REGULATION S-X TABLE OF CONTENTS Article 1—Application of Regulation S-X

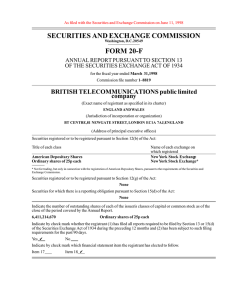

advertisement