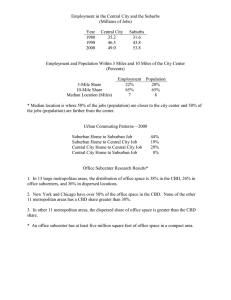

The Intersection of Place and the Economy The Brookings Institution

advertisement