12‐Dec‐11 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups.

advertisement

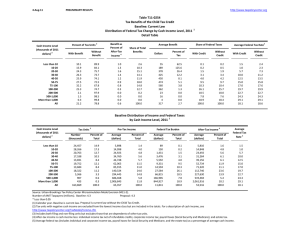

12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2015 Summary Table Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units with Tax Increase or Cut 3 With Tax Cut Pct of Tax Units 25.0 50.6 78.3 88.3 92.1 95.6 98.4 99.0 99.4 99.6 99.9 78.1 Avg Tax Cut ‐383 ‐671 ‐1,144 ‐1,582 ‐1,940 ‐3,279 ‐5,465 ‐10,474 ‐31,197 ‐101,562 ‐757,385 ‐9,682 With Tax Increase Avg Tax Increase Pct of Tax Units 0.5 4.1 4.6 5.6 4.7 3.3 1.2 0.9 0.5 0.4 0.1 2.9 43 315 684 728 772 857 1,470 3,020 7,574 5,232 3,787 823 Percent Change in After‐Tax Income 4 1.7 2.1 3.6 4.2 4.4 5.8 7.3 9.4 13.7 19.3 37.8 12.1 Share of Total Federal Tax Change 0.1 0.7 1.4 1.8 1.9 5.9 6.3 19.5 17.0 9.3 35.9 100.0 Average Federal Tax Change ($) ‐95 ‐327 ‐865 ‐1,354 ‐1,746 ‐3,067 ‐5,311 ‐10,229 ‐30,269 ‐98,575 ‐747,731 ‐7,432 Average Federal Tax Rate 5 Change (% Points) ‐1.6 ‐2.1 ‐3.3 ‐3.6 ‐3.7 ‐4.7 ‐5.7 ‐7.0 ‐9.9 ‐13.6 ‐24.2 ‐9.2 Under the Proposal 3.3 1.7 6.3 10.2 13.0 14.6 16.0 18.0 17.8 16.1 11.7 14.8 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 27.0 Proposal: 0.0 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 25.0 50.6 78.3 88.3 92.1 95.6 98.4 99.0 99.4 99.6 99.9 78.1 0.5 4.1 4.6 5.6 4.7 3.3 1.2 0.9 0.5 0.4 0.1 2.9 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 1.7 2.1 3.6 4.2 4.4 5.8 7.3 9.4 13.7 19.3 37.8 12.1 0.1 0.7 1.4 1.8 1.9 5.9 6.3 19.5 17.0 9.3 35.9 100.0 Average Federal Tax Change Dollars Percent ‐95 ‐327 ‐865 ‐1,354 ‐1,746 ‐3,067 ‐5,311 ‐10,229 ‐30,269 ‐98,575 ‐747,731 ‐7,432 ‐32.7 ‐54.2 ‐34.0 ‐26.3 ‐22.0 ‐24.3 ‐26.3 ‐28.1 ‐35.8 ‐45.7 ‐67.5 ‐38.5 Share of Federal Taxes Change (% Points) 0.0 ‐0.1 0.1 0.5 0.9 2.1 1.8 4.5 0.8 ‐0.9 ‐9.7 0.0 Under the Proposal 0.2 0.4 1.7 3.1 4.2 11.4 11.0 31.1 19.1 6.9 10.8 100.0 5 Average Federal Tax Rate Change (% Points) Under the Proposal ‐1.6 ‐2.1 ‐3.3 ‐3.6 ‐3.7 ‐4.7 ‐5.7 ‐7.0 ‐9.9 ‐13.6 ‐24.2 ‐9.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 18,828 26,753 20,164 16,562 13,738 24,031 14,893 23,887 7,059 1,187 603 168,946 Pre‐Tax Income Percent of Total 11.1 15.8 11.9 9.8 8.1 14.2 8.8 14.1 4.2 0.7 0.4 100.0 Average (dollars) 5,900 15,859 26,538 37,305 47,821 65,604 92,846 145,539 305,065 726,148 3,088,329 80,584 Federal Tax Burden Percent of Total 0.8 3.1 3.9 4.5 4.8 11.6 10.2 25.5 15.8 6.3 13.7 100.0 Average (dollars) 292 604 2,546 5,147 7,950 12,625 20,165 36,351 84,553 215,715 1,107,772 19,325 Percent of Total 0.2 0.5 1.6 2.6 3.4 9.3 9.2 26.6 18.3 7.9 20.5 100.0 4 After‐Tax Income Average (dollars) 5,608 15,256 23,992 32,158 39,872 52,980 72,681 109,188 220,512 510,433 1,980,557 61,258 Percent of Total 1.0 3.9 4.7 5.2 5.3 12.3 10.5 25.2 15.0 5.9 11.5 100.0 Average Federal Tax 5 Rate 5.0 3.8 9.6 13.8 16.6 19.2 21.7 25.0 27.7 29.7 35.9 24.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 27.0 Proposal: 0.0 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 3.3 1.7 6.3 10.2 13.0 14.6 16.0 18.0 17.8 16.1 11.7 14.8 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 18.0 45.5 74.3 87.4 91.0 93.7 97.3 96.7 97.9 99.3 99.9 64.7 0.6 4.9 5.7 7.4 7.7 5.5 1.9 2.9 2.1 0.7 0.1 4.5 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.8 1.1 2.4 3.3 3.3 6.0 9.2 11.2 21.3 29.8 48.3 9.8 0.2 1.2 2.6 3.4 3.0 10.5 9.3 17.8 15.8 8.7 27.3 100.0 Average Federal Tax Change Dollars Percent ‐45 ‐167 ‐558 ‐1,021 ‐1,278 ‐2,995 ‐6,244 ‐11,588 ‐46,392 ‐142,586 ‐883,261 ‐3,339 ‐10.5 ‐16.4 ‐17.5 ‐17.4 ‐13.9 ‐20.1 ‐26.4 ‐29.7 ‐49.3 ‐60.2 ‐73.2 ‐33.7 Share of Federal Taxes Change (% Points) 0.3 0.6 1.2 1.6 2.2 3.6 1.3 1.2 ‐2.5 ‐1.9 ‐7.5 0.0 Under the Proposal 1.1 3.0 6.1 8.2 9.6 21.1 13.2 21.4 8.3 2.9 5.1 100.0 5 Average Federal Tax Rate Change (% Points) Under the Proposal ‐0.8 ‐1.1 ‐2.1 ‐2.7 ‐2.7 ‐4.6 ‐6.8 ‐8.2 ‐14.9 ‐19.9 ‐29.1 ‐7.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 14,874 18,897 12,463 9,026 6,458 9,524 4,046 4,174 926 165 84 81,336 Pre‐Tax Income Percent of Total 18.3 23.2 15.3 11.1 7.9 11.7 5.0 5.1 1.1 0.2 0.1 100.0 Average (dollars) 5,819 15,738 26,424 37,254 47,583 65,053 91,748 142,151 311,980 715,451 3,035,414 44,116 Federal Tax Burden Percent of Total 2.4 8.3 9.2 9.4 8.6 17.3 10.4 16.5 8.1 3.3 7.1 100.0 Average (dollars) 425 1,014 3,189 5,859 9,230 14,866 23,619 38,989 94,192 236,787 1,206,782 9,914 Percent of Total 0.8 2.4 4.9 6.6 7.4 17.6 11.9 20.2 10.8 4.9 12.6 100.0 4 After‐Tax Income Average (dollars) 5,394 14,724 23,235 31,395 38,352 50,186 68,129 103,162 217,787 478,664 1,828,632 34,202 Percent of Total 2.9 10.0 10.4 10.2 8.9 17.2 9.9 15.5 7.3 2.8 5.5 100.0 Average Federal Tax 5 Rate 7.3 6.4 12.1 15.7 19.4 22.9 25.7 27.4 30.2 33.1 39.8 22.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 6.5 5.4 10.0 13.0 16.7 18.3 18.9 19.3 15.3 13.2 10.7 14.9 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 42.4 58.9 75.6 84.6 90.7 96.5 98.8 99.5 99.7 99.7 100.0 93.4 0.0 3.2 3.7 2.9 1.8 1.9 0.9 0.4 0.2 0.3 * 1.2 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 5.5 4.4 5.7 5.2 4.8 5.4 6.5 9.0 12.5 17.7 35.9 13.7 0.0 0.2 0.5 0.6 1.0 3.4 5.0 20.8 18.4 10.1 39.8 100.0 Average Federal Tax Change Dollars Percent ‐273 ‐709 ‐1,418 ‐1,755 ‐2,027 ‐2,998 ‐4,877 ‐9,989 ‐27,656 ‐91,142 ‐710,700 ‐15,008 ‐136.1 ‐303.3 ‐82.3 ‐47.0 ‐35.2 ‐29.4 ‐26.6 ‐27.9 ‐33.3 ‐42.9 ‐66.2 ‐40.2 Share of Federal Taxes Change (% Points) 0.0 ‐0.1 ‐0.2 ‐0.1 0.1 0.9 1.7 6.1 2.6 ‐0.4 ‐10.5 0.0 Under the Proposal 0.0 ‐0.1 0.1 0.5 1.2 5.6 9.2 36.0 24.8 9.1 13.7 100.0 5 Average Federal Tax Rate Change (% Points) Under the Proposal ‐5.3 ‐4.3 ‐5.3 ‐4.7 ‐4.2 ‐4.5 ‐5.2 ‐6.8 ‐9.1 ‐12.5 ‐23.3 ‐10.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,193 2,308 2,817 3,184 4,125 10,125 8,981 18,369 5,889 983 495 58,870 Pre‐Tax Income Percent of Total 2.0 3.9 4.8 5.4 7.0 17.2 15.3 31.2 10.0 1.7 0.8 100.0 Average (dollars) 5,175 16,515 26,670 37,640 48,277 66,252 93,522 146,871 304,115 728,319 3,052,733 146,762 Federal Tax Burden Percent of Total 0.1 0.4 0.9 1.4 2.3 7.8 9.7 31.2 20.7 8.3 17.5 100.0 Average (dollars) 201 234 1,723 3,734 5,761 10,210 18,340 35,776 83,102 212,278 1,073,550 37,356 Percent of Total 0.0 0.0 0.2 0.5 1.1 4.7 7.5 29.9 22.3 9.5 24.2 100.0 4 After‐Tax Income Average (dollars) 4,975 16,281 24,946 33,906 42,516 56,042 75,181 111,095 221,014 516,041 1,979,184 109,406 Percent of Total 0.1 0.6 1.1 1.7 2.7 8.8 10.5 31.7 20.2 7.9 15.2 100.0 Average Federal Tax 5 Rate 3.9 1.4 6.5 9.9 11.9 15.4 19.6 24.4 27.3 29.2 35.2 25.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. ‐1.4 ‐2.9 1.1 5.3 7.7 10.9 14.4 17.6 18.2 16.6 11.9 15.2 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 56.7 63.7 89.4 92.8 96.4 97.5 98.2 99.4 98.2 100.0 100.0 84.3 * 1.6 2.3 4.0 2.1 1.8 1.1 0.3 1.8 0.0 0.0 1.9 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 4.2 4.3 5.3 5.5 6.0 6.3 7.5 9.0 12.7 16.9 38.5 7.5 1.1 5.3 8.5 9.8 9.0 17.6 11.5 14.4 7.1 3.2 12.5 100.0 Average Federal Tax Change Dollars Percent ‐303 ‐723 ‐1,349 ‐1,783 ‐2,378 ‐3,300 ‐5,320 ‐9,142 ‐27,763 ‐85,043 ‐719,584 ‐2,778 69.2 90.7 ‐117.9 ‐40.1 ‐30.3 ‐25.4 ‐25.3 ‐25.9 ‐34.8 ‐41.8 ‐67.1 ‐36.9 Share of Federal Taxes Change (% Points) ‐1.0 ‐4.3 ‐3.4 ‐0.5 1.1 4.7 3.1 3.6 0.3 ‐0.2 ‐3.3 0.0 Under the Proposal ‐1.6 ‐6.5 ‐0.8 8.6 12.1 30.2 19.9 24.1 7.8 2.6 3.6 100.0 5 Average Federal Tax Rate Change (% Points) Under the Proposal ‐4.5 ‐4.5 ‐5.0 ‐4.8 ‐5.0 ‐5.1 ‐5.8 ‐6.7 ‐9.3 ‐12.0 ‐24.5 ‐6.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,630 5,290 4,577 3,986 2,750 3,859 1,567 1,144 185 27 13 26,121 Pre‐Tax Income Percent of Total 10.1 20.3 17.5 15.3 10.5 14.8 6.0 4.4 0.7 0.1 0.1 100.0 Average (dollars) 6,699 15,982 26,748 37,118 47,741 65,204 91,930 137,276 297,897 706,379 2,940,222 44,620 Federal Tax Burden Percent of Total 1.5 7.3 10.5 12.7 11.3 21.6 12.4 13.5 4.7 1.6 3.2 100.0 Average (dollars) ‐438 ‐798 1,144 4,451 7,850 13,006 21,068 35,299 79,798 203,643 1,072,213 7,531 Percent of Total ‐0.6 ‐2.2 2.7 9.0 11.0 25.5 16.8 20.5 7.5 2.8 6.9 100.0 4 After‐Tax Income Average (dollars) 7,137 16,780 25,604 32,667 39,891 52,197 70,862 101,977 218,099 502,736 1,868,009 37,089 Percent of Total 1.9 9.2 12.1 13.4 11.3 20.8 11.5 12.0 4.2 1.4 2.4 100.0 Average Federal Tax 5 Rate ‐6.5 ‐5.0 4.3 12.0 16.4 20.0 22.9 25.7 26.8 28.8 36.5 16.9 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. ‐11.1 ‐9.5 ‐0.8 7.2 11.5 14.9 17.1 19.1 17.5 16.8 12.0 10.7 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 54.6 76.8 94.2 96.3 97.7 99.0 99.5 99.5 99.8 99.8 99.8 93.2 0.0 0.3 0.7 2.0 0.9 0.6 0.4 0.4 0.2 0.3 0.2 0.6 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 5.0 5.7 6.9 6.8 7.2 7.4 8.3 9.6 12.2 16.5 36.5 12.8 0.2 1.1 1.9 2.2 2.4 6.0 7.0 21.8 17.0 8.2 32.1 100.0 Average Federal Tax Change Dollars Percent ‐335 ‐1,012 ‐1,799 ‐2,248 ‐2,933 ‐3,972 ‐6,053 ‐10,499 ‐26,351 ‐83,527 ‐707,794 ‐9,878 51.7 68.2 ‐278.3 ‐54.3 ‐39.2 ‐31.9 ‐30.1 ‐28.4 ‐31.3 ‐37.8 ‐63.6 ‐39.3 Share of Federal Taxes Change (% Points) ‐0.2 ‐1.1 ‐1.1 ‐0.4 0.0 0.9 1.4 5.4 2.8 0.2 ‐7.9 0.0 Under the Proposal ‐0.4 ‐1.8 ‐0.8 1.2 2.4 8.3 10.5 35.6 24.1 8.8 11.9 100.0 5 Average Federal Tax Rate Change (% Points) Under the Proposal ‐5.5 ‐6.3 ‐6.7 ‐6.0 ‐6.1 ‐6.0 ‐6.5 ‐7.2 ‐8.8 ‐11.5 ‐23.2 ‐9.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,055 5,354 5,205 4,865 4,063 7,481 5,727 10,299 3,188 488 225 50,185 Pre‐Tax Income Percent of Total 6.1 10.7 10.4 9.7 8.1 14.9 11.4 20.5 6.4 1.0 0.5 100.0 Average (dollars) 6,104 16,179 26,687 37,231 47,981 66,213 93,379 146,387 301,180 726,899 3,052,860 102,460 Federal Tax Burden Percent of Total 0.4 1.7 2.7 3.5 3.8 9.6 10.4 29.3 18.7 6.9 13.3 100.0 Average (dollars) ‐647 ‐1,484 646 4,139 7,480 12,467 20,123 36,939 84,247 221,065 1,112,293 25,118 Percent of Total ‐0.2 ‐0.6 0.3 1.6 2.4 7.4 9.1 30.2 21.3 8.6 19.8 100.0 4 After‐Tax Income Average (dollars) 6,752 17,663 26,040 33,092 40,501 53,745 73,256 109,448 216,933 505,834 1,940,567 77,343 Percent of Total 0.5 2.4 3.5 4.2 4.2 10.4 10.8 29.0 17.8 6.4 11.2 100.0 Average Federal Tax 5 Rate ‐10.6 ‐9.2 2.4 11.1 15.6 18.8 21.6 25.2 28.0 30.4 36.4 24.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. ‐16.1 ‐15.4 ‐4.3 5.1 9.5 12.8 15.1 18.1 19.2 18.9 13.3 14.9 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0402 The Gingrich Tax Plan: All Taxpayers Adopt Flat Tax Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 18.9 25.3 58.6 83.2 89.1 95.6 97.8 98.2 98.8 99.7 100.0 67.7 0.0 0.1 0.5 1.7 1.5 2.4 1.7 1.6 1.2 0.3 * 1.1 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.5 0.5 1.5 3.2 3.6 6.1 8.4 12.9 21.0 28.1 44.0 15.1 0.0 0.2 0.5 1.2 1.2 5.4 5.6 17.6 19.5 11.6 37.1 100.0 Average Federal Tax Change Dollars Percent ‐30 ‐73 ‐374 ‐1,140 ‐1,581 ‐3,522 ‐6,511 ‐14,764 ‐48,286 ‐143,282 ‐859,102 ‐9,420 ‐46.8 ‐51.9 ‐50.3 ‐52.1 ‐44.2 ‐45.8 ‐43.8 ‐48.0 ‐57.0 ‐65.3 ‐74.8 ‐59.0 Share of Federal Taxes Change (% Points) 0.0 0.0 0.1 0.2 0.6 2.3 2.8 5.8 1.0 ‐1.6 ‐11.2 0.0 Under the Proposal 0.0 0.2 0.8 1.6 2.2 9.2 10.4 27.4 21.2 8.9 18.0 100.0 5 Average Federal Tax Rate Change (% Points) Under the Proposal ‐0.4 ‐0.5 ‐1.4 ‐3.1 ‐3.3 ‐5.4 ‐7.0 ‐10.2 ‐15.3 ‐19.6 ‐27.7 ‐12.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,834 8,975 5,212 3,903 2,851 5,623 3,151 4,366 1,477 296 158 38,882 Pre‐Tax Income Percent of Total 7.3 23.1 13.4 10.0 7.3 14.5 8.1 11.2 3.8 0.8 0.4 100.0 Average (dollars) 6,863 15,942 26,318 37,346 47,663 65,129 92,429 145,274 315,054 730,232 3,102,318 78,233 Federal Tax Burden Percent of Total 0.6 4.7 4.5 4.8 4.5 12.0 9.6 20.9 15.3 7.1 16.1 100.0 Average (dollars) 65 140 743 2,188 3,578 7,696 14,878 30,751 84,723 219,482 1,149,373 15,963 Percent of Total 0.0 0.2 0.6 1.4 1.6 7.0 7.6 21.6 20.2 10.5 29.3 100.0 4 After‐Tax Income Average (dollars) 6,798 15,802 25,575 35,158 44,085 57,434 77,551 114,523 230,331 510,750 1,952,945 62,270 Percent of Total 0.8 5.9 5.5 5.7 5.2 13.3 10.1 20.7 14.1 6.2 12.8 100.0 Average Federal Tax 5 Rate 1.0 0.9 2.8 5.9 7.5 11.8 16.1 21.2 26.9 30.1 37.1 20.4 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal implements the Gingrich tax plan, assuming that all taxpayers adopt the 15 percent flat tax. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 0.5 0.4 1.4 2.8 4.2 6.4 9.1 11.0 11.6 10.4 9.4 8.4