Understanding cashflow

advertisement

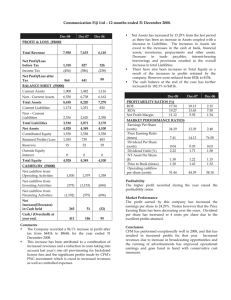

Understanding cashflow Anonymous. Management Accounting. London: Oct 1994.Vol.72, Iss. 9; pg. 32, 2 pgs http://proquest.umi.com/pqdweb?did=24086&sid=10&Fmt=3&clientId=68814&RQT=309 &VName=PQD Abstract (Document Summary) The report and accounts of Johnson Matthey PLC are examined to understand cash flow. From the Johnson Matthey accounts, cash flow statements conforming to current reporting requirements do not have to identify what practitioners know to be the key numbers. It was understood that by using FRS1 directors would not be misleading users of accounts and perhaps some businesses may not become insolvent. Full Text (833 words) Copyright Chartered Institute of Management Accountants Oct 1994 When it was published in September 1991, FRS1 was greeted with widespread acclaim. This new approach to reporting cashflow would focus on unequivocal figures, would prevent directors from misleading users of accounts--some observers even claimed it would prevent businesses becoming insolvent! Today, the picture is different. The Accounting Standards Board invited comments based on experience of using the new approach and, if press comments are to be believed, there is considerable dissatisfaction. It is one of the paradoxes of accountancy that cash flow is actually the simplest of concepts--vital, and well understood within businesses-yet made to look complex by the way it is reported. This month's review--of the latest report and accounts of Johnson Matthey plc--provides a case in point. In general terms, the report is very interesting. The company comprises four divisions-catalytic systems, materials technology, precious metals and colour and print--and claims world leadership in various markets spanning these activities. This is backed up by substantial spending on research and development, which is the subject of two pages of explanation. The involvement in precious metals (and inevitably, therefore, in foreign currencies) opens up a number of risks, and the company's hedging policy is spelled out by John Sheldrake, Executive Director of Finance and Technology (a unique combination?) and a member of this Institute. The two main techniques used involve the borrowing of metals and forward sales. The financial review draws attention to the interest income which arises as a result of the difference between metal interest rates and sterling interest rates, and a chart shows how each has moved in recent years. But back to cashflow. Surprising as it may seem, but as is apparent from the Johnson Matthey accounts, cashflow statements conforming to current reporting requirements do not have to identify what practitioners know to be the key numbers: * How much cash has been generated or absorbed by the company in the period being reported on? * To what extent has the company expanded or contracted, and how does this compare with the profit it has made? Typically, Johnson Matthey's cashflow statement needs to be read in conjunction with various notes to the accounts: one analysing the operating cashflow (essentially profit before depreciation less the increase in working capital), another analysing net borrowings and a third reconciling the movement in net cash. Readers who are not up to speed with the latest accounting practice will not have been helped by an elaboration in the Financial Review which takes a different line. It says there that the group's borrowings fell by L22m in 1994, and that this reflected: This is mathematically correct, of course, but how can this rearrangement of the numbers help readers? Specifically, what can possibly justify adding a pre-tax item like depreciation to a post-tax item like retained profits? From experience elsewhere, Prudentius has noticed that many accountants have to focus so sharply on profits and assets that they forget the cashflow which, chronologically, precedes them. If you are in that position, you might need to remind yourself of the following: 1 For a company to generate cash, the amount it receives from its customers must exceed the sum of the amounts paid to suppliers and employees. 2 The amount of such generation (or absorption if negative) is known within hours of the accounting period ending, i.e. as soon as the last item is entered in the cashbook. 3 Cashflow, like a country's balance of payments, must always balance: if a company generates cash, as defined above, then distributions (of interest, tax and dividends) will exceed new financing (e.g. increased borrowings and/or share issues) by exactly the same amount. 4 Over a period of weeks or months, various accounting processes are undertaken (classification of outgoings into capital and revenue, calculation of depreciation, identification of doubtful debtors or obsolescent stock etc) which, naturally, have no effect on cashflow whatsoever. 5 On completion of those processes, a figure for expansion is established, and by adding this to the unequivocal cash generation figure a profit figure is produced. Only then can the accountant begin to compile the FRS1 statement, which gives the erroneous impression that cashflow is a function of profit. Ignoring minor adjustments like revaluations and currency gains, for simplicity, it is possible to reconstruct the Johnson Matthey cashflow This highlights the fact that the company generated L48m of cash in the year, carried forward assets at a figure L22m higher than the previous year, and therefore showed a profit before interest of L70m. The juxtaposition of these numbers provides a top-level summary of what has happened, and in a form which identifies added value on both cash and accounting bases. It is difficult to imagine that Johnson Matthey's management accounts do not provide the board with such a picture. Given that it requires no additional information, why is it not a requirement to publish it? To borrow from Professor Higgins, why can't published accounts be more like management accounts?