PAY AND BONUSES: SOME KEY ISSUES

advertisement

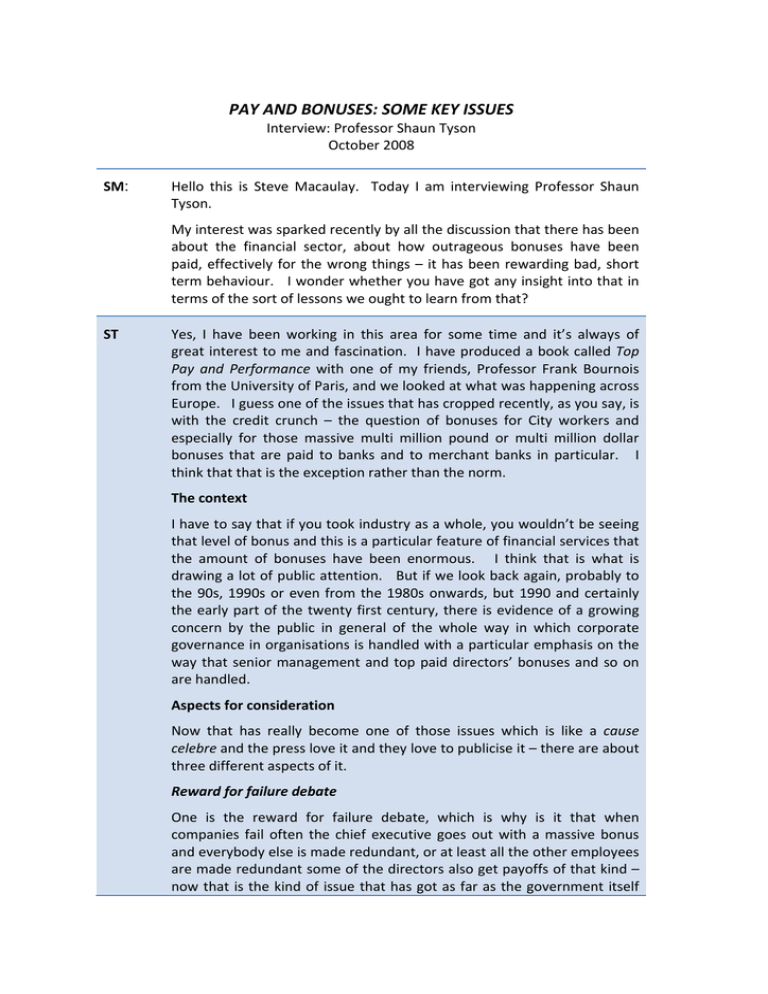

PAY AND BONUSES: SOME KEY ISSUES Interview: Professor Shaun Tyson October 2008 SM: Hello this is Steve Macaulay. Today I am interviewing Professor Shaun Tyson. My interest was sparked recently by all the discussion that there has been about the financial sector, about how outrageous bonuses have been paid, effectively for the wrong things – it has been rewarding bad, short term behaviour. I wonder whether you have got any insight into that in terms of the sort of lessons we ought to learn from that? ST Yes, I have been working in this area for some time and it’s always of great interest to me and fascination. I have produced a book called Top Pay and Performance with one of my friends, Professor Frank Bournois from the University of Paris, and we looked at what was happening across Europe. I guess one of the issues that has cropped recently, as you say, is with the credit crunch – the question of bonuses for City workers and especially for those massive multi million pound or multi million dollar bonuses that are paid to banks and to merchant banks in particular. I think that that is the exception rather than the norm. The context I have to say that if you took industry as a whole, you wouldn’t be seeing that level of bonus and this is a particular feature of financial services that the amount of bonuses have been enormous. I think that is what is drawing a lot of public attention. But if we look back again, probably to the 90s, 1990s or even from the 1980s onwards, but 1990 and certainly the early part of the twenty first century, there is evidence of a growing concern by the public in general of the whole way in which corporate governance in organisations is handled with a particular emphasis on the way that senior management and top paid directors’ bonuses and so on are handled. Aspects for consideration Now that has really become one of those issues which is like a cause celebre and the press love it and they love to publicise it – there are about three different aspects of it. Reward for failure debate One is the reward for failure debate, which is why is it that when companies fail often the chief executive goes out with a massive bonus and everybody else is made redundant, or at least all the other employees are made redundant some of the directors also get payoffs of that kind – now that is the kind of issue that has got as far as the government itself Professor Shaun Tyson who produced a white paper on this and was considering legislating against this is in some way. Financial services sector, especially massive bonuses Secondly the area, I think, which has become apparent as I have said is in the financial services sector, especially massive bonuses, but not unusual in other companies as well, massive bonuses also there, but not to the level usually of financial services. They are kind of eye catching figures. The way that reward packages have been structured And thirdly, I think, it is probably the way that reward packages have been structured that typically, especially a trend coming to the US, has led to some very high payouts which don’t necessarily reflect the performance of the business at that time. So often people have contracts, service contracts, which provide for bonus payments or stock options, which are realised many years or sometime after the actual performance that has produced them. So if you have an option to buy stock and you take that option up and then you sell the stock and you come back with a massive amount of money as a consequence, that might all be attributable to a performance which took place about four or five years ago. So it’s difficult for the press always to pick up on those details, they just see this person getting a massive bonus. There are some very characteristic and amazing cases – I won’t mention the names of individual managers or directors to whom this has happened, but there are many cases, for example, the head of the New York Stock Exchange marched off with a massive payoff when he left and there was about three or four years of litigation consequent to that where this money was seen to recovery. There have been cases where the chairman of a business has taken over the CEO role – I am not talking about Marks and Spencers, I am talking about prior to that – and in so doing has doubled his or her salary just because they have taken on two roles. There have been cases where people have sold off their shares, massive amounts of shares, just prior to a takeover with the obvious result that they have got a massive windfall, obviously from inside knowledge because they knew as directors that the takeover was going to take place and that their shares were going to go up as a consequence. So there are all those kinds of examples which have led people to be rather doubtful about what is going on and I think it feeds into a kind of anti capitalist view as well, that people are there at the top just to make money and exploit their position rather than to provide a service. Actions by Government And we have seen, as a consequence of all these trends and especially of the way that the press and media have picked up on them, a number of actions by governments around the world to reduce the pressure on them Page 2 Professor Shaun Tyson really, to act and to try to create some kind of self regulation on the whole. Some of it has gone beyond self regulation into laws which prohibit certain behaviours – so in the UK we have the Directors Remuneration Report Regulations of 2002 which make it necessary for organisations to set up remuneration committees this is private sector companies and to ensure that all the pay increases or bonus or other reward policy issues that affect the directors are brought to the committee for approval or agreement and it also provides that the shareholders will vote on the remuneration committee’s report. It doesn’t go as far as making the vote a mandatory response, so if in fact a company’s remuneration report is voted down, sadly it doesn’t mean that the director concerned will automatically not get the increase, but there have been cases – Glaxo Smith Kline was a case in point where that has happened and the managing director or chief executive has understood that that means that he can’t have that particular increase and the package has been restructured as a consequence. So, I think it has had an effect, but there are those who have got the brass cheek to take the money anyway. So that says regulations have sought to bring some control and some order in, and the same kind of process has happened also in France and in Germany and, of course, to some extent in the United States with Sarbanes Oxley. Sarbanes Oxley is, I think, mostly aimed at not just misbehaviour in bonuses, but really at criminal actions that companies might take following the Enron scandal, but subsequently to that I think they secured an exchange commission and the US have brought in more regulation or are certainly seeking to do that of bonuses for directors. So I think there has been a response by governments around the world and there is real convergence here, although I don’t know that it was necessarily designed that way, but there is a convergence across Europe and in the US towards still relatively light touch regulation, still an element of self regulation. Before these laws were brought in, in the UK there was the combined code, which was the code that every company which was quoted on London Stock Exchange would have signed up to, which really was much the same as what was produced from the Directors Remuneration Report Regulations of 2002, which sort of puts into law regulation. So there has always been an element of self regulation, but there have also been these big exceptions and those are the ones that hit the headlines. Issues and problems So I think that is the history of it, now bonuses and all these other aspects of the package are also a reflection of labour market trends and the argument that is always put forward is that it is difficult to find high quality directors and that chief executives and directors take big risks and therefore should get big rewards if they come off. Page 3 Professor Shaun Tyson Now, the problem is that they seem to get rewarded whether they come up or not, so its heads they win, tails they win. So that is the problem and that has to do with the targeting – the extent to which their targets that are being set they going to achieve anyway and they are not really stretch targets. And it has to do with really whether the remuneration committee is getting involved, as I think it should do, in objective setting and approving these bonus packages in advance, to make sure that there is nothing within them which is going to lead to people being paid irrespective of their performance. SM I feel as though we have covered a lot of ground during this short discussion, so thank you very much for giving us the benefit of your time and expertise. ST Thank you. Page 4