Chaos Theory and Microeconomics: An Application to Model Specification and... Estimation Author(s): Steven G. Craig, Janet E. Kohlhase, David H. Papell

advertisement

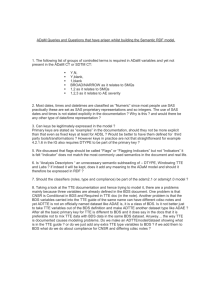

Chaos Theory and Microeconomics: An Application to Model Specification and Hedonic Estimation Author(s): Steven G. Craig, Janet E. Kohlhase, David H. Papell Source: The Review of Economics and Statistics, Vol. 73, No. 2 (May, 1991), pp. 208-215 Published by: The MIT Press Stable URL: http://www.jstor.org/stable/2109510 Accessed: 02/07/2010 15:50 Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at http://dv1litvip.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you may use content in the JSTOR archive only for your personal, non-commercial use. Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at http://www.jstor.org/action/showPublisher?publisherCode=mitpress. Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed page of such transmission. JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org. The MIT Press is collaborating with JSTOR to digitize, preserve and extend access to The Review of Economics and Statistics. http://dv1litvip.jstor.org CHAOS THEORY AND MICROECONOMICS: AN APPLICATION TO MODEL SPECIFICATION AND HEDONIC ESTIMATION StevenG. Craig,JanetE. Kohlhase,andDavidH. Papell* Abstract-This paperis the firstto applythe theoryof deterministicchaos to a microeconomicproblem.Previousapplications of chaos theoryto time series data, while successfulin uncoveringnonlinearities,have not providedguidelines for problems.In contrast,we resolvinguncoveredmisspecification show that a modifiedtest statistic from chaos theory is an extremelyvaluabletool in microeconomicmodel specification becauseit showswhen excludedinformationis correlatedwith includedinformation.This test, appliedto hedonicestimation of marginalhousingprices,is able to distinguishamongalternative regressionspecificationsand assists in discoveringa parsimoniousspecificationdevoidof nonlineareffects. I. Introduction JNTERESTin the theoryof deterministicchaos has recently exploded. Although the theory originated in the hard sciences, applicationsof chaos theory to economics, as described by Grandmont (1985), Brock (1988), and Baumol and Benhabib (1989), are becoming more common. All of the empirical applicationsto date, however, have used macroeconomicor financial time series data. Even though researchershave been successful in detecting evidence of nonlinear structure,they have not yet used chaos theory to provide guidelines for model specificationto purge nonlinearitiesfrom the data. Our application of chaos theoryto microeconomicdata offers a naturalway to attempt to resolve the presence of nonlinearstructurethroughan examinationof model specification. In this paper we present an innovativestatistical test, based on the BDS test of Brock,Dechert, and Scheinkman(1987),to detect the presence of nonlinear structurein microeconomicdata. The essence of our test is to examinethe residualsof a regression for systematic patterns. In a time series context, the data follow a natural order. With cross section data, the choice by which variable to order the data becomes imnportant. We demonstratethat our modified BDS test examineswhetherthere is informationomittedfrom the regressionthat is correlatedwith the variable by which the residuals are ordered. Omitted informationcorrelatedwith includedvariablescan either be truly omitted variables, or can be a nonlinearcombinationof the informationalready included in the regression. While there are no systematic methods for finding excluded variables, it is possibleto explorenonlinearcombinations of included variablesas alternativeregression specifications. To illustratethe importanceof chaos theory to microeconomicresearch, we apply the test for nonlinear structure to a hedonic housing price regression.This applicationis particularlyimportant since model specificationis a crucial issue without clear theoreticalguidancein the housing literature.' We show that the residualsfrom the standardspecificationtypicallyexhibitnonlinearities; that is, the residuals are not independently and identicallydistributed(iid). For some of the cases that we examine,we are able to purge the nonlinearitiesfrom the system by examiningalternativespecificationsof the regressionmodel. There are two separateaspects of specification in applied economics that are highlightedin the hedonichousingliterature.One is to find the best overallfit of a regressionequation.The second is to determine whether the central coefficient of the model is correctly estimated. While the econometric literature has recently proliferated with new specificationtests that addressthe first of these problems,no test exists that is focused Received for publicationSeptember1, 1989. Revision accepted for publicationAugust9, 1990. * Universityof Houston and Hunter College and Graduate Center, CUNY; Universityof Houston and Hunter College and Graduate Center, CUNY; and Universityof Houston, respectively. We would like to thank Dee Dechert for unravellingsome of the complexitiesof chaos theory and the BDS test for us. We have also benefitedfrom discussionswith Chera Sayers, the commentsof two excellentreferees,and fromseminarsat the Dallas FederalReserveBank,the Universityof Houston, 1Applications in labor economics,such as the specification HunterCollege,and WayneState University.Partialresearch supportfor Craigand Kohlhasewas providedby Texas Ad- of earningsequations(Murphyand Welch, 1990), may also benefitfromour approach. vancedResearchProgramGrant003652-113. [ 208 ] Copyright? 1991 CHAOS THEORY AND MICROECONOMICS upon a single variable in order to address the second of these problems.The modifiedBDS test is appliedwith respect to a single variablein the equation and does not rely on the overall goodness of fit of the regressionmodel. Complicatedfunctionalforms are often needed to obtain the highest possible goodness of fit measures.Achievingthe best overall goodness of fit sacrifices,however, the parsimoniousspecification needed to make precise statements about single regression coefficients. The problem, as discussed in Cassel and Mendelsohn (1985), is that complicated functional forms can make it difficultto calculatemarginalprices and standard errorsof specifichousingcharacteristics.We find that the modified BDS test gives valuable informationwhen appliedto the analysisof individual variablesin hedonic housingregressions. We applythe modifiedBDS test to the specification of a hedonic housing price equation used in Kohlhase (1991). We search for the existence of systematicnonlinearitiesin the errorterm of a regression.If systematicnonlinearitiesare found, we can conclude that the error term is not independentlyand identicallydistributedand that the regressionspecificationneeds to be exploredfurther. We applythe test and show how it leads to a parsimoniousspecificationwith ease of interpretationof the coefficientsof a single variable. The test is described in section II. We show that orderingby one of the right hand side variables of the regression allows the BDS test to detect correlationsbetween the includedvariable and informationexcluded from the regression. Section III discussesthe applicationof the modified BDS test to the hedonic housing equation. This applicationshowsthat a parsimoniousspecification,which allows straightforwardanalysisof the effects of a single variable and relativelyuncomplicatedcalculationof the resultingstandard errors, retains some of the desirable features of more complexfunctionalforms. Section IV offers conclusionsand suggestionsfor furtherresearch. II. A One Variable Specification Test The problem we analyze is to determine the correct specificationof a hedonic housing price equationsuch as: g(P)=f(X)+e (1) 209 where P is the price of a residential dwelling, and X representsa vectorof characteristicsof the house, the neighborhoodcharacteristicsof the area, and its location. Goodness of fit tests, such as Box and Cox (1964),examinethe overallspecification of (1) and maximize an appropriately defined likelihood function. As pointed out in Cassel and Mendelsohn (1985), however, if the true specificationof (1) is ln(P) = Eai ln(Xi) + bjXj + e (2) ri then goodness of fit tests will prefer a log-log2 specificationover all others.This is in spite of the fact that Xj is not specified correctly in the log-log form. Such a misspecificationmay be crucial if Xj is the variableof interest.The modified BDS test developed here is the first diagnostic test capableof examiningthe errorstructurewith respect to a single variable. A. Outlineof the Basic BDS Test The BDS test developed in Brock et al. (1987) examinesthe patternof a series of data. Compare the ith observationto the (i + 1)th observation. There is some positiveprobabilitythat this pair of observationsis within a known distance (d) of each other. Now consider a third observation. Again there is a probabilitythat it is within the same distanceof the second. If these three observations are from an iid series, the probabilitythat each pair is within d is well defined. The BDS test compareshow often a series of data points are actually within d of each other to the expected value if the series were distributediid. Define an Indicatorfunction I, where I = 1 if the absolutevalue of the differencebetween two points is less than or equal to d, and I = 0 otherwise. The embeddingdimension m defines the number of points that are compared in a series.3The function C depends on the sum over the productof the indicatorfunctionsfor each m 2 Here we define log-linearto mean ln(P) is a functionof linearX's, linearto meana linearspecification,and log-logto indicatelogs of both the left and righthand side variables. 3 The embedding dimension defines the "m dimensional cube" that would be filled by the data if the data are truly random.If the data are deterministic,then a functionof the data would show a relationshipin m dimensionalspace. For our purposes,the embeddingdimensionsimplyrepresentsa parameterto be specified,where m can be specified larger the largeris the data set. THE REVIEW OF ECONOMICS AND STATISTICS 210 as C(m,n,d) = cl E -1<i<j<n ( 1iId(Xi+k, Xj+k))j k=O (3) where m is the embedding dimension, n is the number of observationsminus m, d is the distance between two points that causes the indicator function to equal one, and X represents a data point. The expression in parentheses will equal one if all m - 1 pairs of points are within d of each other, and it will equal zero if even one of the pairs of points is fartherapartthan d. The summationshows how many times in an entire data series there is a succession of m - 1 pairs that are close (within d). The BDS test relies on a proof that C(m, n, d) asymptoticallyapproachesCmin probabilitywhen the data series is independent and identically distributed.Brock et al. (1987) use this result to derive a statistic, called a C statistic, that depends on comparing the actual calculation of C(m, n, d) to the calculationof [C(1, n, d)]m.If the data are independent and identically distributed, this difference should approach zero. Asymptotically,the difference between the two functions divided by the standard error approachesa standardnormaldistribution.Dechert (1987) has written a computerprogramto calculate the BDS statisticdefined as BDS = nl/2(C(m, n, d) - [C(1, n, d)]m}/bm (4) where the numeratoris called the C statisticand bmis the standarddeviationof the C statistic.4If there are more (or less) points close together than would be expected from iid data, where [C(, n, d)]mis the numberof times a series of iid points would be expected to be close, then the BDS statistic indicates the likelihood that those points could have been generatedby an iid series. B. Applicationof the BDS test to MicroData The BDS test describedin (4) has been applied to macroeconomictime series data to search for 4 This is the C test based on Corollary2 of Theorem2 of Brocket al. (1987),ratherthan the S test whichrelies on the ratio of C functions. occurrencesof systematicnonlinearities(for example Brock and Sayers, 1988). In a time series context, the data have a natural order. In the microeconomiccontextwe must impose sequencing on the data by sorting on the variable of interest. What further differentiatesour application of the BDS test from the time series context is that applicationto micro data allowsconsideration of why a series of residuals might or might not be "close"to one another.If the observations are ordered randomly,it would be expected that the BDS statisticwouldbe zero, as the errorterm should be iid. On the other hand, assume the data are ordered by one of the right hand side variables.If there is a misspecificationerror, either through incorrect functional form or an omitted variable that is correlated with the included variables, then the BDS statistic will be significantlydifferentfrom zero. Brockand Dechert (1988) have proventhat the BDS test is a good specification test for time series data provided the residuals of the estimated regressioncan be written as a function of the currentand lagged values of the residualsof the true relation.In the case of omittedvariables for micro data, the intuitionworks the same way because the estimatedresidualsare a functionof the omittedvariables.This can be seen by assuming the true model is (5) g(P) = f (X) + h(Z) + u where u is independently and identically distributed.Assume the equation is estimatedomitting the Z terms: (6) g(P) = f(X) + v so that the errorterm of the estimatedregression is (7) v=h(Z)+u. If the excluded information(Z) from the true regression(5) is correlatedwith the included information(X) in the actual regression(6), then equation (7) can be rewritten to depend upon only the includedinformation: (8) v = w(X) + e + u = g(P) - f(X) where e is an iid error term independent of u and w(X) describes how the excluded information is correlatedwith the included information. Brockand Dechert (1988) show that if g(P) f(X) is independent of X, then v is iid. The CHAOS THEORY AND MICROECONOMICS modificationto the BDS test that we propose involves ordering the data by X, the included variableof interest. If there is a relation such as w(X), then sorting by X will uncover the fact that g(P) - f(X) will depend on the size of X. Thus the indicatorfunction in the BDS test will capturethe relationshipin w(X) by showingthat the error terms do not have equal probabilityof being close to each other. We therefore are able to use the BDS test as a specificationtest to look for the importanceof excludedinformationfrom the regression. To see why the patternof residualsreflectsthe information omitted from the regression, consider a set of residuals sorted by X and the probabilitythat a given pair of residualswill be within, in absolute value terms, d of each other. If the series of residuals are iid, the probability that one pair of residualsis close to each other is unaffectedby whether the previouspair of residuals is close or not. If the residuals reflect the omitted information w(X), however, then the probabilitythat they are within d of each other can be predictedbased on knowledgeof whether the previous residuals are close to each other. The predictionis possible only because the previous pair reflects the impact of the omitted information. That is, the BDS test will show a significantly greater probabilitythan independence of finding residuals close to each other when the residualshave been orderedby an includedvariable. Therefore the probability that the BDS statistic is significantlydifferent from zero depends on the probabilitythat there is an omitted variablethat is correlatedwith the includedvariable. The key to the test we propose is how the excluded informationimpacts the included variables.When the functionalformof a regressionis not correct, it is quite likely that the excluded informationis related to the included information. Even in the case of truly omitted variables, however,the BDS test will detect the influenceof omitted informationif it is correlated with the included information. This poses a potential problem for the applied researcher, in that a significantvalue of BDS (showing a lack of iid) may mean more than one problemexists. On the other hand, a BDS value insignificantlydifferent from zero shows that excluded informationdoes not have any significanteffect on the estimated 211 parametersof interest. Thus our modified BDS test has the advantage of providinga stopping rule in the search for an appropriatespecification. III. Empirical Application of the Modified BDS Test We applythe modifiedBDS test to the residuals from the housing price equation used in Kohlhase (1991). Hedonic estimation to find marginalprices of varioushousingattributesprovides a particularlyuseful application because there is no theoreticallypreferredfunctionalform and the correct functional form is likely to be rathercomplicated.For manypurposes,however, what is of interest is the marginal price of a specific housing attribute.We focus here on the marginal price of square feet of living area (SQFT) for illustrativepurposes. The data set consists of 1366 cross sectional observations on housing prices in Houston in 1985. There are three types of variablesdifferentiated by geographiclevel.5 The first type differs by observationand includes housing characteristics such as SQFT. The second and third types vary by geographic area, Keymap number and census tract level.6 The second and third type of variablesmay have systematipmeasurementerror due to geographicaggregationbias, so we concentrate on discussing the specification of a house-specificvariable SQFT, and report other specificationsfor comparison.Variablesthat are truly constant over geographic area, however, should not pose a problemfor the modifiedBDS test. Our goal is to find an estimate of the marginal price of SQFT where we are confident that we have capturedany nonlinearitiesin the specification of this variable. We proceed in two steps. 5 Variables included in the regression are of 4 types: (1) house-specific-square feet, lotsize, parking,bedrooms, fireplaces, baths, condition, age, central air, range, dishwasher,(2) Keymapnumberspecific-distance to toxicwaste site, (3) census tract specific-distance to employment,% owneroccupied,% with high school education,income,poor, blue collar, black, hispanic,% under 19 years, and (4) time period-dummies for quarter.A data appendixis available from the authors. 6 There are 286 keymapletter areas and 155 census tract areas in the data set. A Keymapletter area is about 0.56 squaremiles and the averagecensustractis about3.44 square miles. 212 THE REVIEWOF ECONOMICSAND STATISTICS First we examine three primarysimple specifications, linear, log-log, and log-linear to find a preferredbasic functionalform. Because the preferred log-linear specificationdoes not pass the modifiedBDS test, we examine alternativeinteraction and higher order terms. This allows us to find a relativelyparsimoniousspecificationwhere the marginal price of SQFT and its standard error are straightforwardto calculate,but which still meets the requirementsof statisticalreliability as identifiedby an iid error structure. TABLE 1.-MODIFIED FOR ALTERNATIVE Basic Modelb Linear Log-Log Log-Linear a BDS TEST RESULTS FUNCrIONAL FORMS ca (Standard Error) 1.57 (0.15) 0.43 (0.09) 0.29 (0.07) BDS Statisticc 10.61 4.84 4.06 Calculated from the regression residuals sorted by SQFT. See text. Significance test from zero. A. Evidence for Systematic Nonlinearities Table 1 presentsthe C statistics,their standard errors, and the resulting BDS statistics for the three alternativehedonic housing price equation specificationswith the data ordered by SQFT.7 There are two basic results presented in table 1. First, there is considerableevidence of nonlinear structure,as the BDS statistics are all over 4V8 Second, table 1 shows that the log-linear functional form is clearlypreferredto the linear, and is weakly preferred to the log-log. This can be seen because the log-linearspecificationhas a C statistic significantlybelow that of the linear model, and a C statistic lower than that of the log-log model.9We will thereforeuse the log-linear specificationin the remainderof the paper.10 We find the BDS test to have considerably more powerfor detectingcomplexpatternsin the error structurethan do commonlyused tests for functionalform. We performtwo standardfunctional form tests: MacKinnon,White and David- son's (1983) PE test and Kmenta's (1986) Durbin-Watson(DW) statistic test. Neither provides any clear guidance about which functional form of the regressionis preferredand the inconclusive results in the DW test do not even warn the researcherof the nonlinearityproblem. We also estimate an autoregressivemovingaverage (ARMA) model on the basic residualsordered by SQFT for the log-linearregression,and find that, based on the Ljung-BoxQ Statistic,the appropriate specification for our data is an ARMA (1, 1). We then apply the modified BDS test to the residuals from the ARMA model. Purgingthe linear structurefrom the residuals, however, appears to have little effect. The C statistic falls insignificantlyfrom 0.29 (0.07) for the basic model residuals to 0.27 (0.07) on the ARMA residuals. Further, the resulting BDS statistic of 3.82 indicates that significantnonlinear structureremains. 7 We use an embeddingdimension(m) of 5 and a distance (d) of the standarddeviationof the data dividedby the range. B. Respecification of the Basic Model The resultsare robustfor values of m between 3 and 10 and While the preferencefor the log-linearspecififor valuesof d between 0.5 and 1.5 times that chosen. 8 We use standardnormaltables to calculateprobabilities. cation is consistent with results elsewhere, the Hsieh and LeBaron(1988) show that smallsampleproperties BDS statistics in table 1 indicate that further of the BDS statisticonly become importantfor sample sizes model specificationis needed. There is statistical less than 500. 9 The test of significanceis approximateonly and is based evidence that the regression residuals vary syson comparing the statistic z = (Cl - C2)/(Var(C1 - C2))5 to a standardnormaldistribution,where Cl is the C-statistic in model 1. This calculationis approximatebecause the covariancebetween Cl and C2 has not yet been theoretically derivedand is assumedhere to be zero. z equals7.73 comparing the linear model to the log-linear,and z equals 1.21 comparingthe log-log to the log-linearmodel. 10Both the linear and the log-linearspecificationinclude SQFT squared as in the basic Kohlhase model. The BDS statisticwithoutthe squaredtermis significantlyhigherunder both of these specifications,but the relative results are unchanged. tematically, but nonlinearly, with the size of SQFT. When the regression residuals are ordered randomly,the BDS statistic falls to 0.003 with a standard error of 0.06. It is therefore because of orderingby SQFT that we uncover a pattern in the residualsthroughthe BDS test. Possible causes of a significantBDS statistic include omitted unobservedvariables,higher order terms, or interactionterms. Clearly,it is not CHAOS THEORY AND MICROECONOMICS 213 TABLE2.-MODIFIED BDS TESTRESULTS possible to include unobserved variables. We WITHVARIOUSINTERACTION TERMS therefore first search higher order terms of the ca included variables.While squared terms have a (Standard BDS theoreticalbasis, to capturevariationin marginal Error) statisticb effects for example, further higher order terms are not very appealing theoretically. Including Interaction Variable .18 2.66 terms up to SQFT to the sixth power, however, SQFT (.07) reduce the BDS to 3.12 which is still significantly Lotsize .24 4.16 (.06) different from zero. We conclude that simple Bedrooms .06 0.92 nonlinearities are not the explanation for the (.07) observedpatternof the regressionresiduals. Fire .23 3.30 (.07) To refine the model further,we desire a parsiBath .15 2.18 monious set of interaction terms that will still (.07) allow a relatively straightforwardcalculation of Cond .29 4.08 (.07) the marginalprice of SQFT. There is no clear Age .30 4.11 guidance as to which interaction terms, or how (.07) manyinteractionvariables,might be appropriate. Air .24 3.60 (.07) Table 2 presents BDS results when each of the .30 Range 4.54 house-specific characteristics, and two region(.07) specific variables,is used as an interactionvariToxic .21 2.77 (.08) able with all of the other variablesin the regresCBD .41 5.16 sion model. In all cases, we ordered the data by (.08) SQFT to calculatethe BDS statistic.We find that Other Specifications .44 5.97 an interaction with the number of bedrooms No Sqft Squared (.07) (BED) passes the BDS test.1"The BDS statistic With Higher Order .23 3.12 of 0.92 shows that the hypothesisof iid residuals Sqft Terms (.07) cannot be rejected at the 5% level. This specifi- a Calculated from the regression residuals sorted by SQFT. cation has the furtherattractionthat the marginal bSignificance test from zero. price of SQFT calculationonly involves SQFT, the squared term, and the interaction of these TABLE 3.-MARGINAL PRICE OF A SQUARE FOOT OF LIVING AREAa two variableswith BED. Choosing a specificationwith BED as the in- Basic Model $52.49 teractionvariableis attractiveon a priorigrounds. (2.34) The interactionallowsthe marginalpriceof SQFT Bedroom Interaction -Two Bedrooms 33.42 to vary by the number of bedrooms. Table 3 (4.06) presents the marginal price of SQFT and its -Three Bedrooms 50.93 (2.32) standarderror under the two alternativespecifi-Four Bedrooms 68.44 cations. In the basic model, a marginalprice of a (3.64) square foot of living area is estimated to cost -Five Bedrooms 85.95 (6.33) $52.49 irrespectiveof other house characteristics. errors are in standard aAsymptotic parentheses. the Under interactive and correctly specified model, however, the marginalprice varies from $33.42for a two bedroomhouse to $85.95for five bedrooms.The modified BDS test allows a cer- has captured any systematic nonlinearitieswith tain confidencethat the interactionspecification respect to squarefeet. In addition,the advantage of the parsimoniousspecification is shown be11The BED interactionspecificationis not the only possible cause the marginal prices of SQFT calculated specificationthat passes the modifiedBDS test, for example, under the interaction model are still estimated additionalinteractionvariablesalso pass. Brockand Dechert relativelyprecisely. (1988) conclude their paper by speculatingon whether the Because of the success of the BED interaction BDS test is a uniquetest for specificationerror.Ourempirical resultsindicatesthat it is not. model, we examine other housing characteristics 214 THE REVIEW OF ECONOMICS AND STATISTICS TABLE4.-MODIFIED BDS TESTRESULTS WITHINTERACTION TERMS Basic Model Bedroom Interaction ca Sorted Variable SQFT Lotsize Bedrooms Fire Bath Cond Age Air Range Toxic CBD Ca (Standard Error) BDS statisticb (Standard Error) BDS statisticb .29 (.07) .32 (.07) .51 (.07) .34 (.07) .28 (.07) .29 (.07) .53 (.07) .37 (.07) .44 (.07) .71 (.07) .82 (.07) 4.06 .06 (.07) .28 (.07) .25 (.07) .14 (.07) .11 (.07) .11 (.07) .32 (.07) .11 (.07) .20 (.07) .55 (.07) .49 (.07) 0.92 4.44 7.09 4.69 3.98 4.08 7.44 5.18 6.15 9.87 11.42 4.25 3.78 2.12 1.64 1.65 4.76 1.66 3.01 8.26 7.40 a Calculatedfrom the regressionresidualssorted by indicated variable. bSignificance test from zero. and their performanceon the BDS test. Table 4 presents the results. The first two columns show BDS test results for the basic model when the residuals are ordered by each of the housing specific characteristics,plus the Keymapvariable TOXICas well as the CensustractvariableCBD.12 None of the variables that we use to sort the residualsshow an insignificantBDS statistic.The second two columns show the residuals of the BED interactionmodel when orderedby each of the variables.In addition to SQFT, three other variablesnow show BDS statistics insignificantly differentfrom zero at the 5% level: the number of baths, condition of the house, and the presence of air conditioning.In fact, with the exception of lotsize, all of the variablesin the model show a significantimprovementin the C statistics. Thus the numberof bedroomsappearsto be an importantsourceof nonlinearitieswith respect to many of the housingcharacteristics. One of the most valuableaspects of the modified BDS test is that unlike many other tests, the BDS test provides a stopping rule in the search for an appropriatespecification.When the residuals are found to be iid, informationexcluded from the regression is not correlated with the ordering variable. For example, the BDS test shows that the residuals from the basic model augmentedby bedroominteractionsare iid when ordered by SQFT. In contrast,a standardF-test about the inclusion of more variables, such as CBD or TOXICinteractions,would lead the researcherto add unnecessarycomplexity. We have shown that the modified BDS test is an importantdiagnostictool when examiningthe specificationof a regressionequationwith respect to a single variable.There are, however, important limitationsto using the modified BDS test. As discussedearlier,when variablemeasurement exhibits geographic aggregation bias, the BDS test may show significantnonlinearities for all 12 We omitted from table 4 two house-specificcharacteris- specifications.Further,we found several specifitics, dishwashersand numberof parkingspaces, because the coefficientestimates in the basic model were quite low and cations where the BDS statistic is larger using three interactivevariablesthan one.13 This may imprecise(t-statisticsless than 0.1). CHAOS THEORY AND MICROECONOMICS be because some interaction variables induce nonlinearitiesinto the data rather than control for them. Even more important,perhaps, is that in additionto incorrectfunctionalform, another source of significantBDS statistics can be omitted variables.The finding that the BDS statistic when the regression residuals are ordered by lotsize do not fall with the BED interactionis not very reassuring.The BDS statisticusing the basic log-linearmodel is 4.44. With the BED interaction, it fell slightlyto 4.25. With three interaction variables, it is still 4.46. In fact, we failed to discovera specificationfor lotsize that providesa significantimprovementin, much less passes, the modified BDS test. As with all diagnostictests, the test is able to indicate where more work is needed without being very specific about how to correctthe problem. IV. Summaryand Conclusions This paper has shown that an application of chaos theory providesan excellent tool for investigating microeconomicmodel specification.The modified BDS test proposed here provides an importantdiagnostictest for the presence of nonlinear structurein microeconomicdata, and provides an important indication about whether a particular variable in a regression is correctly specified. The modified BDS test examines whether the residuals of a regression equation exhibit a systematicpatternwhen ordered by the right hand side variable of interest. The test therefore determineswhether excluded information from the specified regression is correlated with the variable of interest; a determinationof no correlationindicatesthat the resultingparameter estimates are unbiased. The modified BDS test applied to micro data is an importantspecification test with respect to a single variablebecause possible sources of excluded information consist of alternativefunctionalforms employing includedvariables. Specificationtests for a single variable are especiallyimportantin applicationswhere a precise coefficient on a specific variable is desired. We have applied the modifiedBDS test to a hedonic housing price regression,and are able to find a 13 For example,interactionswith BED, TOXIC,and CBD produce a BDS statistic of 0.93, despite the fact that BED only as an interactionvariableproducesa BDS of 0.92. 215 relatively parsimoniousspecification where the residualsare iid when ordered by square feet of living area. Thus we offer the first attempt to mediate the trade-offbetween a complexspecification of the overallequationand ease of manipulation for a particularregressioncoefficient. The test for nonlinearstructure,when used on macroeconomic data, can give evidence about whether the residualsare iid, but does not indicate how the model can be transformedto purge the systematiccomponentfrom the residuals.In the microeconomiccontext, the modified BDS test is an excellentsignpostabout potentialerrors in modellingbecause orderingby the variableof interestprovidesa methodfor uncoveringsystematic nonlinearitiesin the residuals. REFERENCES Baumol,WilliamJ. and Jess Benhabib,"Chaos:Significance, Mechanism,and EconomicApplications,"TheJournal of EconomicPerspectives3 (Winter1989),77-106. Box, G. E. P. and D. R. Cox, "An Analysisof Transformations,"Journalof the RoyalStatisticalSocietySeriesB, 26 (1964),211-252. Brock,WilliamA., "Introductionto Chaosand OtherAspects of Nonlinearity,"in W. A. Brockand A. G. Malliaris, DifferentialEquations,Stabilityand Chaosin Dynamic Economics(New York:North-Holland,1988). Brock,WilliamA., and W. Davis Dechert, "A GeneralClass of SpecificationTests: The Scalar Case," Proceedings of the Businessand EconomicStatisticsSection,American StatisticalAssociation(1988),70-79. Brock, William A., W. Davis Dechert, and Jose A. Scheinkman,"A Test for IndependenceBased on the CorrelationDimension,"SSRI WorkingPaper #8702, 1987. Universityof Wisconsin-Madison, Brock, WilliamA., and Chera L. Sayers, "Is the Business CycleCharacterizedby DeterministicChaos?"Journal of MonetaryEconomics22 (1988),71-90. Cassel,Eric, and RobertMendelsohn,"The Choice of FunctionalFormsfor HedonicPriceEquations:Comment," Journalof UrbanEconomics18 (Sept. 1985),135-42. Dechert, W. Davis, "A Programto CalculateBDS Statistics for the IBM PC,"Universityof Houston,1987. Grandmont, Jean-Michel, "On Endogenous Competitive Business Cycles," Econometrica 53 (Sept. 1985), 995-1045. Hsieh, David A. and Blake LeBaron,"FiniteSampleProperties of the BDS StatisticI: DistributionUnder the Null Hypothesis,"Universityof Chicagomimeo, May 1988. Kmenta,Jan, Econometrics(New York:Macmillan,1986). Kohlhase,Janet E., "The Impact of Toxic Waste Sites on HousingValues,"Journalof UrbanEconomics30 July 1991),1-26. MacKinnon,J. G., H. White, and R. Davidson,"Tests for Model Specificationin the Presence of Alternative Hypotheses:Some FurtherResults,"Journalof Econometrics21 (Jan. 1983),53-70. Murphy,KevinM. and FinisWelch,"EmpiricalAge-Earnings Profiles,"Journalof LaborEconomics8 (Apr. 1990), 202-229.