Employer-Assisted Housing: Competitiveness Through Partnership September 2000 Fellowship Program for Emerging Leaders

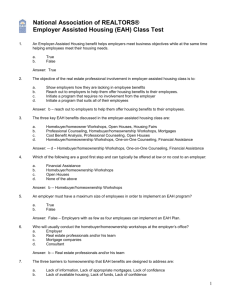

advertisement