For professional investors and advisers only. This document is not... September 2015

advertisement

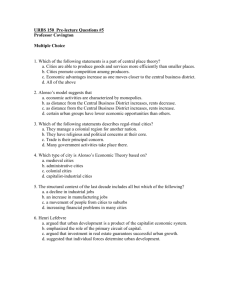

September 2015 For professional investors and advisers only. This document is not suitable for retail clients. Schroder Real Estate When will Central London office rents peak? Central London offices have recently been the star performer of the UK commercial real estate market. Total returns on City and West End offices averaged 14.2% per annum and 16.1% per annum respectively over the five years to June 2015 (source: MSCI), well above the all property average of 10.1% per annum. Mark Callender, Head of Real Estate Research While part of this outperformance was due to a relatively favourable fall in yields, this re-rating was supported by a big upswing in rents, reflecting both strong employment growth and low levels of new office building. Average grade office rents in the City and Mayfair have risen by 50–60% from their trough in early 2010 (source: Co-Star /PPR) and certain areas such as Shoreditch and the South Bank have seen even faster growth, as they have graduated from fringe locations into integral parts of the Central London market. Given that property yields appear unlikely to fall much further, assuming that interest rates start rising in 2016, the key question now for investors is when will Central London office rents peak? Chart 1: Central London Office Rents Average rent, £ per sq ft 75 65 55 45 35 25 Jeremy Marsh, Real Estate Research Analyst 15 2000 2001 2002 Soho 2003 2004 2005 Paddington 2006 City 2007 2008 2009 Southbank 2010 2011 2012 Shoreditch 2013 2014 2015 Q2 Mayfair Source: Co-Star / PPR, August 2015. That Central London office rents are now above their previous peak may leave some investors feeling queasy, but the 2008 peak is an arbitrary level rather than an important milestone (see Chart 1). Looking forward, what really matters are the future demand and supply forces shaping the occupier market. On the demand side, Oxford Economics forecasts that office employment1 in Central and Inner London will increase by 12%, or 200,000 people, between 2014 and 2019 (see Chart 2). Encouragingly, this expansion should be based on a range of diverse sectors, as London continues to develop as an international hub for IT, media and professional services (e.g. accountancy, architecture, law and scientific research). By contrast, employment in financial services is likely to be flat and cuts in government spending mean that jobs in public administration are expected to decline. Office employment is defined as administrative services, financial services, IT and communication, professional services (e.g. accountancy, architecture, law, management consultancy, scientific research ), public administration and real estate. 1 Schroder Real Estate When will Central London office rents peak? 2 Inevitably, there are risks around these employment forecasts. Recent volatility in equity and commodity markets reflects worries that the slowdown in China could be much sharper than previously anticipated. Likewise, there are concerns that the IT sector could falter, although it seems unlikely that it will suffer a trauma like 2000–2002, when the industry was dominated by start-up companies with lots of promise, but no revenues. Chart 2: Central London Office Employment Employment, million 2.25 2.00 1.75 1.50 1.25 1.00 0.75 0.50 0.25 Financial services Professional and scientific Administration and Real Estate Government 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 0.00 IT Source: Oxford Economics, June 2015. Note: The forecasts should be regarded as illustrative of trends. Actual figures will differ from forecasts. Please see important information regarding forecasts. Furthermore, there is a possibility that the UK could leave the EU. Our assumption is that the majority will vote to stay, rather than gamble on the unknown of an exit. In this scenario, office occupier demand might slow in the 3–6 months leading up to the referendum, which will probably be in 2016, but would then rally afterwards. However, if the UK did vote to leave then it would probably hit office demand as companies which need unfettered access to the EU (e.g. investment banks, professional services) began to re-locate some of their operations to Dublin, Frankfurt, Paris and other European cities. That would also have a knock-on effect on London’s residential, retail and industrial markets. In general the outlook on the supply side is also benign (see Chart 3). In Docklands and Mid-Town the total amount of office space is forecast to increase by only 3–4% between 2014–2019 (source: PMA) and it is actually expected to fall marginally in the West End, as some older offices are converted to residential or hotels. The exception is the City where developers have announced plans for a number of new towers on Bishopsgate and Leadenhall. If three, or four of these schemes go ahead, then the total stock of office space will increase by around 10% over the next five years. While new capital controls mean that banks are still reluctant to fund speculative developments, other lenders such as insurers and debt funds are starting to fill the gap. Chart 3: Central London Office Space Office floorspace, million sq ft 70 60 50 40 30 20 10 0 City 1990 Source: PMA, July 2015. West End and Mid-Town 1995 2000 2005 2010 Docklands 2014 2019 Forecast Schroder Real Estate When will Central London office rents peak? 3 If we combine the healthy prospects for employment with the generally subdued outlook for office building, then it seems likely that Central London office rents will continue to rise through 2016 and 2017, albeit probably at a slower rate than in 2014 and 2015. Our key assumptions are that there are no economic shocks and that the UK stays in the EU. What happens from 2018 is more difficult to predict, but there is a risk that the City will start to suffer from an over-supply of office space which will depress rents. Conversely, we believe that there are other areas which could see further rental growth through 2018–2019. In particular, Farringdon, Stratford and Whitechapel stand to gain from the start of Crossrail services in late 2018, while Battersea and Nine Elms should benefit from the opening of the extension to the Northern Line underground in 2020. In addition, we think that the new Francis Crick and Alan Turing Institutes will give further impetus to Bloomsbury and King’s Cross and that the redevelopment of the Shell Centre and Elizabeth House could revitalise the Waterloo office market. While new building at the macro level will tend to push rents down, other things being equal, at the micro level it can breathe new life into an area, as demonstrated by the positive impact of More London and The Shard on the South Bank near London Bridge. www.schroders.com/realestate Important Information: For professional investors and advisors only. This document is not suitable for retail clients. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Real Estate Investment Management Limited (Schroders) does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Schroders has expressed its own views and opinions in this document and these may change. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Any forecasts in this document should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. We accept no responsibility for any errors of fact or opinion and assume no obligation to provide you with any changes to our assumptions or forecasts. Forecasts and assumptions may be affected by external economic or other factors. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them can go down as well as up and may not be repeated. Investors may not get back the amounts originally invested. Use of IPD data and indices: © and database right Investment Property Databank Limited and its Licensors 2015. All rights reserved. IPD has no liability to any person for any losses, damages, costs or expenses suffered as a result of any use of or reliance on any of the information which may be attributed to it. Issued by Schroder Real Estate Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1188240 England. Authorised and regulated by the Financial Conduct Authority. For your security, communications may be taped or monitored. w47631