CS – EXECUTIVE TAX LAWS & PRACTICE MOCK TEST PAPER – 1

advertisement

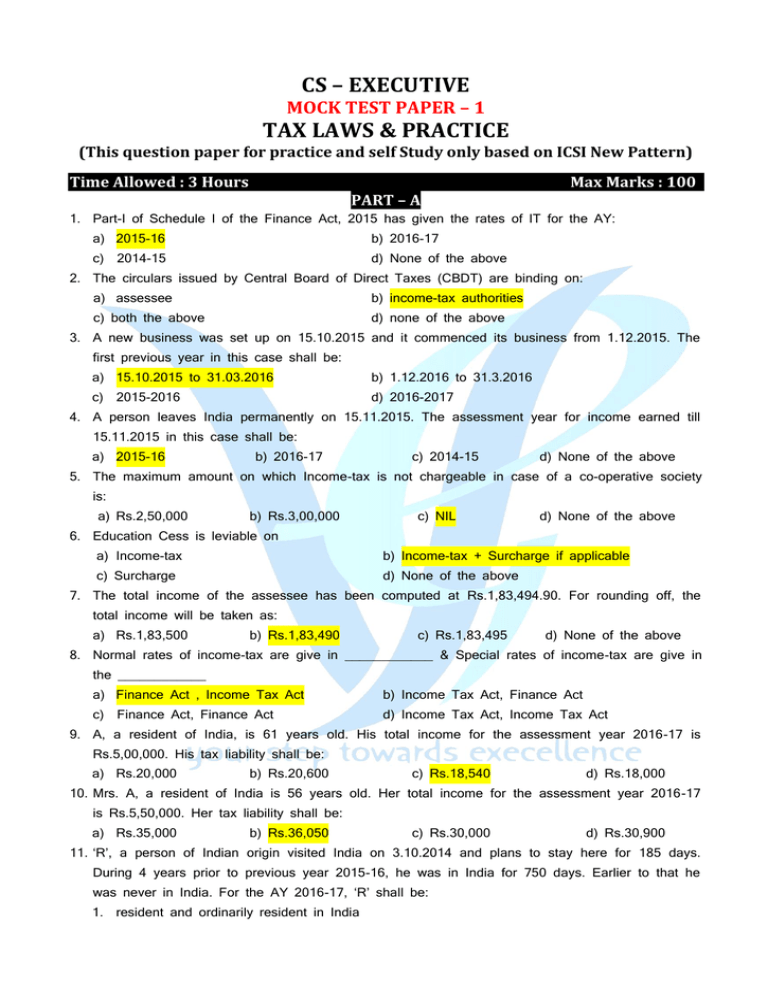

CS – EXECUTIVE MOCK TEST PAPER – 1 TAX LAWS & PRACTICE (This question paper for practice and self Study only based on ICSI New Pattern) Time Allowed : 3 Hours Max Marks : 100 PART – A 1. Part-I of Schedule I of the Finance Act, 2015 has given the rates of IT for the AY: a) 2015-16 b) 2016-17 c) d) None of the above 2014-15 2. The circulars issued by Central Board of Direct Taxes (CBDT) are binding on: a) assessee b) income-tax authorities c) both the above d) none of the above 3. A new business was set up on 15.10.2015 and it commenced its business from 1.12.2015. The first previous year in this case shall be: a) 15.10.2015 to 31.03.2016 b) 1.12.2016 to 31.3.2016 c) d) 2016-2017 2015-2016 4. A person leaves India permanently on 15.11.2015. The assessment year for income earned till 15.11.2015 in this case shall be: a) 2015-16 b) 2016-17 c) 2014-15 d) None of the above 5. The maximum amount on which Income-tax is not chargeable in case of a co-operative society is: a) Rs.2,50,000 b) Rs.3,00,000 c) NIL d) None of the above 6. Education Cess is leviable on a) Income-tax b) Income-tax + Surcharge if applicable c) Surcharge d) None of the above 7. The total income of the assessee has been computed at Rs.1,83,494.90. For rounding off, the total income will be taken as: a) Rs.1,83,500 b) Rs.1,83,490 c) Rs.1,83,495 d) None of the above 8. Normal rates of income-tax are give in ____________ & Special rates of income-tax are give in the ____________ a) Finance Act , Income Tax Act b) Income Tax Act, Finance Act c) d) Income Tax Act, Income Tax Act Finance Act, Finance Act 9. A, a resident of India, is 61 years old. His total income for the assessment year 2016-17 is Rs.5,00,000. His tax liability shall be: a) Rs.20,000 b) Rs.20,600 c) Rs.18,540 d) Rs.18,000 10. Mrs. A, a resident of India is 56 years old. Her total income for the assessment year 2016-17 is Rs.5,50,000. Her tax liability shall be: a) Rs.35,000 b) Rs.36,050 c) Rs.30,000 d) Rs.30,900 11. ‘R’, a person of Indian origin visited India on 3.10.2014 and plans to stay here for 185 days. During 4 years prior to previous year 2015-16, he was in India for 750 days. Earlier to that he was never in India. For the AY 2016-17, ‘R’ shall be: 1. resident and ordinarily resident in India 2. resident but not ordinarily resident in India 3. non-resident 12. ‘R’, a citizen of India left India for U.S. on 16.8.2014 for booking orders on behalf of an Indian Company for exporting goods to U.S. He came back to India on 5.5.2015. He had been resident in India for the past 10 years. For assessment year 2016-17, R shall be: a) resident and ordinarily resident in India b) resident but not ordinarily resident in India c) non-resident in India 13. Dividend paid by an Indian company is: a) Taxable in India in the hands of the recipient b) Exempt in the hands of recipient c) Taxable in the hands of the company and exempt in the hands of the recipient d) None of the above 14. Agricultural income is exempt provided the: a) Land is situated in India b) Land is situated in any rural area India c) Land is situated whether in India or outside India. d) None of the above 15. R gifted his house property to his wife in 2009. Mrs. R has let out the house property @ Rs.5,000 p.m. The income from such house property will be taxable in the hands of: a) Mrs. R b) R. However, income will be computed first as Mrs. R’s income and thereafter clubbed in the income of R. c) R, as he will be treated as deemed owner and liable to tax d) None of the above 16. R has taken a house property on lease for 15 years from G and let out the same to S. Income from such house to R shall be taxable as: a) income under the head other sources b) income from house property as R is deemed owner c) both of the above d) none of the above 17. R gifted his house property to his married minor daughter. The income from such house property shall be taxable in the hands of: a) R as deemed owner b) R. However, it will be first computed as minor daughters income and clubbed in the income of R c) income of married minor daughter d) None of the above 18. Fair rental value of a house is Rs.1,50,000; standard rent Rs.1,20,000, actual rent Rs.1,30,000. Municipal taxes paid during the previous year for the past 7 years is Rs.1,40,000. The annual value shall be: a) Rs. NIL b) (-) Rs.10,000 c) None of the above d) Rs.20,000 19. Tick the deductions which shall be allowed in the case of one self-occupied house property whose annual value is nil. a) 30 % of net annual value b) insurance premium c) ground rent d) interest on borrowings 20. Period of holding bonus shares or any other financial asset allotted without any payment shall be reckoned from: a) the date of holding of original shares/financial asset b) the date of offer of bonus shares/financial asset c) the date of allotment of such bonus shares/financial assets 21. Distribution of assets by a company at the time of liquidation shall be regarded as a transfer and subject to capital gain: a) in the hands of the company b) in the hands of the shareholders c) in the hands of both company as well as shareholders d) neither in the hands of a company nor in the hands of shareholders 22. Transfer by holding company to its subsidiary company or by a subsidiary company to its holding company shall not be regarded as transfer if the holding company owns: a) 90 % shares of the subsidiary company b) 100 % shares of the subsidiary company c) 51 % shares of the subsidiary company 23. The assessee is allowed to opt for market value as on 1.4.1981 in case of: a) all capital assets b) all capital assets other than depreciable assets c) all capital assets other than depreciable assets, goodwill of a business, right to manufacture, tenancy rights, loom hours and route permits 24. The cost of acquisition of the right shares to a person who purchased the right to acquire the share from the existing shareholder shall be: a) market value of right share on date of allotment b) price at which these shares are offered c) price at which these shares are offered plus the amount paid to the person renouncing the right 25. No indexation of cost of acquisition is done even though there is LTCG in case of: a) bonds or debentures b) certain assets held by non-residents c) certain assets held by non-residents and any bonds or debentures other than capital indexed bonds issued by Government d) Any of the above 26. Where capital asset is converted into stock-in-trade then for the purpose of computation of capital gain, the full value of consideration shall be: a) the market value of the asset on the date of sale of such asset b) the market value of the asset on the date of conversion of such asset c) the price for which it is sold d) Any of the above 27. Where the entire block of the depreciable asset is transferred after 36 months, there will be: a) short-term capital gain b) long-term capital gain c) short-term capital gain or loss d) long-term capital gain or loss 28. For claiming exemption under section 54, the assessee should transfer: a) any house property b) a residential house property c) a residential house property, the income of which is taxable under the head income from house property 29. For claiming exemption u/s 54EC, the amount to the extent of capital gain should be invested within six months from the date of transfer in: a) State Bank of India b) Notified securities c) State Bank of India or Notified securities d) Bonds of the NHAI or RECL 30. Total income for AY 2016-17 of an resident individual including long-term capital gain of Rs.60,000 is Rs.2,90,000. The tax on total income shall be: a) Rs. 8,000 b) Rs. 6,180 c) Rs. 12,000 d) Rs. 8,240 31. R Ltd., pays a salary of Rs.2,10,000 to his employee ‘G’ and undertakes to pay the Income Tax amounting to Rs.3,090 during the PY 2015-16 on behalf of ‘G’. The gross salary of G shall be: a) Rs. 2,10,000 b) Rs. 2,13,090 c) Rs. 2,06,910 d) None of the above 32. ‘R’ was employed on 1.7.2009 in the grade of Rs.15,000-400-17,000-500-22,000. His gross salary for the assessment year 2016-17 shall be: a) Rs.1,99,200 b) Rs.2,04,000 c) Rs.2, 08,500 d) Rs.2,10,000 33. ‘R’ was employed from 1.8.2012 in the grade of Rs.15,000-400-17,000-500-22,000 and his salary was fixed at Rs.16,200 from the date of joining. His gross salary for the assessment year 201617 shall be: a) Rs.1,99,200 b) Rs.2,04,000 c) Rs.2,08,000 d) Rs.2,10,000 34. Gratuity shall be fully exempt in the case of: a) Central and State Government employees b) Central and State Government employees and employees of local authorities c) Central and State Government employees and employees of local authorities and employees of statutory corporation. d) None of the above 35. ‘R’ who claimed the exemption of gratuity in the post to the extent of Rs.3,00,000, was entitled to the gratuity from the present/second employer amounting to Rs.8,00,000 in the previous year 2011-12 as he retired on 25.10.2011. ‘R’ shall be entitled to exemption to the maximum extent of: a) Rs.7,00,000 b) NIL d) Rs.6,00,000 d) 8,00,000 36. Un-commuted Pension received by a Government employee is: a) Fully exempt b) Fully taxable c) partially taxable d) none of the above 37. An employee was also entitled to gratuity. He got 60 % of his pension commuted and received a sum of Rs.12,00,000 as commuted pension. The exemption in his case shall be: a) Rs.12,00,000 b) Rs.4,00,000 c) Rs.6,66,667 d) Rs.8,00,000 38. ‘R’ is entitled to Hostel expenditure allowance of Rs.600 p.m. for his 3 children @ Rs.200 per child. The exemption in this case shall be: a) Rs.600 p.m. b) Rs.400 p.m. c) Rs.300 p.m. d) Rs. 100 p.m. 39. ‘R’ is entitled to a transport allowance of Rs.2,000 p.m. for commuting from his residence to office and back. He spends Rs.600 p.m. The exemption shall be: a) Rs.1,000 p.m. b) Rs.1,600 p.m. c) Rs.800 p.m. d) None of the above 40. Entertainment allowance in case of Government employee is: a) fully exempt b) fully taxable c) exempt up to certain limits mentioned in section 16(ii) d) first included in salary and thereafter deduction allowed from gross salary under section 16(ii) 41. As per section 139(1), a company shall have to file return of income: a) when its total income exceeds Rs.2,50,000 b) when its total income exceeds the maximum amount which is not chargeable to income-tax c) in all cases, irrespective of any income or loss earned by it 42. A dies on 15.11.2011 and his total income till 15.11.2015 was Rs.2,90,000. Thereafter, the business of A was inherited by his son R and his total income from such business was Rs.2,45,000. The son does not have any other income. In this case the son: a) has to file a consolidated return of income amounting to Rs.3,65,000 b) has to file two returns of income, one on behalf of his father for Rs.1,90,000 and other in his own capacity for Rs.1,75,000 c) has to file one return of income on behalf of his father for Rs.3,65,000 d) has to file one return of income on behalf of his father for Rs.2,90,000 43. The assessee could not file his return of income for AY 2016-17 within the time allowed as per section 139(1). His assessment u/s 144 was completed on 15.1.2018 and it was communicated to him on 19.1.2018. The assessee in this case could file the belated return till: a) 14.1.2018 b) 15.1.2018 c) 18.1.2018 d) 31.3.2018 44. The assessee in response to a notice u/s 142(1) submitted a return of loss of Rs.1,10,000 within the time allowed in the said notice. In this case the assessee: a) shall be allowed to carry forward such loss as the return is filed within the time allowed. b) shall not be allowed to carry forward such loss 45. R Ltd., who submitted the return of income for AY 2016-17 on 5.12.2016 finds some mistake in the return submitted by it. In this case R Ltd.: a) can revise the return of income till 31.3.2012 b) can revise the return of income till 31.3.2013 c) cannot revise such return of income d) on the discretion of Assessing Officer 46. If any income has to be clubbed under section 64, it will be clubbed under the: a) head, income from other sources b) relevant head to which it belongs c) none of these two d) head which he desires to 47. Where a house property is transferred by an individual to his or her minor child other than a married minor daughter without adequate consideration, income from such house property shall be subject to provisions of: a) Section 64(1A) i.e., minor income to be clubbed in the income of the parent whose income other than such income is greater b) Section 27 i.e., the transferor shall be deemed owner of such house property and taxable under section 22 c) None of these 48. R has gifted Rs.10,00,000 to his wife on 1.4.2007. The wife invested the above sum as capital contribution to the firm where she is a partner and earned interest every year. The total capital of Mrs. R as on 1.4.2011 including 3 years interest was Rs.15,00,000. During the year she earned Rs.2,70,000 as interest on such capital balance. The income to be clubbed in the hands of R shall be: a) Rs.2,70,000 b) Rs.1,80,000 c) Rs.NIL d) Rs. 2,50,000 49. Substantial interest for the purpose of clubbing provisions u/s 64(i) & (ii) shall be of: a) the individual only b) the individual & his spouse taken together c) the individual along with his relatives 50. Naveen contributed a sum of ` 30,000 to an approved institution for research in social science, which is not related to his business. The amount of deduction eligible u/s35 would be: a) ` 30,000 b) ` 45,000 c) ` 37,500 d) No deduction as it is unrelated to his business 51. Under the Income tax Act 1961, depreciation on machinery is charged on: a) purchase price of the machinery b) market price of the machinery c) d) All of the above written down value of the machinery 52. Under section 44AB, specified date means _______ of the assessment year. a) 30th Sep of AY c) b) 31st July of AY 30th Sep of PY d) 30th Nov of AY 53. Depreciation allowance charged on intangibles (know-how, patent etc.) is @ ____ % of WDV a) 15% b) 25% c) 20% d) 30% 54. The amount of additional depreciation in respect of new building constructed in financial year 2014-15 at a cost ` 25 lakh for manufacturing garments will be ________. a) 20% b) 10% c) Nil d) 15% 55. Rate of depreciation charges on fully temporary wooden structure for the AY 2016-17 is: a) 5% b) 10% c) 100% d) none of the above 56. For an assessee engaged in business and profession, any compensation received for not producing CFC and HCFC from Govt. of India under multilateral fund of Montreal Protocol a) is taxable under head Other Sources b) is taxable under head PGBP c) is not taxable under head PGBP d) None of the above 57. When shall depreciation be restricted to 50% of depreciation allowed? a) If asset is put to use for less than 180 days in any year b) If asset is put to use for less than 180 days in year of acquisition c) If asset is put to use for less than 200 days in year of acquisition d) None of the above 58. An assessee who has a block of ` 250 lakh of plant and machinery. He sold the entire block for ` 170 lakh, an asset of `20 lakh was acquired during the year. On what amount should he charge the depreciation and what shall be the amount of capital gain. a) Nil, Nil b) 100, Nil c) Nil, (100) d) Nil, 100 59. An assessee paid an amount to a research association having an object the undertaking of scientific research. The research is related to his business. What amount of deduction shall be allowed under section 35(1)(ii) a) 175% of the amount paid b) Nil, since research is related to the business of the assessee c) 125% of the amount paid d) None of the above 60. If assessee purchases land and building through composite agreement, cost of the land is …………………. and that of building is …………………….. a) not allowable as deduction, allowed as deduction u/s 35(1)(iv) b) allowed as deduction u/s 35(1)(iv), allowed as deduction u/s 35(1)(iv) c) not allowable as deduction, not allowable as deduction d) allowed as deduction u/s 35(1)(iv), not allowable as deduction 61. Unilateral relief is provided by government in case: a) where no agreement exist b) where agreement exist c) d) None of the above Either a) or b) 62. Kalpesh Kumar, a resident individual, is musician deriving income of ` 75,000 from concerts performed outside India. Tax of ` 10,000 was deducted at source in the country where concerts were performed. India does not have any double tax avoidance agreement with that country. His income in India amounted to ` 2,25,000. Compute tax liability of Kalpesh Kumar for AY 2015-16 assuming he deposited `10,000 in Public Provident Fund & paid medical insurance premium in respect of his father, aged 65 years, `20,000. Calculate tax payable in India. a) ` 3,270 b) nil c) 63. Specified domestic transaction defined under; a) Section 92A b) Section 92B c) Section 92BA 64. Report of transfer pricing shall be furnished: a) on or before 30th November of PY c) `5,150 d) ` 10,000 d) Section 92CA b) on or before 30th November of AY on or after 30th November of AY d) on or after 30th November of PY 65. Maintenance, keeping of information and document is defined under a) Section 92D b) Section 92F c) Section 92E d) Section 92BA 66. Appeal to ITAT shall be given in how many days? a) 45 b) 60 c) 180 d) 120 67. On which question can appeal to High Court be filed? a) Question of fact b) Question of law c) Any of the above d) as per discretion of High Court 68. What is total amount during the previous year upto which TDS on rent under section 194I shall not be deducted? a) ` 30,000 b) ` 75,000 c) ` 2,00,000 d) ` 1,80,000 69. What shall be rate of TDS on fees for professional or technical service under section 194J? a) 20 % b) 10 % c) 30 % d) 15 % 70. Compute the taxable income of Mr. A for the A.Y.2015-16. Income from salary 4,00,000 Loss from self-occupied property (-) 70,000 a) 4,00,000 b) 3,30,000 c) 3,65,000 d) Nil PART – B 71. If the aggregate value of taxable service in the preceding financial year exceeds Rs. 10,00,000, service tax shall be payable during the current financial year a) If the aggregate value of taxable service exceed, Rs. 10,00,000 during the current year. b) on the entire aggregate value of service, c) If the aggregated value of taxable service exceeds Rs. 10,00,000 during the current financial year. d) None of the above 72. The provisions relating to valuation of taxable services are contained in: a) section 65 of the Finance Act, 1994 b) section 67 of the Finance Act, 1994 c) d) None of the above section 65A of the Finance Act, 1999 73. Gross amount charged for the taxable services includes: a) only that amount received towards the taxable service which is received before the provision of such services b) Only that amount received towards the taxable service which is received after the provision of such services. c) Any amount received towards the taxable services whether received before, during or after provision of such services. d) None of the above 74. Secondary and Higher Education Cess was levied by – a) The Finance(2) Act, 2004 b) The Finance Act, 2006 c) d) None of the above The Finance Act, 2007 75. Ravi rents a residential house G who uses it for residential purpose. Service tax ……… on such renting. a) will be charged b) not be levied since mentioned in negative list c) d) none of the above will be partially charged 76. A service provider has provided service of ` 17,00,000 during the preceding financial year, out of which service of ` 9,00,000 were provided from Delhi premises and rest from Noida premises. Determine his eligibility for service tax provider exemption notified in NN 33/2012 a) Yes, since services from either premises does not exceed ` 10,00,000 b) No, since turnover from both premises exceed ` 10,00,000 c) Any of the above d) None of the above 77. Service of transportation of passengers, with or without accompanied belongings by which of following is mentioned in negative list. a) stage carriage b) metro, monorail or tramway c) both of the above d) none of the above 78. Service of transportation of passengers, with or without accompanied belongings by which of following is chargeable to service tax a) railways in a class other than first class b) railways in a class other than an air conditioned coach c) railways in a class other than first class or an air conditioned coach d) none of the above 79. Service of transportation of passengers, with or without accompanied belongings by which of following is mentioned in negative list. a) metered cabs, auto rickshaws b) radio taxi c) both of the above d) none of the above 80. A service provider provided service of ` 8,00,000 during preceding financial year, how much service tax is payable by him during current financial year if he provides service of ` 6,00,000 out of which service worth ` 2,00,000 were provided under the brand name of other person a) Service tax will be payable on ` 6,00,000 b) Service tax will be payable on ` 2,00,000 c) d) Service tax is not payable by him Service tax will be payable on ` 4,00,000 81. Loading and unloading charges of sugarcane for ` 16 lakhs. Service tax …………… transaction. a) will not be levied since it is mentioned in negative list c) b) shall be levied on will be exempt d) none of the above 82. Return of service tax is to be filed in: a) Form ST-I b) Form ST-3 c) Form ST-2 d) Form ST-4 c) Form ST-2 d) Form ST-4 83. Revised return of service tax is to be filed in: a) Form ST-I b) Form ST-3 84. Return of service tax has to be filed: a) monthly b) quarterly c) half-yearly d) yearly 85. Due date of filing return is: a) 25th of the month following the particular half-year b) 5th of the month following the particular half-year c) 15th of the month following the particular half-year d) 30 days of the month following the particular half-year 86. What is the due date of return for the half year ended 30 th September? a) 5th October b) 15th October c) 25th October d) 30th October c) 25th April d) 30th April 87. What is the due date of return for the half year ended 31 st March? a) 5th April b) 15th April 88. A return can be revised within how many days? a) within a period of 90 days from the due date of return b) within a period of 90 days from the date of submission of the original return c) within a period of 60 days from the date of submission of the original return d) cannot be revised 89. Where an assessee provides more than one taxable service, how many return shall be filed by him? a) single return b) multiple return c) single return, details in each of the columns of Form have to be furnished separately for each of the taxable service rendered by him d) separate return for each taxable service 90. Where the gross amount charged is inclusive of service tax payable, how shall service tax be computed? a) Gross amount charged x 12% / 112% b) Gross amount charged x 12.36% / 112.36% c) Gross amount charged x 12.36% / 100% d) Gross amount charged x 14% / 114% 91. Application for registration is to be made in Form a) From ST 1 b) From ST 3A c) From ST 3 d) From ST 4 92. Who is liable to make mandatory application for registration? a) Every person b) Every person liable to pay service tax c) d) None of the above Either of above 93. A manufacturer purchased raw material for ` 1,12,500 (inclusive of 12.5% VAT) and capital equipment/ goods for ` 6,24,000 (inclusive of 4% VAT). Capital goods are depreciated over the period of 3 years as per straight line method. How much credit is available to the manufacturer if he follows Consumption Variant method. a) 12,500 b) 20,500 c) 36,500 d) Nil 94. When goods have been sold from one state to another state, what shall be payable on such sale? a) Value added tax b) Central sales tax c) Input tax credit to the extent of 2% shall be disallowed d) None of the above 95. When goods have been transferred as stock transfer from one state to another state, what shall be payable on such sale? a) Value added tax b) Central sales tax c) Input tax credit to the extent of 2% shall be disallowed d) None of the above 96. …………..is the first state and …………..is last state for adoption of VAT law? a) Uttar Pradesh, Haryana b) Haryana, Uttar Pradesh c) d) Japan, China Jammu & Kashmir, Haryana 97. Which of the following statement is false? a) ITC on purchase of goods for personal use is not allowed as credit b) Where purchase Invoice is not available with the claimant, ITC is allowed as credit c) Where the Invoice does not show the amt. of tax separately, ITC is not allowed as credit d) None of the above 98. Which of the following statement is false? a) ITC on purchase of goods for personal use is not allowed as credit b) Where there is evidence that purchase Invoice has not been issued by selling registered dealer from whom the goods have been purchased, ITC is allowed as credit c) Where goods have been used consumption or provided free of charge as gifts, ITC is not allowed as credit d) None of the above 99. Mr. A (Registered Dealer) who purchases goods from a manufacturer (Registered Dealer) on payment of ` 2,25,000 (including VAT) and earns 10% profit on purchase. The goods have been sold to retailers and VAT rate on purchase and sale is 12.5%. How much VAT is payable by the dealer on such sale? a) 2,500 b) 2,812.5 c) 6,680 d) Nil 100. Product X is taxable @ 4% and Product Y is taxable @12.5%. Product X is sold for `100,000 and Product Y for ` 50.000. Total input tax credit is available for ` 5,000. What would be the net VAT payable? a) ` 5,250 b) ` 5,000 c) ` 2,500 d) ` 10,250