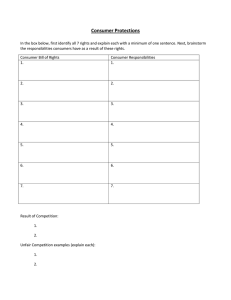

The Influence of Extended Warranty Policy in Malaysian Culture Perspective:

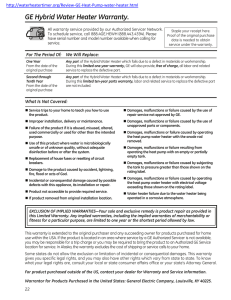

advertisement