Using Past Income Data to Verify Current Medicaid Eligibility

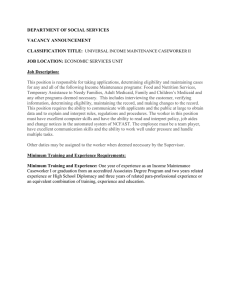

advertisement