10.7

13.8

18.1

23.2

1.9

2.1

4.3

5.3

26.0

29.9

17.9

Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009

1

Cash Income Level

(thousands of 2008 dollars)

2

Less than 10

10-20

20-30

30-40

40-50

50-75

75-100

100-200

200-500

500-1,000

More than 1,000

All

Number

(thousands)

2,765

6,689

4,053

2,142

1,714

4,095

2,542

3,191

1,082

221

126

28,639

Tax Units

3

Percent of Total

9.7

23.4

14.2

7.5

6.0

14.3

8.9

11.1

3.8

0.8

0.4

100.0

Average

Income

(Dollars)

6,577

15,129

24,891

35,242

46,021

63,445

88,251

137,801

298,445

696,175

3,134,426

75,721

Average

Federal Tax

Burden

(Dollars)

181

398

1,264

2,108

3,537

7,255

12,856

25,941

71,508

188,052

974,445

14,178

Average After-

Tax Income

(Dollars)

6,396

14,731

23,627

33,134

42,483

56,190

75,395

111,860

226,937

508,123

2,159,981

61,543

4

Average

Federal Tax

Rate

5

7.7

11.4

14.6

18.8

24.0

2.8

2.6

5.1

6.0

27.0

31.1

18.7

Share of Pre-

Tax Income

Share of Post-

Tax Income

Share of

Federal Taxes

Percent of Total Percent of Total Percent of Total

3.6

12.0

10.3

20.3

14.9

0.8

4.7

4.7

3.5

7.1

18.2

100.0

4.1

13.1

10.9

20.3

13.9

1.0

5.6

5.4

4.0

6.4

15.5

100.0

1.5

7.3

8.1

20.4

19.1

0.1

0.7

1.3

1.1

10.2

30.3

100.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07).

Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older.

NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010.

The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827.

(1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to

45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a

5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients.

(2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.