CS – EXECUTIVE TAX LAWS & PRACTICE MOCK TEST PAPER – 2

advertisement

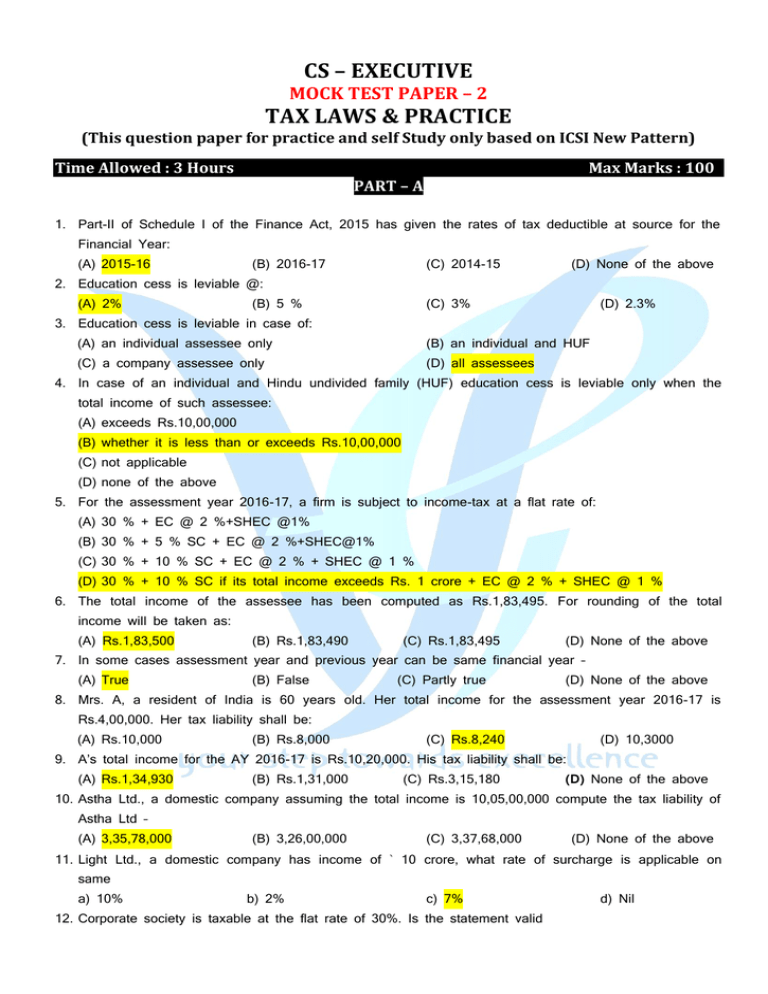

CS – EXECUTIVE MOCK TEST PAPER – 2 TAX LAWS & PRACTICE (This question paper for practice and self Study only based on ICSI New Pattern) Time Allowed : 3 Hours Max Marks : 100 PART – A 1. Part-II of Schedule I of the Finance Act, 2015 has given the rates of tax deductible at source for the Financial Year: (A) 2015-16 (B) 2016-17 (C) 2014-15 (D) None of the above 2. Education cess is leviable @: (A) 2% (B) 5 % (C) 3% (D) 2.3% 3. Education cess is leviable in case of: (A) an individual assessee only (B) an individual and HUF (C) a company assessee only (D) all assessees 4. In case of an individual and Hindu undivided family (HUF) education cess is leviable only when the total income of such assessee: (A) exceeds Rs.10,00,000 (B) whether it is less than or exceeds Rs.10,00,000 (C) not applicable (D) none of the above 5. For the assessment year 2016-17, a firm is subject to income-tax at a flat rate of: (A) 30 % + EC @ 2 %+SHEC @1% (B) 30 % + 5 % SC + EC @ 2 %+SHEC@1% (C) 30 % + 10 % SC + EC @ 2 % + SHEC @ 1 % (D) 30 % + 10 % SC if its total income exceeds Rs. 1 crore + EC @ 2 % + SHEC @ 1 % 6. The total income of the assessee has been computed as Rs.1,83,495. For rounding of the total income will be taken as: (A) Rs.1,83,500 (B) Rs.1,83,490 (A) True (B) False (C) Rs.1,83,495 (D) None of the above 7. In some cases assessment year and previous year can be same financial year – (C) Partly true (D) None of the above 8. Mrs. A, a resident of India is 60 years old. Her total income for the assessment year 2016-17 is Rs.4,00,000. Her tax liability shall be: (A) Rs.10,000 (B) Rs.8,000 (C) Rs.8,240 (D) 10,3000 9. A’s total income for the AY 2016-17 is Rs.10,20,000. His tax liability shall be: (A) Rs.1,34,930 (B) Rs.1,31,000 (C) Rs.3,15,180 (D) None of the above 10. Astha Ltd., a domestic company assuming the total income is 10,05,00,000 compute the tax liability of Astha Ltd – (A) 3,35,78,000 (B) 3,26,00,000 (C) 3,37,68,000 (D) None of the above 11. Light Ltd., a domestic company has income of ` 10 crore, what rate of surcharge is applicable on same a) 10% b) 2% c) 7% 12. Corporate society is taxable at the flat rate of 30%. Is the statement valid d) Nil a) valid b) invalid c) Partially valid d) none of them 13. Surcharge @..... shall be levied if total income of domestic company exceeds ` 10 crore. a) 2% b) 5% c) 12% d) Nil 14. R gifted the house property to his minor son which was let out @ Rs.5,000 p.m. Income from such house property shall be taxable in the hands of: (A) Minor son (B) R. However, it will be first computed as minor’s income and thereafter clubbed in the income of R (C) R, as he will be the deemed owner of such house property and liable to tax (D) None of the above 15. R transferred his house property to his wife under an agreement to live apart. Income from such house property shall be taxable in the hands of: (A) R as deemed owner (B) R. However, it will be computed first as Mrs. R’s income and thereafter clubbed in the hands of R (C) Mrs. R (D) None of the above 16. R is owner of superstructure although the land was taken by him on lease. The income from such house property shall be taxable under the head: (A) income from other sources (B) income from house property (C) income from PGBP (D) none of the above 17. R has taken a house on rent and sublets the same to G. Income from such house property shall be taxable under the head: (A) income from house property (B) income from other sources (C) At the option of assessing officer (D) None of the above 18. Municipal valuation of the house is Rs.1,00,000; whereas the fair rent of house property Rs.1,20,000 and standard rent is Rs.1,10,000; actual rent received or receivable is Rs.1,40,000; municipal taxes paid 10 %. The annual value in this case shall be: (A) Rs.90,000 (B) Rs.1,00,000 (C) Rs.1,30,000 (D) Rs. 91,000 19. Municipal valuation of the house is Rs.1,20,000, fair rent is Rs.1,40,000; standard rent is Rs.1,30,000; whereas actual rent received or receivable is Rs.1,25,000; municipal taxes paid are Rs.40,000. The annual value in this case shall be: (A) Rs.1,00,000 (B) Rs.85,000 (C) Rs.90,000 (D) Rs. 63,000 20. The last date of filing the return of income u/s 139(1) for AY 2016-17 in case of a Company assessee is: (A) 30th October (B) 30th September of the AY (C) 31st March of the AY (D) 30th November of the AY in case it is required to furnish report referred to in Section 92E and 30th September of the AY in any other case 21. The last date of filing the return of Income u/s 139(1) for AY 2012-13 in case of non-corporate business assessee whose accounts are not liable to be audited shall be: (A) 31st July of the AY (C) 31st October of AY (B) 30th June of the AY (D) None of the above 22. An individual or HUF having income u/H profits or gains from Business & Profession are required to file the return in: (A) Form No.ITR 6 (B) Form No.ITR 4 (C) Form No.ITR 5 (D) Form No.ITR 7 23. Assessment u/s 143(3) for the AY 2006-07 was completed on 28.12.2007. On 28.12.2011 the Assessing Officer notices that income of Rs.90,000 has escaped assessment. The notice u/s 148 in this case can be issued till: (A) 31.3.2011 (B) 31.3.2013 (C) 31.3.2014 (D) 31.9.2011 24. ‘R’, who is entitled to a Salary of Rs.15,000 p.m., took an advance of Rs.40,000 against the salary in the month of March 2012. The gross salary of ‘R’ for the AY 2012-13 shall be: (A) Rs.2,20,000 (B) Rs.1,80,000 (C) None of these two (D) 2,40,000 25. ‘R’, who is entitled to Salary of Rs.20,000 p.m., took advance salary from his employer for the months of April and May 2012 along with salary for March 2012 on 31.03.2012. The gross salary of ‘R’ for assessment year 2012-13 shall be: (A) Rs.2,40,000 (B) Rs.2,80,000 (C) None of these two (D) 2,00,000 26. ‘R’ worked with a previous employer for 3 years but was not entitled to any gratuity. He worked with the present employer for 8 years and 7 months. The completed years of service for calculating exemption of gratuity shall be taken as: (A) 11 years (B) 8 years (C) 9 years (D) 2 years 27. For the purpose of calculating exemption of gratuity, salary shall include: (A) fixed commission (B) commission if it is a fixed percentage on turnover (C) none of these two (D) At the option of assessee 28. ‘A’ is entitled to children education allowance @ Rs.80 p.m. per child for 3 children amounting to Rs.240 p.m. It will be exempt to the extent of: (A) Rs.200 p.m. (B) Rs.160 p.m. (C) Rs.240 p.m. (D) Rs. 100 p.m. 29. ‘R’ is entitled to Rs.6,000 as medical allowance. He spends Rs.4,000 on his medical treatment and Rs.1,000 on the medical treatment of his major son not dependent on him. The exemption in this case shall be: (A) Rs.4,000 (B) Rs.5,000 (C) Rs.NIL (D) Rs. 200 p.m. 30. ‘R’ is an employee of a Transport Company. He is entitled to transport allowance of Rs.10,000 p.m. He spends Rs.4,000 p.m. The exemption shall be: (A) Rs.10,000 p.m. (B) Rs.4,000 p.m. (C) Rs.7,000 (D) None of the above 31. Mrs. R, wife of R who is employed in G Ltd. went for bypass surgery in England along with her husband. Expenses on medical treatment of wife and stay outside India of wife and R amounted to Rs.7,00,000 as against Rs.6,50,000 permitted by RBI. The travel expenses amounted to Rs.1,50,000. All expenses were reimbursed by the employer. Assume the gross salary and income from other sources of the employee are Rs.1,40,000 and Rs.80,000 respectively. The taxable perquisite in this case shall be: (A) Rs.NIL (B) Rs.50,000 (C) Rs.2,00,000 (D) Rs.1,50,000 32. Leave travel concession is a tax free perquisite: (A) for one journey in a block of 4 years (B) one journey per year (C) two journeys in a block of 4 years (D) none of the above 33. Salary of employee is Rs.2,00,000. Fair rent of the unfurnished house given to employee is Rs.1,30,000. The valuation of the perquisite of the house— In case of Government Employee shall be: (A) Rs.20,000 (B) License fee determined by the Government (C) Rs.50,000 (D) Rs.1,30,000 34. The employee is provided with furniture costing Rs.1,50,000 along with house w.e.f. 1.7.2011. The value of the furniture to be included in the valuation of unfurnished house shall be: (A) Rs.11,250 (B) Rs.15,000 (C) Rs. 22,500 (D) Rs.16,875 35. If the bonus shares are acquired before 1.4.1981, the cost of acquisition of such bonus shares shall be: (A) nil (B) market value of such bonus share on the date of allotment (C) market value as on 1.4.1981 36. Where the capital asset is converted into stock-in-trade, the indexation of cost of acquisition and cost of improvement shall be done: (A) till the PY of conversion of such capital asset (B) till the PY in which such asset is sold (C) none of these two 37. Where a partner transfers any capital asset into the business of firm, the sale consideration of such asset to the partner shall be: (A) market value of such asset on the date of such transfer (B) price at which it was recorded in the books of the firm (C) cost of such asset to the partners(B) 38. The exemption under section 54 shall be available: (A) to the extent of capital gain invested in the house property (B) proportionate to the net consideration price invested (C) to the extent of amount actually invested 39. If the assessee wishes to deposit money under capital gain scheme for claiming exemption under section 54, it should be deposited within: (A) six months from the date of transfer (B) within six months from the end of the relevant previous year (C) due date of furnishing the return of income u/s 139(1) (D) six months or within due date of furnishing the return of income whichever is earlier 40. For claiming exemption under section 54B the assessee should acquire: (A) urban agricultural land (B) rural agricultural land (C) any agricultural land 41. Exemption u/s 54EC shall be available for transfer of: (A) any long-term capital asset (B) residential house property (C) any long-term capital asset other than residential house property 42. For claiming exemption u/s 54EC, amount to the extent of the capital gain should be invested: (A) within 2 years from the date of transfer (B) within 3 years from the date of transfer (C) within 6 months from the date of transfer (D) within 6 months of transfer or before the due date of furnishing the return of income, whichever is earlier 43. Relative for the purpose of section 64(1)(ii) shall include: (A) spouse, brother and sister of the individual (B)spouse, brother, sister or any lineal ascendant or descendant of that individual (C) spouse, children and dependent brothers and sisters of the individual (D) spouse, children, dependent parents, dependant brothers and sisters of the individual 44. Where spouse of an individual gets any remuneration from a concern in which such individual has substantial interest, then such remuneration shall be included: (A) in all cases (B) only when such remuneration is received by the spouse due to his/her technical or professional qualification (C) in all cases except when remuneration is received by the spouse due to his/her technical or professional qualifications 45. As per section 64(i) & (iv), there shall be included in the income of an individual, any income arising from the gift of the spouse of: (A) any capital asset (B) any asset (C) any asset other than house property 46. Specified domestic transaction defined under; a) Section 92A c) Section 92BA b) Section 92B d) Section 92CA 47. Reference to Transfer pricing officer is given under a) Section 92CA b) Section 92C c) Section 92A d) Section 92B 48. Perquisite received by the assessee during the course of carrying on his business or profession is taxable under the head. (A) Salary (B) Other sources (C) Business or Profession 49. Export incentives received by an assessee are: (A) exempt (B) taxable under section 28 (C) exempt up to certain limits 50. Interest on capital or loan received by a partner from a firm is: (A) exempt u/s 10(2A) (B) taxable u/H business and profession (C) taxable u/H income from other sources (D) taxable u/H business and profession on account of interest on capital and income from other sources on account of loan to the firm 51. Under the head Business & Profession, the method of accounting which an assessee can follow shall be: (A) Merchantile system only (B) Cash system only (C) Merchantile or Cash system only (D) Hybrid system (E) Any of these systems 52. W.D.V. of block of 15 % as on 1.4.2015 is Rs.5,00,000. An asset amounting to Rs.1,00,000 was acquired on 1.11.2015 and put to use on 1.12.2015. During the previous year 2015-16 a part of the block (other than the new asset) is sold for Rs.5,40,000. The depreciation to be allowed for this block is: (A) Rs.9,000 (B) Rs.4,500 (C) Rs.5,000 53. If in the above case, this part of the block is sold for Rs.4,80,000 instead of Rs.5,40,000, the depreciation allowed shall be: (A) Rs.10,500 (B) Rs.18,000 (C) Rs.9,000 54. An asset which was acquired for Rs.5,00,000 was earlier used for scientific research. After the research was completed the machinery was brought into the business of the assessee. The actual cost of the asset for the purpose of inclusion in the block of asset shall be: (A) Rs.5,00,000 (B) Rs. NIL (C) Market value of the asset on the date it was brought into business 55. If the income of a business before claiming capital expenditure on scientific research is Rs.50,000 and the capital expenditure incurred on scientific research related to the business of the assessee is Rs.80,000, then Rs.30,000 shall be: (A) business loss (B) unabsorbed capital expenditure on scientific research (C) none of these two 56. Donation for scientific or social or statistical research shall be allowed as deduction to the extent of: (A) 50 % of the donation so made (B) 100 % of the donation so made (C) 125 % of the donation so made (D) 150 % of the donation so made 57. If donation is made to a National Laboratory or a University or IIT with the specific direction that scientific research should be for an approved programme, the amount of deduction shall be: (A) 50 % of the donation so made (B) 100 % of the donation so made (C) 125 % of the donation so made (D) 200 % of the donation so made 58. Loss under the head income from house property can be carried forward: (A) only if the return is furnished before the due date mentioned u/s 139(1) (B) even if the return is not furnished (C) even if the return is furnished after the due date 59. Within how many days should appeal be filed to High Court? a) 45 b) 60 c) 180 d) 120 60. Which is the first appellate authority? a) Income tax appellate authority b) Commissioner of Income Tax (Appeal) c) High Court d) Supreme Court 61. What is maximum amount upto which TDS on commission on sale of lottery tickets shall not be deducted? a) ` 5,000 b) ` 20,000 c) ` 1,000 d) Nil 62. What shall be the rate of TDS under section 194I on payment of rent of plant and machinery where rent is paid to any person other than individual or HUF? a) 1 % b) 2 % c) 10 % d) Nil 63. What is total amount during the previous year upto which TDS on rent under section 194I shall not be deducted? a) ` 30,000 b) ` 75,000 c) ` 2,00,000 d) ` 1,80,000 c) 5,000, 10% d) 1,000, 10% 64. In case of winnings from horse races, payments exceeding …………… are subject to tax deduction at source at the rate of ……………..%? a) 5000, 30% b) 10,000, 30% 65. When rate as per Income tax for a transaction is 15% whereas as per DTAA is 20%. Which rate of tax shall be applicable a) 20% b) 15% c) 17.5% 66. Which of the following type of relief is provided by the government a) Bilateral relief b) Unilateral relief c) Both a) and b) d) None of the above d) Nil 67. An assessee paid an amount of ` 5,00,000 to IIT for conducting scientific research, what amount of deduction shall be allowed and under which section? (A) ` 5,00,000, 35CCC (B) ` 7,50,000, 35(2AA) (C) ` 10,00,000, 35(2AA) (D) ` 10,00,000, 35CCD 68. What is the amount of deduction available under section 35(2AB)? a) 175 % of the expenditure b) 200 % of the expenditure c) 150 % of the expenditure d) 125 % of the expenditure 69. The maximum amount which can be paid without deduction of tax at source from winning from lotteries is…………? a) 10,000 b) 5,000 c) 1,000 d) 20,000 70. The rates of income tax are mentioned in a) Income-tax Act, 1961 b) Annual Finance Acts c) both Income-tax Act, 1961 and Annual Finance Acts d) None of the above PART – B 71. Which section decides the responsibility of payment of service tax? (A) Section 68 b) Section 70 c) Section 69 d) Section 71 72. An amount of Rs. 2,00,000 was paid to the service provider for service provided on 7th September 2014, invoice was issued on 15th September, 2014 and the service was completes on 10 th September, 2014. Service tax shall be paid by B on a) 7th September, 2014 b) c) 10th September, 2014 b) 15th September, 2014 d) 9th September, 2014 73. If invoice is for Rs. 19,000 and payment received is Rs. 18,000 after deducting a TDS of Rs.1,000, service tax will be payable on (A) Rs. 18,000 b) Rs. 19,000 c) Rs. 1,000 d) Rs. 20,000 74. Transport of passengers, with or without accompanied belongings by embarking from an airport located in the state of Haryana is exempt from service tax by virtue of a) Negative list b) Notification No. 26/2012 c) Notification No. 25/2012 d) None of the above and is taxable 75. Which of the following documents need to be submitted by assessee being a partnership firm who has made an application for registration? (A) Copy of Permanent Account Number, Proof of Address (B) Identity Proof, copy of partnership deed and particulars of partners (C) All of the above (D) None of the above 76. Certificate of registration shall be issued in how many days from receipt of application a) 7 days b) 10 days c) 15 days d) any number of days 77. Swachh bharat cess rate is? a) 0.5% on value of taxable service b) 2% on the value of taxable service c) 0.5% on the value of All services d) 2% on the value of All services 78. In which of situation is registration compulsory? a) when the taxable annual turnover of a dealer does exceeds the threshold of Rs. 5 Lakh b) when dealer is an importer c) any of the above d) none of the above 79. A manufacturer purchased raw material for Rs. 1,12,500 (inclusive of 12.5% VAT) and capital equipment/ goods for Rs. 6,24,000 (inclusive of 4% VAT). Capital goods are depreciated over 3 years straight line. How much credit is available to manufacturer if Gross product Variant method followed. a) 12,500 b) 20,500 c) 36,500 d) Nil 80. If the aggregate value of taxable service in preceding previous year in less than Rs. 10,00,000, service tax in the current financial year shall be payable: a) on entire aggregate value of all service b) on amount in excess of 10,00,000 c) on entire aggregate value of exempted service d) None of the above 81. Due date of payment of service tax in case of a company is a) 5th day a of month immediately following each quarter except for the quarter ending March b) 5th day of month immediately following the calendar month except for the month of March c) 25th day of month immediately following the calendar month except for the month of March d) None of the above 82. If the due date of payment of service tax is public holiday, when shall it be paid? a) paid on next working day b) paid on previous working day c) any of the above d) payable on due date only 83. Which notification provides that which services will be fully exempt from service tax? a) Notification No. 26/2012 b) Notification No. 25/2012 c) d) Notification No. 27/2012 Notification No. 30/2012 84. Legal services provided by an individual as an advocate or a partnership firm of advocates by way of legal services to any person other than business entity is exempt from service tax by virtue of a) Negative list b) Notification No. 25/2012 c) Notification No. 26/2012 d) None of the above and is taxable 85. The power to levy service tax is now provided by the Constitution vide entry No. a) 92C of the Union list b) 97 of the Union list c) 54 of the State list d) 93 of the Union list 86. Service tax is governed and administered by a) CBDT b) CBEC c) Both of the above d) None of the above 87. A service provider provided service of ` 8,00,000 during preceding financial year, how much service tax is payable by him during current financial year if he provides service of ` 6,00,000 out of which service worth ` 2,00,000 were provided under the brand name of other person a) Service tax will be payable on ` 6,00,000 b) Service tax will be payable on ` 2,00,000 c) Service tax will be payable on ` 4,00,000 d) Service tax is not payable by him 88. Service of transportation of passengers, with or without accompanied belongings by which of following is chargeable to service tax (A) railways in a class other than first class (B) railways in a class other than an air conditioned coach (C) railways in a class other than first class or an air conditioned coach (D) none of the above 89. ABC Handlers undertook the following activities. State that service tax shall be charged on what amount Supply of farm labor 58,000 Warehousing of namkeens 1,65,000 (A) 58,000 (B) 1,65,000 (C) 2,23,000 (D) Nil 90. Activity of a commission agent or a clearing and forwarding agent who sells goods on behalf of another for a commission, would attract service tax. Is the statement valid? (A) Valid (B) Invalid (C) Partly invalid (D) cannot say 91. External asset management services received by Reserve Bank of India from overseas financial institutions is …………… a) mentioned in negative list b) exempt by virtue of Notification 25/2012 c) taxable d) None of the above 92. Where a dealer purchased a good for `100 after payment of VAT of ` 12.50, the same is sold for ` 150, how much amount shall be payable by him at the time of same when the output tax rate is 12.50% where VAT is computed using Invoice credit method. a) ` 6.25 b) ` 12.50 a) Gross Product Variant b) Consumption Variant c) Income Variant d) All of the above 93. Which of the following are variants of VAT? c) ` 12 d) Nil 94. As per Gross Product Variant, tax credit on purchase of ………………. is given a) Inputs (Raw materials and components) c) both of the above d) None of the above b) Capital goods 95. A manufacturer purchased raw material for ` 1,12,500 (inclusive of 12.5% VAT) and capital equipment/ goods for ` 6,24,000 (inclusive of 4% VAT). Capital goods are depreciated over the period of 3 years as per straight line method. How much credit is available to the manufacturer if he follows Consumption Variant method. a) 12,500 b) 20,500 c) 36,500 d) Nil 96. While paying CST a) Input tax credit can be utilized b) Input tax credit cannot be utilized c) Input tax credit may be utilized d) CST shall be paid in cash only 97. CST paid on sale is allowed as credit to the purchaser. Is the statement valid? a) Valid b) Invalid c) Partly valid d) None of the above 98. …………..is the first state and …………..is last state for adoption of VAT law? a) Uttar Pradesh, Haryana b) Haryana, Uttar Pradesh c) Jammu & Kashmir, Haryana d) Japan, China 99. Which of the following statement is false? a) ITC on purchase of goods for personal use is not allowed as credit b) Where purchase Invoice is not available with the claimant, ITC is allowed as credit c) Where the Invoice does not show the amt. of tax separately, ITC is not allowed as credit d) None of the above 100. Which of the following statement is false? a) ITC on purchase of goods for personal use is not allowed as credit b) Where there is evidence that purchase Invoice has not been issued by selling registered dealer from whom the goods have been purchased, ITC is allowed as credit c) Where goods have been used consumption or provided free of charge as gifts, ITC is not allowed as credit d) None of the above