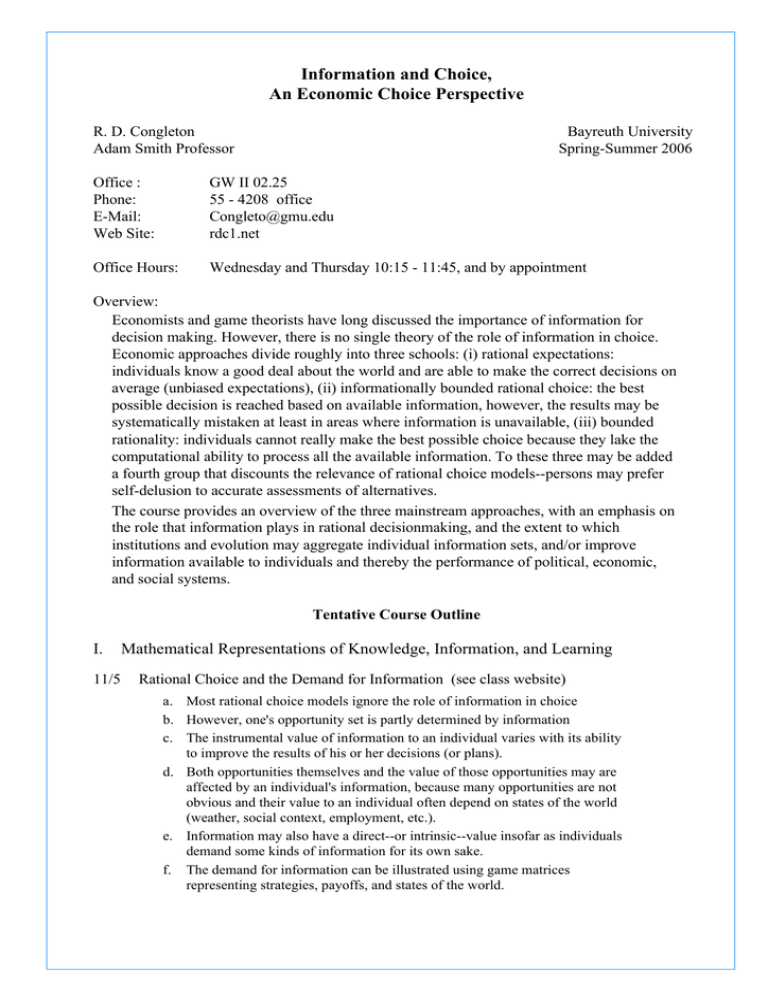

Information and Choice, An Economic Choice Perspective

advertisement

Information and Choice, An Economic Choice Perspective R. D. Congleton Adam Smith Professor Bayreuth University Spring-Summer 2006 Office : Phone: E-Mail: Web Site: GW II 02.25 55 - 4208 office Congleto@gmu.edu rdc1.net Office Hours: Wednesday and Thursday 10:15 - 11:45, and by appointment Overview: Economists and game theorists have long discussed the importance of information for decision making. However, there is no single theory of the role of information in choice. Economic approaches divide roughly into three schools: (i) rational expectations: individuals know a good deal about the world and are able to make the correct decisions on average (unbiased expectations), (ii) informationally bounded rational choice: the best possible decision is reached based on available information, however, the results may be systematically mistaken at least in areas where information is unavailable, (iii) bounded rationality: individuals cannot really make the best possible choice because they lake the computational ability to process all the available information. To these three may be added a fourth group that discounts the relevance of rational choice models--persons may prefer self-delusion to accurate assessments of alternatives. The course provides an overview of the three mainstream approaches, with an emphasis on the role that information plays in rational decisionmaking, and the extent to which institutions and evolution may aggregate individual information sets, and/or improve information available to individuals and thereby the performance of political, economic, and social systems. Tentative Course Outline I. 11/5 Mathematical Representations of Knowledge, Information, and Learning Rational Choice and the Demand for Information (see class website) a. Most rational choice models ignore the role of information in choice b. However, one's opportunity set is partly determined by information c. The instrumental value of information to an individual varies with its ability to improve the results of his or her decisions (or plans). d. Both opportunities themselves and the value of those opportunities may are affected by an individual's information, because many opportunities are not obvious and their value to an individual often depend on states of the world (weather, social context, employment, etc.). e. Information may also have a direct--or intrinsic--value insofar as individuals demand some kinds of information for its own sake. f. The demand for information can be illustrated using game matrices representing strategies, payoffs, and states of the world. 18/5 Statistical representations of information, theories, and states of the world. a. b. c. d. Information as accuracy. Information as bits. Imperfect information as uncertainty. Imperfect information as ignorance. Learning as increasing certainty (Bayes Law). In contrast with learning as reductions in ignorance, which may increase uncertainty. e. Necessity of mistakes in rational choice models with limited information. f. Conservatism and rules of thumbs as methods of economizing on information 25/5 Rational decision making with imperfect information. a. b. c. d. e. f. Knight's distinction between Risk and Uncertainty Markets for assigning risks Is invention search, discovery, or risk allocation? The cost of processing information: time, attention, and creativity Normal science as search (Popper). Paradigm shifts as reductions in ignorance (Kuhn). II. Economics and Information 1/6 Markets as Information Aggregation Arrangements a. b. c. d. 8/6 Disaggregated Information Coordination as a method of Information Aggregations. Prices as information Usefulness and limits of perfect information assumptions of perfectly competitive models. The Demand for Information a. b. c. d. 15/6 (see class website) Stigler's search model How informed can informational demand actually be? Subjectivism of information demand: prudential and subjective purposes The demand for human capital The Supply of Information a. Production of Information: Signaling and Advertising b. Wasteful and productive signaling games c. Production of Information: intermediate informational goods, partially processed information d. Production of Information: public education e. Production of Information: cheap talk 22/6 Rational Expectations? a. b. c. d. e. f. As a substitute for the perfect information assumptions As a definition of "rationality" Specialization and Local Information as justifications Ignorance and the Dilemma of the Expert Is a sucker born every minute? Regulatory solutions for asymmetric information problems: fraud laws and warrantees III. Information and Politics 29/6 Rational Ignorance and Elections a. b. c. d. 6/7 (see class website) Review of the spatial voting model The median voter model Democratic mistakes: fiscal and other regulatory illusions Illustration: Crisis Management Condorcet's Jury Theorem and Galton's theory of median estimation a. On the informational aggregating potential of committees: perspective, experience and estimation b. Median estimation and the normal distribution c. Imperfect information and estimating candidate quality d. Ignorance and estimating candidate quality e. Majority rule as information aggregation: the properties of median estimators IV. Information, Institutions, and Evolution 13/7 Evolution and Society as Information Filters a. b. c. d. 20/7 (see class website) Prof. Hegselmann's simulated information networks Convergence in the short and long run Role of experts Prudential and social limits on subjectivity More on Markets as Information Aggregating Devices a. Betting Markets b. Evidence and Theory c. Limits to betting--are lottery players rational? 27/7 Conclusion and Overview: the role of information in choice a. b. c. d. e. Information as the medium of analysis and decision making Error detection and correction Informationally bounded rationality Subjectivism and the demand for "truth" Institutional solutions to informational dilemmas Grades: 2 Point Version of the Class: Take Home Exam 10 Point Version of Class: Take Home Exam (20%) and Term Paper (80%)