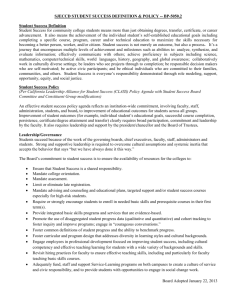

Synthesis of Findings Roadmap to Coverage:

advertisement