Manufactured Housing Community-and Asset-Building Strategy as a

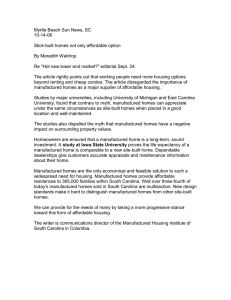

advertisement