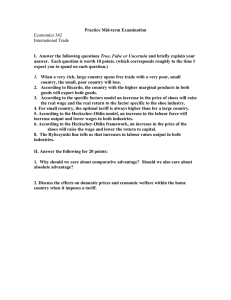

Men, Women, and Machines: How Trade Impacts Gender Inequality Chinhui Juhn ,

advertisement