Document 14789766

advertisement

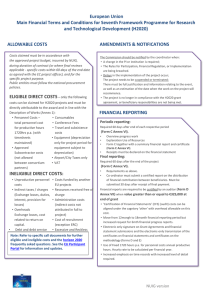

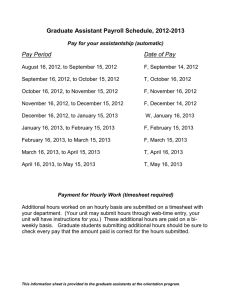

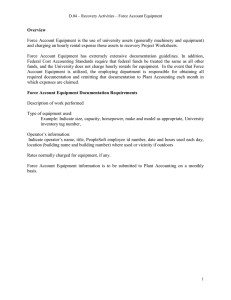

* * Member States (MS) /Associated Countries(AC) H2020 Financial Rules- Example of collaborative projects e.g. Applicable to Universities Applicable to SME’s e.g. Applicable to Universities Applicable to SME’s A maximum TTG of 8 months - 5 months for informing all applicants on scientific evaluation - 3 months for signature of Grant Agreement (GA) - ERC may take longer - interviews •Through the Participant Portal •Electronic-only submission of reports •Of the Grant Agreement •Of the Amendments •Financial Statements and Technical reports Annex 1: Description of the action Annex 2: Estimated budget Annex 3: Accession Forms, 3a & 3b Annex 4: Financial statements Annex 5: Certificate on the financial statements Annex 6: Certificate on the methodology Link to Annotated Model Grant Agreement: http://ec.europa.eu/research/participants/data/ref/h2020/grants_m anual/amga/h2020-amga_en.pdf •Personnel costs (incl. employer’s costs) •Travel, equipment (Note: depreciation rules if applicable), goods, works and services, Airport Taxes and City taxes allowed •Subcontracting •Overhead (Flat rate 25%) • VAT must be included on all Costings where applicable -------------------------------------------------- • 1720 hours p.a / 215 Days p.a (N.B! See following slides for sample timesheet record and calculation of annual personnel costs) Timesheet: template available in the AGA (version 19/12/2014) 13 Disclaimer: Information not legally binding Personnel costs: hourly rate A: General case ! The hourly rate is to be calculated per financial year If the financial year is not closed at the time of reporting, the beneficiary must use the hourly rate of the last closed financial year available. 01/10/2014 31/03/2016 Reporting period (example) 2014 Hourly rate of 2014 2015 Hourly rate of 2015 Advantages 14 Disclaimer: Information not legally binding 2016 Hourly rate of 2015 also for these months Exercise: General calculation of personnel costs Step 1.b Calculate the hourly rate: annual productive hours Out of the three options offered by the H2020 grant agreement: i. Fixed hours ii. Individual annual productive hours iii. Standard annual productive hours The beneficiary applies option 1 for all its staff Annual productive hours of Ms R. = 1720 ? 15 What if Ms R. would be a part time employee? Disclaimer: Information not legally binding Exercise: General calculation of personnel costs Step 2 Identify the hours worked for the action Ms R. worked some hours in December 2015 (registered in a timesheet): And in 2016 she signed a declaration of exclusive work in the action covering the period: Hours worked for the action in 2016 = (1720 / 12 months) x 1,5 months = 215 16 Disclaimer: Information not legally binding Exercise: General calculation of personnel costs Step 3 Multiply the hours worked for the action by the hourly rate As 2016 is on-going, the 2015 hourly rate will apply also for the 2016 months of the reporting period ! 215 x 22.67 = 4 874.05 EUR 17 Disclaimer: Information not legally binding • Costs pre formal start date as per Contract (except equipment as agreed with PO) • Costs not related to the project • Notional costs are not eligible • • Any cost which does not meet the conditions of an eligible cost Interest owed • Provisions for possible future losses or charges exchange losses • Costs declared, incurred or reimbursed in respect of another Community project • Cost of return on capital debt and debt service charges • Excessive or reckless expenditure • Any cost which does not meet the definition of eligible costs • Bank charges to receive EC grant funds • Indirect taxes and duties (central government taxes), unless allowed in Call. Subcontracting of action tasks is allowed, if it is: necessary for the action justified & described in DoW (Description of work) quantified in the estimated budget may only cover part of the action best value for money Funding for non-project partners “affiliated Third Parties“ can only report their own actual costs • Name/assignment of the “Third Party“ must be agreed in the GA • The “Third Party“ must be an associated enterprise (parent company/subsidiary company/ affiliated company) of the participant or • A legal link must exist with the project partner Proposal Technical annex Records of meetings Periodic activity/progress reports Financial reports and all associated back up to costs ensuring procurement and financial rules followed and adhered to Management reports Technical reports Dissemination and implementation plans Time sheets – for everybody involved (Academics, Researchers, Students) Only for direct costs funding ≥ 325.000 EUR • Are to be submitted only once at the end of the Project • Shorter Time to Grant: 8 months • 100% funded unless otherwise stated on Call • One single flat rate of 25% for Indirect Costs (Overhead) • If Direct Budget €325K or greater, one CFS (audit certification) required at end of grant. • Personnel: Standard Productive Hours - Default productive hours 1720p.a • VAT must be included in all costs • Move to Electronic submissions on EU Portal • Airport and City Taxes allowed under H2020. Central government taxes - not allowed. • H2020 reporting periods and prefinancing moving from 12 months periods to 18 months periods (Note - can be exceptional cases where reporting will occur in shorter time period) • Change in 'language' - Good and Bad Synonyms: e.g. Marketing (bad) ; Dissemination (good) LINKS: Research Accounts: H2020 AMGA