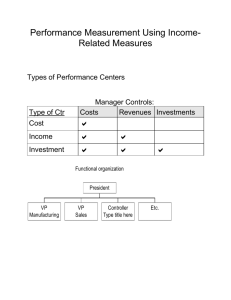

Introduction

advertisement

1 Introduction We also discuss two methods of relating profit to the investment base : 1. ROI 2. EVA We will discuss the investment base. The investment base is types of asset that may be employed in an investment center. 2 Structure of the Analysis The purposes of measuring assets employed are : 1. To provide information that is useful in making sound decisions about assets employed and to motivate managers to make these sound decisions that are in the best interests of the company. 2. To measure the performance of the business unit as an economic entity. 3 Structure of the Analysis In general business unit managers have two performance objectives : 1. They should generate profits from the resources at their disposal. 2. They should invest in additional resources only when the investment will produce an adequate return. The purpose of relating profits to investments is to motivate business unit managers to accomplish these objectives. 4 Structure of the Analysis The two ways of relating profits to asset employed are : 1. Return on Investment (ROI) ROI is a ratio. The numerator is income, as reported on the income statement. The denominator is assets employed 2. Economic Value Added (EVA) EVA is a dollar amount, rather than a ratio. It is found by subtracting a capital charge from the net operating profit. This capital charge is found multiplying the amount of assets employed by a rate. 5 Structure of the Analysis Balance Sheet ($ 000s) Current Liabilities 50 Account payable 150 Other current 200 400 Total current liabilities _ Current Assets Cash $ Receivables $ Inventory $ Total current assets $ Fixed assets Cost $ 600 Depreciation $ 300 Book value $ 300 Total Assets $ 700 _ $ 90 $ 110 $ 200 Corporate Equity $ 500 Total Equities $ 700 _ Income Statement _ Revenue $ 1,000 Expense, except depreciation $ 850 Depreciation $ 50 Income before taxes $ 100 Capital charge ($ 500 * 10 %) $ 50 Economic Value Added (EVA) $ 50 Return On Investment (ROI) $ 100/$ 500 : 20 % 6 Structure of the Analysis EVA is conceptually superior to ROI. Nevertheless, it is clear from the surveys that ROI is more widely used in a business rather than EVA. 7 Measuring Assets Employed In deciding what investment base to use to evaluate investment center managers, headquarters asks two questions : 1. What practices will induce business unit managers to use their assets most efficiently and to acquire the proper amount and kind of new assets ?. 2. What practices best measure the performance of the unit as an economic entity ?. 8 Measuring Assets Employed 1. Cash • Many companies use a formula to calculate the cash to be included in the investment base • Some companies omit cash from the investment base. These companies reason that the amount of cash approximates the current liabilities. 9 Measuring Assets Employed 2. Receivables • Business unit managers can influence the level of receivables indirectly, by their ability to generate sales, and directly, by establishing credit terms and approving individual credit accounts. • The usual practice is to include receivables at the book amount, which is the selling price less an allowance for bad debts 10 Measuring Assets Employed 3. Inventories • Inventories ordinarily are treated in a manner similar to receivables – that is, they are often recorded at end of period amounts even though intra period averages would be preferable conceptually 11 Measuring Assets Employed 4. Working Capital in General • At one extreme, companies include all current assets in the investments base with no offset for any current liabilities. • At the other extreme, all current liabilities may be deducted from current assets. 12 Measuring Assets Employed 5. Property, Plant and Equipment • If depreciable assets are included in the investment base at net book value, business unit profitability is misstated. • The fluctuation in EVA and ROI from year to year can be avoided by including depreciable assets in the investment base at gross book value rather than at net book value. • If depreciation is determined by the annuity, rather than the straight line method, the business unit profitability calculation will show the correct EVA and ROI. 13 Measuring Assets Employed 6. Leased Assets • The business unit managers are induce to lease, rather than own, assets whenever the interest charge that is built into the rental cost is less than the capital charge that is applied to the business unit’s investment base, because it would increase EVA. 14 EVA vs ROI Most companies employing investment centers evaluate business units on the basis of ROI rather than EVA. There are three apparent benefits on ROI measure : • • • It is a comprehensive measure in that anything that affects financial statements is reflected in this ratio ROI is simple to calculate, easy to understand, and meaningful in absolute sense ROI is a common denominator that may be applied to any organizational unit responsible for profitability, regardless of size or type of business. 15 EVA vs ROI The EVA approach has some inherent advantages. There are four compelling reasons to use EVA over ROI : • • • • With EVA all business units have the same profit objective for comparable investments. Decisions that increase a center’s ROI may decrease its overall profits. If an investment center’s performance is measured by EVA, investments that produce a profit in excess of the cost of capital will increase EVA and therefore be economically attractive to the manager. Different interest rate may be used for different types of assets. In contrast to ROI, EVA has a stronger positive correlation with changes in a company’s market value. 16 EVA vs ROI EVA = Net profit – Capital charge Where (1) : Capital charge = Cost of capital x Capital employed Another way to calculate EVA (2): EVA = Capital employed (ROI – Cost of capital) 17 EVA vs ROI The following actions can increase EVA : • Increase in ROI through business process reengineering and productivity gains, without increasing the asset base. • Divestment of assets, products and/or businesses whose ROI is less than the cost of capital • Aggressive new investments in assets, products, and/or businesses whose ROI exceeds the cost of capital • Increase in sales, profit margins or capital efficiency or decrease in in cost of capital percentage without affecting the other variables in equation (2) 18 Introduction This discussion focuses on financial performance measures 19 Calculating Variances • Most companies make a monthly analysis of the differences between actual and budgeted revenues and expenses for each business unit and for the whole organization. • A more thorough analysis identifies the causes of the variances and the organization unit responsible. • Effective systems identify variances down to the lowest level of management • Therefore, it is possible to identify each variance with with the individual manager who is responsible for it. 20 Calculating Variances The analytical framework use to conduct variance analysis incorporates the following ideas : • Identify the key causal factors that affects profits • Break down the overall profit variances by these key causal factors • Focus on the profit impact of variation in each causal factors 21 Calculating Variances • Try to calculate the specific, separable impact of each causal factor by varying only that factor while holding all other factors constant • Add complexity sequentially, one layer at a time, beginning at a very basic “commonsense” level (“peel the onion”). • Stop the process when the added complexity at a newly created level is not justified by added useful insights into the casual factors underlying the overall profit variance 22 Calculating Variances Revenue Variances • The calculation is made for each product line, and the product line results are then aggregated to calculate the total variance. 23 Variations in Practice Time Period of the Comparison • Some companies use performance for the year to date as the basis for comparison. For period ended June 30, they would use budgeted and actual amounts for the six months ending on June, rather than the amounts for June. • A comparison for the year to date is not as much influenced by temporary aberrations that may be peculiar to the current month. 24 Variations in Practice Focus on Gross Margin • Gross margin = Selling prices – Manufacturing cost 25 Variations in Practice Focus on Gross Margin • Evaluation The formal standards used in the evaluation of reports on actual activities are : 1. Predetermined standards If carefully prepared and coordinated, these are excellent standards 2. Historical standards These are records of past actual performance. Results for the current month may be compared with the results for last month, or with results for the same month a year ago. 3. External standards 26 Variations in Practice Full Cost Systems • If the company has a full cost system, both variable and fixed overhead costs are included in the inventory at the standard cost per unit • Variance = Budgeted fixed production cost at the actual volume – Standard fixed production costs at that volume • The important point is that production variances should be associated with production volume, not sales volume 27 Variations in Practice Amount of Detail We analyzed revenue variances at several levels : 1. In total 2. By volume, mix and price 3. By analyzing the volume and mix variance 4. By industry volume and market share At each of these levels, we analyzed the variances by individual products. The process of going from one level to another is often referred to as “peeling the onion “. 28 Variations in Practice Engineered and Discretionary Costs • A favorable variance in engineered costs is usually an indication of good performance, that is the lower the cost, the better the performance • By contrast, the performance of a discretionary expense center is usually judged to be satisfactory if actual expenses are about equal to the budgeted amount, neither higher or lower. 29 Limitations of Variance Analysis 1. Although it identifies where a variance occurs, it does not tell why the variance occurred or what is being done about it. 2. To decide whether a variance is significant 3. The performance reports become more highly aggregated, offsetting variances might mislead the reader. Finally, the reports show only what was happened. They do not show the future effects of actions that manager has taken. 30 Limitations of Variance Analysis Management Action • There is one cardinal principle in analyzing formal financial reports. The monthly profit report should contain no major surprises. • One of the most important benefits of formal reporting is that is provides the desirable pressure on the subordinate managers to take corrective actions on their own initiative • Profit reports are worthless unless they lead to action Performance Measurement Systems 31 Framework for Designing Performance Measurement Systems What counts, get measured What gets rewarded, really counts STRATEGY What gets done, gets rewarded What gets measured, gets done Performance Measurement Systems Balance Scorecard • The balance scorecard is an example of a performance measurement system. • The four perspective of balance scorecard : 1. Financial (eq. profit margin, ROA, cash flows) 2. Customer (eq. market share, customer satisfaction index) 3. Internal business (eq. employee retention, cycle time reduction) 4. Innovation and learning (eq. percentage of sales from new products) 32 Performance Measurement Systems Balance Scorecard In creating the balanced scorecard, executives must choose a mix of measurements that : 1. Accurately reflect the critical factors that will determine the success of the company’s strategy 2. Show the relationships among the individual measures in a cause and effect manner 3. Provide a broad based view of the current status of the company 33 34 Performance Measurement Systems Cause Effect Relationships Among Measures Perspective Measures Innovation and learning perspective Manufacturing skills Internal business perspective First pass yields Order cycle time Customer perspective Customer Satisfaction survey Financial perspective Sales revenue growth 35 Interactive Control • The primary role of management control is to help execute strategies. • The chosen strategy defines the critical success factors which become the local point for the design and operation of control systems. • In a rapidly changing and dynamic environment, creating a learning organization is essential to corporate survival. • The main objective of interactive control is to facilitate the creation of a learning organization Interactive Control Control System as a Strategy Implementation Tool Chosen Strategy Critical success Factors Design and operation of management control system 36 Interactive Control Interactive Control Today’s Management Control System Tomorrow’s Strategy 37 38 Interactive Control Interactive control has the following characteristic : • A subset of the management control information that has a bearing on the strategic uncertainties facing the business becomes the focal point • Senior executives take such information seriously • Managers at all levels of the organization focus attention on the information produced by the system • Superiors, subordinates and peers meet face to face to interpret and discuss the implications of the information for future strategic initiatives • The face to face meetings take the form of debate and challenge of the underlying data, assumption, and appropriate actions. Interactive Control Control System as a Strategy Formation Tool Strategic Uncertainties Use of a subset of management control information interactively New strategies 39 40 Service Organizations in General Management control in service industries is somewhat different from management control in manufacturing companies 41 Service Organizations in General Characteristics : • Absence of inventory buffer • Difficulty in controlling quality • Labor intensive • Multi unit organizations 42 Professional Service Organizations Special Characteristics : a. Goals b. Professionals c. Output and Input Measurement d. Small Size e. Marketing 43 Professional Service Organizations Management Control Systems : a. Pricing b. Profit Centers and Transfer Pricing c. Strategic Planning and Budgeting d. Control of Operations e. Performance Measurement and Appraisal 44 Financial Service Organizations Financial service organizations include commercial bank and thrift institutions, insurance companies and securities firms 45 Financial Service Organizations Special Characteristics : While the general principles and concepts of management control systems apply, they need to be adapted to the following special characteristics of the financial services industry : a. b. c. d. Monetary Assets Time Period for Transactions Risk and Reward Technology 46 Nonprofit Organizations A nonprofit organization, as defined in law, is an organization that cannot distribute assets or income to, or for the benefit of, its members, officers, or directors. This definition does not prohibit an organization from earnings a profit, it prohibits only the distribution of profits. 47 Corporate Strategy Implications for Organization Structure • Different corporate strategies imply different organization structures and, in turn, different controls • The organization structure implications of different corporate strategies are given on the next slide • At the “single industry” end, the company tends to be functionally organized • “Unrelated diversified” company (conglomerate) is organized into relatively autonomous business units 48 Corporate Strategy Different Corporate Strategies : Organizational Structure Implications Single Industry Related Diversified Unrelated Diversified Organizational structure Functional Business units Holding company Industry familiarity of corporate management High Functional background Relevant Of corporate management Operating Decision making authority More centralized Low Mainly Finance More decentralized Size of corporate staff High Low Reliance on internal promotions High Low Use of lateral transfers High Low Corporate culture Strong Weak 49 Corporate Strategy Implications for Management Control Different corporate strategies imply the following differences in the context in which control systems need to be designed : • Corporate level managers may not have significant knowledge of, or experience in the activities of the company’s various business units. • Single industry and related diversified firms possess corporatewide core competencies on which the strategies of most of the business units are based. 50 Corporate Strategy Different Corporate Strategies : Management Control Implications Single Industry Related Diversified Unrelated Diversified Strategic Planning Vertical cum Vertical only horizontal Budgeting, Control Low High Over Budget Formulation Importance Attached Low High to Meeting the Budget Transfer Pricing High Sourcing Flexibility Constrained Incentive Compensation Bonus Criteria Financial/non financial criteria Bonus Determination Approach Bonus Basis Primarily subjective Based both on business & corporate performances Low Arm’s length market pricing Primarily financial criteria Primarily formula based Based on business unit performance 51 Business Unit Strategy Business Unit Mission : The BCG Model Cash source High Low Hold Build “ Star “ “ Question mark “ Harvest Divest “ Cash cow “ “ Dog “ High Market growth rate Low High Relative market share High Cash use Low Low 52 Business Unit Strategy The BCG Model • Build This mission implies an objective of increased market share, even at the expense of short term earnings and cash flow • Hold This strategic mission is geared to the protection of the business unit’s market share and competitive position • Harvest This mission has the objective of maximizing short term earnings and cash flow • Divest This mission indicates a decision to withdraw from the business either through a process of slow liquidation or outright sale 53 Corporate Strategy Different Strategic Mission : Implications for Incentive Compensation Percent Compensation as Bonus Bonus Criteria Build Relatively High More emphasis on non financial criteria Bonus Determination Approach More subjective Frequency of Bonus Payment Less frequent Hold Harvest Relatively Low More emphasis on financial criteria More formula based More frequent 54 Top Management Style The management control function in an organization is influenced by the style of senior management