The Community Reinvestment Act After Financial Modernization: A Baseline Report

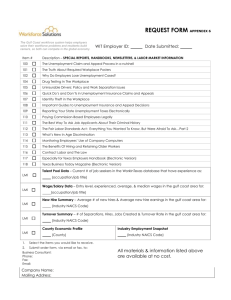

advertisement