I. Federalism as a Form of Polycentric Governance

advertisement

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

I. Federalism as a Form of Polycentric Governance

a. For example, in some cases a subset of local officials are appointed by higher

levels of government.

b. In other cases, local governments have relatively little ability to make tax,

expenditure, or regulatory decisions.

A. Thus far in the course, we have analyzed:

i. the positive properties of a single tax or expenditure program in

isolation

ii. the normative properties of such taxes and expenditures

iii. the normative or "economic" case for government services and

regulation: externalities and public goods problems

iv. and, the politics the underlie the main (large and well known) tax and

expenditure programs selected by elected governments.

v. All these analyses were grounded in relatively simple and general

models of rational decision making.

iii. The parliaments of most federal governments include a chamber that

represents state (provincial, lander, etc.) interests.

w Some political scientists insist that a truly federal government always have a

chamber in the national legislature that represents state interests.

w However, such a structure is not necessary for what economists refer to as

“fiscal federalism.”

w What is required for fiscal federalism is simply some local independence

and some authority to make fiscal (tax and/or spending) decisions.

B. We now turn to settings in which governments are not monolithic

unitary organizations, but rather decentralized, federal, or confederal

governments.

i. Such policy making structures are common: within most countries,

there are regional and local governments, as well as central (national or

federal) governments.

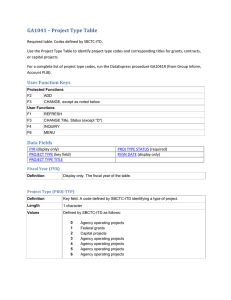

II. Public Finance in Federal Systems

A. In cases in which several of the “levels” of government have

independent taxing and/or spending authority, a country or nation state

can be said to exhibit fiscal federalism (Oates 1972, 1977, 1999; see

also Mueller in Congleton and Swedenborg 2006).

i. Fiscal federalism does not require political federalism in the sense of a

national senate, but it does require “polycentric” decentralized

governance (Ostrom 1972, McGinnis 1999, Hooghe and Marks 2003).

{ For example, within the US, there are national (federal), state, county,

and town governments. Similar divisions exist in most countries.

ii. In most cases, the rules of the central government constrain the

authority of the regional and local governments.

iii. Nonetheless, in cases in which the various governments are

independently elected--rather than appointed by the central

government in some way--and the local governments have significant

control over local fiscal and regulatory policy, the result is a

decentralized, “polycentric” system of governance.

a. Within the US, individual state, county and town governments (local voters)

can usually control local taxes and expenditures.

b. Similar decentralized control over taxes and expenditures also exist in

Canada, Australia and Switzerland.

ii. The greater is the independence of local governments and the broader

is their fiscal and regulatory authority, the more decentralized is a

federal (or other polycentric) government.

iii. In other less decentralized federal systems, control over many local

taxes and expenditures is exercised by higher levels of governments.

C. In federal systems of governance, the central government is formally

sovereign, rather than the “member” states, but the states have

independent formal legal (constitutional) status.

i. Federal states, thus, include a hierarchy of governments with more or

less overlapping jurisdictions, but more or less independent policy

making procedures.

ii. Some federal systems are more decentralized than others, because their

local governments are less independent and/or have less authority than

in others.

a. Independent state and local governments exist, but they are not able to set

many (or any) local tax rates or may have very limited control over local

expenditures.

b. Fiscal federalism exists in such countries as well, if local governments can

make some independent fiscal decisions.

1

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

C. Among the vertical relationships given most attention by economists

are intergovernmental grants and political feedbacks.

i. One important strand of state and local public finance explores the

effects of "intergovernmental grants" on state and local policy choices.

iv. Within "unified" governments, local governments may also be more or

less independent and more or less free to determine taxes,

expenditures, borrowing, and regulations.

w Such states may be considered to be "federal" in the fiscal sense because

taxing and/or spending authority is distributed between national, state, and

local governments.)

w Illustration of the effect of an intergovernmental grant on local

expenditures.

ii. Another concerns the political effects that "states" have on higher

levels of government, insofar as state voters and their representatives

have "regional" rather than national interests (See Knight in Congleton

and Swedenborg 2006).

Figure 1: Levels of Government

Central Government

a. The existence of intergovernmental grants and targeted grants tend to induce

local and state governments to lobby in favor of such programs.

b. One possible result is "Pork barrel politics" a.k.a. the "fiscal commons

problem" (discussed below).

Intergovernmental Grants

Regional (State) Gov. 1

Local Gov A

Local Gov B

Local Gov C

Regional (State) Gov. 2

Local Gov D

iii. Still another concerns how bargaining between levels of government

affect the extent of centralization observed (Congleton, Bacaarria, and

Kyriacou 2003).

iv. In addition to the vertical relationships, there are several “horizontal”

relationships that are of interest to economists.

Local Gov E

a. For example, to the extent that "tax base" is mobile across local

governmental jurisdictions, intergovernmental competition over taxes,

expenditures, and regulation tends to emerge.

{ If community A has higher taxes than Community C, people from

community A will tend to move to community C--unless the services in

community B are noticeably better than those in community C.

{ (The effects of competition between government are discussed below.)

b. There are also regulatory externalities that tend to be associated with local

governments.

B. Federal systems of governance have both “vertical” and “horizontal”

relationships among governments.

i. With respect to “vertical” relationships: some services and taxes may

simply be mandated by higher levels of government.

a. Local governments are constrained in what they can do by state laws.

b. State governments are constrained in what the can do by national laws.

c. In the diagram above, the red arrows can be thought of as "mandates" placed

on local governments and/or as grants (subsidies) paid to local governments.

D. The economics and politics of these fiscal relationships not only allow

us to understand federal governments operate but also help us analyze

how federal systems should be designed.

ii. In addition to mandates and prohibitions from higher levels of

government, there are often subsidies from "upper" levels of

governments to "lower" levels of governments that create new

opportunities for local governments to provide services without having

to raise local taxes.

III. The Effects of Intergovernmental Grants

A. Modeling the effects of intergovernmental grants requires a model of

local governmental decision making (Bradford and Oates 1971, Romer

and Rosenthal 1980, Gramlich 1998).

2

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

b. (Add indifference curves to diagrams like that above, and analyze how different

kinds of grants tend to affect the level and distribution of government services

within a community.)

i. Within democracies, these can be based on the median voter model,

perhaps augmented by the effects of interest groups and

intergovernmental competition (see below).

ii. The median voter model ( and median legislator model and governor

models) allow the decisions of government to be modeled as if they

were made by a single person.

iii. This, in turn, allows us to use diagrams from microeconomics to

represent the effects of conditional and unconditional grants on local

governments.

iv. For the most part, the empirical evidence on the effects of grants is

consistent with such one person (median voter) models of government

decision making.

v. There is however one puzzle, often termed the "fly paper effect"

(Hamilton 1983, Bailey and Connolly 1998, Jacoby 2002).

a. Block grants, which resemble lump sum grants, increase government services

by more than one would expect based on standard consumer models.

b. The grants "stick" to the programs they are aimed at, rather than inducing

tax reductions that the median voter model seems to predict.

B. The median voter and intergovernmental grants.

i. As was the case for ordinary subsidies, intergovernmental grants can be

"lump sum" or "marginal" (block grants or matching grants).

{ That is to say, in a community that spends 10% of its income on government

services why aren't 90% of block grants used to reduce taxes?

w As true of ordinary subsidies, grants may also be conditional or not.

{ (There are several theories that can be used to explain this, but all require

more complex models of governance than our simple median voter

model, and not all are very convincing.)

ii. Both conditional and unconditional matching grants affect relative

prices of alternative government services.

w Both conditional and unconditional block grants have income effects but

not relative price effects.

IV. The Pork Barrel Dilemma

A. The existence of intergovernmental grants creates incentives for state

and local governments (and state representatives and senators) to lobby

for programs that benefit their own states--even if they do not benefit

the nation as a whole.

i. The federal government funds specific highway and water projects that

benefit only a particular city or metropolitan area, but which are paid

for by taxes imposed on everyone in the country.

The Median Voter's Allocation Problem

G2

Lump Sum Grant

T/Pg2

(Draw in the Median Voter's

indifference curves to see the

effects of these grants.)

Conditional Lump Sum Grant

No Grant Circumstance

a. Programs that often have regional rather than national benefits include: flood

insurance, hurricane relief, ports and harbor spending, railroad and airport

subsidies.

b. Many highway and irrigation projects, national parks, and museums also

mainly produce local benefits.

Matching Grant

T/Pg1

G1

Gov Service 1

ii. Groups will press for targeted projects that generate benefits for them that are lower

than their own tax costs.

iii. How intergovernmental grants change the public budget constraint is

illustrated above. How such grants affect public policy require adding

the indifference curves of the "pivotal policy maker."

a. Such targeted programs (ear marks) can lead to inefficient policies at the

national level, because central government expenditures are normally funded with

general revenues.

a. For most of our purpose the relevant indifference curves are those of the

median voter (or directly elected city planner).

3

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

b. In such cases, the national funding of local projects induces a good deal more lobbying than

would occur if the projects were funded at local levels, because local benefits are more likely

to exceed local tax costs if other taxpayers are paying most of the cost.

the Pork Barrel Dilemma

Region B

iii. Most central government revenues are raised through broad-based

taxes, as with the income tax, corporate income tax, and sales (VAT)

tax.

Build Road

Don't Build Road

A, B

A, B

Build W

(-2, -3)

( +2, -4)

Don't build W

( -4, +1)

( 0, 0)

Region A

w This implies that the cost of targeted programs are spread over the nation

or state as a whole, even if benefits are only locally distributed.

iv. Adopting such targeted programs requires majority support within the

central government's legislature.

a. The payoffs to the region B and region A coalitions consist of their own

narrow benefits from their projects less half of the total cost of the projects

adopted.

a. Thus, not every possible project that has local support can be funded.

b. However, it is possible that a majority of voters (or legislators) receives net

benefits that are smaller than the costs imposed on the minority opposed to

the project or program of interest.

c. It is also possible for majority coalitions to be assembled for a group of

earmarks that have benefits that are smaller than their costs for the nation as

a whole.

d. This problem is sometimes called the "fiscal commons" problem or the

"pork barrel dilemma."

w If neither project is built, no benefits and no costs are realized.

w If just the road is built, then region A gets (1 - 10/5) = -4 in net benefits.

Region B, on the other hand pays its share of the costs and receives only

very small benefits (6 - 10/2) = +1.

w If just the water project is built, then region A gets most of the benefits but

pays only half the costs, (8 - 12/2) = +2. Region B gets its small benefit at

the cost of half of the water project, (2 - 12/2) = -4.

B. Illustration of the Pork Barrel Dilemma

i. Consider two programs with negative social net benefits, but majority

support from two narrow coalitions.

w If both projects are built, Region A gets (1-4) = -3 and region B gets (2 - 4)

= -2 in net benefits.

b. Each coalition has incentives to press for passage of their project, regardless

of what the other coalition does.

{ Notice that the payoffs in this case resemble those of a Prisoner's

dilemma game.

{ Each group has a dominant strategy

c. As a consequence, each project is adopted at the Nash equilibrium of

this game.

a. Each project has total costs that exceed its total benefits, but that regional

benefits are greater than regional costs under central government financing,

because of the use of general taxes.

b. For the purposes of illustration, assume:

w that a regional highway costs 10 billion dollars and provides 1 billion

dollars of benefits to region A and 6 billion dollars of benefits to region B.

w However, both coalitions would be better off if neither of the projects

were actually built!

w Assume also that a regional water project costs 12 billion dollars and

generates 8 billion dollars of benefits for region A, but only 2 billion dollars

of benefits for region B.

iii. The fiscal commons problem arises because of fiscal externalities. One

region's centrally funded programs impose costs on other regions, who

have to pay for those projects even though they receive little if any

benefit.

ii. The following game matrix can be used to illustrate this pork barrel

dilemma.

4

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

w Note that prices are higher for consumers, lower for firms, and overall

market output is lower than in the untaxed setting.

iv. This problem can be avoided by (i) making the regions fund their own

projects, (ii) by rigorously using cost benefit analysis, or (iii) by

adopting a generality rule (see Buchanan and Congleton 1998).

w (Students should work this linear taxation problem out as an exercise.)

a. (Explain why these three solutions would all solve the dilemma.)

b. (Are there other solutions that would also avoid the PD outcome while

allowing projects with positive net benefits to be built? For example, how

might user fees or benefit taxes be applied?)

iv. A tax-revenue maximizing government (leviathan) will set the tax

rate to maximize revenue (at the top of the Laffer curve).

w Given R = tQ* = (at-bt2)(c)/(b+c), the revenue maximizing tax can be

found by differentiating R with respect to t and setting the result equal to

zero:

V. Overlapping Tax Bases: The Fiscal Commons Problem

w t* = a/2b which implies that Q* = (1/2)(ca/(b+c))

A. In cases in which government fiscal authority is decentralized, there can

be competition between levels of governments, and in some cases

governments at the same level, over a tax base.

w Market output under leviathan taxation is exactly half the untaxed market

quantity, see part a.

v. Now suppose that taxes are imposed by two independent tax-revenue

maximizing governments, in which case t = t1 +t2 and tax revenue for a

single government is tiQ* ( where Q* can be written as in part b).

a. The problem of over using a given tax base is a fiscal externality problem is

similar to the fiscal commons problem for expenditures outlined above, but

in this case generates over taxation rather than over supply of services

b. (Of course, both phenomena may occur with the same federal government.)

c. The common tax base problem is one possible rational choice explanation

for taxation beyond the level that maximizes revenue in a Laffer Curve

diagram (Flowers, 1988).

w For government 1 this is simply

w R = t1Q* = t1 (a-bt)(c)/(b+c) = (a t1 - bt12 - bt1t2)(c)/(b+c)

w Differentiating with respect to t1 , setting the result equal to zero, and

solving for t1*, produces the best reply function for government 1:

B. Consider the case in which excise taxes are imposed by two tax revenue

maximizing governments on the same tax base (product or service

market).

i. Suppose that the demand curve for this market is: QD = a - bP and the

supply curve is QS = cP, with QD(P*) = QS(P*) in the pretax

equilibrium.

w t1* = (a-bt2)/2b

w A similar function can be derived for the second government:

w t2* = (a-bt1)/2b

vi. At the Nash equilibrium, both governments will be on their best reply

functions.

w In the absence of an excise tax, the market clearing price would have

equated supply and demand: cp = a - bP , which implies that

w Solving for the symmetric case, allows the Nash equilibrium taxes to be

characterized: ti** = a/3b

w P* = a/(b+c) and Q* = cP* = ca/(b+c)

ii. In the case in which an excise tax of amount t is imposed, the condition

for market clearing price(s) is QD(Pc*) = QS(Pc*-t) or c(Pc-t) = a - bPc.

iii. A bit of algebra allows the consumer and supplier price, market

output, and tax revenue to be determined:

w This implies a combined tax of t= a/3b +a/3 = 2a/3b at the Nash

equilibrium.

w Note that this is higher than the revenue maximizing tax found in part

c, (2/3)(a/b) > (1/2)(a/b).

vii. Two leviathan governments that rely on the same tax base would

jointly impose tax rates that are beyond the revenue maximum of a

Laffer curve.

w Pc* = (a+ct)/(b+c) ; Ps* = (a+ct)/(b+c) - t = (a-bt)/(a+b);

w Q* = (a-bt)(c)/(b+c) ; R = tQ* = (at-bt2 )(c)/(b+c)

5

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

{ Otherwise "public consumers" will vote with their feet and move to

other places that provide better value for their tax dollars (taking "their

tax bases" with them).

C. Students should work through the duopoly taxation problem as an

exercise.

{ What happens if the number of governments is N rather than 2?

{ Is this a more plausible scenario for democratic or autocratic

governments? Explain.

v. Intergovernmental competition does not always work as well as

Tiebout suggests, but this idea has informed a good deal of discussion

about the desirability of decentralizing the provision of services.

VI. Intergovernmental Competition: the Tiebout Model

B. Tiebout's model provides one of the strongest arguments in support of

decentralized governance.

A. Charles Tiebout (1954) pointed out that intergovernmental competition

between local governments can be very similar to competition between

firms in competitive markets.

w Decentralizing the provision of local services potentially allows voters to

get just what they want from goverment--no more and no less.

w That is to say, intergovernmental competition can generate patterns of local

public services and taxes that are Pareto efficient.

C. Although Tiebout may be a reasonable first approximation for

competition between local governments (and condo associations) within

a metropolitan area, clearly there are limits to its applicability--just as

there are limits to the applicability of his theory of perfect competition

in ordinary markets.

i. How sensitive are the Tiebout results to the assumptions?

i. Tiebout uses migration and changes in local tax bases to characterize a

perfectly competitive version of intergovernmental competition at

state and local levels.

a. He assumes that moving from one community to another is costless and

motivated entirely by differences in local public services and taxes.

b. He also assumes that competition for residents produces a wide range of

fiscal packages to choose from.

c. In this model, "tax and service competition" can be very similar to "price and

quality competition" in private competitive markets.

a. Clearly, the cost of moving between governments is not trivial, and tends to

vary with the level of government.

{ Does this imply that none of the predictions will hold up?

b. Or is there enough mobility into and out of communities within many

regions to put competitive pressure on local governments?

{ A large number of persons are always moving for other reasons and may

choose communities in large part for the combination of services and

taxes offered.

ii. In the limit, "voting with one's feet" produces a competitive

equilibrium among communities in which:

a. Each community provides its bundle of public services at least cost.

b. Every community is ideally sized to produce its bundle of services.

c. Each community's residents are "homogeneous" in their demand for local

public services.

d. Each voter-resident pays the marginal cost of his own services.

ii. Economies of scale or networks may reduce the number of

competing "town-firms" that can be sustained in a "Tiebout world" in

a manner that reduces the range of choice available to

voter-taxpayer-consumers.

iii. Such tax and service combinations meet the Lindalh conditions for

efficient provision of public services (as well as the Samuelsonian

ones).

iv. Note that this process does not require an effective political system to

achieve Pareto efficient results, only very mobile tax payers who can

take their part of the tax base with them.

{ The menu of government services that voter-taxpayer-consumers can

choose from may be more limited than the Tiebout model implies.

{ The effect of economies of scale parallel those in the microeconomic

analysis of perfect competition vs. monopolistic competition, oligopoly,

and monopoly.

{ In such cases, local politics will again be an important determinant of

citizen welfare.

{ In order to tax mobile resources, communities (towns, states, and

countries) have to provide services commensurate with their tax costs.

iii. The existence of intergovernmental externalities may also imply that

some services are under provided locally and others are over provided.

6

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

a. The logic closely parallels our earlier analysis of externalities between

individuals and/or firms.

{ NIMBY problems may also emerge.

{ Transfer programs may be underprovided.

b. Solving externality and public goods problems may require "treaties-Coasian

contracts" or "interventions by other levels of government."

i. Consider the case of regulations and taxes that affect pollution within a

state.

ii. A community's regulations tend to affect the behavior of firms and

consumers who produce effluents, but only those that live in the

territory governed by the local government are directly affected by its

regulation.

iii. By affecting the level of externalities (or in some cases by producing

local public services) local governments produce benefits or impose

costs on persons living in other communities.

D. The existence of economies of scale and externalities provide an

economic rationale for federal systems with several "levels" of

government with responsibilities for providing services in different

sized jurisdictions.

{ For example, the more stringent a community's regulations are, the less

likely it is that effluents are emitted in a way that affects other

communities.

{ If Tiebout worked perfectly, it would imply that an efficient federal

government would be composed largely of local governments with a very

small central government with the sole task of guaranteeing citizen

mobility among communities.

{ (Explain why)

C. The local nature of politics implies that the government of one territory

is not likely to take account of the spillove costs or benefits that it

imposes on neighboring territories.

VII. Externalities and Regional Governments

D. For example, a "race to the bottom" may emerge if towns compete to

attract (polluting) industry (and tax base) by lowering environmental

regulations to attract firms to their communities.

i. A 3x3 game matrix can be used to illustrate the problem (see below).

A. All levels of governments can address externality problems through the

measures previously discussed: civil law, direct regulation, taxation and

subsidization, tradable permits etc.

i. However, there are limits to every government’s ability to solve an

externality, in the sense of limiting them to Pareto efficient levels.

ii. Some externalities are too broad to be handled by a single government.

The Race to the Bottom Dilemma

{ Regional environmental externalities often arise from the use of air and

water systems as a methods of disposing of undesirable substances

(pollution).

{ Global warming is partly a worldwide externality problem and there is not

world government.

Community B's environmental Regulations

weak

moderate

strong

A,B

A,B

A,B

weak

6,6

8,4

9,2

moderate

4,8

7,7

8,5

strong

2,9

5,8

6,6

A's env regs

iii. It also bears noting that governmental reglatory and tax policies

generate externalities, as in the fiscal commons problem above and in

the “race to the top” and “race to the bottom” cases developed in this

section.

iv. There are a wide variety of spillovers among communities and among

countries.

B. In many cases the existence of inter-state externalities implies that the

state regulations (or taxes) produce costs or benefits for other

communities.

ii. The payoffs can be thought of as (i) social surplus if governments are

benevolent social net benefit maximizers, (ii) votes if they are

competitors in democratic community elections, or (iii) as utility levels

7

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

of the median voter if the strong form of the median voter theorem

holds in the two communities, states, or nations.

{ The payoffs have been constructed to illustrate the problem of interest.

{ Note that both communities have pure dominant strategies (weak

regulations).

{ The (weak, weak) cell is, consequently, the Nash equilibrium of the game.

The Race to the Top Dilemma

NIMBY

iii. The Nash equilibrium involves too little environmental regulation in

the sense that a Pareto superior move exists at the Nash equilibrium.

Community B's environmental Regulations

a. Note that there is a Pareto superior move (at the level of governments) from

(weak weak) to (moderate moderate) regulations.

b. The median voter of both these communities could potentially benefit by

coordinating their regulations and agreeing to adopt somewhat stronger

regulations.

weak

medium

strong

A,B

A,B

A,B

weak

6,6

4,8

2,9

medium

8,4

7,7

5,8

strong

9,2

8,5

6,6

A's env regs

iv. Note that this problem is very much like the free rider problem

associated with private efforts to adopt pollution reducing products,

and could be represented geometrically as well.

{ In such a diagram, the regulation would be set at the median voter's

optimal level, but there would be a spillover external benefit from the

regulation that affects neighboring communities.

{ (Try drawing such a diagram as an exercise. )

iv. Similar NIMBY-type regulatory problems also occur for locating

power plants, refineries, airports, shopping malls, and interstate

highways.

v. Such "political prisoner's dilemma games" are sometimes called

instances of "government failure" as opposed to "market failure.,"

because they arise because of the actions of government (rather than

inaction).

E. The opposite regulatory externality problem--over regulation--can also

occur.

i. A "race to the top" (NIMBY) tends to emerge if towns compete to

discourage polluting industries from locating in their communities by

enacting strict environmental regulations.

VIII. Inter-regional externality problems

{ NIMBY is an acronym for Not In My Back Yard.

{ For example, towns (etc.) may want to discourage land fills, incinerators,

water treatment plans, or nuclear waste facilities from locating in their

jurisdictions.

A. Some externality problems are "too large" to be dealt with by a single

local government, but are not reciprocal (symmetrical) in the sense of

the previous illustrations.

i. In some cases, the regulatory externality is "one way," because all of

the benefits of additional regulations or costs of effluents fall entirely

on persons outside the community.

ii. A 3x3 game matrix can be used to illustrate the problem (see below).

iii. The Nash equilibrium involves too much environmental regulation in

the sense that a Pareto superior move exists at the Nash equilibrium

{ Note that there is a Pareto superior move from (strong strong) to

(medium medium) regulations.

{ The median voters of both these communities could potentially benefit by

coordinating their regulations and agreeing to adopt somewhat weaker

regulations.

{ (Such might be the case in the tall smoke stack example discussed in class

if the wind always blows in one direction.)

ii. In such cases, community A’s regulations affect community B, but

community B’s regulations do not affect community A.

8

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

ii. Electoral pressures may induce higher levels of government to adopt

policies that affect all the emissions sources and all of the benefits and

costs, rather than just a subset of them.

iii. Higher levels of government may also attempt to induce the local

government to coordinate their regulatory policies.

B. Such asymmetric cases, resemble the "race to the bottom" game,

because each community has an incentive to under-regulate the

externality in question.

i. Communities in asymmetric cases have no interest in regulating the

emission.

ii. There will again be unrealized gains from coordinating regulations

within the communities affected by the externalities, but they cannot be

realized by simply "trading regulations."

{ For example, governments state governments may mandate particular

local regulations or provide Pigovian subsidies or taxes that induce

communities to coordinate their regulatory decisions.

iv. They may also support agreements between communities by granting

authority to negotiate such agreements and by enforcing the

agreements in state or national court systems.

a. In such cases, the affected communities down wind or down stream will have

to compensate the community that can potentially regulate the emissions

source for the cost of doing so. (Some form of "side payment" will be

necessary.)

b. (Use a diagram and a game matrix to illustrate the nature of this regulatory

externality problem.)

C. Note that the externality arguments for centralization are not based on

the properties of the environmental or other externality problems, but

on defects in political decision making associate with addressing

those problems.

IX. Solutions to Regulatory Externality Problems

{ It is an attempt to address government rather than market failures.

A. One solution for regulatory externality problems is for the towns to

meet and work out a "Coasian" agreement to internalize the externality

problem.

i. In the cases of regulatory externalities, the communities can agree to

tighten up or relax the relevant environmental regulations.

ii. In the case of asymmetric externalities, communities downwind or

down stream can make cash payments or provide other services to the

community that controls the externality.

iii. Note that the such agreements are struck by governments rather

than all affected parties, and so are Pareto superior moves only at

the level of governments.

iv. (In the case of nation states, these Coasian contracts are called

treaties.)

D. There are many cases in which a l government cannot adopt Pareto

efficient regulations or service levels--even if it wants to--because part

of the problem is generated by persons or companies outside their

jurisdiction.

i. In international cases, the only possible solutions at present are

Coasian contracts (regional alliances or treaties).

w National may negotiate with each other and sign agreements to coordinate

policies or to create a "special use district" of the same "size" as the

externality.

w Such contracts are also possible within federal systems in which a subset of

local or regional governments agree to coordinate their policies.

w (Examples include airport and transit authorities, as with those between

NY, NJ and CN, or between VA, MD, and DC.

B. Another solution to such "regulatory externality" problems is to shift

policy responsibility to higher levels of government that can

"coordinate" the selection of environmental regulations or mandate

regulations across the communities of interest.

i. A county or state government should, in principle, take account of

county or statewide benefits.

ii. Most substantive international treaties and most international

organizations are products of Coasian contracts and most address

international externality problems of various kinds.

a. For example, in the various international environmental treaties, countries

agree to strengthen various environmental regulations to deal with an

international externality.

9

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

b. Examples include international water commissions (US and Canada, Sweden

and Denmark) and international environmental treaties.

i. Services with global economies of scale should be provided by the

national government (national defense, macroeconomic policy,

redistribution)

ii. Services with that require relatively large service areas or numbers of

customers should be produced by state governments. (regional

highways, higher education, etc.)

iii. And services that can be effectively provided in relatively small service

areas or for relatively small customer bases should be provided by local

governments. (police and fire protection, elementary education, local

roads, sanitation services etc.)

E. International organizations rarely have coercive authority and so rarely

can impose solutions, but they can serve as a forum for working out

Coasian contracts.

i. Adjacent countries may ask states to regulate "county externalities,"

states form a treaty organization that makes recommendations about

“international” regulatory externalities.

ii. In Europe the regulation of many international externalities is

coordinated by the European Community.

{ (Note that the simple production-based arguments imply that particular

services should be provided by only a single level of government.)

a. Note that this solution is of limited value for international regulation and

public good problems because there are no world or continental

governments.

iv. Addressing problems of intergovernmental externalities and

economies of scale will require governments with larger jurisdictions

than those that provide local fire protection.

{ The results of Coasian contracts can be highly imperfect (relative to Pareto

optimality) in international settings. Discuss some of these.

X. The Economic Logic of Assigning Fiscal Responsibilities to

Different Levels of Government

$/G

A. The Tiebout case for decentralization suggests that services should be

provide by government's with the smallest jurisdictions (territories)

sufficient to realize all economies of scale for the service of interest.

Losses from Cenralized Mandates of Uniform Provision

of Local Public Services

Reduced NSB = a' + b' +c'

a. Oates (1972) develops this point more formally with his decentralization

theorem.

b. The EU adopts this idea with its "subsidiarity principle."

MBal

B. The externality and commons arguments reach similar conclusions.

Responsibility for “internalizing” externalities should be placed at the

smallest governmental level large enough to address the externality.

MBbob

c'

a. As noted above there are a variety of policy solutions for commons and

externaltity problems and a variety methods through which such solutions

can be chosen.

b. However, the best match between local demands and policies occurs in

decentralized systems.

c. See Ostrom (1990)

a'

c'

MC

b'

MBcathy

G*c

G*b

Qcentral

G*a

Q of governmetnt Service

(G )

C. The optimal size of governmental units (territories) that provide

particular services can be analyzed by studying economies of scale in

producing the services of interest..

10

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

D. Wallace Oates (1972) argues that if policy or service X has an effect on

region Z, then the whole region should be managed by one government.

ii. In this case, there is a conflict (tradeoff) between avoiding Nimby and

"race to the bottom" problems, and benefiting from decentralization.

a. (Use two community SMB curves facing the same MC to show the losses

from uniform rules that address local environmental problems.)

i. Similarly, it can be argued that the "service district" (regional governed)

should be large enough to realize all economies of scale in producing

the service of interest.

iii. In cases in which the subjective costs and benefits of externalities vary

among communities, the level of government that can best handle the

externality problems is not always clear.

a. For example, some forms of education, police services, and environmental

regulation have only local effects.

b. The Oates-Tiebout analysis suggests that responsibilities for those services

should be local rather than state or national.

c. (Variety is good in the Oates-Tiebout framework.)

d. (Would fiscal equalization make sense in this framework? Discuss.)

B. These production and externality-based economic arguments, however,

neglect the advantages of variation in the services provided and also the

political costs associated with larger regional governments with greater

monopoly power.

i. There are political costs associated with merging quite different areas

into a single metropolitan area.

ii. On the other hand, other services tend to have regional effects as with

commuter networks, other forms of air and water pollution, and some

forms of police authority.

iii. Large--but not national--externality problems, such as lake or river

water pollution can be best addressed by state government or regional

consortiums of states.

iv. There are evidently great economies of scale in military force, which

suggest that national governments should have responsibility for this

service.

a. The community becomes more heterogeneous.

b. Monitoring costs tend to increase.

c. Each voter has a smaller effect on service levels through his locational choice

and voting behavior.

d. Competition tends to fall as the number of government service packages

diminishes.

w (Indeed, come "community mergers" may be just cartelizing behavior by

local politicians who attempt to escape from competitive pressures.)

w Similarly, insofar as the advantages of free trade zones increase with size, so

the national government should have responsibility for maintaining free

trade within the nation.

ii. It also bears noting that carefully assigning fiscal responsibilities to

specific levels of government is only one method of addressing these

kinds of problems.

a. Other solutions also exist, as noted in our previous analysis of solutions to

externality problems.

b. One can also use mandates and Pigovian subsidies and taxes (conditional

grants) to address intergovernmental externality and public goods problems.

c. The federal structure can also be left a bit open ended so that communities

and states can form "consortiums" or "regional authorities" to address

regional interests. (Treaties or Coasian Contracts).

XI. Political and Economic considerations when assigning or

revising responsibilities among governments.

A. Centralization has both economic and political costs.

i. Centralization often implies that environmental regulations that address

local problems will (usually) become uniform among the communities,

which tends to be inefficient if "average" preferences for

environmental quality differs among communities.

C. The best (utilitarian or contractarian) assignment of authority for

providing services to specific levels of government (should) take

account of both economic and political costs.

a. If communities differ in their demand for environmental quality because

their tastes or income differ then a uniform regulation will tend to generate

fewer net benefits for the state than a pattern of regulations that reflect

differences in demand.

11

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

ii. Differences in the bargaining power and interests among participating

governments is likely to affect the distribution of fiscal and regulatory

authority adopted.

D. It bears noting, however, that in practice the degree of decentralization

that occurs within a polity is determined by constitutional and

quasi-constitutional negotiations rather than by utilitarian philosophers

or economists.

C. In Practice, a good deal of asymmetry is observed within federal and

confederal systems.

i. For example, in Spain, Navarra and the Basque communities have

formal tax and expenditure powers beyond those of the other

"autonomous communities."

XII. Endogenous Decentralization and Asymmetric Federalism

A. Most economic models of federalism assume that each government at a

given level has the same authority to make fiscal and regulatory

decisions. However, the assumption of uniform jurisdictional size and

power is not completely accurate.

i. For example, we observe significant differences in physical size,

population, income, and political representation for state and local

governments.

{ Galicia and Catalonia have special authority over education, language, and

culture.

{ In Canada, Quebec has special powers to encourage the use of the

French language and protect the French-Canadian culture.

{ In the United Kingdom, the Scottish Parliament has significantly more

policy-making authority than the Welsh Parliament.

{ In the United States, Indian reservations have their own specific taxing

and regulatory authority that differ from those of ordinary state

governments.

{ California, the most populous state, has unique powers of environmental

regulation.

{ In China, Hong Kong has been granted unique legal and political

institutions: "one country, two systems."

a. In the United States, California is physically the third largest state with 11%

of the citizens, whereas Wyoming, the sixth largest state includes less than

1% of the U. S. population.

b. Requejo (1996) notes that New South Wales includes 35% of the population

of Australia, whereas Tasmania includes less than 3%. North Rhine Westfalia

includes some 21% of the population of Germany, whereas Bremen includes

less than 1% of the population.

c. Uttar Pradesh includes 16% of the population of India, whereas Sikkim

includes less than a twentieth of one percent.

ii. Large cities in many countries often have powers of taxation and

regulation that smaller cities lack or rarely use.

ii. That population and population densities vary so widely implies that

demands for local services also tend to vary widely among these

regional governments and, moreover, implies that political power

within their respective democratic central governments is also likely to

vary widely by state, lander, and province.

{ New York City and Washington D. C. have their own income and sales

taxes.

iii. Asymmetries are also common among the members of large

international organizations.

{ In the European Union, some members retain more autonomy than

others inasmuch as they have opted out of or delayed membership in the

menu of treaties that define the responsibilities of affiliated countries.

{ The responsibilities of members of the United Nations with respect to

military armaments, human rights, and environmental regulations are

similarly defined through a series of treaties with quite different

signatories.

{ Different nations formally retain different degrees of autonomy both

within and without these very decentralized confederations.

B. That regional interests and bargaining power vary is important for fiscal

federalism, because national constitutions do not fully specify the degree

of decentralization within a nation at any single point in time or through

time.

i. Rather, the degree of decentralization is determined by a series of

political bargains within and between national and regional legislatures

in which both the details of policy and the powers to make policies are

negotiated and renegotiated through time.

12

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

a. Individuals prefer to work for firms that are close to the rail lines, and

consumers prefer to live and shop at stores near the rail lines—other things

being equal—because the net of transport real wages are higher and net of

transport prices are lower along the rail lines.

b. This increases net benefits and profits for consumers and firms located near

the rail lines.

c. Moreover, rental revenue from the right of ways allows the favored city to

reduce other tax rates within the city.

D. Service differences across communities may also emerge in both

decentralized and unified states, because communities may have unequal

influence over the decisions of the central government because of

differences in population, political heterogeneity, history, or size.

i. For example, equal representation by population often implies unequal

representation by regions or economic interests, and vice versa.

{ In the US, some states have far more influence in the House than in the

Senate, and these differences have been shown to influence the pattern of

intergovernmental grants

iii. Given these economic advantages, persons and firms from within the

favored city and throughout the country of interest will attempt to

relocate near to the rail lines of the favored city.

ii. Unequal influence within the central government implies that central

government policies will often favor some regions or communities over

others.

{ In principle, the favored city continues expanding its rail network and

attracting tax base up to the point where the marginal increase in revenue

and tax base generated by an extra kilometer of new right of way equals

the marginal cost of the right of way less any loss in tax base generated by

investor fears concerning the use of eminent domain—or until no private

firm is willing to expand its rail network because traffic densities are too

low to recover its costs. The latter, of course, expands outward from the

city center as immigration of capital and labor occurs.

{ Analysis of variation voting power has a long and distinguished history in

the public choice literature. (See for example: Mueller, 1989.)

{ However, this form of asymmetry is not the same as that analyzed here in

which regional governments acquire different degrees of local

policy-making authority.

E. Asymmetric federalism exists whenever governments at the same

level of geographic responsibility—towns, counties, cities, or

states—have different regulatory and fiscal powers.

iv. Although there is a limit to the urban growth encouraged by this city’s

unique power of eminent domain, the favored city becomes an

important commercial and cultural center well before this limit is

reached. Its internal market and population expands.

{ Such differences in policy authorities create a "supply-side" source of

variation in government services, regulations, and taxes in addition to the

standard demand-side variation in local demand stressed in models of

local fiscal competition.

{ Specialization increases; and wages and profits increase as productivity

rise.

{ Other cities that have to rely entirely upon private provision of rail

services falter, because holdout problems make assembling long right of

ways very difficult—indeed intractable—for private firms acting alone.

{ The more autonomous city grows and prospers—while other similar

cities that would have copied the strategy of the favored city are legally

unable to do so.

F. For example, consider the case in which only a single city is granted

authority to use eminent domain to produce “right of ways” for light

rail transport services.

i. Suppose that the favored city sells or rents the right of ways to private

railroad companies.

a. This provides the city with a unique source of revenue and also a unique

economic advantage.

b. Both effects allow the more autonomous government to provide a more

attractive fiscal and economic environment for its residents than possible for

otherwise similar governments.

v. Other local fiscal and regulatory "privileges" can have similar effects,

insofar as the additional authority allows favored governments to

provide a more attractive fiscal package than legally possible for other

similar governments.

G. Asymmetric federalism may take a variety of institutional forms.

i. Specific asymmetries may be created by a nation’s constitution by

assigning different areas of competency to various regions of the

country.

ii. Light rail has the effect of reducing transport costs to city apartments,

shops, and factories that operate in an otherwise competitive market.

13

EC741 Public Economics Handout 12: Fiscal and Regulatory Relationships Among Governments

ii. Alternatively, the constitution may allow the possibility of alternative

internal arrangements that allow the formation of many levels and

combinations of fiscal authority.

{

H. Surprisingly little research has been done asymmetric forms of

federalism.

i. Tiebout, 1956, and Oates, 1972, pioneered the economic analysis of

fiscal federalism and intergovernmental relationships.

a. For example, a national constitution may simply allow states to organize

themselves into various subnational organizations of states, cities, or

counties.

b. An international treaty organization may allow a subset of member states to

pursue their own interests within the terms of the treaty.

a. Inman and Rubinfeld (1997) provide a nice survey of issues in subsequent

literature.

b. Molander (2004) provide a more international review of fiscal federalism in

unitary states.

c. Qian and Weingast (1997) elaborate the role that federalism can play in

solving various commitment and information problems.

iii. This possibility allows a range of federal structures that is more

complex than normally analyzed by economists. However, it is clear

that that many internal organizational structures tend to produce

asymmetric forms of fiscal federalism.

ii. None of these papers or books includes any reference or comments on

asymmetric forms of federalism.

a. The figure below illustrates one such internal structure.

If we interpret the interregional government as another level of centralized

control, it is clear that local government 1 retains more autonomy than local

governments 2 and 3, because it is not bound by the decisions of the

regional government, if the regional government is not granted exclusive

areas of competency.

a. Requejo (1996) analyses some general features of existing asymmetries within

modern states.

b. Congleton, Bacarria, and Kyriacou (2003) analyze the political foundations of

asymmetric distribution of authority within nation states and international

organizations.

Internal Institutional Asymmetry

within

Federal Governments

Central

Government

Inter Regional

Organization

Regional

Government 1

Regional

Government 2

Regional

Government 3

14