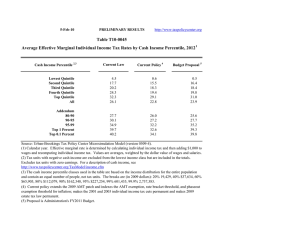

28-Jul-15 PRELIMINARY RESULTS Lowest Quintile Second Quintile

advertisement

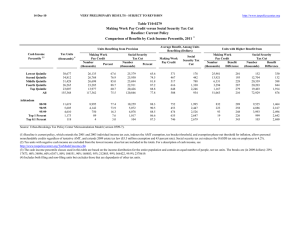

28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2015 ¹ Detail Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit Without Benefit Benefit as a Percent of AfterTax Income 4 Share of Total Benefit Share of Federal Taxes Average Benefit Dollars Percent of Federal Taxes With Provision Average Federal Tax Rate6 Without Provision With Provision Without Provision 0.4 5.2 19.3 41.7 75.6 22.3 99.6 94.9 80.7 58.3 24.4 77.7 0.0 0.0 0.2 0.5 1.2 0.7 0.0 0.5 3.8 13.7 82.0 100.0 0 12 93 391 2,791 472 0.1 0.5 1.2 2.2 3.4 2.8 0.8 3.4 9.2 17.5 69.0 100.0 0.8 3.3 9.0 17.4 69.3 100.0 3.6 7.8 13.1 17.0 25.7 19.8 3.6 7.8 13.3 17.4 26.6 20.4 69.0 81.1 83.8 87.1 85.0 31.0 18.9 16.3 13.0 15.0 0.8 1.1 0.9 1.8 1.7 16.4 14.6 15.5 35.4 14.4 1,084 1,995 2,828 25,362 101,268 3.3 3.8 2.8 3.6 3.1 14.3 10.8 15.9 27.9 13.4 14.4 11.0 15.9 28.1 13.4 20.0 21.8 25.2 33.4 34.9 20.6 22.6 25.9 34.6 36.0 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile, 2015 1 Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Average (dollars) Percent of Total Average Federal Tax Rate 6 0.8 3.4 9.2 17.5 69.0 100.0 12,478 30,191 51,687 85,961 238,685 67,140 5.2 9.8 15.0 21.1 49.2 100.0 3.6 7.8 13.1 17.0 25.7 19.8 14.3 10.8 15.9 27.9 13.4 133,005 187,059 303,273 1,404,229 6,149,316 14.2 9.6 11.7 13.8 6.2 20.0 21.8 25.2 33.4 34.9 Federal Tax Burden Percent of Total Average (dollars) Percent of Total Average (dollars) 47,416 37,240 33,429 28,192 23,717 171,259 27.7 21.7 19.5 16.5 13.9 100.0 12,939 32,747 59,484 103,603 321,278 83,723 4.3 8.5 13.9 20.4 53.1 100.0 461 2,556 7,797 17,641 82,593 16,582 12,247 5,921 4,422 1,128 115 7.2 3.5 2.6 0.7 0.1 166,149 239,064 405,492 2,107,531 9,446,793 14.2 9.9 12.5 16.6 7.6 33,144 52,005 102,219 703,303 3,297,476 Percent of Total After-Tax Income 5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 * Less than 0.05 (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2015 dollars): 20% $22,769; 40% $44,590; 60% $78,129; 80% $138,265; 90% $204,070; 95% $290,298; 99% $709,166; 99.9% $3,474,762. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit 4 Without Benefit Percent Change in After-Tax 5 Income Share of Total Benefit Average Benefit Dollars Share of Federal Taxes Percent With Provision 6 Average Federal Tax Rate Without Provision With Provision Without Provision 0.1 2.8 13.6 36.4 69.4 22.3 99.9 97.3 86.4 63.6 30.6 77.7 0.0 0.0 -0.1 -0.4 -1.1 -0.7 0.0 0.2 2.1 11.5 86.2 100.0 0 5 50 290 2,311 472 0.1 0.3 0.8 2.0 3.3 2.8 0.0 2.1 7.5 16.8 73.5 100.0 0.0 2.0 7.4 16.6 73.8 100.0 -0.2 5.8 12.0 16.5 25.4 19.8 -0.2 5.8 12.1 16.8 26.2 20.4 60.8 74.3 82.7 85.4 83.8 39.2 25.7 17.4 14.6 16.2 -0.8 -0.9 -1.0 -1.7 -1.6 17.1 14.1 19.3 35.6 15.0 892 1,506 2,719 21,738 89,088 3.2 3.4 3.2 3.5 3.1 15.3 11.9 17.4 28.8 14.0 15.4 11.9 17.5 29.0 14.0 19.8 21.7 24.8 33.2 34.9 20.4 22.4 25.6 34.3 35.9 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total Percent of Total Average Federal Tax 6 Rate After-Tax Income Average (dollars) 5 38,028 35,628 34,157 32,072 30,108 171,259 22.2 20.8 19.9 18.7 17.6 100.0 12,075 28,678 52,104 89,964 272,883 83,723 3.2 7.1 12.4 20.1 57.3 100.0 -25 1,671 6,236 14,840 69,295 16,582 0.0 2.1 7.5 16.8 73.5 100.0 12,100 27,007 45,868 75,124 203,588 67,140 4.0 8.4 13.6 21.0 53.3 100.0 -0.2 5.8 12.0 16.5 25.4 19.8 15,501 7,544 5,739 1,324 136 9.1 4.4 3.4 0.8 0.1 141,954 205,634 347,512 1,865,759 8,376,926 15.4 10.8 13.9 17.2 7.9 28,082 44,642 86,275 618,786 2,921,905 15.3 11.9 17.4 28.8 14.0 113,872 160,992 261,238 1,246,973 5,455,020 15.4 10.6 13.0 14.4 6.4 19.8 21.7 24.8 33.2 34.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2015 dollars): 20% $15,703; 40% $29,565; 60% $50,184; 80% $84,118; 90% $122,704; 95% $171,602; 99% $405,273; 99.9% $2,000,055. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Single Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit Without Benefit Benefit as a Percent of AfterTax Income 4 Share of Total Benefit Share of Federal Taxes Average Benefit Dollars Percent of Federal Taxes With Provision Average Federal Tax Rate6 Without Provision With Provision Without Provision 0.1 2.1 10.9 31.3 63.9 14.0 99.9 97.9 89.1 68.7 36.1 86.1 0.0 0.0 0.1 0.4 1.1 0.5 0.0 0.4 3.4 16.8 79.4 100.0 0 3 31 207 1,414 183 0.0 0.2 0.6 1.8 3.3 2.4 1.9 5.6 13.8 22.1 56.5 100.0 1.9 5.4 13.5 22.0 57.0 100.0 5.3 7.9 13.5 17.8 25.5 18.1 5.3 7.9 13.6 18.2 26.3 18.5 55.6 71.4 81.1 79.1 81.6 44.4 28.6 18.9 20.9 18.5 0.9 1.1 1.2 1.6 1.5 22.4 15.9 18.4 22.7 10.5 684 1,207 2,113 14,813 56,496 3.2 3.8 3.6 3.0 2.6 16.3 9.9 12.1 18.1 9.6 16.5 10.1 12.2 18.2 9.6 21.0 22.4 25.2 35.4 36.4 21.7 23.2 26.1 36.4 37.4 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Pre-Tax Income Average (dollars) Percent of Total Average Federal Tax Rate 6 1.9 5.6 13.8 22.1 56.5 100.0 8,955 20,720 34,266 53,327 125,015 35,389 7.5 14.3 19.3 22.4 36.4 100.0 5.3 7.9 13.5 17.8 25.5 18.1 16.3 9.9 12.1 18.1 9.6 80,045 111,202 175,233 918,933 3,828,103 13.6 7.6 7.9 7.3 3.7 21.0 22.4 25.2 35.4 36.4 Federal Tax Burden Number (thousands) Percent of Total Average (dollars) Percent of Total Average (dollars) 25,695 21,192 17,313 12,893 8,920 86,656 29.7 24.5 20.0 14.9 10.3 100.0 9,457 22,491 39,633 64,900 167,774 43,186 6.5 12.7 18.3 22.4 40.0 100.0 502 1,771 5,366 11,573 42,760 7,797 5,197 2,099 1,381 244 29 6.0 2.4 1.6 0.3 0.0 101,295 143,204 234,173 1,421,673 6,021,732 14.1 8.0 8.6 9.3 4.7 21,250 32,002 58,941 502,740 2,193,630 Percent of Total After-Tax Income 5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2015 dollars): 20% $15,703; 40% $29,565; 60% $50,184; 80% $84,118; 90% $122,704; 95% $171,602; 99% $405,273; 99.9% $2,000,055. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit Without Benefit Benefit as a Percent of AfterTax Income 4 Share of Total Benefit Share of Federal Taxes Average Benefit Dollars Percent of Federal Taxes With Provision Average Federal Tax Rate6 Without Provision With Provision Without Provision * 3.6 15.8 38.8 72.4 38.1 100.0 96.4 84.2 61.2 27.6 61.9 0.0 0.0 0.1 0.4 1.1 0.8 0.0 0.1 1.3 8.7 89.9 100.0 0 7 71 334 2,771 1,032 0.1 0.3 1.0 1.9 3.4 3.1 -0.1 0.7 4.1 13.9 81.2 100.0 -0.1 0.7 4.0 13.7 81.4 100.0 -1.9 5.3 10.9 15.7 25.3 21.6 -1.9 5.3 11.0 16.0 26.2 22.2 63.3 76.3 84.2 87.4 85.5 36.7 23.7 15.8 12.6 14.5 0.8 0.9 1.0 1.8 1.7 15.5 14.1 20.6 39.7 16.2 1,004 1,674 2,985 23,436 100,693 3.1 3.3 3.1 3.7 3.2 15.1 12.9 20.2 33.0 15.3 15.1 12.9 20.2 33.2 15.3 19.3 21.5 24.7 32.7 34.5 19.9 22.2 25.5 33.9 35.7 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Pre-Tax Income Average (dollars) Percent of Total Average Federal Tax Rate 6 -0.1 0.7 4.1 13.9 81.2 100.0 18,602 38,236 61,258 93,352 242,107 123,240 1.3 3.6 9.3 20.4 65.8 100.0 -1.9 5.3 10.9 15.7 25.3 21.6 15.1 12.9 20.2 33.0 15.3 134,184 183,357 292,211 1,312,512 5,901,009 17.4 12.9 16.9 18.6 8.0 19.3 21.5 24.7 32.7 34.5 Federal Tax Burden Number (thousands) Percent of Total Average (dollars) Percent of Total Average (dollars) 4,905 6,750 10,804 15,659 19,462 58,086 8.4 11.6 18.6 27.0 33.5 100.0 18,253 40,357 68,754 110,771 324,150 157,102 1.0 3.0 8.1 19.0 69.1 100.0 -349 2,121 7,496 17,419 82,042 33,862 9,257 5,048 4,141 1,017 97 15.9 8.7 7.1 1.8 0.2 166,177 233,596 388,188 1,951,482 9,014,806 16.9 12.9 17.6 21.7 9.6 31,993 50,239 95,977 638,970 3,113,797 Percent of Total After-Tax Income 5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2015 dollars): 20% $15,703; 40% $29,565; 60% $50,184; 80% $84,118; 90% $122,704; 95% $171,602; 99% $405,273; 99.9% $2,000,055. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit Without Benefit Benefit as a Percent of AfterTax Income 4 Share of Total Benefit Share of Federal Taxes Average Benefit Dollars Percent of Federal Taxes With Provision Average Federal Tax Rate6 Without Provision With Provision Without Provision 0.1 3.5 17.1 43.3 64.6 13.3 99.9 96.6 82.9 56.7 35.4 86.7 0.0 0.0 0.1 0.5 0.9 0.3 0.0 1.2 10.2 35.5 53.2 100.0 0 5 64 409 1,533 140 0.0 0.7 1.0 2.6 2.8 2.4 -9.3 4.3 24.9 33.4 46.6 100.0 -9.1 4.2 24.6 33.5 46.8 100.0 -10.3 2.2 10.6 16.9 24.9 11.1 -10.3 2.3 10.7 17.3 25.6 11.3 67.2 62.4 48.5 87.1 79.7 32.8 37.6 51.5 12.9 20.3 0.9 0.6 0.5 1.6 1.2 22.5 6.7 4.4 19.5 7.6 1,009 870 1,161 22,582 82,155 3.5 2.0 1.4 3.2 2.2 15.9 8.3 7.5 14.9 8.5 16.0 8.2 7.5 15.1 8.5 20.9 22.3 25.3 33.5 35.1 21.6 22.8 25.7 34.5 35.9 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Pre-Tax Income Average (dollars) Percent of Total Average Federal Tax Rate 6 -9.3 4.3 24.9 33.4 46.6 100.0 19,119 35,343 53,616 77,662 166,243 46,014 12.4 23.3 26.2 20.5 17.5 100.0 -10.3 2.2 10.6 16.9 24.9 11.1 15.9 8.3 7.5 14.9 8.5 110,428 151,446 242,520 1,405,864 6,980,760 7.5 3.6 2.8 3.7 2.0 20.9 22.3 25.3 33.5 35.1 Federal Tax Burden Number (thousands) Percent of Total Average (dollars) Percent of Total Average (dollars) 7,078 7,166 5,322 2,873 1,147 23,633 30.0 30.3 22.5 12.2 4.9 100.0 17,338 36,153 59,958 93,405 221,264 51,742 10.0 21.2 26.1 21.9 20.8 100.0 -1,781 810 6,341 15,743 55,020 5,728 738 256 124 29 3 3.1 1.1 0.5 0.1 0.0 139,577 195,007 324,617 2,112,681 10,757,795 8.4 4.1 3.3 4.9 2.7 29,149 43,560 82,098 706,817 3,777,035 Percent of Total After-Tax Income 5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2015 dollars): 20% $15,703; 40% $29,565; 60% $50,184; 80% $84,118; 90% $122,704; 95% $171,602; 99% $405,273; 99.9% $2,000,055. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Tax Units with Children Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit Without Benefit Benefit as a Percent of AfterTax Income 4 Share of Total Benefit Share of Federal Taxes Average Benefit Dollars Percent of Federal Taxes With Provision 6 Average Federal Tax Rate Without Provision With Provision Without Provision * 4.3 21.4 51.1 81.9 30.6 100.0 95.7 78.6 48.9 18.1 69.4 0.0 0.0 0.2 0.5 1.3 0.8 0.0 0.2 2.5 12.8 84.6 100.0 0 8 96 518 3,601 796 0.0 0.7 1.2 2.5 3.7 3.4 -1.5 1.0 7.1 16.9 76.4 100.0 -1.4 1.0 6.9 16.8 76.6 100.0 -9.4 2.8 11.6 16.9 26.2 19.9 -9.4 2.9 11.7 17.3 27.1 20.6 78.5 83.8 86.6 88.4 87.6 21.5 16.3 13.4 11.6 12.4 1.0 1.0 1.1 2.1 1.9 17.6 11.8 17.0 38.1 15.2 1,489 2,066 3,616 31,620 130,333 4.0 3.4 3.1 4.1 3.6 15.0 11.5 18.6 31.2 14.3 15.1 11.6 18.6 31.5 14.3 20.1 22.3 25.9 33.4 34.6 20.9 23.0 26.7 34.8 35.8 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Pre-Tax Income Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total Average Federal Tax 6 Rate 20,090 38,952 62,905 100,954 273,970 95,383 4.3 8.4 13.5 20.8 53.7 100.0 -9.4 2.8 11.6 16.9 26.2 19.9 150,289 210,174 338,118 1,543,502 6,911,782 14.9 10.1 13.3 15.5 6.7 20.1 22.3 25.9 33.4 34.6 After-Tax Income Number (thousands) Percent of Total Percent of Total 10,060 10,242 10,174 9,772 9,316 49,840 20.2 20.6 20.4 19.6 18.7 100.0 18,362 40,092 71,124 121,436 371,025 119,143 3.1 6.9 12.2 20.0 58.2 100.0 -1,728 1,140 8,219 20,482 97,055 23,760 -1.5 1.0 7.1 16.9 76.4 100.0 4,698 2,272 1,868 478 46 9.4 4.6 3.8 1.0 0.1 188,026 270,318 456,133 2,317,833 10,560,871 14.9 10.4 14.4 18.6 8.2 37,736 60,144 118,016 774,331 3,649,089 15.0 11.5 18.6 31.2 14.3 Average (dollars) 5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2015 dollars): 20% $15,703; 40% $29,565; 60% $50,184; 80% $84,118; 90% $122,704; 95% $171,602; 99% $405,273; 99.9% $2,000,055. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0125 Tax Benefit for the Deduction and Refund for State and Local Taxes Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Elderly Tax Units Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent of Tax Units With Benefit Without Benefit Benefit as a Percent of AfterTax Income 4 Share of Total Benefit Share of Federal Taxes Average Benefit Dollars Percent of Federal Taxes With Provision 6 Average Federal Tax Rate Without Provision With Provision Without Provision 0.0 1.2 7.1 23.4 54.0 14.4 100.0 98.8 93.0 76.6 46.0 85.6 0.0 0.0 0.0 0.2 0.9 0.5 0.0 0.2 1.4 9.1 89.4 100.0 0 2 18 143 1,704 291 0.0 0.3 0.7 1.6 2.6 2.3 0.2 1.2 4.5 13.2 80.4 100.0 0.2 1.2 4.5 13.1 80.6 100.0 1.5 2.5 5.6 11.3 25.1 17.2 1.5 2.5 5.7 11.4 25.7 17.6 41.4 59.9 75.7 80.5 80.8 58.6 40.1 24.3 19.5 19.3 0.4 0.7 0.9 1.4 1.4 10.4 13.3 18.9 46.8 24.9 373 1,053 2,053 16,671 68,755 1.8 2.9 2.8 2.6 2.6 13.4 10.5 15.5 40.9 22.4 13.4 10.6 15.6 41.1 22.4 16.6 19.7 23.6 33.9 35.6 16.9 20.3 24.2 34.8 36.5 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Pre-Tax Income Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total Average Federal Tax 6 Rate 11,309 23,591 43,907 71,806 199,669 61,279 3.1 10.2 15.7 21.6 49.8 100.0 1.5 2.5 5.6 11.3 25.1 17.2 105,629 148,338 237,545 1,237,337 4,860,407 14.0 8.9 10.4 16.5 8.4 16.6 19.7 23.6 33.9 35.6 After-Tax Income Number (thousands) Percent of Total Percent of Total 6,747 10,548 8,773 7,376 6,116 40,001 16.9 26.4 21.9 18.4 15.3 100.0 11,475 24,187 46,526 80,917 266,492 73,992 2.6 8.6 13.8 20.2 55.1 100.0 167 596 2,619 9,111 66,824 12,713 0.2 1.2 4.5 13.2 80.4 100.0 3,247 1,466 1,076 328 42 8.1 3.7 2.7 0.8 0.1 126,674 184,805 310,833 1,872,660 7,547,908 13.9 9.2 11.3 20.7 10.8 21,045 36,468 73,287 635,323 2,687,501 13.4 10.5 15.5 40.9 22.4 Average (dollars) 5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 1.5 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Table shows the tax benefit under current law of the deduction and refund for state and local taxes. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2015 dollars): 20% $15,703; 40% $29,565; 60% $50,184; 80% $84,118; 90% $122,704; 95% $171,602; 99% $405,273; 99.9% $2,000,055. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income.