A Model of Capital and Crises Zhiguo He Northwestern University and NBER

advertisement

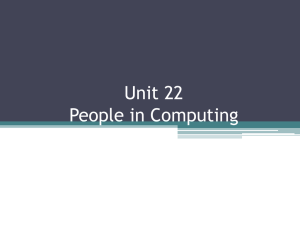

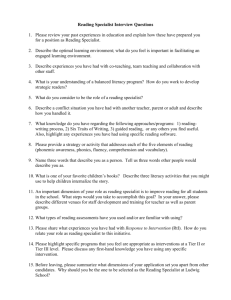

A Model of Capital and Crises Zhiguo He Booth School of Business, University of Chicago Arvind Krishnamurthy Northwestern University and NBER AFA, 2011 Introduction I I Intermediary capital can a¤ect asset prices. We study the role of distressed intermediary capital in the crises of market with complex asset classes (e.g. MBS). Introduction I I I Intermediary capital can a¤ect asset prices. We study the role of distressed intermediary capital in the crises of market with complex asset classes (e.g. MBS). A General Equilibrium (GE) model where intermediaries, rather than households, are marginal. I I I I Frictions are endogenously derived based on optimal contracting considerations. Mechanism: Intermediation capital a¤ects participation/risk-sharing. In normal times households participate through intermediation; When intermediaries su¤er losses, I I Distressed intermediary sector averse to hold risky positions, risk premium goes up. Households “‡y to quality,” drive down interest rate. Model Structure (1) I Unit supply of risky asset with dividend riskless asset in zero-net supply. I I I I hR ∞ 0 e ρh t i ln cth dt . Limited participation in risky asset market. They invest in intermediaries. Specialists E I = gdt + σdZt , and Risky asset price Pt and interest rate rt are determined in GE. Households E I dD t Dt R∞ 0 e ρt ln ct dt , ρ < ρh . They run intermediaries. Only intermediaries/specialists can invest in the risky asset. They are marginal investors. Derive Intermediation Constraint from moral hazard primitives. Model Structure (2) The economy. I I Intermediation: 1) Short-term contracting between agents; 2) Equilibrium in competitive intermediation market; Asset pricing: 3) Optimal consumption/portfolio decisions; 4) GE. The Heart of the Model: (equity) Capital Constraint I Say household with wealth Wth , and specialist with wealth Wt . I I I Given specialist’s contribution Wt in the intermediary, household contributes Tth as equity investment (for risk sharing). Capital Constraint: Tth is capped at mWt so risk sharing is capped at 1 : m. Intermediation capacity mWt is increasing in the specialist’s contribution Wt , as re‡ection of agency friction. The Heart of the Model: (equity) Capital Constraint I Say household with wealth Wth , and specialist with wealth Wt . I I Given specialist’s contribution Wt in the intermediary, household contributes Tth as equity investment (for risk sharing). Capital Constraint: Tth is capped at mWt so risk sharing is capped at 1 : m. I Intermediation capacity mWt is increasing in the specialist’s contribution Wt , as re‡ection of agency friction. I How to interpret m? 1. Intermediary capital requirement: outside/inside contribution ratio; (Holmstrom-Tirole, QJE) I O¢ cers/Directors inside holdings in …nancial industry around 18%. 2. Incentive contract— the performance share of hedge fund managers. Think of “2 and 20.” 3. Mutual funds’‡ow-performance sensitivity. Specialist’s Wt tracks his past gains and losses (Shleifer-Vishny, JF) Intermediation Constraint: An Example (1) I Say m = 1, Wth = 80. Comparing Wth to mWt . I Unconstrained Region: Wt = 100. Then Tth = Wth = 80; I I Zero net debt. Risky asset price Pt = Wt + Wth = 180. Fund’s total equity 180. Intermediary holds risky asset without leverage, …rst-best risk sharing. Intermediation Constraint: An Example (2) I Constrained Region: Wt = 50. Then Tth = mWt = 50; Intermediation Constraint: An Example (2) I I I Constrained Region: Wt = 50. Then Tth = mWt = 50; Intermediary’s total equity is 50 + 50 = 100. But Pt = 130. In equilibrium, the intermediary borrows 30 from the debt market; I I I It is supplied by households Wth Specialist and household have equal shares in the intermediary; Specialist’s leveraged position in risky asset: α= I Tth = 30. 130/2 specialist’s portion of asset = = 130%. specialist’s equity 50 Risk premium has to adjust to make this high leverage optimal. Risk Premium and Interest Rate Interest Rate Risk Premium 0.05 0.7 m=4 m=6 0.6 0 0.5 c w (m=6)=9.07 0.4 c w (m=6)=9.07 0.3 c w (m=4)=13.02 -0.05 c w (m=4)=13.02 m=4 m=6 0.2 -0.1 0.1 0 0 5 10 15 Scaled Specialist's Wealth w 20 25 0 5 10 15 Scaled Specialist's Wealth w 20 25 Intermediation Stage Game I Short-term contracts only. At time t, contract from t to t + dt. I Household with wealth Wth , and specialist with wealth Wt . I Household contributes Tth , specialist Tt . TtI = Tth + Tt . Intermediation Stage Game I Short-term contracts only. At time t, contract from t to t + dt. I Household with wealth Wth , and specialist with wealth Wt . I I Household contributes Tth , specialist Tt . TtI = Tth + Tt . Specialist in charge of intermediary. Moral Hazard: 1. Unobserved due diligence action st = f0, 1g. I Shirking (st = 1) reduce return by X t but brings private bene…t B t . 2. Unobserved portfolio choice EtI (dollar exposure to risky asset); I I Undoing activity. Not crucial. Fund’s return EtI (dRt rt dt ) + TtI rt dt st Xt dt, private bene…t st Bt dt. Focus on implementing working. Intermediation Contract I A¢ ne contracts for sharing returns. I βt : specialist’s share; K̂t dt: transfer to specialist. βt TtI I Set Kt I Dynamic budget constraint 8 < dWt = rt Wt dt ct dt + βt EtI (dRt I : dWth = Tt rt + K̂t . rt Wth dt cth dt + (1 βt )EtI rt dt ) + Kt dt, (dRt rt dt ) Kt dt. Reduce contract to ( βt , Kt ). Sharing rule and fee. I I Specialist chooses Et = βt EtI . Household buys risk exposure Eth = (1 βt )EtI from intermediary. In competitive intermediation market, the fee will take some simple linear form. IC Constraint and Maximum Household’s Exposure I IC constraint: specialist bears at least a certain fraction of risk. I I I I Incentive provision. Skin in the game. Bt No shirking: βt Xt Bt 0 ) βt Xt A lower bound on βt . 1 1 +m . Specialist always chooses βt EtI = Et independent of βt . I In the paper we show Et is independent of K . IC Constraint and Maximum Household’s Exposure I IC constraint: specialist bears at least a certain fraction of risk. I I I I Incentive provision. Skin in the game. Bt No shirking: βt Xt Bt 0 ) βt Xt A lower bound on βt . Specialist always chooses βt EtI = Et independent of βt . I I EI t In the paper we show Et is independent of K . fund’s total risk exposure. S: Et = βt EtI , H: Eth = (1 I βt ) EtI . Household exposure from the contract, or exposure supply: Eth = (1 I 1 1 +m . As βt 1 1 +m , βt )EtI = 1 βt βt Et . households maximum exposure Eth m Et . Key Intuition and Equity Implementation I I The households exposure is capped due to agency frictions Eth mEt . It caps a risk-sharing rule between households and specialists. I I Incentive provision implies that specialists have to bear su¢ cient risk. In bad times this friction kicks in. I Even if specialists wealth is low, they still have to bear disproportionally large risk. Key Intuition and Equity Implementation I I The households exposure is capped due to agency frictions Eth mEt . It caps a risk-sharing rule between households and specialists. I I Incentive provision implies that specialists have to bear su¢ cient risk. In bad times this friction kicks in. I Even if specialists wealth is low, they still have to bear disproportionally large risk. I Equity implementation: Households (outsiders) cannot hold more m (equity) shares. than 1 + m I Equity capital constraint: Given specialist’s equity Wt , households can make at most mWt equity contributions. I Recall contract ( βt , Kt ) . We have derived equilibrium βt . What determines fee Kt ? I Households pay competitive fees in the intermediation market. Competitive Intermediation Market At time t, specialists make o¤ers ( βt , Kt ) to households who can accept/reject o¤ers. The intermediation market reaches equilibrium if: 1) βt is incentive compatible; 2) no pro…table deviation coalitions. Lemma: In equilibrium, households face a per-unit-exposure price of kt 0: to purchase Eth , he has to pay Kt = kt Eth . I Idea: equivalence between core and Walrasian equilibrium. I I Households and specialists form coalitions to chop o¤ the exposure linearly. Now we start studying agents’consumption/portfolio problems. Households’ Consumption/Portfolio Rules I Log investors. Simple consumption rule; myopic mean-variance portfolio choice. I Risky asset excess return dRt rt dt = π R ,t dt + σR ,t dZt . hR i h ∞ Household max E 0 e ρ t ln cth dt subject to I fc t ,Et g dWth = Wth rt dt I I cth dt + Eth (dRt rt dt ) kt Eth dt. Standard problem; households achieve exposure Eth by paying per-unit-cost of kt . Optimal consumption cth = ρh Wth , optimal exposure π k Eth = Rσ,t2 t Wth . R ,t I Optimal risk exposure is decreasing in exposure price kt . Specialists’ Consumption/Portfolio Rules 1 βt βt Et I The specialist supplies an exposure I kt , he gets intermediation fees Kt dt = kt R∞ The specialist is solving: max E 0 e I 1 βt βt Et ρt fc t ,Et , βt g dWt = Et (dRt I . Given exposure price rt dt ) + max βt 2[ 1 +1m ,1 ] 1 βt βt dt. ln ct dt subject to kt Et dt + Wt rt dt ct dt. i h βt = 1 +1m if kt > 0, otherwise βt 2 1 +1m , 1 if kt = 0. Exposure supply schedule. Et is the exposure expected by households, and must coincide with the specialist’s actual optimal choice in REE. Specialists’ Consumption/Portfolio Rules 1 βt βt Et I The specialist supplies an exposure I kt , he gets intermediation fees Kt dt = kt R∞ The specialist is solving: max E 0 e I I 1 βt βt Et ρt fc t ,Et , βt g dWt = Et (dRt I . Given exposure price rt dt ) + max βt 2[ 1 +1m ,1 ] 1 βt βt dt. ln ct dt subject to kt Et dt + Wt rt dt ct dt. i h βt = 1 +1m if kt > 0, otherwise βt 2 1 +1m , 1 if kt = 0. Exposure supply schedule. Et is the exposure expected by households, and must coincide with the specialist’s actual optimal choice in REE. π Solution: ct = ρWt and Et = σ2R ,t Wt , and specialists receive fee R ,t of Kt = qt Wt where qt = 1 βt βt kt π R ,t . σ2R ,t Unconstrained vs. Constrained Regions (1) Unconstrained vs. Constrained Regions (1) Equilibrium Asset Prices: Solution I We derive everything in closed form. I State variables (Dt , Wt ). Scales with Dt . I Uni-dimensional state variable wt distribution. Wt /Dt captures wealth Equilibrium Asset Prices: Solution I We derive everything in closed form. I State variables (Dt , Wt ). Scales with Dt . I Uni-dimensional state variable wt distribution. I Consumption rules ct = ρWth , cth = ρh Wth . I Zero net debt Wt + Wth = Pt , goods clearing ct + cth = Dt . So Pt 1 = h+ 1 Dt ρ I Wt /Dt captures wealth ρ ρh Specialist’s risky (percentage) position αt = constrained region. wt . Pt (1 +m )W t > 1 in Asset Pricing (1) I The economy is in constrained region whenever wt = Wt /Dt < w c I In unconstrained region, wt increases deterministically toward w c . I I I 1 . mρh + ρ Perfect risk sharing rule. Relative patience level ρ < ρh matters. In constrained region, specialists take a higher leverage than households. Therefore wt becomes stochastic and drops when fundamental falls. When (scaled) intermediary capital wt falls in constrained region, I Risk premium rises; I Interest rate falls; I Volatility rises; I Correlation endogenously rises. Asset Pricing (2) Uncon. Region Con. Region Et Wt 1 1 +m Pt αt 1 σR ,t σ π R ,t σ2 kt 0 rt 1 +(ρh ρ)w t (1 +m ) ρh w t σ 1 +(ρh σ2 w t (m ρh + ρ ) (1 +m ) ρh m ρh + ρ (1 +m ) ρh m ρh + ρ >σ 1 1 +(ρh ρ)w t 1 ( ρ +m ρh )w t (1 +m ) ρh σ 2 (1 ρw t )(1 +(ρh ρ)w t ) w t (m ρh +ρ)2 ρh + g +ρ ρ ρ )w t >1 σ2 ρh wt σ2 h ρh + g + ρ ρ ρ (1 +m ) 1 wt ρ > σ2 >0 ρ h wt m 2 ρh + (m ρh ) (1 ρw t ) ( ρ +m ρh ) 2 2 i Risk Premium and Interest Rate Interest Rate Risk Premium 0.05 0.7 m=4 m=6 0.6 0 0.5 c w (m=6)=9.07 0.4 c w (m=6)=9.07 0.3 c w (m=4)=13.02 -0.05 c w (m=4)=13.02 m=4 m=6 0.2 -0.1 0.1 0 0 5 10 15 Scaled Specialist's Wealth w I I I 20 25 0 5 10 15 20 25 Scaled Specialist's Wealth w Asymmetry. Crisis like. When constraint binds wt < w c , specialist bears disproportionally large risk, causing more volatile pricing kernel. Flight to quality. 1) Specialists precautionary savings. 2) Household ‡y to debt market. Comovement I Consider an in…nitesimal asset with dDt d D̂t = + σ̂d Ẑt . Dt D̂t I I I ˆ t is: The correlation between dRt and dR ˆ t) = q corr (dRt , dR 1 1 + (σ̂/σR ,t )2 . Unconstrained region, since σR is constant, the correlation is constant. Constrained region, rising correlation. I Market return volatility σR ,t rises, magnifying the common component of returns. Concluding Remarks (1) I Canonical intermediation friction meets canonical GE asset pricing models. I Calibratable, easy to quantify e¤ects. I We have another paper where specialists have general CRRA power utility, with capital constraint as given. I I I Calibrate the model to the MBS market; Add in labor income, debt households (create leverage in unconstrained region), and other necessary twists... Study the crisis dynamics (especially recovery), government liquidity injection policies, etc. Concluding Remarks (2): Calibration result 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5 0.12 25% 0.1 20% 0.08 15% 0.06 10% 0.04 5% 0.02 0 0 0.05 0.1 c w /P=0.91 Transit from 12% 10% 7.5% 5% 4% 0.15 0.2 0.25 w/ P 0.3 0.35 0.4 0.45 0 0.5 Crisis Recovery W/o Capital Infusion W. Capital Infusion (48bn) 0.17 0 0.66 0.31 2.72 2.20 5.88 5.06