Edvard Munch, The Scream (1893)

advertisement

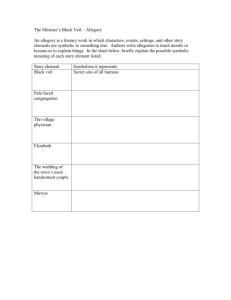

Edvard Munch, The Scream (1893) (depicting effect of Mt. Krakatoa eruption in 1883) Module V – Corporate Externalities Chapter 11 Piercing the Corporate Veil Bar exam Corporate practice Law profession Citizen of world • PCV factors • PCV in tort cases – Close vs. public corporation – Fail to observe formalities – Commingling personal and business – Inadequate capitalization – Active participation • Why limited liability? – Investment – Diversification – Public trading markets Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil – Enterprise liability – Corporate shareholders • PCV in contract cases – Abuse of form – Assumption of risk • PCV in corporate groups – “Normal” parent-sub relationship – Corporate confusion • Compare to UFTA Slide 2 of 36 What is limited liability? • Mandatory rule? • Default rule? – Majoritarian – Tailored – Penalty NC Bus Corp Act § 55-6-22. Liability of shareholders. (a) A purchaser from a corporation of its own shares is not liable to the corporation or its creditors with respect to the shares except to pay the consideration for which the shares were authorized to be issued or specified in the subscription agreement. (b) Unless otherwise provided in the articles of incorporation, a shareholder of a corporation is not personally liable for the acts or debts of the corporation except that he may become personally liable by reason of his own acts or conduct. Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 3 of 36 Is limited liability inherent? • Early corporation Owners – shareholders = partners – calls on Shs (2x-5X) • Mid-19th Century innovation – LL - selected businesses – some retain Sh call regime – banks through Depression Entity • Late 20th Century expansion – LL all bus orgs – except professional "supervisors” (some states) Corporations: A Contemporary Approach Outside creditors Chapter 11 Piercing the Corporate Veil Slide 4 of 36 Why limited liability? Consider risks of investing in a pharmaceutical company. Value of limited liability … • Encourage investment? • Permit diversification? • Reduce monitoring cost? • No need monitor co-Shs? • Uniform share valuation? • Permit public stock mkt? Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 5 of 36 Diversification Inv. X Inv. Y Inv. Z Portfolio XYZ Weak 15% 2% -5% 4% Strong 5% 18% 25% 16% Expected 10% 10% 10% 10% Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 6 of 36 Should limited liability have exceptions? Pros • Encourage investment • Foster diversification • Encourage mgmt risktaking • Facilitate stock markets Corporations: A Contemporary Approach Cons • Discourage extension of credit • Insider opportunism • Externalization of risks • Sh irresponsibility Chapter 11 Piercing the Corporate Veil Slide 7 of 36 Piercing in tort cases … verbigeration (vuhr-bij-uh-RAY-shun) noun Obsessive repetition of meaningless words and phrases. Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 8 of 36 Walkovsky v. Carlton (N.Y. Court of Appeals 1966) Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 9 of 36 Theories of liability PCV (Individual) liability Corp 1 •2 cabs •2 mdls Seon •2 cabs •2 mdls Carlton Corp 3 •2 cabs •2 mdls Walkovsky (tort creditor) Corporations: A Contemporary Approach ........ Corp 10 .•2 cabs •2 mdls Garage Inc. Enterprise liability Chapter 11 Piercing the Corporate Veil Slide 10 of 36 Walkovsky v. Carlton (N.Y. Court of Appeals 1966) Enterprise liability Individual liability “… these corporations are alleged to be operating as a single entity, unit and enterprise. … It is one thing to assert that a corporation is a fragment of a larger corporate combine which actually conducts the business … "It is not enough to allege the defendant dominated and controlled a fragmented corporate entity. The corporate form may not be disregarded merely because the assets of the corporation, together with mandatory insurance coverage, are insufficient to sure the plaintiff recovery. Taxi owner operators are entitled to form such corporations. Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 11 of 36 Majority “The responsibility for imposing condition on incorporation has been committed to the Legislature, [which does not] require taxi corporations [to] carry automobile liability insurance over and above that mandated by the Vehicle and Traffic Law. Corporations: A Contemporary Approach Dissent The attempt to do corporate business without providing any sufficient basis of financial responsibility to creditors is an abuse of the separate entity and will be ineffectual to exempt the shareholders from corporate debts. Ballantine. It certainly could not have intended to shield those individuals who New York State organized corporations, with Legislature the specific intent of avoiding responsibility to the public, where the operation of the corporate enterprise yielded profits sufficient to purchase additional insurance. Chapter 11 Piercing the Corporate Veil Slide 12 of 36 Individual liability "There were no allegation that Carlton was actually doing business in his individual capacities or shuttling personal funds in and out of the corporation without regard to formality. Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil What happens on remand? Slide 13 of 36 What if corporate shareholder? Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 14 of 36 Radaszewski v. Telecom Corp. (8th Cir. 1992) Telecom wholly-owned subsidiary Contrux inadequate insurance Radaszewski Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 15 of 36 Alter Ego Doctrine "Under Missouri law, a plaintiff needs to show ... (1) complete combination ... of policy and business practice in respect to the transaction attacked .... (2) such control must have been used by the defendant to commit fraud or wrong .... and (3) the aforesaid control and breach of duty must proximately cause the injury .... “ Corporations: A Contemporary Approach Is buying cheap insurance “wrong”? By the way, what law applies in a piercing case – did the tort victim choose the law where the tortfeasor is incorporated? Chapter 11 Piercing the Corporate Veil Slide 16 of 36 Does the PCV “test” matter … Walkovsky (taxi cab) Radasjewski (parent co.) General test “prevent fraud / achieve equity” Alter ego (1) control (2) used to commit wrong, (3) proximate cause Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 17 of 36 Piercing in Contract Cases … What are PCV factors? Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 18 of 36 Complex Computing Co. Straw SH Horton Street Assoc. Glazier Albert Option to buy Runs business Gets consulting K Full control No formalities Personal assurances C3 Sales rep agreement Freeman Corporations: A Contemporary Approach Horton Street Note Theberges Chapter 11 Piercing the Corporate Veil Slide 19 of 36 Complex Computing Co. Horton Street Assoc. Glazier, with the help of some buddies, incorporates C3 to acquire a computer license from Columbia Univ. • Glazier, though designated a "scientific adviser" of C3, holds an option to buy all the C3 stock and actually runs C3 • C3 signs up Freeman as sales rep under an agreement that promises commissions and a hefty severance package • To sell out to Thomson, Glazier has C3 can Freeman / Glazier is then paid handsomely in the sale and Freeman gets nothing • Freeman holds unfulfilled contractual promises and sues – – C3, which is a shell – Glazier on a PCV theory Albert incorporates Horton Street to buy rental properties from the Worden Group in a heavily leveraged acquisition • Albert assumes full control of HS, though does not maintain separate books or follow corporate formalities • HS assumes a promissory note that Worden Group had given Theberges / Albert says he will "stand behind" HS • after economic reversals, HS liquidates 2 properties to discharge part of Theberges' mortgage, but defaults on note • Theberges hold an unpaid note and sue – – HS, which is insolvent – Albert on a PCV theory. Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 20 of 36 Count the piercing factors … Factor Wisdom C3 / HS CHC Y/Y Public 0% / CHC 40.5% Corp SH N/N Corp 37.2% / indiv 43.1% Tort N/N Tort 31.0% / K 42.0% 4 – sole shareholder Y Y/Y 1 Sh 49.6% / 3+ Shs 35.0% 5 – dominate/control Y Y/Y Found 34% - PCV 57.0% 6 – fail formalities Y Y/Y Found 10% - PCV 66.9% 7 – inadequate capital Y N/Y Found 8% - PCV 73.3% 8 – confusion/commingle Y Y/Y Found 16% - PCV 84.2% 9 – misrepresentation Y N/N Found 11% - PCV 91.6% 10 – personal guarantees Y N/Y N/A 1 – Public vs. CHC 2 – corp vs. indiv 3 – tort vs. K TOTAL Corporations: A Contemporary Approach Thompson (1600 cases thru 1985) 5-5 / 7-3 Chapter 11 Piercing the Corporate Veil Slide 21 of 36 Distinguish the cases … Complex Computing Co. Horton Street Assoc. “evidence of wrongdoing” “oral promises … sharp business practices” Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 22 of 36 Piercing in Corporate Groups … How different from “individual” cases? What is framework? What are factors? Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 23 of 36 Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 24 of 36 Gardemal v. Westin Hotel Co (5th Cir 1999) OTR Associates v IBC Services (NJ App 2002) The concierge at a Westin hotel in Mexico suggested that John Gardemal go snorkeling at Lover's Beach. He did and died. The beach was notoriously unsafe. A shopping mall leased space to a Blimpie subsidiary, whose franchisee failed to pay rent and was kicked out. Westin-Mexico is the Westin sub that managed the hotel. Is the parent liable for tort of its sub? The mall then sued the parent, Intl Blimpie Corp, to collect rent arrearages owed by the sub. Is the parent liable? No piercing! Veil pierced! (“typical parent-sub relationship”) (“evasion, fraudulently carried out”) Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 25 of 36 PCV as remedy for “fraudulent conveyance” … Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 26 of 36 Howard (devoted spouse) Fraudulent Conveyance Assigns income Wanda (medical grad) Student loans Bank Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 27 of 36 Uniform Fraudulent Transfer Act § 4. Transfers Fraudulent as to Present/Future Creditors § 7. Remedies of Creditors (a) A transfer made or obligation incurred by a debtor is fraudulent as to a creditor, whether the creditor’s claim arose before or after the transfer was made or the obligation was incurred, if the debtor made the transfer or incurred the obligation . . . . (1) with actual intent to hinder, delay, or defraud creditors (2) without receiving a reasonably equivalent value in exchange for the transfer or obligation, and the debtor: (i) was engaged or was about to engage in a business or a transaction for which the remaining assets of the debtor were unreasonably small in relation to the business or transaction; or (ii) intended to incur, or believed or reasonably should have believed that he [or she] would incur, debts beyond his [or her] ability to pay as they became due . (a) In an action for relief against a transfer or obligation under this [Act], a creditor . . . may obtain: (1) avoidance of the transfer or obligation to the extent necessary to satisfy the creditor’s claim Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil (3) ... (i) an injunction against further disposition by the debtor or a transferee, or both, of the asset transferred or of other property; (ii) appointment of a receiver to take charge of the asset transferred or of other property of the transferee; or (iii) any other relief the circumstances may require. Slide 28 of 36 Uniform Fraudulent Transfer Act § 4. Transfers Fraudulent as to to Creditors § 4. Transfers Fraudulent as to to Present/Future Creditors (a) A transfer made or obligation incurred by a debtor is fraudulent as to a creditor, whether the creditor’s claim arose before or after the transfer was made or the obligation was incurred, if the debtor made the transfer or incurred the obligation . . . . (1) with actual intent to hinder, delay, or defraud creditors or (2) without receiving a reasonably equivalent value in exchange for the transfer or obligation, and the debtor: (i) was engaged or was about to engage in a business or a transaction for which the remaining assets of the debtor were unreasonably small in relation to the business or transaction; or (ii) intended to incur, or believed or reasonably should have believed that he [or she] would incur, debts beyond his [or her] ability to pay as they became due . Corporations: A Contemporary Approach (a) Transfer is fraudulent as to a creditor if debtor made the transfer . . . . (1) with actual intent to hinder creditors OR (2) without receiving FMV and debtor: Chapter 11 Piercing the Corporate Veil (i) Was business where remaining assets were unreasonably small OR (ii) should have believed would be unable to pay debts as came due. Slide 29 of 36 Group hypo How do six cases we’ve studied come out … (1) under PCV doctrine (2) UFTA? Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 30 of 36 Case Pierce? UFCA? Y (“shuffling”) Y N (insured) N Complex Computing Y (profited when sold business) Y Darbro N (no siphoning) N Westin Hotel N (not undercap) N IBC Services Y (deceive + undercap) Y Walkovsky Radazjewski Shareholders Siphon Deceive Corporation Credit Creditor Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 31 of 36 PCV ~ UFTA Case PCV UFTA Walkovsky v. Carlton No PCV because setting up corp structure + min insurance OK under NY law. Yes PCV for “shuffling” Yes FT when corps made payments to Sh, leaving “unreasonably small assets” Radazjewski v. Telecom No PCV because sub bought lowcost insurance (allowed by law) No FT because insurance as required, no $ transfers to parent Freeman v. C3, Glazier Yes PCV because dominant “Sh” left C3 asset-less after Thomson sale Yes FT because Thomson proceeds went only to “Sh” Theberge v. Darbro No PCV because Shs never withdrew $$, just sharp dealings No FT because Shs actually putting in more $$, not out Gardemal v. Westin Hotel No PCV because no indication Mex sub lacked financial resources No FT because no commingling of operations, no transfers OTR v. IBC Services Yes PCV because parent confused creditor about who obligated Yes FT because “shell” was intended to confuse creditor + insufficient assets Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 32 of 36 The end Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 33 of 36 Reverse piercing … Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Slide 34 of 36 Connolly v. VFW (Colo. 2006) Connolly (bankruptcy trustee) Phillips How does Connolly Propose to get Parcel A Into Phillips’s estate? 51% Philsax, Inc. Corporations: A Contemporary Approach Chapter 11 Piercing the Corporate Veil Margaret 49% Quit claim Parcel A Slide 35 of 36