Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit

advertisement

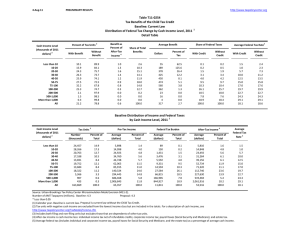

23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2011 Summary Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All With Tax Cut Pct of Tax Avg Tax Cut Units * 3.4 11.2 24.5 32.6 40.3 46.5 25.6 5.5 3.0 2.1 19.1 ** ‐204 ‐318 ‐412 ‐509 ‐657 ‐820 ‐674 ‐500 ‐497 ‐1,058 ‐598 With Tax Increase Avg Tax Pct of Tax Increase Units 0.0 * 0.5 2.0 3.2 9.5 13.3 42.4 61.6 52.2 36.2 9.9 0 ** 291 438 589 448 427 809 2,768 4,225 6,030 1,255 Percent Change in After‐Tax Income 4 Average Federal Tax Change ($) 0.0 0.1 0.2 0.3 0.4 0.4 0.5 ‐0.2 ‐0.7 ‐0.4 ‐0.1 0.0 0 ‐7 ‐34 ‐92 ‐147 ‐222 ‐324 170 1,678 2,192 2,158 10 Average Federal Tax Rate5 Change (% Points) 0.0 ‐0.1 ‐0.1 ‐0.3 ‐0.3 ‐0.4 ‐0.4 0.1 0.6 0.3 0.1 0.0 Under the Proposal 1.5 1.0 5.6 9.7 12.2 14.7 16.6 19.8 23.3 24.6 29.1 18.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 4.3 Proposal: 4.8 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase * 3.4 11.2 24.5 32.6 40.3 46.5 25.6 5.5 3.0 2.1 19.1 0.0 * 0.5 2.0 3.2 9.5 13.3 42.4 61.6 52.2 36.2 9.9 Percent Change in After‐Tax Income 4 0.0 0.1 0.2 0.3 0.4 0.4 0.5 ‐0.2 ‐0.7 ‐0.4 ‐0.1 0.0 Average Federal Tax Change Dollars Percent 0 ‐7 ‐34 ‐92 ‐147 ‐222 ‐324 170 1,678 2,192 2,158 10 0.0 ‐4.6 ‐2.4 ‐2.7 ‐2.6 ‐2.4 ‐2.2 0.6 2.5 1.3 0.3 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 ‐0.1 ‐0.1 ‐0.2 ‐0.2 0.1 0.5 0.1 0.0 0.0 Under the Proposal 0.1 0.2 1.5 3.0 3.8 9.3 10.1 26.2 18.9 7.9 18.9 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 ‐0.1 ‐0.1 ‐0.3 ‐0.3 ‐0.4 ‐0.4 0.1 0.6 0.3 0.1 0.0 Under the Proposal 1.5 1.0 5.6 9.7 12.2 14.7 16.6 19.8 23.3 24.6 29.1 18.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 24,457 28,266 20,763 17,188 13,691 19,752 13,684 18,322 5,366 907 433 163,869 Percent of Total 14.9 17.3 12.7 10.5 8.4 12.1 8.4 11.2 3.3 0.6 0.3 100.0 Pre‐Tax Income Average (dollars) 5,898 14,998 24,923 34,760 44,748 62,065 85,915 140,324 294,445 686,468 2,906,843 65,357 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 1.4 4.0 4.8 5.6 5.7 11.5 11.0 24.0 14.8 5.8 11.8 100.0 89 150 1,431 3,476 5,592 9,331 14,594 27,584 66,816 166,985 844,931 11,841 0.1 0.2 1.5 3.1 4.0 9.5 10.3 26.1 18.5 7.8 18.9 100.0 After‐Tax Income 4 Average (dollars) 5,810 14,848 23,492 31,284 39,156 52,734 71,320 112,739 227,628 519,484 2,061,912 53,516 Percent of Total 1.6 4.8 5.6 6.1 6.1 11.9 11.1 23.6 13.9 5.4 10.2 100.0 Average Federal Tax Rate 5 1.5 1.0 5.7 10.0 12.5 15.0 17.0 19.7 22.7 24.3 29.1 18.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 4.3 Proposal: 4.8 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase * 3.9 12.3 27.4 35.4 30.1 14.1 6.2 1.6 2.2 2.2 11.9 0.0 * 0.2 0.2 0.4 14.4 35.8 41.9 38.6 31.8 24.8 4.4 Percent Change in After‐Tax Income 4 0.0 0.1 0.2 0.3 0.4 0.2 ‐0.1 ‐0.4 ‐0.4 ‐0.3 ‐0.1 0.0 Average Federal Tax Change Dollars Percent 0 ‐8 ‐39 ‐101 ‐159 ‐75 84 394 949 1,294 1,322 ‐11 0.0 ‐1.2 ‐1.5 ‐2.1 ‐2.1 ‐0.6 0.5 1.3 1.3 0.8 0.1 ‐0.2 Share of Federal Taxes Change (% Points) 0.0 0.0 ‐0.1 ‐0.2 ‐0.2 ‐0.1 0.1 0.2 0.2 0.0 0.0 0.0 Under the Proposal 1.1 2.9 6.4 8.9 9.5 17.4 11.5 16.3 10.4 4.2 11.3 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 ‐0.1 ‐0.2 ‐0.3 ‐0.4 ‐0.1 0.1 0.3 0.3 0.2 0.0 0.0 Under the Proposal 4.8 4.7 10.1 13.4 16.9 19.1 21.4 22.2 24.2 24.9 32.8 17.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 19,360 19,808 12,116 8,974 5,964 7,023 2,998 2,554 679 117 54 80,235 Percent of Total 24.1 24.7 15.1 11.2 7.4 8.8 3.7 3.2 0.9 0.2 0.1 100.0 Pre‐Tax Income Average (dollars) 5,794 14,819 24,807 34,679 44,652 61,151 84,771 135,493 298,048 680,990 2,994,162 34,300 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 4.1 10.7 10.9 11.3 9.7 15.6 9.2 12.6 7.4 2.9 5.9 100.0 277 705 2,549 4,756 7,689 11,751 18,045 29,705 71,047 168,174 979,397 5,895 1.1 3.0 6.5 9.0 9.7 17.5 11.4 16.0 10.2 4.2 11.3 100.0 After‐Tax Income 4 Average (dollars) 5,517 14,114 22,258 29,923 36,963 49,399 66,727 105,787 227,001 512,816 2,014,765 28,405 Percent of Total 4.7 12.3 11.8 11.8 9.7 15.2 8.8 11.9 6.8 2.6 4.8 100.0 Average Federal Tax Rate 5 4.8 4.8 10.3 13.7 17.2 19.2 21.3 21.9 23.8 24.7 32.7 17.2 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.3 9.0 19.2 26.7 46.4 58.9 29.8 6.0 3.1 2.0 30.4 0.0 0.0 0.2 3.5 4.8 6.6 4.4 41.8 65.2 55.6 38.2 19.8 Percent Change in After‐Tax Income 4 0.0 0.0 0.1 0.3 0.3 0.6 0.7 ‐0.1 ‐0.8 ‐0.5 ‐0.1 ‐0.1 Average Federal Tax Change Dollars Percent 0 0 ‐31 ‐90 ‐133 ‐323 ‐493 116 1,776 2,352 2,289 61 0.0 0.0 ‐32.8 ‐5.5 ‐4.1 ‐4.3 ‐3.7 0.4 2.7 1.4 0.3 0.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 ‐0.1 ‐0.3 ‐0.4 0.1 0.5 0.1 0.0 0.0 Under the Proposal 0.0 ‐0.1 0.0 0.5 1.1 5.3 8.9 30.4 22.8 9.5 21.6 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 ‐0.1 ‐0.3 ‐0.3 ‐0.5 ‐0.6 0.1 0.6 0.3 0.1 0.1 Under the Proposal ‐2.0 ‐3.3 0.3 4.4 6.8 11.5 14.9 19.3 23.1 24.6 28.5 19.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,469 2,703 3,378 3,963 4,983 9,785 9,374 15,014 4,529 760 361 56,662 Percent of Total 2.6 4.8 6.0 7.0 8.8 17.3 16.5 26.5 8.0 1.3 0.6 100.0 Pre‐Tax Income Average (dollars) 5,327 15,680 25,178 35,096 45,043 63,042 86,496 141,559 294,076 687,868 2,827,391 122,041 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 0.1 0.6 1.2 2.0 3.3 8.9 11.7 30.7 19.3 7.6 14.8 100.0 ‐104 ‐520 93 1,650 3,206 7,570 13,370 27,219 66,190 166,914 804,129 23,791 0.0 ‐0.1 0.0 0.5 1.2 5.5 9.3 30.3 22.2 9.4 21.5 100.0 After‐Tax Income 4 Average (dollars) 5,430 16,200 25,085 33,446 41,837 55,472 73,126 114,340 227,886 520,954 2,023,262 98,249 Percent of Total 0.1 0.8 1.5 2.4 3.7 9.8 12.3 30.8 18.5 7.1 13.1 100.0 Average Federal Tax Rate 5 ‐2.0 ‐3.3 0.4 4.7 7.1 12.0 15.5 19.2 22.5 24.3 28.4 19.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 1.5 7.4 19.1 35.1 46.1 35.1 10.5 6.5 0.6 4.5 14.8 0.0 * 1.4 4.4 6.5 5.1 20.7 56.9 63.3 49.6 35.9 4.9 Percent Change in After‐Tax Income 4 0.0 0.0 0.1 0.2 0.4 0.5 0.2 ‐0.4 ‐1.0 ‐0.4 ‐0.1 0.1 Average Federal Tax Change Dollars Percent 0 ‐2 ‐20 ‐60 ‐148 ‐270 ‐112 462 2,139 1,778 2,527 ‐36 0.0 0.2 3.4 ‐2.9 ‐2.9 ‐3.0 ‐0.7 1.7 3.2 1.2 0.3 ‐1.1 Share of Federal Taxes Change (% Points) 0.0 ‐0.1 ‐0.2 ‐0.2 ‐0.3 ‐0.5 0.1 0.6 0.4 0.1 0.1 0.0 Under the Proposal ‐4.0 ‐11.2 ‐3.7 9.4 14.8 28.1 20.7 22.1 10.4 3.9 9.5 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 ‐0.1 ‐0.2 ‐0.3 ‐0.4 ‐0.1 0.4 0.7 0.3 0.1 ‐0.1 Under the Proposal ‐13.5 ‐10.6 ‐2.4 5.7 11.0 14.5 17.7 21.0 23.6 23.3 29.8 9.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,465 5,465 4,876 3,748 2,382 2,528 1,092 633 120 20 9 24,414 Percent of Total 14.2 22.4 20.0 15.4 9.8 10.4 4.5 2.6 0.5 0.1 0.0 100.0 Pre‐Tax Income Average (dollars) 6,710 15,268 25,027 34,564 44,489 60,717 84,509 131,174 289,344 662,717 2,823,081 35,432 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 2.7 9.6 14.1 15.0 12.3 17.7 10.7 9.6 4.0 1.5 2.9 100.0 ‐908 ‐1,615 ‐583 2,042 5,055 9,048 15,100 27,050 66,045 152,411 837,365 3,270 ‐3.9 ‐11.1 ‐3.6 9.6 15.1 28.7 20.7 21.5 10.0 3.8 9.3 100.0 After‐Tax Income 4 Average (dollars) 7,618 16,883 25,610 32,522 39,434 51,669 69,409 104,123 223,299 510,307 1,985,715 32,163 Percent of Total 3.4 11.8 15.9 15.5 12.0 16.6 9.7 8.4 3.4 1.3 2.3 100.0 Average Federal Tax Rate 5 ‐13.5 ‐10.6 ‐2.3 5.9 11.4 14.9 17.9 20.6 22.8 23.0 29.7 9.2 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.4 4.6 14.7 24.5 44.1 57.8 31.3 4.4 1.8 1.8 22.5 0.0 0.1 1.5 6.3 9.6 11.7 10.3 49.0 77.7 68.5 49.7 17.9 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.1 0.2 0.5 0.7 ‐0.2 ‐1.0 ‐0.6 ‐0.2 ‐0.1 Average Federal Tax Change Dollars Percent 0 0 ‐8 ‐29 ‐78 ‐257 ‐467 194 2,335 3,100 3,244 97 0.0 0.0 0.6 ‐2.3 ‐2.0 ‐3.1 ‐3.4 0.7 3.4 1.8 0.4 0.6 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 ‐0.1 ‐0.3 ‐0.4 0.0 0.6 0.1 ‐0.1 0.0 Under the Proposal ‐0.6 ‐1.9 ‐1.1 0.8 2.1 7.0 9.6 30.9 23.8 9.6 19.8 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.4 ‐0.5 0.1 0.8 0.5 0.1 0.1 Under the Proposal ‐19.7 ‐16.5 ‐5.6 3.5 8.6 12.9 15.4 19.6 24.0 26.1 30.0 18.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,818 5,749 5,818 5,069 4,083 6,557 5,473 8,493 2,554 404 177 48,380 Percent of Total 7.9 11.9 12.0 10.5 8.4 13.6 11.3 17.6 5.3 0.8 0.4 100.0 Pre‐Tax Income Average (dollars) 6,240 15,486 25,108 34,703 44,647 62,489 85,937 141,033 293,197 690,964 2,823,394 87,155 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 0.6 2.1 3.5 4.2 4.3 9.7 11.2 28.4 17.8 6.6 11.9 100.0 ‐1,227 ‐2,554 ‐1,407 1,232 3,914 8,285 13,676 27,388 68,150 176,982 843,372 15,551 ‐0.6 ‐2.0 ‐1.1 0.8 2.1 7.2 10.0 30.9 23.1 9.5 19.9 100.0 After‐Tax Income 4 Average (dollars) 7,467 18,040 26,516 33,471 40,733 54,204 72,261 113,645 225,047 513,983 1,980,022 71,604 Percent of Total 0.8 3.0 4.5 4.9 4.8 10.3 11.4 27.9 16.6 6.0 10.1 100.0 Average Federal Tax Rate 5 ‐19.7 ‐16.5 ‐5.6 3.6 8.8 13.3 15.9 19.4 23.2 25.6 29.9 17.8 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 23‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0200 Replace the Mortgage Interest Deduction with a Revenue‐Neutral 21.6 Percent Non‐refundable Credit Limit Mortgages Eligible for Credit to $500,000 on Primary Residences Only Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.2 3.9 17.2 24.9 38.6 42.5 22.8 8.3 6.9 2.6 15.4 0.0 0.0 0.0 0.1 0.1 2.4 3.7 17.1 23.7 18.9 14.1 3.1 Percent Change in After‐Tax Income 4 Average Federal Tax Change Dollars Percent 0 0 ‐8 ‐46 ‐98 ‐224 ‐279 ‐18 368 503 584 ‐53 0.0 ‐0.2 ‐1.4 ‐3.3 ‐4.3 ‐4.1 ‐2.7 ‐0.1 0.6 0.3 0.1 ‐0.6 0.0 0.0 0.0 0.1 0.2 0.4 0.4 0.0 ‐0.2 ‐0.1 0.0 0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 ‐0.1 ‐0.3 ‐0.2 0.1 0.2 0.1 0.2 0.0 Under the Proposal 0.1 0.3 0.8 1.5 2.0 7.8 9.2 23.7 19.7 9.1 25.9 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.4 ‐0.3 0.0 0.1 0.1 0.0 ‐0.1 Under the Proposal 0.8 0.7 2.2 3.9 4.8 8.6 11.9 16.0 20.5 22.0 29.4 14.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,246 8,807 4,635 3,579 2,957 4,677 2,878 3,397 1,035 196 95 35,530 Percent of Total 9.1 24.8 13.0 10.1 8.3 13.2 8.1 9.6 2.9 0.6 0.3 100.0 Pre‐Tax Income Average (dollars) 6,597 14,675 24,605 34,628 45,236 61,976 86,127 139,164 296,495 675,363 2,953,404 63,396 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 1.0 5.7 5.1 5.5 5.9 12.9 11.0 21.0 13.6 5.9 12.5 100.0 53 102 540 1,380 2,266 5,525 10,505 22,332 60,515 147,778 866,178 9,049 0.1 0.3 0.8 1.5 2.1 8.0 9.4 23.6 19.5 9.0 25.7 100.0 After‐Tax Income 4 Average (dollars) 6,543 14,573 24,065 33,249 42,971 56,451 75,622 116,832 235,981 527,585 2,087,226 54,347 Percent of Total 1.1 6.7 5.8 6.2 6.6 13.7 11.3 20.6 12.7 5.4 10.3 100.0 Average Federal Tax Rate 5 0.8 0.7 2.2 4.0 5.0 8.9 12.2 16.1 20.4 21.9 29.3 14.3 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal: replaces the mortgage interest deduction with a revenue‐neutral 21.6 percent non‐refundable credit; and limits mortgages eligible for the credit to $500,000 on primary residences only. We approximate the $500,000 limit on mortgages with a limit on mortgage interest eligible for the credit of $25,000. Estimates assume that individuals pay down their mortgage in response to a smaller tax benefit for mortgage interest. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.