Advances in Sustainable and Competitive Manufacturing Systems

advertisement

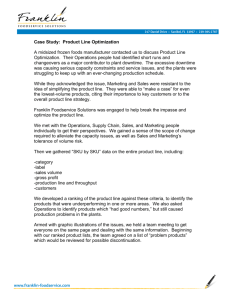

Lecture Notes in Mechanical Engineering Américo Azevedo Editor Advances in Sustainable and Competitive Manufacturing Systems 23rd International Conference on Flexible Automation and Intelligent Manufacturing The Power of Analytical Approaches Towards the Development of Differentiated Supply Chain Strategies: Case Study Alexander A. Kharlamov, Luis Miguel D. F. Ferreira and Janet Godsell Abstract Companies are facing challenging circumstances: markets are evolving; clients are becoming more and more demanding and unpredictable; product variety is rising; time windows are shrinking; and error tolerance is decreasing. Therefore, companies must adapt and improve their supply chains, develop a differentiated supply chain strategy to solve the supply–demand mismatch. So far, the main differentiation approach has been focused on: (a) product; (b) customer; and (c) market characteristics. This paper uses a case based research approach in the context of a business-to-business food company to analyse the use of analytical tools commonly applied in other fields of research to support the identification of product and customer characteristics relevant for supply chain strategy differentiation. Using daily recorded sales data over two operational years we apply the following methods: Principal Component Analysis (PCA) followed by Cluster Analysis (CA). A new differentiator (order corrections) is introduced, in between characteristic correlation is spotted and used to generate a more meaningful attributes (case specific), creating four product segments based on proximate characteristics. Therefore, by reducing a large product portfolio into manageable groups of homogeneous SKU’s it is possible to assign a proper set of supply chain tailored practices. A. A. Kharlamov J. Godsell Cranfield School of Management Cranfield, Bedforshire MK43 0AL, UK L. M. D. F. Ferreira (&) GOVCOPP, Departamento de Economia, Gestão e Engenharia Industrial, Universidade de Aveiro, Aveiro 3810-193, Portugal e-mail: lmferreira@ua.pt A. Azevedo (ed.), Advances in Sustainable and Competitive Manufacturing Systems, Lecture Notes in Mechanical Engineering, DOI: 10.1007/978-3-319-00557-7_100, Springer International Publishing Switzerland 2013 1223 1224 A. A. Kharlamov et al. 1 Introduction Supply chains (SCs) are a source of competitive advantage [1], and management of SCs is crucial as SCs compete with others SCs, rather than simply between firms [2, 3]. Over the last decades, it became obvious that one strategy does not fit all situations [3–6]. Moreover, SCs depend on, for example: product characteristics [7], product lifecycle [8], and supply and demand patterns [9, 10]. Facing this growing complexity, management of SCs is a broad and overarching function, extending beyond firm’s boundaries [11, 12]. Additionally, the amount of data regarding daily logistic activity is rocketing due to powerful IT systems supporting management. The phenomena of big data present both threats and opportunities [13]. On one hand, without proper approaches business can be overloaded with meaningless data. On the other hand, mining all that data using proper tools can provide managers with useful information. This enable increased SC visibility and valuable knowledge, thus, rational supply chain management (SCM). Facing the need for differentiated supply chain strategies and growing amount of supply chain data, in this paper we describe a single case based research carried on a business-to-business (B2B) food company. Using a deductive-abductive approach, we rely on daily captured sales data at order level over two years of activity to segment stock keeping units (SKUs) based on demand characteristics. Previous studies have relied on qualitative approaches [5, 7, 8, 14] and quantitative analysis focused on profiling average demand volume against its coefficient of variation (CV). Additionally, we found none contributions relying on data mining methods for supply chain differentiation. Consequently, this paper’s originality is the application of advanced analytical tools to mine supply chain data using a starting pool of classification variables most commonly found in literature (enriched with ‘‘Order Corrections Ratio’’ variable). Although the applied data mining tools are fairly common in other fields such is marketing [15], the value of this paper is its successful introduction into the field of SCM. Consequently, we suggest an alternative approach for supply chain differentiation using quantitative methods. 2 Literature Review SCM is becoming more and more critical to remain competitive in the market [1]. Consequently, the problematic of the ‘‘right’’ SC has been alive for a while and after some decades of research there are already many conceptual models and frameworks [2, 5, 9, 12, 14, 16–18]. One of the first clear references on the problematic (and one of the most cited articles) is Fisher’s seminal work ‘‘What is the right SC?’’ [7]. Later, Naylor et al. [19] suggested the integration of the lean/ agile paradigms into the total SC strategy. Then, going to a more conceptual level, The Power of Analytical Approaches Towards the Development 1225 Lee [20] published the well-known article ‘‘Triple-A SC’’ stating that the SC strategy should be developed in spite of adaptability, agility, and alignment. Thus, these contributions possibly are the best foundation of differentiated (segmented) SC strategies and as further publications suggest, have inspired many researchers to go deeper [5, 21–23]. It is clear that one size does not fit all [6], as well as the importance of the link between the customer value proposition and operations strategy [3] considering the important detail: similar products can have very different demand patterns leading towards demand driven SCs discussed further. One of the bottom-lines in the literature is that matching customer requirement with product characteristics and ensuring delivery should be one of the greatest concerns for the management [8, 9, 24]. Therefore, it is important to align SC strategy and products classification variables accordingly to the target market [9, 14, 25]. SC market orientation is more and more necessary what requires the identification of the classification variables [7, 11, 17]. On this idea, Christopher and Towill [14, 26] created models by considering dominant classification variables using a set of variables such as duration of life-cycle, lead-time, volume, variety, and CV [27, 28] known as DWV3 [26]. This set of variables is generalizable, although, its relevance and applicability is questionable from case to case. Thus, a form of selection and evaluation is necessary. SC dependence of product and market characteristics is clear [5, 7, 29]. For example, one way of distinguishing products is regarding its functional or innovative nature [7] best matched by different SC configurations: physically efficient SCs for functional products and market-responsive SCs for the innovative ones. Following the same principle, Lamming [29] expanded the Fisher’s model [7] by considering the product uniqueness and complexity, while Lee [10] focused the analysis on supply and demand uncertainty. Finally, the concept of differentiation concerns the division into different groups of SKUs/customers sharing similar product/service requirements and demand patterns. Its main purpose is to enable better understanding so the company can best satisfy the clients’ needs. Thus, as SCs (and operations strategy in general) are dependent on customer requirements, market and product characteristics, these may be considered as the three pillars of a SC and may be used to develop a differentiated SC strategy. In summary, this leads towards differentiated SCs that are based on a number of attributes. Due to the link between SC processes with product life cycles and the business strategy [30], product life-cycle and SC strategy [8], and finally integration of SC strategy and marketing [12]. This outlines the three bodies of literature that should be used to approach SC differentiation and all three must be aligned with the business strategy [31, 32]. Finally, this suggests that SC differentiation is based on (a) SCM, (b) SC processes, and finally (c) marketing [5]. From the SC perspective, conceptually the approach on SC differentiation should start with the context analysis and then, by means of classification variables used as filters, create distinct segments and profiles that must be matched to different operations strategies [5]. 1226 A. A. Kharlamov et al. 3 Research Approach This is a single instrumental case on the organizational level, focused on the demand planning processes. The company produces fruit composites (make to order) on a tailor made basis for the food industry being one of the top European players. Founded more than two decades ago, it supply’s the major players in the food industry. There are several reasons making this case relevant. Food industry, more specifically food SCM has received little attention in the literature despite the fact that food sector holds a major relevance. There are several challenges in this field. For example, SC integration is limited by product and processes specifics [33]. Additionally, maintaining high food quality is demanding, as it depends on environmental conditions, storing, and transport [34]. One of the main drivers for SCM in the food industry is the integration of product quality and logistics, named quality controlled logistics [35]. Consequently, further practical application is beneficial as it covers one of the actual problems in the food SCM: The matching of different SC flows with product and customer characteristics. It has been suggested that products with different attributes and different end customers should be delivered in different distribution channels. 3.1 Data Collection and Methods The study started with a general meeting for problem identification followed by the data collection. This was considered a critical stage to understand the situation, the main problems and opportunities as SCs are dependent on the context and the needs [36]. The collected data contained demand history logs (two years of orders), enriched attribute for each SKU, specifically the bill of materials, shipping requirements, production process details. Finally, we organized the working data set at a week level for two-year demand volumes for each SKU. Facing the high variety (more than 1 K different SKUs), it is practically impossible/inefficient to analyse each portfolio element individually. Thus, we looked for a way to reduce the complexity. For that purpose, a relatively young field called data mining and knowledge discovery from data offers many already recognized methods used in other fields of research [15]. The adopted process was the Cross Industry Standard Process for Data Mining (CRIPS-DM) [37], being this paper’s focus on the modeling and evaluation phases. The modeling phase take into cluster analysis (CA) after principal component analysis (PCA) using IBM SPSS software, as it is one of the possible ways for segmentation already applied in customer relationship management for customer segmentation [15]. The Power of Analytical Approaches Towards the Development 1227 4 Data Analysis The modeling phase began with the classification variables selection. The data availability as well as heterogeneity was the very first selection criteria for the initial set of variables. Constrained by the availability in the historical data-log, we obtained the raw set for almost one thousand SKU’s at the order level during two years daily. It was then explored, cleaned, and transformed looking for the maximum number of variables. After obtained the set, we performed some basic descriptive statistics to explore the obtained variables. Consequently, some of the extracted variables revealed total homogeneity, thus they were automatically dropped out, but others remained as described further. Firstly, variables such as the product life-cycle duration, point of product configuration, profit margin, or reliability of delivery were impossible to obtain given the circumstances and data accessibility (confidentiality). However, variables such as: Time windows for delivery; Demand volume; Product variety; Coefficient of variation; Flexibility; Minimum run size; Change-over times; Frequency of delivery; and Product complexity, were successfully extracted (the weekly measure for frequency was set up due to the companies weekly expenditures practice.) Additionally, based on several discussions of the problem we suggested a new variable: Order Corrections Ratio (OCratio), as being the number of corrected orders divided by the total number of orders for some specific SKU. The ratio between the number of corrected orders and the total orders for a specific SKU gives an indicator of how efficient is the client’s inventory management and planning. This regards to the fact that each SKU is exclusive to only one client while one client holds multiple SKUs. Secondly, descriptive statistics revealed that some of the variables presented equal values for all of the SKU’s. Namely, minimum run size and change-over time followed one standard protocol, thus, featured equal values for all the SKU’s. Even though complexity was not equal to all of the SKU’s, its measure was dubious due to the particularities of different recipes, thus we decided to drop this variable out to avoid further misinterpretation. Thirdly, following the descriptive statistics and analysis, we selected five variables: Time window for delivery; Order corrections ratio, demand volume, CV, and frequency of delivery (weeks with delivery). Those were simplified by means of PCA and then clustered using the Ward’s method on the Euclidean’s distance between observations in order to achieve groups of products sharing similar characteristics. Finally, the model’s outputs, namely segments, and its different features were validated and discussed through several meetings with the supply chain manager, production manager, and internal control manager. 1228 A. A. Kharlamov et al. 4.1 Principal Component Analysis Principal component analysis (PCA) is a method of variable reduction which transforms a vector of observations into a new set of vector observation. It assumes that there are linear correlations among some of the classification variables, thus only suitable for numerical continuous fields (scale variables). It is a way of condensing various dimensions into a small, sometimes more meaningful (and bearable) number of variables when rotation is applied, however, at the expense of some information loss. PCA with orthogonal rotation is here used to reduce the number of classification variables (simplification) using the linear correlation among the classification variables, producing new, standardized, uncorrelated, and often more meaningful components. This procedure allows better insight on the data structure as well as its visual representation in most of the cases [15]. An examination of the Kaiser– Meyer–Olkin measure of sampling adequacy suggested that the sample was factorable (KMO = 0.630). As shown in Table 1, in this specific case CV is significantly correlated to the time window for delivery as well as to volume, frequency of delivery (weeks with delivery) is significantly correlated to the time window for delivery, order corrections, volume, and CV. The strongest correlation is between volume and frequency of delivery (weeks with delivery) while the second strongest correlation is between CV and time window for delivery. Regarding how many dimensions should be extracted, the selected method for this study was the total variance accounted. As those methods are ad-hoc, with no theoretical justification and rely mostly on judgement we set up the rule as being greater than 75 %, so we considered the actual 75,993 % acceptable, extracting three principal components. Orthogonal rotation eases the interpretation of the components, produces uncorrelated components. The rotation method applied for this study was the ‘‘varimax’’ with Kaiser Normalization, which converged in four iterations. After the orthogonal rotation, the total variance is redistributed and each value accounts for the variance of the original variance contained in each component. Table 1 Correlation matrix (a = 0.01) Time Order window correction for delivery Correlation (sig. 1tailed) Order correction -0.030 (0,184) Volume -0.086 (0.004) CV 0.239 (0.000) Weeks with -0.107 delivery (0.001) -0.022 (0.255) 0.028 (0.200) -0.185 (0.000) Volume CV -0.150 (0.000) 0.527 (0.000) -0.159 (0.000) The Power of Analytical Approaches Towards the Development Table 2 Rotated component matrix Classification variables Component 1 Volume Weeks with delivery Time window for delivery CV Order corrections 1229 Communalities 2 3 Initial Extraction 0.984 1.000 1.000 1.000 1.000 1.000 0.656 0.972 0.802 0.602 0.767 0.888 0.846 0.806 0.761 As listed in Table 2, the focus is on significant loadings, as it eases component interpretation by improving the readability of the rotated component matrix, hiding loadings lower than 30 %. • Component 1 (‘‘Volume ? Frequency’’) represents variances of 89 % for volume and 85 % of weeks with delivery (frequency of delivery) both positively correlated, with 0.527 significant correlation from Table 1 meaning that greater volume represents greater frequency of delivery. • Component 2 (‘‘Time window ? CV’’) accounts for 90 % of time window for delivery variance as well as COV variance, both positively correlated (0.237 in Table 1), meaning that longer time window for delivery tends to have greater CV. • Component 3 (‘‘Order Corrections’’) concerns only one classification variable at 98 %, the new proposed order corrections ratio reflecting client’s inventory management and planning performance. Finally, the question is if the derived solution accounts for all the original dimensions. Table 2 lists communalities for each original dimension after the extraction, ranging from 0.602 (the worse) to 0.972 (best). Typically, extractions above 0.500 are considered acceptable [15], suggesting a satisfactory solution, allowing the next step: clustering. 4.2 Cluster Analysis: Segmentation Cluster analysis is a method used to identify patterns and identify groups (clusters) of objects (individuals, entities, etc.) sharing similarities in an n-dimensional space. Usually those groups are not pre-defined. The advantage of clustering techniques is that it can handle efficiently large number of attributes, which dimensions are many times beyond human capabilities. They are not based on a priori personal concepts, intuitions, and perceptions of business people. Instead, segments are induced by data providing real business meaning and value results. The preferred method for this study, based on the bearable number of entities and few variables, was hierarchical clustering, namely Ward’s method based on 1230 A. A. Kharlamov et al. the squared Euclidean distance between elements. Additionally, hierarchical clustering methods are slow and old-fashioned, yet, very robust being easy to understand performing well for under 10 K entities. We used the dendrogram as the criteria for the number of clusters to extract. Figure 1 illustrates all SKU’s plotted in space using the three new components (after PCA extraction), where each SKU is marked with its respective segment domain. We characterized each segment (cluster) based on its centroid Table 3. Consequently, the following key characteristics arose for the four segments: • Cluster 1: This cluster is characterized by the fewest order corrections as well as low average monthly volume per SKU. • Cluster 2: The most significant characteristic of this group is the shortest time window for delivery and high frequency of deliveries what is associated with high volume per month and the lowest average CV. • Cluster 3: SKU’s delivered rarely and low average monthly demand with the highest order correction ratio. • Cluster 4: It contains SKU’s with the longest average time window for delivery as well as highest CV. Fig. 1 SKU’s relative position to the extracted components The Power of Analytical Approaches Towards the Development 1231 Table 3 Segment characteristic Classification variables Segments Revenue (segment sum) Variety (number of SKUs) Volume (mean tons) Weeks with delivery (mean) Time window delivery (average num. of days) CV (mean) Order corrections ratio (mean) Cluster 1: sure and lowvolume SKU’s Cluster 2: quick and frequent SKU’s Cluster 3: rare and undecided SKU’s Cluster 4: Flexible and unstable SKU’s 26 % 498 1,702 9 63 % 188 13,235 37 8% 168 1,517 4 3% 63 1,449 10 33 24 36 196 0.61 0.29 0.37 0.45 0.59 1.72 1.28 0.36 5 Discussion and Implications The need for differentiated SC strategies is eminent. However, most of the differentiation is so far based on pure intuition and managers experience. It should move from this emotional and subjective ‘‘system one’’ thinking toward a more objective and systematized ‘‘system two’’ thinking [38], enabled by data mining methods combined with managers expertise gets the best of both worlds [15]. Moreover, machines are most of the times able to undercover data patterns which even the most talented and experienced human can miss and vice versa: human reasoning and critical pattern recognition is so far unmatched by any machine concerning some cases. Supply chain strategy is part of a more general, company’s competitive strategy composed by a set of practices that must fit together [1, 39]. The current company’s strategy intends to fulfil all requests of his industrial customer (B2B), allowing total customization on a pure make-to-order basis. The actual extra manufacturing capacity is able to buffer all the demand volatility; however, with the expected business growth this strategy will soon become obsolete. Segmentation is a compromise between ‘‘one size fits all’’ strategy and the individual, in most cases topic, least complex approach when each entity of the system is managed separately with ‘‘the unique best’’ strategy. Thus, looking for SC specific classification variables to finding similarities in large number of entities, allow complexity reduction and better demand understanding. Therefore, the advantage of reducing the product portfolio into few groups is that it enables the differentiated strategy matching. As each group features a distinct profile, it can be matched to a proper set of tailored practices [39] as well as KPI’s target adjustment. For example, a simple principle of collaborative forecasting and planning is best match for segments with high order corrections 1232 A. A. Kharlamov et al. Table 4 Matching segments with SC practices and principles Segment Key features Managerial recommendations Sure and lowvolume SKU’s Quick and frequent SKU’s Rare and undecided SKU’s Flexible and unstable SKU’s High variety; low volume S&OP; minimize wasted resources; reduce variety; and postponement Predictable; frequent deliveries; MTF; forecast base demand statistically; stable demand; and high forecast surge demand manually (if any) volume Rare deliveries; unreliable orders; Collaborative forecasting and planning; and short time windows improve visibility and SC transparency; VMI Unpredictable; long time MTO; reduce variety by allowing less windows customization; postponement ratio, as it accounts for client’s inventory management and planning. As a result, Table 4 shows each segment key features and the best matched SC practices and principles. 6 Conclusion Organizations must be adaptable [1, 20], namely its SCs which works like a vessel system providing what is necessary to keep it alive (and growing). SC differentiation might well be one of the essentials for adaptability and its advantages are various. For example, on one hand it might provide ground for SC risk management, revealing high risk segments, enabling the development of mitigation strategies and on the other hand, highly predictable and easily managed segments allowing more efficient and effortless management. In addition, facing the growing complexity, segmentation is one of the best countermeasures, allowing a differentiated view on the SC entities. Conceptually, this notion naturally grew out of several decades of research and practically SC differentiation possibilities are limitless because despite the fact that segmentation methods might be common, its outcomes will be unique for each company. Firstly, there are no doubts on the need for differentiation and adaptability to the context and needs. Seeking for that adaptability and differentiation, practitioners have been relying mostly on their ‘‘intuition’’ and domain expertise to develop SC strategies. Data mining models cannot substitute or replace the significant role of domain experts and their business knowledge being useless without active support of business experts. However, such techniques can spot patterns that even the most experienced expert may have missed. Thus, these techniques complemented with human business expertise constitute a very powerful mean of developing a more successful and robust SC strategies. To be clear: human expertise is critical, no matter how sophisticated a tool can be. The Power of Analytical Approaches Towards the Development 1233 Secondly, feeding SC segmentation models provided with data-mining methods is no longer a problem because modern ERPs generate numerous records every day. The data is there, the Big Data [13], what turns the old problem of ‘‘no data’’ into ‘‘too much data’’. Therefore, managers need the right frameworks and proper tools to extract useful knowledge for SCM, namely SC segmentation must be fed with actual data and not mere beliefs or personal assumptions, enhancing model’s adaptability. Thirdly, an objective and data driven approach enable the fine-tuning of the existing strategies, as well as to automate, enrich, and standardize manager’s work, which so far, is mostly based on personal perceptions and views. This lowers the decision subjectivity, simplifying time-consuming processes. By learning from real data, practitioners can spot natural groups sharing similar characteristics, grouping entities into clusters (segments) lowers the complexity (variety) which allows better match between supply and demand. Additionally, following the need for adaptability to the constant change of customer behavior and SC requirements, re-segmentation (real-time monitoring) keeps managers aware of the market dynamics, allowing the organization to react having solid arguments about what is going on, which ultimately might be automatized into an intelligent system defining the best matching SC strategy ‘‘on the fly’’. In conclusion, the contributions of this research are not only the successful application of data mining techniques on SC differentiation, as well as the suggestion of a new classification variable, the order changeability ratio. This new classification variable is based on standard measures (order change, date, type of change, and other related properties) usually present in most of order log systems and is used for quality management. References 1. Gattorna J, Walters D (1996) Managing the supply chain: a strategic perspective. MacMillan Press, London 2. Christopher M, Towill DR, Aitken J, Childerhouse P (2009) Value stream classification. J Manuf Technol Manage 20(4):460–474 3. Simchi-Levi D (2010) Operations rules: delivering customer value through flexible operations. The MIT Press, Cambridge 4. Christopher M (2011) Logistics and supply chain management, 4th edn. Prentice Hall, Harlow 5. Godsell J, Diefenbach T, Clemmow C, Towill D, Christopher M (2011) Enabling supply chain segmentation through demand profiling. Int J Phys Distrib Log Manage 41(3):296–314 6. Shewchuck P (1998) Agile manufacturing: one size does not fit all. Proc Int Conf Manuf Value Chain 7. Fisher M (1997) What is the right SC for your product? Harvard Bus Rev 75(2):105–116 8. Aitken J, Childerhouse P, Towill D (2003) The impact of product life cycle on supply chain strategy. Int J Prod Econ 85(2):127–140 1234 A. A. Kharlamov et al. 9. Payne T, Peters JM (2004) What is the right supply chain for your products? Int J Log Manage 15(2):77–92 10. Lee H (2002) Aligning SC strategies with product uncertainties. California Manage Rev 44(3):105–119 11. Frohlich M, Westbrook R (2001) Arcs of integration: an international study of supply chain strategies. J Oper Manage 19(2):185–200 12. Jüttner U, Christopher M, Godsell J (2010) A strategic framework for integrating marketing and supply chain strategies. Int J Log Manages 21(1):104–126 13. White T (2009) Hadoop: the definitive guide. O’Reilly, Sebastopol 14. Christopher M, Towill D (2002) Developing market specific supply chain strategies. Int J Log Manage 31(1):1–14 15. Tsiptsis K, Chorianopoulos A (2009) Data mining techniques in CRM: inside customer segmentation. Wiley, Wiltshire 16. Mason-Jones R, Naylor B, Towill DR (2000) Lean, agile or leagile? matching your supply chain to the marketplace. Int J Prod Res 38(17):4061–4070 17. Schnetzler M, Sennheiser A, Schonsleben P (2007) A decomposition-based approach for the development of a supply chain strategy. Int J Prod Econ 105(1):21–42 18. Christopher M, Towill D (2001) An integrated model for the design of agile supply chains. Int J Phys Distrib Log Manage 31(4):435–246 19. Naylor D, Naim M, Derry D (1999) Leagility: integrating the lean and agile manufacturing paradigms in the total supply chain. Int J Prod Econ 62(1):107–118 20. Lee H (2004) The triple—a supply chain. Harvard Bus Rev 82(10):102–112 21. Selldin E, Olhager J (2007) Linking products with supply chains: testing fisher’s model, supply chain management. Int J 12(1):42–51 22. Whitten GD, Green KW Jr, Zelbst P (2012) Triple-a supply chain performance. Int J Oper Prod Manage 32(1):28–48 23. Qi Y, Zhao X, Sheu C (2011) The impact of competitive strategy and supply chain strategy on business performance: the role of environmental uncertainty. Decis Sci 42(2):371–389 24. Li D, O’Brien C (2001) A quantitative analysis between product types and SC strategies. Int J Prod Econ 73(1):29–39 25. Qi Y, Boyer KK, Zhao X (2009) Supply chain strategy, product characteristics, and performance impact: evidence from Chinese manufacturers. Decis Sci 40(4):667–695 26. Christopher M, Towill D (2000) Marrying lean and agile paradigms. In: Proceedings of 7th international annual EUROMA conference, Ghent 27. Childerhouse P, Aitken J, Towill D (2002) Analysis and design of focused demand chains. J Oper Manage 20(6):675–689 28. Vitasek K, Manrodt K, Kelly M (2003) Solving the supply-demand mismatch. Supply Chain Manage Rev 58–64 29. Lamming R, Johnsen T, Zheng J, Harland C (2000) An initial classification of supply networks. Int J Oper Prod Manage 20(6):675–691 30. Hayes RH, Wheelwright SC (1979) Link manufacturing process and product life cycles. Harvard Bus Rev 57(1):133–140 31. Oliver R, Webber M (1982) Supply-chain management: logistics catches up with strategy. In: Logistics: the strategic issues, Chapman Hall, , London, pp 63–75 32. Porter ME (1985) Competitive advantage. The Free Press, New York 33. Ronga A, Akkermanc R, Grunowc M (2011) An optimization approach for managing fresh food quality throughout the supply chain. Int J Prod Econ 131(1):421–429 34. Labuza T (1982) Shelf-life dating of foods, 1st edn. Food and Nutrition Press, Westport 35. Vad Der Vorst JGAJ, Van Kooten O, Marcelis W, Luning P, Beulens A (2007) Quality controlled logistics in food supply chain networks: integrated decision-making on quality and logistics to meet advanced customer demands. In: Proceedings of 14th international annual EUROMA conference, Ankara 36. Parnaby J (1995) System engineering for better engineering. IEE Eng Manage J 5(6):256–266 The Power of Analytical Approaches Towards the Development 1235 37. Shearer C (2000) The CRISP-DM model: The new blueprint for data mining. J Data Warehouse 5(4):13–22 38. Stanovich KE, West RF (2000) Individual differences in reasoning: Implications for the rationality debate? Behav Brain Sci 23:645–665 39. Lapide L (2006) MIT’s SC2020 project: the essence of excellence. Supply Chain Manage Rev 10(3):18