Consumer Education Syllabus

advertisement

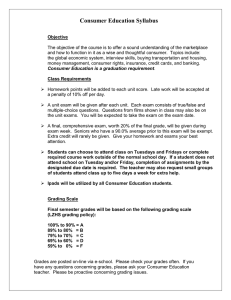

Consumer Education Syllabus Objective The objective of the course is to offer a sound understanding of the marketplace and how to function in it as a wise and thoughtful consumer. Topics include: the global economic system, interview skills, buying transportation and housing, money management, consumer rights, insurance, credit cards, and banking. Consumer Education is a graduation requirement. Class Requirements Homework points will be added to each unit score. Late work will be accepted at a penalty of 10% off per day. A unit exam will be given after each unit. Each exam consists of true/false and multiple-choice questions. Questions from films shown in class may also be on the unit exams. You will be expected to take the exam on the exam date. A final, comprehensive exam, worth 20% of the final grade, will be given during exam week. Seniors who have a 90.0% average prior to this exam will be exempt. Extra credit will rarely be given. Give your homework and exams your best attention. Students can choose to attend class on Fridays or complete required course work outside of the normal school day. If a student does not attend school on Friday, completion of the Friday assignment by the designated due date is required. Ipads will be utilized by all Consumer Education students. Grading Scale Final semester grades will be based on the following grading scale (LZHS grading policy): 100% to 90% = A 89% to 80% = B 79% to 70% = C 69% to 60% = D 59% to 0% = F Grades are posted on-line via e-school. Please check your grades often. If you have any questions concerning grades, please ask your Consumer Education teacher. Please be proactive concerning grading issues. Unit 1 – Economics and You – 2 Weeks Consumers in the marketplace Recession and depression Needs vs. Wants – Opportunity cost Inflation Supply and demand World trade Economic Systems Government and the economy Advertising persuasion and the consumer decision-making process Interview Unit – Finding and Applying for a Job – 2 weeks Career Search Process -Job application, cover letter, resume, interview Unit 2 – The Consumer – 3 Weeks Advertising persuasion and the consumer decision-making process Evaluating alternatives when purchasing food and clothing The car-buying process Unit 3 – Money Management – 3 Weeks Taxes and your paycheck Filing a tax return Setting financial goals Estimating income/expenses Budgeting Advantages and disadvantages of consumer credit Credit rights and responsibilities – Credit ratings Unit 4 – Consumer Protection – 3 Weeks Consumer rights and responsibilities Government and consumer protection Deception and fraud Resolving problems Housing options – renting an apartment vs. buying a home Unit 5 – Banking and Investing Services – 3 Weeks How banks work Simple and compound interest Checking accounts Investing basics Money markets and CDs Mutual funds Other banking services Stocks The importance of saving Retirement investments Unit 6 – Insurance – 2 Weeks Automobile and Homeowners’ insurance Health, Life and Property insurance Healthcare providers, legal assistance providers and government assistance