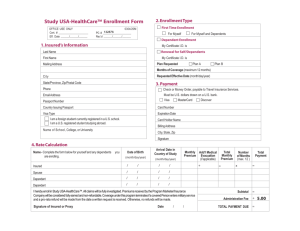

2015 Summary Plan

advertisement