Document 14867351

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

# 259

S A P f f f o a r r n

J J J d o i i i

J J J o n t t t i i i n

V t t t e

V n t e t t n u r t t r t u e r r e

O p

A e c c r r c c a o t t t i i i u o n n t t t s i i s i n g , , ,

S A P a n d J

O

J J o p i i i e n r r t t t a t t

V t i i i e o n n t t t s s u

( ( ( r r e

D o

A u c c c c b l l l o e u

C n r r t t t i i i e n d i g i i t t t

, , ,

) ) ) f f f o r r J J J o i i i n t t t

Page 1 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

S A P a n d J J J o i i i n

V t t t e

V n t e t t n u t t t r u e r e

O p

A e c r c a o t t t i i i u o n n t t t i s i i n g , , , f f f o r J J J o i i i n t t t

S A P a n

J J J d o i i i

J J J o n t t t i i i

( ( n

V t t

D t e

V o n u t e t t n u b l l l t t r t e u e r

C e

O r p e

A e d c i r i i t t c t a

) ) o t t t i i i u o n n t t t i i s i n g , , , f f f o r

Page 2 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

C o u r r s s s e e C o o r r d i i i n a t t t o r r : : :

P r o f f .

.

D r .

.

R .

.

B .

.

C r a w f f o r d – D i i r e c t t o r H R O D C P o s t t g r a d u a t t e T r a i i n i i n g I I n s s t t i i t t u t t e

PhD (University of London);

MEd. M. (University of Bath);

Adv. Dip. Ed. (University of Bristol);

PGCIS (Thames Valley University);

ITC (UWI);

Member of the Standing Council of Organisational Symbolism (MSCOS);

Member of the Asian Academy of Management (MAAM);

Member of the International Society of Gesture Studies (MISGS);

Member of the Academy of Management (MAOM);

LESAN;

Professor, HRODC Postgraduate Training Institute;

Visiting Professor, Polytechnic University of the Philippines (PUP).

Page 3 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

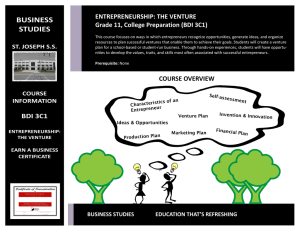

For Whom This Course is Designed

This Course is Designed For:

Joint Venture Accountants;

Financial Accountants;

Chief Financial Officers;

Venture Capitalists;

Treasury Officials;

General Accountants;

Management Accountants;

SAP Programmers;

SAP Accountants;

Internal auditors;

Public accountants;

Assets accountants;

Attorneys;

Human Resource (HR) Officers who need an overview of SAP system and Joint venture Accounting.

Duration: 10 Days

Cost:

£8,000.00

Per Delegate for UK Delivery

£10,000.00

Per Delegate for Delivery outside the UK

Please Note:

V.A.T. (Government Tax) does not apply to Corporate Sponsored Individuals, taking

Programmes or Courses in any location - within or outside the UK.

It applies only to Individuals and Corporations based in the UK and to Non-UK Individual

Residents taking courses in the UK.

Page 4 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Cost includes:

Free Continuous snacks throughout the Event Days;

Free Hot Lunch on Event Days;

Free City Tour;

Free Stationery;

Free On-site Internet Access;

Diploma – Postgraduate – in SAP and Joint Venture Accounting, for Joint

Venture Operations (Double Credit); or

Certificate of Attendance and Participation – if unsuccessful on resit.

HRODC Postgraduate Training Institute’s Complimentary Products include:

1. HRODC Postgraduate Training Institute’s Leather Conference Folder ;

2. HRODC Postgraduate Training Institute’s Leather Conference Ring Binder/

Writing Pad;

3. HRODC Postgraduate Training Institute’s Key Ring/ Chain ;

4.

HRODC Postgraduate Training Institute’s

Leather Conference (Computer

–

Phone) Bag

– Black or Brown;

5.

HRODC Postgraduate Training Institute’s

8GB USB Flash Memory Drive , with

Course Material;

6.

HRODC Postgraduate Training Institute’s

Metal Pen;

7.

HRODC Postgraduate Training Institute’s

Polo Shirt .

**Please see product images, as a separate file - Complimentary Products For Students and Delegates, from HRODC Postgraduate Training Institute.**

Daily Schedule: 9:30 to 4:30 pm.

Location: Central London and International Locations

Schedule - Part 2: http://hrodc.com/London_Postgraduate_Courses_Postgraduate_Diploma_Postgradu ate_Executive_MBA_Schedule_MBA_Diploma_London_UK.htm

Click to book this course: http://www.hrodc.com/Course_Booking_Form_London_Dubai_Kuala_Lumpur_Paris

_Johannesburg_Cairo_Jeddah_Abu_Dhabi_Kuwait_MBA_MSc_MA_Course.htm

Page 5 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

S A P a n d

P e

J e t t t o r i r i i n o l t l t l t e e

V u e e m n t t t

– u r r e

O e i i i l l l

A a c c n c c d o u

G n t a t t s i s i s i n

g , , ,

O f f f p o e r e r r r

J a t t t o i i i i n t t i i o n t n

V e e n t t t u r r e e

Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Petroleum – Oil and Gas – Operation (Double Credit)

C o u r r s s s e e C o n t t t e e n t t t s s s , , , C o n c c e e p t t t s s s a n d I I I s s s s s s u e e s s s

Part 1- Joint Ventures and Alliances: Rationalising the Decision Process

Joint Venture and Alliance Transactions;

Joint Ventures vs. Alliances;

Justification for the Establishment of Joint Ventures and Alliances;

Classification of Joint Ventures

Information and Communications Technologies (ICTs) Availability: Scenarios

Supporting or Mitigating against Joint Ventures and Alliances

Occasions when Joint Ventures and Alliances might enhance the success of

Diversification;

Factoring Organisational Strengths and Weaknesses in Joint Ventures and

Alliances;

Exploiting Synergies in Joint Ventures and Alliances;

The extent to which Joint Ventures and Alliances Might Enhance New Market or

Product Development;

Will Joint Ventures and Allian ces improve or impair prospective partners’

Competitive Advantage?

The extent to which Joint Ventures and Alliances might mitigate Financial Risk;

The Extent to which Cost-Sharing might be an issue in Joint Ventures and Alliances;

Are Joint Ventures and Alliances more likely to promote ‘Efficacy’ or support

‘Waste’?

The relationship between Joint Ventures and Alliances, on the one hand, and

Employee Resourcing, on the other;

Joint Ventures and Alliances Valuation;

Initial Contributions of Partners in Joint Ventures and Alliances;

Predicting Cash Flows of a Venture for Joint Ventures and Alliances;

Determining Long-Term Viability of the Venture;

Page 6 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Calculating the Overall Value of a Venture under Joint Ventures and Alliances.

Part 2 - Operationalising Joint Ventures (1)

"Fixed Operating Costs" in a Joint Venture Operation;

"Variable Operating Costs" in a Joint Venture Operation;

Allocated Costs in Joint Venture Operation;

Authorisation for Expenditure (AFE) as Subservient to Joint Venture Committees ;

Calculating Direct Costs in a Joint Venture Operation,

Calculating Profits, on Working Interest Basis, in a Joint Ventures;

Calculating Working Interest Costs in a Joint Ventures;

Dealing with Maim Vote in an Independent Operations Notice;

Determining Accounting expenditure limits in a Joint Ventures;

Determining Capital Costs in Joint Ventures;

Determining Costs in a Joint Venture Operation;

Determining Operating Expenses in Joint Ventures;

Determining the Operator in a Joint Venture;

Executing Authorisation for Expenditure (AFE) for Information Only ;

Executing Mail Ballots in a Joint Venture Operation;

Fixed vs. Variable Operating Costs in a Joint Venture Operation;

Independent Operations Notice in a Joint Venture Operation;

Indirect Costs in a Joint Venture Operation.

Part 3 - Operationalising Joint Ventures (2)

Joint Account Costs in a Joint Venture Operation;

Mechanism for Tracking Capital Expenditure in a Joint Ventures;

Mechanism for Tracking Operating Expenditures in a Joint Ventures;

Operating a Joint Account in a Joint Ventures;

Operator’s Costs in a Joint Venture Operation

Procedure for seeking Partners’ approval for Projects that exceed the Accounting

Expenditure Limit;

Page 7 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Relationship between an Independent Operations Notice and an AFE in a Joint

Venture Operation.

Risk appropriation for an Independent Operations Notice;

Seeking Partner Approvals, through Authority for Expenditures (AFE);

Specifying Project Benefits in Independent Operations Notice;

The operation and validity of an Independent Operations Notices (ION);

The place of an Independent Operations Notice (ION) in Joint Venture Operation

The purpose of a Supplemental AFE in a Joint Venture Operation;

Use of an Independent Operations Notice (ION) in a Joint Venture Operation;

Using Mail Ballots (MB) to seek Project Approval;

What happens when a project changes or has a cost overrun?

Who can propose a project in a Joint Venture Operation?

Part 4 - Conceptualising and Contextualising Authorisation for Expenditure (AFE) for

Joint Venture Operations (1)

Authorisation for Expenditure (AFE) Conceptualisation;

Authorisation for Expenditure (AFE) as Documentation for Joint Operators ’ Approval for Expenditure;

Cost Control as an Aspect of Authorisation for Expenditure (AFE);

Budgeting as an Feature of Authorisation for Expenditure (AFE);

Monitoring as an Aspect of Authorisation for Expenditure (AFE).

Authorisation for Expenditure (AFE) as a Feature of Joint Venture Agreements

(JVA);

Authorisation for Expenditure (AFE) for Joint Venture Project Approval;

Economical Evaluation in Authorisation for Expenditure (AFE);

Authorisation for Expenditure (AFE) Coding;

Components of Authorisation for Expenditure (AFE);

Preparation, Execution and Monitoring Process of Authorisation for Expenditure

(AFE);

Authorisation for Expenditure (AFE) Process in Join Operation Agreement;

Interest Partner ’s Approval as Authorisation for Expenditure (AFE) Execution.

Page 8 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Part 5 - Conceptualising and Contextualising Authorisation for Expenditure (AFE) for

Joint Venture Operations (2)

Authorisation for Expenditure (AFE) in Production Sharing Contract (PSC);

Authorisation for Expenditure (AFE) for Risk Service Agreement (RSA) or Risk

Service Contract (RSC);

Non-Standard Authorisation for Expenditure (AFE);

Operationally Standardized Authorisation for Expenditure (AFE);

Minimalist Authorisation for Expenditure (AFE);

Addressing Failure to Obtain Approval from all Working Interest Owners of an

Authority for Expenditure Result;

Authorisation for Expenditure (AFE) as Reapproval for Budgeting Excess;

Consequences for Non-reapproval of Authorisation for Expenditure (AFE);

Accumulation of AFE Activities in the General Ledger;

Executing Authorisation for Expenditure (AFE);

Reporting of AFE Activities at AFE Level

Part 6 - Key Elements of SAP Supporting Joint Venture Accounting: An Overview, with Tacit Application (1)

Joint Ventures Operation in SAP

Authorization for Expenditure with SAP, in Joint Venture Operations;

Determining Asset Classes and Sub-Classes with SAP, in Joint Venture Operations;

Tangible and Intangible Assets with SAP, in Joint Venture Operations;

Current Assets with SAP, in Joint Venture Operations;

Cash and Cash Equivalents

Short-term Investments

Receivables

Inventory

Prepaid Expenses

Fixed Asset with SAP, in Joint Venture Operations;

Asset Description with SAP, in Joint Venture Operations;

Setting up Depreciation Parameter

Page 9 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Straight Line Method with SAP, in Joint Venture Operations;

Reducing Balance Method with SAP, in Joint Venture Operations;

Unit of Production Method with SAP, in Joint Venture Operations;

Commencement of Depreciation with SAP, in Joint Venture Operations;

Annual Impairment Testing with SAP, in Joint Venture Operations;

Indicators of Impairment with SAP, in Joint Venture Operations;

Part 7 - Key Elements of SAP Supporting Joint Venture Accounting: An Overview, with Tacit Application (2)

Maintaining Asset Register with SAP, in Joint Venture Operations;

Contents of Asset Register with SAP, in Joint Venture Operations;

Cost with SAP, in Joint Venture Operations;

Date of Purchase with SAP, in Joint Venture Operations;

Supplier’s Name and Address with SAP, in Joint Venture Operations;

Serial Number with SAP, in Joint Venture Operations;

Internal Reference Number with SAP, in Joint Venture Operations;

Depreciation Rate and Method with SAP, in Joint Venture Operations;

Nominal Account Numbers with SAP, in Joint Venture Operations;

Location of the Asset with SAP, in Joint Venture Operations;

Department Using the Asset with SAP, in Joint Venture Operations;

Insurance Detail with SAP, in Joint Venture Operations;

Date of Disposal with SAP, in Joint Venture Operations;

Gains/Losses on Disposal with SAP, in Joint Venture Operations;

Partner’s Share with SAP, in Joint Venture Operations;

Production Sharing Agreement/Contract (PSA/PSC) with SAP, in Joint Venture

Operations;

Payments in Production Sharing Agreement/Contract with SAP, in Joint Venture

Operations;

Joint Venture/Joint Interest Audits and Reports with SAP, in Joint Venture

Operations;

Operating Agreement and AFE with SAP, in Joint Venture Operations;

Minutes of Operator’s Meeting with SAP, in Joint Venture Operations;

Page 10 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Company Labour with SAP, in Joint Venture Operations;

Materials and Services Purchased Externally with SAP, in Joint Venture Operations;

Materials and Supplies Transferred to or from the Operation with SAP, in Joint

Venture Operations;

Warehousing with SAP, in Joint Venture Operations;

Overhead with SAP, in Joint Venture Operations;

Services and Facilities with SAP, in Joint Venture Operations;

Capital and Maintenance Jobs with SAP, in Joint Venture Operations;

Taxes and Insurance with SAP, in Joint Venture Operations;

Allocation of Income and Expenditures with SAP, in Joint Venture Operations;

Capital Assets with SAP, in Joint Venture Operations;

Part 8 - SAP and Joint Venture Accounting – General Ledger/ Master Record

General Ledger Master Record with SAP, in Joint Venture Operations;

Chart of Accounts Data with SAP, in Joint Venture Operations;

Creating a Master Record Centrally with SAP, in Joint Venture Operations;

Creating a Master Record Step by Step with SAP, in Joint Venture Operations;

Creating a Master Record – Reference with SAP, in Joint Venture Operations;

G/L Account Master Record with SAP, in Joint Venture Operations;

G/L Account Master Record

– Chart of Accounts Segment with SAP, in Joint

Venture Operations;

G/L Account Master Record

– Account Group with SAP, in Joint Venture Operations;

G/L Account Master Record

– Company Code Segment Field Status with SAP, in

Joint Venture Operations;

Field Status Screen Layout Link Rules with SAP, in Joint Venture Operations;

Example of Field Status Definition with SAP, in Joint Venture Operations;

Translating the Name of G/L Accounts with SAP, in Joint Venture Operations;

G/L Account Master Record – Company Code Segment with SAP, in Joint Venture

Operations;

G/L Account Currency with SAP, in Joint Venture Operations;

Mass Maintenance with SAP, in Joint Venture Operations;

Page 11 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Blocking a Master Record with SAP, in Joint Venture Operations;

Marking a Record for Deletion with SAP, in Joint Venture Operations;

PART 9 - SAP Closing with SAP, in Joint Venture Operations;

Closing with SAP, in Joint Venture Operations;

System Requirements for Closing with SAP, in Joint Venture Operations;

Period Closing with SAP, in Joint Venture Operations;

Pre-Closing Activities with SAP, in Joint Venture Operations;

Financial Closing with SAP, in Joint Venture Operations;

Foreign Currency Valuation with SAP, in Joint Venture Operations;

Clearing a Receivable/Payable with an Exchange Rate Difference with SAP, in Joint

Venture Operations;

Revaluing Balance Sheet Accounts Managed in Foreign Currency with SAP, in Joint

Venture Operations;

Valuation Method with SAP, in Joint Venture Operations;

Valuation of Open Item with SAP, in Joint Venture Operations;

Foreign Currency Valuation of Open Items with SAP, in Joint Venture Operations;

Flat Rate Value Adjustment with SAP, in Joint Venture Operations;

Flat Rate Value Adjustment Base Amount with SAP, in Joint Venture Operations;

Discounting with SAP, in Joint Venture Operations;

Discounting and Flat Rate Adjustment Steps with SAP, in Joint Venture Operations;

GR/IR Account Allocation with SAP, in Joint Venture Operations;

Financial Accounting Comparative Analysis with SAP, in Joint Venture Operations;

End of Period Reporting with SAP, in Joint Venture Operations;

Year End Closing with SAP, in Joint Venture Operations;

Automatic Line Items (Balance Carried Forward) with SAP, in Joint Venture

Operations;

Managerial Closing with SAP, in Joint Venture Operations;

Page 12 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Part 10 - SAP Sales Cycle and Documents

Sales Cycle with SAP, in Joint Venture Operations;

Sales Documents with SAP, in Joint Venture Operations;

Inquiry with SAP, in Joint Venture Operations;

Quotation with SAP, in Joint Venture Operations;

Sales Order with SAP, in Joint Venture Operations;

Credit & Debit Memo Requests with SAP, in Joint Venture Operations;

Generating Delivery Note with SAP, in Joint Venture Operations;

Generating Goods Received Inward Note (GRIN) with SAP, in Joint Venture

Operations;

Goods Issue with SAP, in Joint Venture Operations;

Billing Document with SAP, in Joint Venture Operations;

Incoming Payment with SAP, in Joint Venture Operations;

Accounts Receivable in the Sales Cycle with SAP, in Joint Venture Operations;

Part 11 - Managing Sales and Accounts Receivables, with SAP, for Joint Venture

Operations

Raising a Sales Invoice, with SAP, for Joint Venture Operations;

Mapping Correct Accounts to Sales Invoice, with SAP, for Joint Venture Operations;

Managing Accounts Receivable, with SAP, for Joint Venture Operations;

Customer Database Maintenance, with SAP, for Joint Venture Operations;

Conducting Historical Analysis, with SAP, for Joint Venture Operations;

Approval Lines for Sales invoices, with SAP, for Joint Venture Operations;

Recording Sales from Invoices, with SAP, for Joint Venture Operations.

Part 12 - Purchases and Accounts Payable, with SAP, for Joint Venture Operations

SAP Contract Formulation: An Overview

Formulating Contract Terms, with SAP, for Joint Venture Operations;

Incorporating, with SAP, for Joint Venture Operations;

Accounting for Taxes, with SAP, for Joint Venture Operations;

Mapping Purchase Orders to Contracts, with SAP, for Joint Venture Operations;

Page 13 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Purchase Order Approval Process, with SAP, for Joint Venture Operations;

Mapping Purchase Order to Cost Ledger Accounts, with SAP, for Joint Venture

Operations;

Setting Up Payment Terms in SAP, with SAP, for Joint Venture Operations;

Establishing ‘System Prompt’ for ‘Payment Run’, with SAP, for Joint Venture

Operations.

Part 13 - Joint Venture Accounting in SAP

Cut Back Process, for Joint Venture Operation, in SAP;

Partners share, for Joint Venture Operation, in SAP;

Billable and Recoverable, for Joint Venture Operation, in SAP;

Authorisation for Expenditure (AFE), for Joint Venture Operation, in SAP;

Billable and Non-Recoverable, for Joint Venture Operation, in SAP;

Non-Billable and Non-Recoverable, for Joint Venture Operation, in SAP;

Implementing Joint Venture accounting agreements within the SAP system;

Account Reconciliation, for Joint Venture Operation, in SAP;

Generating Joint Venture Reports, for Joint Venture Operation, in SAP.

Part 14 - Project Accounting in SAP

Cost Centre and Resource Codes Set Up, for Joint Venture Operation, in SAP;

Mapping GL Accounts to Cost Centre and Resource Codes for Joint Venture

Operation, in SAP;

GL Accounts to Roll Up to Correct Cost Headings for Joint Venture Operation, in

SAP;

Map Cost Centres and/or Resource Codes to Projects, for Joint Venture Operation, in SAP;

Identifying All Project Costs via Cost Centres or Resource Codes, for Joint Venture

Operation, in SAP;

Report Generation along Project Lines, for Joint Venture Operation, in SAP;

Generate Profit and Loss Account by Projects, for Joint Venture Operation, in SAP;

Establishing Project Reports That Can Be Understood by Project Managers, for Joint

Venture Operation, in SAP.

Page 14 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Synopsis of Diploma – Postgraduate, Postgraduate Diploma and

Postgraduate Degree Regulation

Postgraduate Diploma and Diploma – Postgraduate: Their Distinction and

Assessment Requirement

Delegates studying courses of 5-9 days duration, equivalent to 30-54 Credit Hours (direct lecturer contact), will, on successful assessment, lead to the Diploma – Postgraduate. This represents a single credit at Postgraduate Level. While 6-day and 7-day courses also lead to a Diploma – Postgraduate, they accumulate 36 and 42 Credit Hours, respectively.

Delegates and students who fail to gain the required level of pass, at Postgraduate Level will receive a Certificate of Attendance and Participation. The Certificate of Attendance and

Participation will not count, for cumulative purpose, towards the Postgraduate Diploma.

Courses carry varying credit values; some being double credit, triple credit, quad credit and

5-credit, etc. These, therefore, accumulate to a Postgraduate Diploma. As is explained, later, in this document, a Postgraduate Diploma is awarded to students and delegates who have achieved the minimum of 360 Credit Hours, within the required level of attainment.

Credit Value and Credit Hours examples of Diploma

– Postgraduate Courses are as follows:

C r r r e d i i i t t t V a l l l u e

Single-Credit

Double-Credit

Triple-Credit

Quad-Credit

10-Credit (X36 Credit-Hours) to 12-

Credit (X30 Credit-Hours)

Other Credit Values are calculated proportionately.

C r r r e d i i i t t t H o u r r r s

30-36

60-72

90-108

120-144

360

Page 15 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

Because of the intensive nature of our courses and programmes, assessment will largely be in-course, adopting differing formats. These assessment formats include, but not limited to, in-class tests, assignments, end of course examinations. Based on these assessments, successful candidates will receive the Diploma – Postgraduate, or Postgraduate Diploma, as appropriate.

In the case of Diploma – Postgraduate, a minimum of 70% overall pass is expected. In order to receive the Award of Postgraduate Diploma, candidate must have accumulated at least the required minimum ‘credit-hours’, with a pass (of 70% and above) in at least 70% of the courses taken.

Delegates and students who fail to achieve the requirement for Postgraduate Diploma, or

Diploma - Postgraduate - will be given support for 2 re-submissions for each course. Those delegates who fail to achieve the assessment requirement for the Postgraduate Diploma or

Diploma - Postgraduate - on 2 resubmissions, or those who elect not to receive them, will be awarded the Certificate of Attendance and Participation.

D i i i p

P l l l o o s s t t m t g a r r a

– d

P u o a s t s t t t t t e g r r

D a e d g r u r a e t t t e e , , ,

A

P p o p l l s l s i i i t t t c c g r a r t t t i a i i d o u n a t

R t t e e q

D u i i i i i i p r r l l l e o m m e a n t t a t s s n s d

Applicants for Diploma – Postgraduate, Postgraduate Diploma and Postgraduate Degrees are required to submit the following documents:

Completed Postgraduate Application Form, including a passport sized picture affixed to the form;

A copy of Issue and Photo (bio data) page of the applicant’s current valid passport or copy of his or her Photo-embedded National Identity Card;

Copies of credentials mentioned in the application form.

Page 16 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

A d m i i i s s s s i i i o n a n d E n r r o l l l m e n t t t P r r o c e d u r e

On receipt of all the above documents we will make an assessment of the applicants’ suitability for the Programme for which they have applied;

If they are accepted on their Programme of choice, they will be notified accordingly and sent Admission Letters and Invoices;

One week after the receipt of an applicant’s payment or official payment notification, the relevant Programme Tutor will contact him or her, by e-mail or telephone, welcoming him or her to HRODC Postgraduate Training Institute;

Non-European Students will be sent immigration documentation, incorporating a

Visa Support Letter. This letter will bear the applicant’s photograph and passport details;

Applicants will be notified of the dates, location and venue of enrolment and orientation;

NonUK students will be sent general information about ‘student life’ in the UK and Accommodation details.

M o d e s s o f f f S t t t u d y f f f o r r P o s s t t t g r r a d u a t t t e D i i i p l l l o m a C o u r r s e s

There are three delivery formats for Postgraduate Diploma Courses, as follows:

1. Intensive Full-time Mode (3 months);

2. Full-time Mode (6 month);

3. Video-Enhanced On-Line Mode.

Whichever study mode is selected, the aggregate of 360 Credit Hours must be achieved.

Page 17 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

C u m u l l l a t t t i i i v e P o s s t t t g r r a d u a t t t e D i i i p l l l o m a C o u r r s s e s s

All short courses can accumulate to the required number of hours, for the Postgraduate

Diploma, over a six-year period from the first registration and applies to both general and specialist groupings. In this regard, it is important to note that short courses vary in length, the minimum being 5 days (Diploma

– Postgraduate) – equivalent to 30 Credit Hours, representing one credit. Twelve 5-day short courses, representing twelve credits or the equivalent of 360 Credit Hours are, therefore, required for the Award of Postgraduate

Diploma.

A six-day course (Diploma – Postgraduate) is, therefore, equivalent to 36 hours Credit

Hours, representing one credit. Therefore, ten short courses, of this duration, equates to the required 360 Credit Hours, qualifying for the Award of Postgraduate Diploma. While double-credit courses last between ten and fourteen days, triple-credit courses range from fifteen to nineteen days. Similarly, quad-credit courses are from sixteen to nineteen days.

On this basis, the definitive calculation on the Award requirement is based on the number of hours studied (aggregate credit-value), rather than merely the number of credits achieved. This approach is particularly useful when a student or delegate studies a mixture of courses of different credit-values.

For those delegates choosing the accumulative route, it is advisable that at least two credits be attempted per year. This will ensure that the required number of credit hours for the Postgraduate diploma is achieved within the six-year time frame.

Page 18 of 19

SAP_Joint_Venture_Accounting_Course_Sales_Invoice_Accounts_Receivable_Fixed_Asset_Accounting_Project_Accounting_Cost_Centres_Cut_Back_Process_Partners_Share

SAP and Joint Venture Accounting, for Joint Venture Operations Seminar or Course – Leading to Diploma-Postgraduate in SAP and Joint Venture Accounting, for Joint Venture Operations (Double Credit), Accumulating to a Postgraduate

Diploma, Progressing to a Postgraduate Degree - MA, MBA, MSc

P r r o g r r e s s s s i i i o n t t t o P o s s t t t g r r a d u a t t t e D e g r r e e – M A , , , M B A , , , M S c

On the successful completion of the Postgraduate Diploma , delegates may register for the Masters Degree, after their successful completion of Course #7: Research

Project: Design, Conduct & Report .

The Delegates’ Degree Registration Category will be dictated by the courses or modules studied at Postgraduate Diploma Level. The categories relate to Master of

Business Administration (MBA); Master of Arts (MA) Master of Science (MSc);

Executive Master of Business Administration (Executive MBA). Additional details are provided in the document entitled: regulation For HRODC Postgraduate Training

Institute Diploma – Postgraduate - Postgraduate Diploma and Masters Degree –

MA, MBA, MSc.

Terms and Conditions

HRODC Policy Terms and Conditions are Available for viewing at: http://www.hrodc.com/COSTS.htm

Or Downloaded, at: http://www.hrodc.com/Brochure_Download_Centre.Company_Brochures_Seminar_Brochu

res_Seminar_Schedule.htm

The submission of our application form or otherwise registration by of the submission of a course booking form or e-mail bookin g request is an attestation of the candidate’s subscription to our Policy Terms and Conditions, which are legally binding.

Page 19 of 19