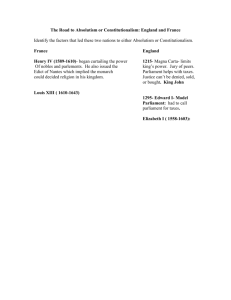

From royal to parliamentary rule without revolution, within divided governments

advertisement