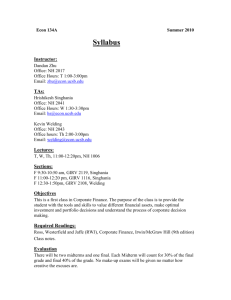

Brandeis University Finance 202a – Corporate Finance

advertisement

Brandeis University INTERNATIONAL BUSINESS SCHOOL Finance 202a – Corporate Finance Spring 2016 Instructor: Debarshi K. Nandy Office: Sachar International Center, Room 209A Email: dnandy@brandeis.edu Phone: (781) 736 - 8364 Office Hours: Wednesday 10:30am to 12:00noon. All other times by prior appointment, please email me to make an appointment. Teaching Assistant: Riddhish Rege Email: ridreg@brandeis.edu Office Hours: TBD. Prerequisites: FIN201a (Investments) and FIN212a (Accounting and Financial Analysis). Course objectives: The objective of this course is to provide an analysis of the major issues affecting the financial policy of a modern corporation in a global environment. We will first review some of the important theoretical and empirical work in each area before going on to discuss real-life cases dealing with the major issues of financial policy facing the firm, such as its choice of dividend policy, capital structure and related financing choices, the role of venture capital financing, the going-public decision, the impact of agency problems between firm management and security holders and between different classes of security holders on corporate governance (and different ways of solving such agency problems), as well as mergers/takeovers and other restructuring decisions. In this context, we will also discuss the valuation of firms and the use of various financial instruments. The purpose of this course is to develop your skills as a financial manager. The course builds on the basics of financial theory FIN201a. Note that this syllabus is preliminary and may change as the course progresses. Method of Instruction: Instruction will be done on the basis of a combination of lectures, case discussions, and problem solving. This course is fast paced, reasonably technical in nature, and it requires each student to do considerable out-of-class work. Problem solving is very important in this course and I encourage participation from all my students in this activity throughout the term. Answers to most assigned questions will be provided to students. You should read the assigned book chapters prior to coming to class. The material will mean a great deal more to you, and you will Page | 1 understand and retain much more of it, especially when you review the class notes and problems prior to an exam. Course materials Text: Ross, Westerfeld, and Jaffe (RWJ), Corporate Finance, 10th Edition, McGraw-Hill, 2011. The materials that I will post on LATTE are as important as the required text. Reading current business periodicals, such as the Financial Times or the Wall Street Journal can only help! I will comment on current business happenings as they may relate to course content. A very important benefit of keeping up with current business events is that it may provide you some ammunition with which you can impress career job interviewers. Cases and Additional Readings: Will be either handed out in class or electronically distributed via LATTE or email. Problem Sets: You will also be provided with additional practice problems on various topics throughout the course. I cannot overemphasize the importance of working these problem sets out in detail by yourself before coming to class. The exam problems are very often modeled on the problems in these problem sets. The most important and most helpful suggestion I can give you for doing well in this course is to do all the assigned questions and problems and then review them so that you are able to do them on the exam. The surest way to do poorly in this course is to not do the assigned problems or leave them to do the day before the exam. If you have any difficulty in solving the problems, please contact me or the TA for this course. Case Assignment: The group assignments for handing in can be completed in groups of no more than four people in your section. Each group will have to present the final assignment in class. Written assignments are due at the start of the class. Late assignments will not be accepted. Each case write-up must include an executive summary (maximum length one page) outlining key issues and recommendations. The main body of the report must be no longer than 8 pages, double spaced. Figures and tables should be put in an appendix at the end of the paper. All figures and tables must be numbered and all pages, including pages with tables and figures must be numbered. Assignment Due dates will be confirmed in class. Grading and Student Evaluation: The final grade will be determined according to the following components: Page | 2 Case Studies (Group and Individual) Quizzes (2 @ 5% each) Midterm Exam Final Exam Final Group Assignment Class Contribution 15% 10% 25% 30% 15% (includes presentation and teamwork) 5% Total 100% Class Contribution: Contribution is an essential component in the overall education experience. Contribution takes many forms: asking informed questions in class, handing in solved problem sets, making intelligent comments, reading the case and being prepared to discuss the issues, actively listening to your peers and working with others. Please remember that quantity is no substitute for quality. There will be ample opportunity to contribute to the class. It is your responsibility to ensure that you take an active role in the class. If this is a problem for you, I urge you to talk to me to discuss ways you can make a contribution. Exams: There will be 2 quizzes, 1 midterm exam and 1 final exam. Quizzes will be held in the second half of the class, midterm will be for the full class, and the final will be a 3 hour exam. The final exam is comprehensive and cumulative. Last minute illnesses only (to be verified with a doctor’s note) will be handled by rearranging the weights of the exams to reflect the missed work. (Weights will be moved to the other exams. Missing the midterm will split its weight equally between the quizzes. Missing a quiz will add its weight to the other quiz). You cannot miss/skip the final exam – if you do you will get zero for the final – the weight from the final will not be moved to the other components. There will be no makeup exams or quizzes for this course, except only under extraordinary circumstances. There is absolutely no opportunity to move the weights for the case studies and/or analyst reports – you must submit them. My exams are not open book or open notes. However, you may bring one crib sheet to each of my quizzes and the mid-term exam and two sheets for the final exam. A crib sheet is an ordinary (A4) piece of paper, 8-1/2"x 11", on which you may write, type, print or copy any notes that you think may be relevant and will help you. You may write or type as small as you wish and you may use both sides of the sheet of paper. You may not staple or tape any extensions or booklets onto the crib sheet. Do not abuse this privilege – if you do there will be severe penalties on your final grade. Use of Laptop Computers and Cell Phones in Class: Page | 3 Cell phones and PDA.s (i.e., Blackberry.s, i-Phones, etc.) must be turned off during lectures. Laptops may be used but only to browse the lecture slides or take notes. Regular class attendance is strongly advised if you want to do well in the course. I stick quite closely to my slides and what I discuss in class when setting exam questions. Laptop computers and cell phones may not be used during exams. Disabilities: If you are a student with a documented disability on record at Brandeis University and wish to have a reasonable accommodation made for you in this class, please see me immediately. Academic Integrity: The instructor enforces all University rules, especially those regarding academic honesty and integrity. Note: there is a zero tolerance level in this area. Plagiarism is cheating. The use of another’s material without permission and without recognition is cheating. This applies to text books, solution manuals, study guides, a friend's assignment, past assignments, internet resources or any other material irrespective of the source. You are expected to be familiar with and to follow the University’s policies on academic integrity: http://www.brandeis.edu/studentlife/sdc/ai/. Instances of alleged dishonesty will be forwarded to the Office of Campus Life for possible referral to the Student Judicial System. Potential sanctions include failure in the course and suspension from the University. Teamwork: Please see the Teamwork Document IBS_Managing-Performance on LATTE. Page | 4 Class Schedule Note: RWJ refers to the Ross, Westerfield, Jaffe, Corporate Finance 10th edition. The instructor reserves the right to add and remove readings from the course and to alter or modify the lecture schedule as required. I will give you notice of any such changes or modifications. Topic and Class Preparation Topic 1 Topic 2 Topic 3 Topic 4 Review of Time Value, Risk-Return Relationship, and Valuing Stocks and Bonds Reading: 1. Review of prior concepts. 2. RWJ Chs 2, 8, 9 (review) 3. RWJ Chs 10, 11 (review) Additional Reading: 4. Graham, John R., and Campbell R. Harvey, 2001, “The theory and practice of corporate finance: Evidence from the field”, Journal of Financial Economics 60, 187243. Do: Review Problem Sets NPV, IRR, and Discounted Cash Flow Valuation Reading: 1. RWJ Chs 3, 4, 5 Do: Problem Set and Group Assignment 1: Case Study: Acid Rain Capital Structure Theory: MM World Reading: 1. Cost of Capital – RWJ – Ch 13. 2. Lecture Notes on Capital Structure on LATTE 3. RWJ Ch 16. Do: Problem Set Capital Structure Theory (cont’d): “Real world with Asymmetric Information, Taxes and Bankruptcy costs” Reading: 1. Lecture Notes on Capital Structure on LATTE 2. RWJ Ch 17 and 30 pp. 929 – 932. Advanced Reading: 3. Jensen, Michael C., and William H. Meckling, 1976, “Theory of the firm: Managerial behavior, agency costs and ownership structure”, Journal of Financial Economics 3, 305-360. 4. Myers, Stewart C., and Nicholas S. Majluf, 1984, “Corporate financing and investment decisions when firms have information that investors do not have”, Journal of Financial Economics 13, 187-221. Topic 5 In Class Discussion of Case Study: Winfield Refuse Management Inc.: Raising Debt vs. Equity. Do: Problem Set Valuation and Capital Budgeting Readings: 1. RWJ Ch 18. Valuation and Capital Budgeting for the Levered Firm Page | 5 Topic 6 Dividend Policy Readings: 1. Lecture Notes on LATTE. 2. RWJ - Ch 19. In Class Discussion of Case Study: Dividend Policy at Linear Technologies. In Class Mid-term Exam either on March 2nd or March 9th Topic 7 Topic 8 Topic 9 (ONLY IF THERE IS TIME) Raising Financing – Equity – Initial Public Offerings (IPOs) and Seasoned Equity Offerings (SEOs) Reading: 1. Jay Ritter and Ibbotson, “Initial Public Offerings”. 2. RWJ – Ch 20. 3. Note on IPOs – from another book chapter on LATTE. In Class Discussion of Case: Knoll Furniture: Going Public. HBS 9-202-114 Do: Problem Sets Corporate Governance and Executive Stock Options Readings: 1. Book Chapter on LATTE on Corporate Governance. 2. Six Challenges in Designing Equity Based Pay – Hall, Journal of Applied Corporate Finance. 3. RWJ – Ch 22, pp. 681 – 703; Ch 23, pp. 726 – 730. Do: Problem Set Mergers & Acquisitions Reading: 1. Positioning for Growth: Carve-outs and Spin-offs. 2. RWJ Ch 29. 3. Book Chapter on LATTE Do: Problem Set Group Assignment: Presentations – Analyst Reports Final Exams - TBA Page | 6