Unit 3 Money Management

advertisement

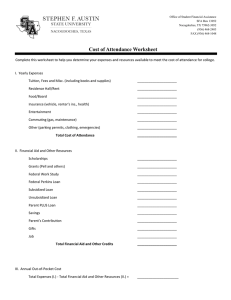

Unit 3 Money Management Taxes and Your Paycheck ► Terms • • • • • to Examine Income Tax FICA Gross income Net income IRS Sample Paycheck Stub W-4 Form Proper Withholding • Paying Too Much • Withholding Too Little 1. Common with students who work only in summer Forced Savings Program 1. Sending extra payments to the IRS 2. Claiming fewer allowances 2. 3. Specifying extra money to be withheld on W-4 Filing a Tax Return ► Income – wages, tips, interest from savings ► Employers will send a Form W-2 by January 31. The form summarizes earnings and withholdings for the year for a specific job. ►A copy of your W-2 Form is sent to the IRS by your employer. Form W-2 Form 1099-INT Taxes the EZ Way People who can use a Tax Form 1040EZ: Single or married and filing jointly with your spouse Person who has no dependents You and spouse are under age 65 Neither you or your spouse is blind Have a taxable income of less than $50,000 Earned no more than $400 in interest No income other than wages, interest, tips, scholarships, or unemployment compensation Form 1040EZ Form 1040 (“complicated”) Completing the 1040 and 1040EZ Forms ► Information to Understand/Remember: Social security number Total wages, salaries, and tips Taxable Interest Income Unemployment Compensation Adjusted Gross Income Deductions Taxable Income Taxes and Government Sources of Federal Government Income Compare The Following Internet Information to Textbook (pg. 171) Principles of Taxation ► Benefit Principle those who use a good or service provided by the government should pay for it ► Ability-to-pay-principle those who have larger incomes should pay a larger share of what they receive (Federal Income Taxes=15%-39.6%) How Taxes are Collected ► Direct Taxes Ex. Income taxes and property taxes ► Indirect Taxes Ex. Renting and paying property taxes ► Pay-as-you-earn Taxes Ex. Federal Withholding Types of Taxes ► Income Tax ► Sales Tax ► Property Tax ► Excise Tax ► Estate Tax ► Gift Tax ► Business or License Tax U.S. Government Spending 1. 2. 3. 4. 5. 6. Social Security, Medicare, and Other Retirement (37%) National Defense, Veterans and Foreign Affairs (20%) Social Programs (18%) Net Interest on the Debt (15%) Physical, Human and Community Development Law Enforcement and General Government Pg. 176 in textbook State and Local Governments Provide the Following: Building and maintaining local roads Operating police and fire protection services Maintaining a criminal justice system Building and staffing public schools Building and operating state colleges and universities Supporting hospitals and other medical facilities Constructing and operating sewage treatment plants Operating unemployment compensation programs Budgeting How will you Use Your Money? Choosing Financial Goals Short Term Goals – hope to achieve within a year or two, may lead to long term goals also being met Ex. Purchase a small item, plan a birthday party, receive an A on a test Long Term Goals – most have a major impact on your life; hope to achieve in more than a year or two Ex. Own a home, start a business, raise a family, retirement planning, Goals Your own goals may affect the following: 1. Your current family 2. Your future family 3. Your community 4. Income 5. Colleagues 6. Friends Tracking Your Income and Expenses ► Establish ► Keep a Filing System Effective Records/Save Receipts ► Choose a Desired Time Frame to Analyze Income and Expenses There are differences between expenses ► Fixed Expenses – same every month ► Flexible Expenses – varies / depends Steps in Preparing a Budget Worksheet Create a Worksheet 2. Estimate your Income *uneven income and realistic income 3. Estimate your Expenses and Savings 4. Record your Actual Income and Expenses 5. Calculate Differences between Estimated Income and Actual Income 1. 3 Student’s Sample Budget Worksheets Budget Pitfalls ► Too much detail – keep it simple ► Keep track of flexible expenses – be specific ► Keep miscellaneous items to a minimum ► Keeping a budget takes commitment and effort – do not give up if you feel it is important What is Credit ► The ability to borrow money in return for a promise of future repayment = credit ► Credit comes with a cost - interest Positive uses of Credit • • • • Opportunity to Purchase a Home Building Equity and Tax Advantages College Education Health Related Costs Service Credit bills – gas, electric, garbage, water, phone When to Borrow 1. 2. 3. 4. 5. Does the item or service need to be purchased right now? Do you have to borrow to purchase right now? Can you afford to make the payments on the loan? Will you be able to borrow to buy items you may need more in the future? Does the loan exceed 20-25% of your takehome pay? Qualifying for Credit ► Credit worthiness – measure of your reliability to repay a loan 1. Character – measure of your sense of financial reliability credit history or need for cosigner for the loan 2. Capacity – financial ability to repay a loan income, fixed expenses, financially overextended? 3. Capital – value of what you own, including savings, investments, and property more capital = the safer it is for you to get a loan Credit Reporting Agencies, or Credit Bureaus ► Equifax www.equifax.com ► Experian www.experian.com ► TransUnion www.tuc.com Sample Credit Application Establishing a Positive Credit Rating 1. 2. 3. 4. 5. Payment History – most important Current Debt Length of Credit History = Risk New Accounts and Inquiries Type of Credit Used – Too many credit cards? Types of Consumer Borrowing • Secured Loan collateral – property pledged to back a loan (home) installment loan – certain number of payments with a certain interest rate (cars) • Unsecured Loan based on credit worthiness alone – no collateral Where to Obtain Loans Banks Finance Companies Life Insurance Companies Credit Card Cash Advances Pawnbrokers Rent-to-Own Companies Credit Cards Credit Card Costs • Annual Fees • Interest • Late Fees (grace period) • Charging over your personal Credit Limit • Advances, credit card company – checks • Minimum Payment Trap Credit Rights and Responsibilities Truth in Lending Truth in Lending Act, 1968, required all banks to calculate credit costs the same way must also disclose the finance charge and the annual percentage rate (APR) Equality in Lending Equal Credit Opportunity Act, passed in 1975 and amended in 1977, made it illegal to refuse credit on the basis of race, color, religion, national origin, sex, marital status, or age. Consumer Responsibilities Involving Credit ► Accept Responsibility ► Know your Debt Capacity ► Practice Self-Control pay more than the minimum avoid too many credit cards pay cash for small purchases keep accurate records Maintaining a Good Credit Rating ► Start small ► Save regularly (pay yourself first) ► If married, establish your own credit history ► Pay bills on time, never ignore bills ► Read what you sign ► Provide personal information only when absolutely necessary – avoid ID theft