Supplementary written evidence submitted by Roger Farmer, Distinguished Professor of

advertisement

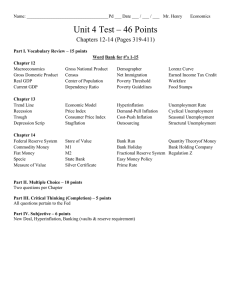

Supplementary written evidence submitted by Roger Farmer, Distinguished Professor of Economics, UCLA This note addresses two questions that were raised by the Committee following my testimony on April 23rd 2013. First, what is the output gap and can it help to guide monetary policy? The second explores the feasibility of setting up a sovereign wealth fund as an alternative to fiscal policy. All references in square brackets refer to the articles listed in the bibliography. Part 1: The output gap and inflation targeting 1. Existing Bank forecasting models are based on a theory of the relationship between output and inflation known as the natural rate hypothesis, abbreviated as the NRH. The NRH asserts that when output is below potential there is downward pressure on wages and prices and we should expect inflation to fall. When output is above potential, there is upward pressure on wages and prices and we should expect inflation to rise. This implication is not borne out by real world data (see [1],[10],[11]). 2. The NRH asserts that markets are self-stabilizing. There is a ‘natural rate of unemployment’ that reflects job-turnover and a ‘natural rate of output growth’ that reflects innovation and technological advances at full employment. The natural level of output is called ‘potential output’. When GDP differs from potential output, the difference is called ‘the output gap’. The idea that there is a natural unemployment rate and a natural level of output is not in itself a problem. Where theory has failed us is by assuming that a market economy has a tendency rapidly to re-establish full employment and maximum growth through adjustments in wages and prices. 3. According to the NRH, if households and firms do not accurately forecast future inflation, they may write wage contracts that allow wage inflation to fall below price inflation. In this case, unemployment will be below its natural rate and the output gap will be negative. Or, they may predict too much price inflation and write contracts that cause real wages to rise faster than is warranted by technological improvements. In this case, unemployment will be above its natural rate and the output gap will be positive. An important implication of this theory is that unemployment can only differ from its natural rate as long as expectations of inflation are incorrect. 4. The lynchpin of the Bank’s forecasting model, COMPASS, is an equation called the Phillips curve that connects inflation and expected inflation to the output gap. For that equation to work well, the forecaster needs a measure of potential output and its analogue in the labour market, the natural rate of unemployment. The natural rate of unemployment is difficult to measure because there is no stable relationship between inflation and unemployment. As a consequence, central bankers continue to rely on a model that does not tell us in advance if the measured output gap will put upward or downward pressure on inflation. 5. Defenders of the natural rate hypothesis have responded to this critique by arguing that the natural rate of unemployment is time varying. But they do not provide us with a way of establishing in advance, how it varies over time. In the absence of a theory of what determines the natural rate of unemployment, the theory has no predictive content. When the theory fails it must be because the natural rate changed. A theory like this, which cannot be falsified by any set of empirical observations, is religion, not science. 6. I have shown in my research [10], that the NRH can effectively be replaced by modelling confidence as a separate independent force that determines demand. That research has significant implications for the current crisis. It implies that holding the interest rate at zero, and waiting for the economy to recover is not likely to be any more successful in the U.K. than it has been in Japan, a country that has experienced nearly two decades of stagnation and low interest rates 7. My work, [6], lends support to a policy of Bank purchases of assets. However, it is important to differentiate the size of the balance sheet from its composition. The beneficial effects of QE arise from restoring the value of financial assets and enabling households to concentrate on the purchase of goods rather than paying down debt that is high only relative to the current moribund economy. Extending that policy would require that the Bank supports the value of equity prices. That need not involve the purchase of additional risky assets; it can equally be accomplished by selling existing gilts and replacing them with riskier securities including shares in the stock market. Average inflation by decade 10 BOX 1: The Failure of Natural Rate Theory 8 6 1970s 1980s 4 1950s 2 2000s 1960s 1990s 0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 Average unemployment by decade Source [11]. The Phillips Curve, Decade by Decade This chart plots the average U.S. inflation rate against the average U.S. unemployment rate for each decade from the 1950s through the 2000s. Over each decade there should be as many quarters when inflation was above expected inflation as quarters when it was below expected inflation. The natural rate hypothesis predicts that the points in this graph should line up around a vertical line at the natural rate of unemployment. In the real world, the line is closer to horizontal than vertical. 8. If, as I propose, the Bank were to sell existing gilts and lower the stock of high-powered money, that policy would put upward pressure on interest rates and depress aggregate demand. For that reason, the policy is opposed by those whose worldview is based on the NRH. But opposition based on that argument ignores the ability of the Bank to offset the depressing effect of an interest rate increase on aggregate demand, by engaging in a policy of investing government assets in risky securities. 9. The Bank believes that it has effectively controlled inflation in the period since inflation targeting began in 1992. The record supports that belief. But inflation was conquered by raising the interest rate when inflation expectations increased and lowering it when inflation expectations fell. While the interest remains at zero, that mechanism is not operative and there is currently no effective nominal anchor (see [8]). 10. I believe that it is important to escape from the current policy of very low interest rates sooner rather than later. Through an aggressive policy of equity purchases, financed by issuing longterm gilts, the Treasury could increase the value of financial assets in the hands of the public and restore private consumption spending. If the additional gilts are allowed to flow to the private sector, rather than being purchased by the Bank, this policy will put upward pressure on longterm bond yields and lead to an engineered recovery and a return to a more normal regime of positive interest rates. Part 2: Managing Financial Market Volatility with a Sovereign Wealth Fund 11. In Part 2, I outline a proposal that has the potential to prevent future financial crises and put the U.K. economy on a path to full employment and sustained growth. It involves the creation of an actively traded sovereign wealth fund designed to manage stock market volatility. My proposal is based upon quantitative empirical studies ([6],[7],[14]) that demonstrate the existence of a stable connection between the stock market and unemployment. My recommendation is also informed, in part, by the conclusions of academic research, [13], that won this year’s inaugural Maurice Allais Prize for an outstanding European research paper of the last ten years. Financial Markets are Too Volatile 12. Economists have known since the early 1980s ([15], [16]), that share prices are too volatile. Excess volatility shows up in the markets as large swings in the price-earnings (PE) ratio, a number that has historically been less than 5 and greater than 40. Simple economic models predict that the PE ratio should be constant. The reality is very different. Real world financial markets are plagued by asset market bubbles, followed by financial crises that have devastating, long-lasting consequences. 13. There are a number of important instances where markets fail. Examples include natural monopolies, public education and health care. My academic work, [6], has shown that the financial markets are a further example of a market failure that arises, in this instance, from incomplete participation. Unborn children cannot make financial trades. If they were able to trade in what I have called prenatal financial markets [6], those trades would smooth out financial volatility and remove the worst effects of financial crises. Unemployment and the Stock Market 14. Financial crises are associated with recessions. In published academic work, [7], I have shown that there is a stable relationship between the stock market and unemployment in the U.S. and my research team [14], has replicated that study in U.K. data. When household wealth increases, households spend more. Increased spending leads to increased employment and increased profits. The existence of a stable connection between stock market wealth and unemployment implies that unemployment can, potentially, be used as a target to guide financial policy. 15. By preventing financial market volatility, financial policy can remove damaging swings in the stock market that generate demand driven business cycles. In the current situation, where a financial crash has already occurred, financial policy can restore the value of financial wealth by increasing the value of equity prices and giving households and firms the confidence to purchase goods and services. That policy would create a virtuous cycle of increased spending and employment that would generate the earnings necessary to justify the initial increase in equity prices. Bubbles and crashes are self-fulfilling prophecies. But they are not inevitable. My Proposal for a Sovereign Wealth Fund 16. To manage financial market volatility, I propose the creation of a Sovereign Wealth Fund with the goal of stabilizing the value of share prices. I recommend that Parliament constitute an independent commission to study the practical aspects of this proposal. The following suggestions are aspects that any such commission would want to consider. 17. Is this a fiscal or monetary policy? It has aspects of both. It is fiscal in the sense that active trade of a Treasury portfolio has the potential to create both gains and losses to the taxpayer. It is monetary in the sense that it involves the management of an asset portfolio, an activity that has traditionally been carried out by the Bank of England. A financial policy of this kind would act as an alternative to fiscal stimulus. Unlike fiscal stimulus, it would not cost the taxpayer a penny and would instead be likely to raise revenue for the Exchequer. 18. Who should operate the Fund? I recommend that the Fund be managed by the newly created Financial Policy Committee, operating in consultation with the monetary policy committee, (MPC). Parliament would set out operational guidelines, but the day-to-day running of the fund should be independent of short-term political considerations. Independence is important for the same reasons that informed the creation of Bank of England independence. 19. What should be traded? The FPC should control a broad market aggregate. It should define the characteristics of an acceptable exchange-traded fund (ETF) and encourage private financial institutions to create funds with these characteristics. An acceptable fund should be value weighted and include all publicly traded companies. Because the goal is financial stabilization and not industrial policy, it is important that the FPC should not have the power to allocate capital to individual companies or even to broad asset classes. 20. How large should the fund be? The goal of the fund is to stabilize markets. The size of intervention needed to maintain any given price would depend, in part, on the confidence of market participants. The more credible is an announcement, the smaller the intervention required to achieve it. An initial purchase of £150b would be a good starting point. But: it is important that no upper bound should be placed on the possible size of an intervention in order to avoid private investors from gaming the fund. 21. How would the policy operate? Each month, the FPC would make an informed judgement as to the current state of the economy. Suppose that the ETF is currently trading at 120 but, in the judgement of the committee, unemployment is too high relative to target. The FPC would announce a new value at which it would be willing to purchase shares in the fund, for example, 130, and a targeted growth rate for the fund over the next month, for example, 3% annualized. 22. How would the fund be paid for? It would be paid for by issuing gilts. The policy does not involve an increase in the public sector borrowing requirement. On the asset side, the fund would receive dividend payments from companies in the ETF. On the liability side of its balance sheet, it would make interest payments to holders of FPC debt. 23. How would the policy interact with traditional monetary policy? That depends on the maturity of the debt structure of the fund. A purchase of ETFs, paid for by selling long duration gilts onto the private market, would put upward pressure on long-term interest rates and facilitate a return to a more normal functioning of the financial markets. Currently, the MPC has lost access to its traditional instrument for controlling inflation. There is a significant chance that a situation may arise where the MPC decides that is prudent to raise short-rates while unemployment is still unacceptably high. Financial policy, through active trades in the stock market, would give policy makers the option of targeting the real economy independently of the price level. 24. Isn’t it the case that monetary policy cannot influence the long-term unemployment rate? Yes. But active control of the stock market is a fiscal policy not a monetary policy. My recommendation is based on a coherent theory that reconciles Keynesian and classical economics in a new way and explains why high involuntary unemployment will persist if we do not act to prevent it (see [2],[3],[4],[5],[9]). 25. Isn’t there a danger of inflating an asset market bubble? Yes. But that is the point. A bubble is only dangerous to the real economy if it is allowed to burst. Currently, households and firms that borrowed during the 2000s are paying down debt. That debt was sustainable when the value of collateral was high. It became unsustainable when the value of collateral assets crashed following the financial crisis. By restoring the value of equity, those households and firms that are currently in debt will be able to redirect their purchasing power to the real economy. 26. How do we know when to slow down the economy? A policy of financial control must act to prevent bubbles as well as crashes. When unemployment falls to a sustainable level, the FPC should act to slow the growth of equity prices. Theory predicts that lower unemployment will be accompanied by additional output of goods and services only up to a point. Pushing unemployment below its optimal rate will lead to lower output growth. Just as monetary policy makers make judgements based on a range of different indicators; so must financial policy makers. 27. How would active financial policy affect the future returns to debt and equity? Historically, the stock market has paid a return that is roughly five percentage points higher than the return on gilts. That return exists to compensate market participants for the risk involved from excessive stock market volatility. By stabilizing that volatility, the future return on equity will fall, and the return on gilts will rise, until returns on the ETF is approximately equal to the return to long-term government debt. Economic theory suggests that this return should be stabilized at approximately the growth rate of the real economy. 28. Has anything like this been tried before? A number of central banks have bought equity. The Hong Kong Monetary Authority bought shares during the Asian financial crisis and came out ahead. Taiwan has bought shares of individual companies in the past but on a small scale and without any coherent guiding philosophy. A policy of actively maintaining the price of a stock market index has never been tried. 29. Isn’t this like trying to fix the exchange rate? Yes and no. A policy of fixed exchange rates cannot work if the exchange rate peg is inconsistent with domestic policy goals. It runs into the problem that, to support an exchange rate above a market determined level; a Central Bank would eventually run out of foreign exchange. Stock market stabilization is different since there are no bounds to feasible intervention on either the upside or the downside. A solvent national treasury has the potential to buy the entire market if necessary. And on the downside, the central bank has the power to sell the market short if it deems that the market is overheating. 30. Isn’t it inequitable to reward the owners of stocks? Yes and no. It is true that stock ownership is concentrated predominantly among the wealthy although U.K. pension funds would also be important beneficiaries of a policy that increases the value of financial assets. More importantly, unemployment is strongly correlated with stock market wealth over the long-term. For most of us, our most important asset is the present value of labour income. By initiating a virtuous cycle of increasing employment and wealth, a sovereign wealth fund will not only benefit the rich. It will benefit all those who find jobs as the economy recovers. Conclusion 31. Political and economic institutions evolve in response to historical events. The institution of central banking is one such institution and a policy of targeting the interest rate was considered radical at one time. History has taught us that financial market volatility has damaging effects and economic theory explains why this is so; participation in these markets is necessarily incomplete. It is time to consider a policy to correct this market failure. References [1] Beyer, Andreas and Roger E. A. Farmer (2007): “Natural Rate Doubts,” Journal of Economic Dynamics and Control, 31, pp. 797—825. [2] Farmer, Roger E. A. (2010a): Expectations Employment and Prices, Oxford; Oxford University Press. [3] Farmer, Roger E. A. (2010b): How the Economy Works: Confidence, Crashes and Self-Fulfilling Prophecies, Oxford; Oxford University Press. [4] Farmer, Roger E. A. (2012a): “Confidence, Crashes and Animal Spirits,” Economic Journal, 122(559), pp 155-172. [5] Farmer, Roger E. A. (2012b): “The Evolution of Endogenous Business Cycles”, CEPR discussion paper 9080 and NBER working paper 18284. [6] Farmer, Roger E. A. (2012c): “Qualitative Easing: How it Works and Why it Matters,” NBER working paper 28421 and CEPR discussion paper 9153. [7] Farmer, Roger E. A. (2012d): “The Stock Market Crash of 2008 Caused the Great Recession: Theory and Evidence,” Journal of Economic Dynamics and Control, 36, pp. 696-707. (Plenary Address to the Society for Computational Economics: Federal Reserve Bank of San Francisco, summer 2011) [8] Farmer, Roger E. A. (2012e): “The effect of conventional and unconventional monetary policy rules on inflation expectations: theory and evidence”, Oxford Review of Economic Policy, Vol. 28, No. 4, Pages 622-639 [9] Farmer, Roger E. A. (2013a): “Animal Spirits, Financial Crises and Persistent Unemployment”, Economic Journal 568, May, forthcoming [10]Farmer, Roger E. A. (2013b): “Animal Spirits, Persistent Unemployment and the Belief Function,” Chapter 7 in Rethinking Expectations: The Way Forward for Macroeconomics, Princeton New Jersey; Princeton University Press, Roman Frydman and Edmund Phelps, Eds. [11] Farmer, Roger E.A. (2013c): “The Natural Rate Hypothesis: An Idea Past its Sell by Date”, Bank of England Quarterly Bulletin, forthcoming. [12] Farmer, Roger E. A. and Dmitry Plotnikov (2011): “Does Fiscal Policy Matter? Blinder and Solow Revisited,” Macroeconomic Dynamics, 16(S1) pp. 149-166 [13] Farmer, Roger E. A., Alain Venditti and Carine Nourry (2012): "The Inefficient Markets Hypothesis: Why Financial Markets Do Not Work Well in the Real World" CEPR discussion paper, 9283 and NBER Working Paper 18647 [14] Giuliano, Fernando (2012): “Stock Market Prices and Unemployment in the U.K.”, UCLA working paper [15] Leroy, Stephen F. and R. Porter (1981): “Stock Price Volatility: A Test based on Implied Variance Bounds,” Econometrica, 49, 97—113. [16] Shiller, Robert J. (1981): “Do stock prices move too much to be justified by subsequent changes in dividends?,” American Economic Review, 71, 421—436. June 2013