Fund Costs and Charges March 2016 Schroder

advertisement

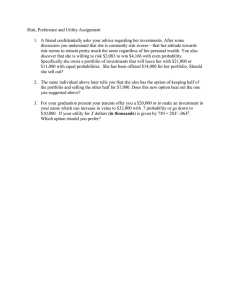

Schroder Fund Costs and Charges March 2016 *Ongoing Charges1 (includes AMC) Funds *Annual Management Charge (AMC)2 **Pricing Policy3 Spread (dual priced funds) Entry Charge4 Exit Charge5 Performance Fee6 ***Portfolio Transactions Costs7 0.00% 0.00% 0.00% 0.00% Dilution Dilution Adjustment for Adjustment for single Priced single Priced Funds Bid Funds Offer (purchases) (redemptions) A Class Shares (****P1 where available) Accumulation Units Z Class Shares (****P2 where available) Accumulation Units A Class Shares (****P1 where available) Accumulation Units Z Class Shares (****P2 where available) Accumulation Units Absolute Return Bond Fund 1.12% 0.72% 1.00% 0.60% ****Schroder Absolute UK Dynamic Fund 1.67% 1.17% 1.50% 1.00% 0.66% 0.67% 0.00% 0.00% 20% of NAV Change 0.07% All Maturities Corporate Bond Fund 1.12% 0.53% 1.00% 0.45% 0.48% 0.48% 0.00% 0.00% 0.00% 0.00% Asian Alpha Plus Fund 1.71% 0.96% 1.50% 0.75% 0.43% 0.39% 0.00% 0.00% 0.00% 0.13% Asian Income Fund 1.69% 0.93% 1.50% 0.75% 0.00% 0.00% 0.00% 0.10% Asian Income Maximiser 1.70% 0.95% 1.50% 0.75% 0.37% 0.31% 0.00% 0.00% 0.00% 0.08% Core UK Equity Fund 1.41% 0.78% 1.25% 0.63% 0.15% 0.63% 0.00% 0.00% 0.00% 0.08% Dynamic Multi Asset Fund 1.40% 0.40% 1.20% 0.35% 0.01% 0.01% 0.00% 0.00% 0.00% 0.02% European Alpha Income Fund 1.67% 0.92% 1.50% 0.75% 0.18% 0.24% 0.00% 0.00% 0.00% 0.24% European Alpha Plus Fund 1.68% 0.93% 1.50% 0.75% 0.00% 0.00% 0.00% 0.27% European Fund 1.70% 0.95% 1.50% 0.75% 0.12% 0.19% 0.00% 0.00% 0.00% 0.13% European Opportunities Fund 1.67% 0.92% 1.50% 0.75% 0.15% 0.23% 0.00% 0.00% 0.00% 0.16% European Smaller Companies Fund 1.71% 0.96% 1.50% 0.75% 0.76% 0.00% 0.00% 0.00% 0.20% Gilt & Fixed Interest Fund 0.57% 0.05% 0.00% 0.00% 0.00% 0.00% Global Alpha Plus Fund 1.75% 1.00% 1.50% 0.75% 0.00% 0.00% 0.00% 0.14% Global Emerging Markets Fund 1.71% 0.96% 1.50% 0.75% 0.00% 0.00% 0.00% 0.17% Global Equity Income Fund 1.71% 0.96% 1.50% 0.75% 0.00% 0.00% 0.00% 0.09% Global Healthcare Fund 1.67% 0.92% 1.50% 0.75% 0.00% 0.00% 0.00% 0.13% Global Property Income Maximiser 1.70% 0.95% 1.50% 0.75% 0.26% 0.30% 0.00% 0.00% 0.00% 0.09% Global Property Securities Fund 1.67% 0.92% 1.50% 0.75% 0.15% 0.21% 0.00% 0.00% 0.00% 0.09% 0.75% 0.20% 0.32% 0.00% 0.00% 0.00% 0.00% Global Recovery Fund 0.50% 1.00% 0.53% 0.66% 0.42% 0.11% 0.19% 0.60% 0.13% 0.24% 0.24% Income Fund 1.66% 0.91% 1.50% 0.75% 0.62% 0.00% 0.00% 0.00% 0.03% Income Maximiser 1.66% 0.91% 1.50% 0.75% 0.62% 0.00% 0.00% 0.00% 0.05% Managed Balanced Fund 1.63% 0.88% 1.50% 0.75% 0.12% 0.12% 0.00% 0.00% 0.00% 0.00% Mixed Distribution Fund 1.50% 0.87% 1.25% 0.63% 0.10% 0.10% 0.00% 0.00% 0.00% 0.00% Managed Wealth Portfolio 1.99% 1.24% 1.50% 0.75% 0.00% 0.00% 0.00% 0.02% MM Diversity Balanced Fund 1.78% 1.28% 1.00% 0.50% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% MM Diversity Fund 1.75% 1.25% 1.00% 0.50% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% MM Diversity Income Fund 1.75% 1.25% 1.00% 0.50% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% MM Diversity Tactical Fund 1.83% 1.33% 1.00% 0.50% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% MM International Fund 1.94% 1.44% 1.00% 0.50% 0.00% 0.02% 0.00% 0.00% 0.00% 0.00% MM UK Growth Fund 1.93% 1.43% 1.00% 0.50% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Monthly High Income Fund 1.38% 0.73% 1.25% 0.60% 0.00% 0.00% 0.00% 0.00% QEP Global Active Value Fund 1.67% 0.93% 1.50% 0.75% QEP Global Core Fund 0.40% Recovery Fund 1.67% 0.92% 1.50% 0.75% Small Cap Discovery Fund 1.76% 1.01% 1.50% 0.75% 0.67% Strategic Bond Fund 1.45% 0.80% 1.25% 0.60% Strategic Credit Fund 1.16% 0.75% 1.00% 0.60% Tokyo Fund 1.67% 0.91% 1.50% 0.75% ****European Absolute Target Fund 1.42% 0.92% 1.25% 0.75% 0.17% UK Alpha Income Fund 1.66% 0.91% 1.50% 0.75% UK Alpha Income Fund 1.67% 0.92% 1.50% 0.75% 0.19% 1.14% 0.35% 0.12% 0.15% 0.00% 0.00% 0.00% 0.07% 0.07% 0.12% 0.00% 0.00% 0.00% 0.04% 0.00% 0.00% 0.00% 0.05% 0.59% 0.00% 0.00% 0.00% 0.37% 0.57% 0.57% 0.00% 0.00% 0.00% 0.00% 0.45% 0.45% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.02% 0.15% 0.00% 0.00% 20% of NAV Change 0.02% 0.16% 0.64% 0.00% 0.00% 0.00% 0.18% 0.17% 0.65% 0.00% 0.00% 0.00% 0.18% 0.78% 0.44% *Ongoing Charges1 (includes AMC) Funds *Annual Management Charge (AMC)2 **Pricing Policy3 Spread (dual priced funds) Entry Charge4 Exit Charge5 Performance Fee6 ***Portfolio Transactions Costs7 0.00% 0.00% 0.00% 0.13% Dilution Dilution Adjustment for Adjustment for single priced single priced funds Bid funds Offer (purchases) (redemptions) A Class Shares (****P1 where available) Accumulation Units Z Class Shares (****P2 where available) Accumulation Units A Class Shares (****P1 where available) Accumulation Units Z Class Shares (****P2 where available) Accumulation Units UK Alpha Plus Fund 1.66% 0.91% 1.50% 0.75% UK Corporate Bond Fund 1.11% 0.61% 1.00% 0.50% 0.48% 0.48% 0.00% 0.00% 0.00% 0.00% UK Dynamic Smaller Companies Fund 1.66% 0.91% 1.50% 0.75% 1.55% 1.63% 0.00% 0.00% 0.00% 0.13% UK Equity Fund 1.66% 0.91% 1.50% 0.75% 0.75% 0.00% 0.00% 0.00% 0.04% UK Mid 250 Fund 1.66% 0.91% 1.50% 0.75% 1.17% 0.00% 0.00% 0.00% 0.06% UK Opportunities Fund 1.66% 0.91% 1.50% 0.75% 0.00% 0.00% 0.00% 0.28% UK Smaller Companies Fund 1.66% 0.91% 1.50% 0.75% 2.55% 0.00% 0.00% 0.00% 0.06% US Mid Cap Fund 1.66% 0.91% 1.50% 0.75% 0.20% 0.00% 0.00% 0.00% 0.13% US Smaller Companies Fund 1.67% 0.92% 1.50% 0.75% 0.35% 0.00% 0.00% 0.00% 0.20% 0.83% 0.21% 0.64% *Ongoing charges and Annual Management Charges taken from most recent report and accounts available on 31 March 2016. **The spread for dual priced funds is on a bid to offer basis and for single priced funds is mid to bid and mid to offer. ***Calculated as at 31 March 2016. ****Absolute UK Dynamic and European Absolute Target have P1/P2 share classes in place of A/Z classes. Notes 1Ongoing Charge (previously known as TER Total Expense Ratio) – this figure is based on the fund’s actual expenses for the period. It covers all aspects of operating the fund during the period, including fees paid for investment management, administration and independent oversight functions. Where a fund invests in other funds, the Ongoing Charge will include the impact of the charges made in those other funds. In the case of Z class units, it does not include payments to your financial adviser and/or any other firm through which you invest. You pay for these services directly. 2Annual Management Charge (AMC) – part of, and included in, the Ongoing Charge. This charge relates to the annual costs of running and management of the fund. 3 Pricing Policy. Dual priced funds – net investments into the fund take place at the issue price and net withdrawals from the fund take place at the cancellation price. The spread figure shown is the difference between the issue and cancellation price. The issue price is calculated by reference to the offer prices of the underlying investments, plus an allowance for portfolio transaction costs. The cancellation price is calculated by reference to the bid prices of the underlying investments, less an allowance for portfolio transaction costs. This means that when investments are bought or sold as a result of other investors joining or leaving the fund, your investment is fully protected from the costs of these transactions. Single priced funds – the fund’s price will be adjusted upwards or downwards depending on the net flows into or out of the fund. A fund’s dealing price will only be adjusted if the daily net flow into or out of a fund exceeds 1% of the value of the fund. The amount of any such adjustment is calculated by reference to the estimated costs of dealing in the underlying investments, including the spread and the portfolio transaction costs. Adjustments to the price of the fund help to protect your investment from the costs of dealing in the fund i.e. it aims to ensure that investors buying or selling from a fund bear a portion of the associated trading costs. 5Exit Charge – there is no exit charge when you leave a Schroders fund. 6Performance Fee – Schroders charge a performance fee on some of their funds. 7Portfolio Transaction Costs – This is an average number over the last three financial years. Portfolio transaction costs are made up of the broker commissions and stamp duty incurred as a necessary part of buying and selling the funds’ underlying investments in order to achieve their investment objectives. In the case of shares, portfolio transaction costs are paid by the fund on each transaction. Comparing portfolio transaction costs for a range of funds may give a false impression of the relative costs of investing in them for the following reasons. –Transaction costs do not necessarily reduce returns. The net impact is the combination of the effectiveness of the manager’s investment decisions in improving returns and the associated cost of investment –Historic transaction costs are not an effective indicator of the future impact on performance –Transaction costs for buying and selling investments due to other investors joining or leaving the fund may be recovered from those investors –Transaction costs vary from country to country –Transaction costs vary depending on the types of investment in which the fund invests –As the manager’s investment decisions are not predictable, transaction costs are also not predictable. 4Entry Charge – otherwise known as Initial Charge. From 31 December 2012, we removed the Initial Charge from all of our fund classes. You pay directly any charges made by your financial adviser and/or other firm through which you invest. Issued in March 2016 by Schroder Unit Trusts Limited, 31 Gresham Street, London EC2V 7QA. Registered No:4191730 England. Authorised and regulated by the Financial Conduct Authority. w48765