‘The Price You Pay’: The Impact of State Funded... Residential Property Values in England

advertisement

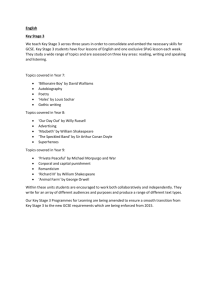

‘The Price You Pay’: The Impact of State Funded Secondary School Performance on Residential Property Values in England1 John Glen and Joseph Nellis School of Management, Cranfield University. Abstract: This paper examines the relationship between state funded secondary school performance and local residential property values in seven major English cities. When choosing which secondary school they wish their sibling(s) to attend, parents will be aware of the school’s performance in Key Stage 3, GCSE and A- level examinations. We suggest that GCSE examination results will be the measure of school performance that parental choice will be most closely correlated with. Therefore, secondary schools with good GCSE examination results will be ‘oversubscribed’ in that more students will wish to attend these schools than there are places available. Schools will then have to develop mechanisms for rationing the available places; central to rationing strategies in English schools at the moment is geographical proximity to the school of choice. Parents will thus have a strong incentive to purchase houses in the ‘catchment’ area of high performing schools. Our results suggest that this is the case, with high performing schools stimulating a price premium in local residential property markets of between 1-3% for each additional 10% point improvement in the pass rate in GCSE examinations. 1. Introduction Gibbons and Machin (2008) state that anecdotal evidence, media reports, and even dinner party discussions lend credence to the claim that good schools raise local house prices. The capitalisation of school performance into local property values has been the subject of a number of studies in the US and latterly in the UK. Typically, these studies have been crosssectional and have found a positive relationship between a chosen measure of standardised student test scores performance and local residential property values. Taylor (2005) provides a review of the literature on the capitalisation of school performance into property values, citing studies by Cheshire and Shepherd (2004); Weimer and Wolkoff (2001); Hayes and Taylor (1997); Bogart and Cromwell (1997); Haurin and Brasington (1996); Leach and Campos (2003). The 1988 Education Reform Act introduced the national curriculum into English schools and legislated for the provision of testing of schoolchildren at ages 7, 11 and 14 at the end of Key Stages 1, 2 and 3 respectively. Students would then typically complete GCSE (General Certificate of Secondary Education) examinations at the end of Key Stage 4, aged 16. The 1 The authors are grateful to HSoS plc for providing the database used in this study and for research funding support. 1 Act placed a focus on measuring the outputs of state funded education in England at the end of all four Key Stages. This reflected a general concern on the part of those legislating to provide outputs from the state education system which would equip the UK labour force with the skills, knowledge and competencies necessary to drive economic growth in an increasingly competitive global economy (Elkins and Elliott, 2004). The publication of school performance data in relation to public examinations at GCSE level has led to predictable outcomes according to Elkins and Elliott (2004) namely that those schools which perform best are oversubscribed while underperforming schools fail to achieve their target intake of pupils. The argument in favour of publishing examination performance data is that it will encourage underperforming schools to do better and high performing schools to maintain or further improve their academic standards. The introduction of testing of school pupils at ages 7, 11 and 14, as well as public examinations at GCSE and A-level2 has provided a wealth of information on the performance of schoolchildren at various stages of their school lives. In addition, the formal inspection of schools by OFSTED (Office for Standards in Education) has provided additional detailed information on the performance of children, teaching staff and management in state funded schools. This has given parents a plethora of data upon which to assess the performance of schools. As a result, teachers are now deemed to be more accountable to head teachers, governors, parents and central government for their performance. This paper is concerned with the impact of state funded secondary school performance on house prices in seven3 major cities/urban conurbations in England. The significance of this study stems from the fact that housing and house prices are critically important to the local and national economies. Housing is the most important asset purchased by most UK households and a large proportion of personal sector wealth is tied up in residential property. Furthermore, any capitalisation of school performance into local property prices will have implications concerning the ability of low income families to access high performing, state funded schools. 2 A- Level examinations are typically taken by students after a further two years of post-compulsory education, typically age 18. 3 Greater London, Birmingham, Bristol, Leeds, Greater Manchester, Liverpool and Newcastle. 2 The structure of the paper is as follows: the next section briefly summarises the details of the schools’ performance regime which has existed in England since 1988 and the nature of capitalisation of school performance into residential property prices. Section 3 describes the dataset employed in this study and the main procedures adopted to render it suitable for statistical analysis. Section 4 provides an abridged outline of the modelling framework adopted in this paper (a more detailed description is available from the authors on request), while Section 5 discusses the main empirical results. Finally, Section 6 draws together the main conclusions and sets out the key findings. 2. The Capitalisation of Secondary School Performance in England into residential property prices The value which parents place on good school performance would be easy to assess if education services were sold in a free and competitive market. However, since there is no observable market price for state-provided schooling, an indirect method must be found to place a monetary value on the services provided by state-funded schools. The hypothesis we are proposing in this paper is that, all other things being equal, a higher level of school performance will be capitalised into higher property values. In other words, parents wishing to gain access to schools with a superior academic performance will bid up the price of properties which are most geographically proximate to a high performing school. They will do this in order to ensure that their children are in the catchment area of the high performing/oversubscribed school and are therefore eligible for entry into that school. This theoretical argument follows Starrett (1981), Wildasin (1987) and Hoyt (1999) who all argue that where there is a relatively inelastic supply of housing, land and house prices will rise in those areas which provide relatively more attractive amenities, to the point where the additional price paid reflects the perceived additional value of high-quality local amenities. The capitalisation of local amenities and neighbourhood effects into residential property values has been widely researched in the US. Brasington (2002) provides a thorough overview of the capitalisation debate, the key point being that capitalisation of any differential in local amenity is contingent upon a supply of housing which is inelastic with respect to price. In extremis where this is not the case, any differential in local amenity which produces an increase in housing demand would be met instantaneously by an increase 3 in housing supply and, therefore, there would be no measurable impact on residential house prices. Furthermore, there could be differing levels of capitalisation across a given urban space due to different elasticises of supply of housing within it. For example, we may expect the elasticity of supply of housing to be more responsive to demand on the edge of urban areas where more land for development may be available and planning restrictions may be less restrictive. However, recent inner-city developments in some of the major conurbations within England may have produced a more responsive supply of housing in those areas. The recent debate about the lack of supply of housing in the UK and the response emanating from the Office of the Deputy Prime Minister would suggest that it is reasonable to assume that the elasticity of supply of housing in the UK is such that differences in local amenities are likely to be capitalised into local property prices. Although, in so far as there has been a more elastic response from housing supply, we might expect the impact of school performance on property prices to have been dampened. Bartik (1988) provides an informative taxonomy of the impact of local amenities on house prices, location choices and housing supply. Firstly, he argues that an increase in the supply of high amenity locations would reduce the house price premium which people would be willing to pay for the high amenity. This is interesting in the context of school performance because the introduction and publication of school performance measures has resulted in an increase in the average performance of schools. On the basis of Bartik’s assertion we might expect this to reduce the premium paid for good school performance, as the average level of school performance across all schools has increased. Table 1 below shows that there has been a step increase in the average performance of schools in England as a whole over the period 1988 to date. As such, this means that there are more schools offering enhanced performance in terms of student examination results at GCSE level. In a competitive market this effectively means that there is a greater supply of good schools, as measured by GCSE performance of students. A greater supply of good schools should lead to a reduction in the “price” which parents have to pay in order for their siblings to gain entry to a good school. 4 Table 1: Percentage of students achieving 5 or more A*-C GCSE pass grades in English Schools.4 1988/89 1989/90 1990/91 1991/92 1992/93 1993/94 1994/95 1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 Boys 29.8 30.8 33.3 34.1 36.8 39.1 39.0 39.9 40.5 41.3 42.8 44.0 44.8 46.4 47.9 48.8 51.4 53.8 56.4 Girls 35.8 38.4 40.3 42.7 45.8 47.8 48.1 49.4 50.0 51.5 53.4 54.6 55.4 57.0 58.2 58.8 61.4 63.5 65.5 Total 32.8 34.5 36.8 38.3 41.2 43.3 43.5 44.5 45.1 46.3 47.9 49.2 50.0 51.6 52.9 53.7 56.3 58.5 60.8 Source: Department for Education and Science. However, it could well be the case that parents are not only assessing the absolute level of school performance but also its relative level. If this is the case then it is likely that parents will be willing to “pay” not only for high performing schools but for schools which are high performing and out performing the other providers in any particular geographical location. This introduces the concept of school performance league tables. These tables are a creation of the media in the UK and it should be noted that the UK Department for Education and Science does not produce official league tables. Second, Bartik (1988) suggests that where amenity levels are low this will tend to attract low income households. Locations that improve more than the average will tend to attract high income households. A number of studies in the US have shown that school performance is positively correlated with the composition of the student body. Crone (1998) argues that empirical evidence is available to show that academic achievement can be improved by the peer group effect. 4 The GCSE A* grade was introduced in 1994 to recognise exceptional performance at the top end of the scale. 5 Third, any increase in the quantity of local amenities will decrease demand for housing characteristics that are amenity substitutes. Conversely, there will be an increase in demand for housing characteristics that are amenity compliments. This last point may mean that improved performance of a school which is located in a low income location may attract higher income households into that area with the result that not only is the performance of the local school improved but a process of gentrification may occur in the local housing stock. Finally, Bartik (1988) focuses upon the inter-temporal nature of the capitalisation of improved local amenity. He identifies a three stage process. In the first instance there is an improvement in local amenity. This is followed by a second stage whereby the improvement in local amenity is recognized by those agents who are active in the local property market. The third stage involves these agents reflecting improvements in local amenity in their willingness to pay a premium for properties that embody the improved local amenity. This process is important in the context of this study. Schools are incentivised to improve the academic performance of their students in public examinations; this improved performance is then reported in official statistics released by the Department for Education and Science and, finally, house buyers can be expected to react to the improved school performance in their willingness to pay a premium for properties which are proximate to the high performing schools. The publicity in both local and national media that has surrounded the performance of state schools has ensured that parental awareness of the performance of state secondary schools has been greatly enhanced. It would, therefore, seem a reasonable expectation, a priori, that parents have the requisite knowledge available to them in order to assess both the absolute and relative performance of individual schools. The focus of this paper is on the capitalisation of state funded secondary school performance in England into residential property prices. The single measure of school performance employed in the analysis is the percentage of students, in any one academic year, gaining five or more GCSE passes at grades A*-C. In doing so we are guided by Lambert and Lines (2000), who state that: 6 ‘ …..GCSEs are now seen as a way, by aggregation, of certifying the whole school.’5 Downes and Zabel (2002) in their study of the impact of school characteristics on house prices in Chicago found that homeowners paid attention to school outputs, i.e. test scores, and not inputs in the form of per pupil expenditures by schooling authorities. Brasington and Haurin (2006) examined the extent to which homeowners valued traditional measures of school performance (absolute test scores), of which GCSE examination pass rates are an example. These traditional measures contrast with the relatively new value-added measures of school quality, which attempt to measure the capability of students as they enter the secondary schooling process and compare this with the test scores on exit, the difference between the two being the value added. With this approach it is the measure of value added which acts as a measure of school quality rather than the absolute performance at the end of the process. Whilst educationalists may argue that the value-added approach represents a much more effective evaluation of school performance, Brasington and Haurin (2006) report that homeowners value average test scores and levels of expenditure on education above any measure of student value-added when assessing local school performance. They argue therefore that it is average test scores which are capitalised into local property prices rather than value-added measures of school performance. Perhaps the most telling manifestation of the impact of school performance on property prices is to be found on the UK internet property search site “Rightmove”. One of the services provided by Rightmove to prospective purchasers of property is the capability to click through from any property to information on the nearest state funded secondary schools. The information includes straight-line distance to those schools, examination performance of those schools, as measured by GCSE pass rates and the most recent OFSTED report. 5 The primacy of GCSE results as an indicator of state funded, secondary school performance is most probably due to the disproportionate amount of media coverage which GCSE results are given, at both the local and national level, compared to Key Stages, 1, 2 and 3 and A-level results. 7 3. Description of the Dataset This section describes the data employed in this study, including the data cleansing procedures adopted. The results reported in this paper are based on an exceptionally large dataset developed by HBoS (the largest residential mortgage lender in the UK). The dataset covers all the house purchase transactions on which the HBoS plc group has provided mortgage loans between 1983 and 2007 (totalling more than 5 million transactions) although, for the purpose of this paper, we have only selected data for the period from 2001 to 2007. This period is chosen as a result of: • a desire to present estimations of capitalisation which are contemporary rather than historical. • following Bartik (1988), a desire to allow for a period of time to elapse whereby house purchasers were aware of differing school performances and could reflect this in their willingness to pay for new properties. In relation to the second point, we feel that the availability of data electronically on the Department for Education and Science website has been an important conduit via which ‘reliable’ information has been made available to parents and house purchasers. Our analysis examines the impact of school performance on residential property values in seven selected major cities in England, namely Greater London, Birmingham, Bristol, Leeds, Greater Manchester, Liverpool and Newcastle. The data on school performance measure the performance of individual schools in terms of the percentage of students attaining five passes at GCSE grades A* to C. This percentage score was entered as a continuous variable in our preferred hedonic house price regression model. The data on school performance were obtained from The Department for Education and Science website. The website also provided us with the required locational data in terms of the postcode of each school. In order to allow for the capitalisation of school performance into property prices we have lagged the school performance data one period. Thus, we have regressed 2001 school performance results on 2002 property price values. The rationale for this approach is that it is historical school performance data that will impact current offer prices for residential 8 properties. In addition, we are suggesting that it is the most recent historical school performance data that will have the most immediate impact on the price offered by house purchasers. The data on house price characteristics is provided from the HBoS mortgage data set. The richness of this dataset allows us to analyse the impact of school performance on residential property values to an extent which we feel has not been possible for researchers previously in the UK. The database includes purchase price, recorded at the mortgage approval stage, as well as a detailed breakdown of the information on the following house characteristics: • property type, i.e. whether the house is detached, semi-detached, terraced, bungalow, flat or maisonette; • number of habitable rooms; • floor space area; • number of bathrooms; • number of toilets; • availability of central heating; • number of garages and garage spaces; • garden; • age of property; Over and above these physical house characteristics, the database also includes information on the location of each property in terms of postcodes. In order to locate each property and each school in our dataset, we employed Royal Mail Post Office postcodes. We then utilised the Royal Mail's POSTZON software to provide us with an Ordinance Survey (OS) grid map reference. This grid reference effectively places each property on the bottom left-hand corner of a 100 metre by 100 metre grid. To each of the Eastings and Northings of the OS grid reference a five was added, which effectively located each of our properties at the centre of the 100 metre by 100 metre grid; i.e., at the expected location of any property within a 100 metre grid. We then developed a simple computer macro which applied Pythagoras's theorem and calculated the straight line distance between each property in the dataset and the nearest school. 9 Rosenthal (2003) reports that POSTZON locates each school and house within a maximum of 70 metres of its true location and concludes that for the purpose of locating the nearest school to a given residential property, the use of the POSTZON database is unlikely to result in a serious misallocation of houses to the nearest school. Gibbons and Machin (2008) suggest that a lack of clearly defined catchment areas for state schools introduces an amount of ambiguity in the link between residential property locations and accessibility to school. Rosenthal (2003) also comments that a lack of national information on school catchment areas makes it difficult to test the assumption that the geographically closest state secondary school is the relevant school, in terms of catchment area, for any given property. Using data from a particular English city (Stoke-on-Trent) Rosenthal tested the extent to which the closest school to a given property, as calculated using the POSTZON dataset, coincided with the catchment area within which a given property was placed. Reassuringly, in 83% of all observations the nearest school coincided with the catchment area zoning of a particular property. The HBoS dataset includes a special locational classification regime used in the UK, known as ACORN, A Classification of Residential Neighbourhoods 6. This regime allocates ratings according to geo-demographic information, allowing for the categorisation of the location of each property at two levels: at the micro level (immediate residential neighbourhood) and at the macro level (wider surrounding area). In our study the inclusion of ACORN codes, in so far as they allow for the influence of the socioeconomic characteristics of a neighbourhood population, should pick up some of the socalled peer group affects; i.e., our study allows for the socio-economic impacts on school performance noted by Crone (1998). Based on postcode information, the location of each property is classified into an ACORN group. The HBoS dataset employs eight main ACORN groups, as shown in Table 2 below. 6 For the full details of the ACORN classification system, based on postcodes, see CACI (2006). 10 Table 2: Description of Main ACORN Groups ACORN Group Main Characteristics of Group A Areas where residents are wealthy investors B Prospering families C Areas of traditional money D Young urbanites EFG Areas of middle aged families (comfortable), contented pensioners and families and individuals looking to settle down (Middle Aged Comfort (E), Contented Pensioners (F) and Settling down (G)) H Moderate living IK Meagre means and impoverished pensioners J Inner city existence (low income singles and couples, with little financial activity; multi-ethnic young singles renting flats; high rise poverty, relying on welfare; poor young, multi-ethnic who are financially inactive) Data Cleansing Prior to modelling the relationship between school performance and local property prices, the dataset was ‘cleansed’. The purpose of this cleansing is to take account of coding errors in the information and to eliminate properties which are atypical or can be described as outliers. Therefore, the cleansed dataset only includes those properties which meet the following selection criteria: • purchase price between £ 30,000 and £6 million; • number of bedrooms, bathrooms, toilets, living rooms, garages or garage spaces must not exceed nine in each case; • number of habitable rooms must be less than 20; • size property must be less than 500 square metres; • mortgage advance must be less than 10 times either the main or the additional applicant’s income. 11 Certain transactions are regarded as atypical and have therefore been excluded from the analysis. These include: • houses sold at ‘ nonmarket’ prices, such as council houses sold at a discounted prices to their tenants and other sales to sitting tenants in the private sector; • houses sold without vacant possession or which are unusual in being mixed freehold and leasehold; • transactions for which there was an error in recording or coding of the data at source; In addition to these standard cleansing procedures we added a further condition: • a house is excluded if the nearest school is further than 10 km away. The purpose of this last condition is to provide an outer boundary to the urban conurbations which we have studied. 4. Modelling Framework In this study we employ the hedonic approach to price measurement in order to determine a monetary valuation which parents place on the performance of schools. The hedonic pricing method makes use of price differentials in properties with different attributes to determine the value of those attributes. These attributes include both physical characteristics of a particular property such as number of bedrooms, floor area (square metres) and number of bathrooms, as well as locational variables which in this study include the ‘quality’ of the most proximate state school. For the purpose of this analysis we assume that the housing stock in the major urban conurbations that we are studying is not sufficiently elastic in its supply so as to negate any capitalisation of difference in housing amenity resulting from school performance. The hedonic approach assumes that when consumers purchase houses they are buying physical house characteristics, such as floor area, the existence or otherwise of central heating and a number of bedrooms, as well as the neighbourhood and environmental characteristics which the houses location offers to a potential purchaser. By regressing the physical, neighbourhood and environmental characteristics of a set of properties against the purchase price as the dependent variable, it is possible to calculate implicit prices for each of the characteristics. 12 Hedonic pricing methods have been employed to calculate the value of a wide range of both “welcome” and “unwelcome” local amenities. These include aircraft noise (Levesque, 1994), air quality (Chay and Greenstone, 1998), hazardous waste sites (McCluskey and Rausser, 2000), woodland (Garrod and Willis, 1992) and proximity to churches (Do et al., 1994; Carroll et al., 1996). A number of studies, including those by Blomquist et al., (1988) and Thayer et al., (1992), have attempted to measure more than one environmental “good” using the same hedonic model. A key criticism of the hedonic pricing model approach concerns the treatment of omitted variables, i.e., when a specific local amenity is identified and included in the hedonic estimation it may be the case that the included variable is picking up the influence of another excluded local variable, where it may not have been possible to include a reliable indicator of the impact of the excluded variable. If this is the case, OLS estimation techniques will provide biased parameter estimates. It may be the case, as Gibbons and Machin (2008) argue, that it is difficult to measure the supply of an amenity that is accessible from a given location. In this study, we would argue that locational data allows us to identify the closest school and therefore, in so far as it is practicably possible, we feel we have identified access to the ‘focus’ amenity of school quality. As with many previous studies we employ examination performance as the measure of school quality. However, it is the case that examination performance may reflect the socioeconomic background of the students who are in the school catchment area. Clapp et al., (2007) found evidence in Connecticut that students’ test scores have a positive impact on property values. Furthermore, they found that the ethnic composition of a neighbourhood also impacted property values. For example, the proportion of Hispanics in a specific neighbourhood appeared to have a negative impact on property values, although there was evidence that the impact declines over time. Hilber and Mayer (2004) argue that because of the capitalisation of school performance into local property prices, those residents who do not have children have an incentive to see an improvement in school performance. Furthermore, they argue that such residents have an incentive to see increased expenditure on public schooling. Hilber and Mayer (2004) also 13 found that the capitalisation of school performance was strongest in those areas where the supply of housing was inelastic. Choice of functional form Box and Cox (1964) have developed a statistical procedure based on likelihood ratio tests to identify the functional form providing the best fit. This procedure is used to identify the adequate transformation of the dependent variable, as well as the appropriate transformations of the explanatory variables considered. However, one limitation of this test is that it cannot assess any of the qualitative characteristics, due to the fact that they are represented by dummy variables. As a result, the incorporation of qualitative variables to which price may be related non-linearly cannot be tested. The Box-Cox procedure is described in Spitzer (1982) and results reported in Fleming and Nellis (1985) have indicated that the regression results are substantially more sensitive to transformations of the dependent variable than of the explanatory variables. According to the Box-Cox test procedure, a logarithmic transformation of the dependent variable (in this case house price) is the most appropriate functional form for the hedonic regression model. In many instances this preference is related to the ease with which parameter estimates can be interpreted. Furthermore, as Cropper et al., (1988) suggest, the lack of theoretical guidance on functional form for hedonic price functions has led most researchers to adopt goodness-offit criteria. Indeed, Garrod and Willis (1992) favour the semi-log specification on this basis while Laasko (1992) points to the ease of interpretation. Consequentially, a semi log model is used in the results reported below. Optimal combination of explanatory variables Analyses were also carried out to determine the optimal combinations and appropriate transformations of the explanatory variables in the regression equations, based on the locational and physical house characteristics. In particular, the results showed that floor area consistently outperforms the number of habitable rooms in explaining house prices and thus the former variable is incorporated in the final regression model. Multicollinearity With such a rich data set it is desirable to use as many variables as possible to define the house price equation. In practice, some explanatory variables may be correlated with each 14 other – in other words, the problem of multicollinearity may exist. Garrod and Willis (1992) indicate that multicollinearity is a common problem in hedonic price functions and one which is often conveniently ignored. However, as multicollinearity is such a significant issue in hedonic price equations we also undertook a number of other checks to test for it. As outlined in Belsey et al. (1980), eigenvalues (λ) can be employed to generate conditional indices and the conditional number (K). Where there is no multicollinearity present the eigenvalues for each parameter estimate would be equal to 1. As eigenvalues move away from 1 this indicates the existence of multicollinearity. The conditional indices matrix can be calculated by dividing eigenvalues λi/λj for all parameter estimates in the preferred equation. As a rule of thumb, values between 100 and 1000 in the conditional indices matrix would suggest moderate multicollinearity while values over 1000 would suggest that the problem of multicollinearity is a serious issue. Furthermore, it is possible to calculate a conditional number (K) by dividing the maximum eigenvalues attached to a parameter in our preferred equation by the minimum eigenvalues attached to a parameter in the equation, and taking the square root of the resulting value; i.e.: K = √(λmax/λmin) Again, a general rule of thumb is that if K lies between 10 and 30 there is moderate to strong multicollinearity and if it exceeds 30 there is severe multicollinearity. Finally, as the preferred regression equation covered more than one time period we have indexed the equation using the ‘time dummy’ method (Fleming and Nellis, 1985). Therefore, with time incorporated as a dummy variable, percentage changes in price can be observed directly as the coefficient on the time variable, our base year in all cases being 2001. 5. Empirical Results Our preferred equation emerged from a process of experimentation with functional form and combinations of explanatory variables. Ultimately our choice of preferred equation focused upon a combination of ‘goodness of fit’, statistical significance of explanatory variables and minimisation of multicollinearity. In order to facilitate comparison across different geographical spaces we have applied the same functional form (i.e. semi-log) to all of the equations in our analysis. Furthermore, our preferred equation includes the same set of 15 explanatory variables in all instances. The robustness and consistency of the model in part reflects the enormous amount of work which has been done by HBoS, as part of their house price index analysis, over a large number of years7. The performance of what Graves et al. (1988) term ‘focus’ variables – in this paper, the school performance variables - is of primary importance. We experimented with dummy variables including those which separated the dataset into discrete deciles and excluded the deciles which included the national average and local average school performance; we also experimented with excluding lower deciles and higher deciles. Finally, we included dummies to pick up the effect of better than and worse than performances with respect to national and local averages. In all of these cases the dummy variables failed to work as effectively as the continuous specification of the school performance variable that we ultimately included in our preferred equation. The final regression model uses the natural log of house price as the dependent variable (ln P) and the following independent variables: dummy variables to capture the impact of house type (detached, semi-detached, terraced, flat and bungalow); the existence of a garden; none or partial central heating and the age of the property (split into four distinct classifications properties built between 1919-45, 1945-60, post-1960 and new build). A set of ACORN ratings dummy variables were included to allow for variability in neighbourhood characteristics while annual time dummy variables were included to allow for the influence of inflationary effects over the period 2001-2007 not associated with the physical, neighbourhood or environmental characteristics of the properties in the dataset. A dummy variable was incorporated to link each property with the nearest secondary school. Continuous measures of numbers of bathrooms, toilets, garages and garage spaces and floorspace (measured in square metres) were also included in the final equation. As noted earlier, the data set allowed us to experiment with specifications which included the number of habitable rooms but this specification was rejected in favour of a continuous floorspace variable on the basis of goodness-of-fit and the overall performance of other variables in our preferred equation. 7 We are grateful for the guidance and advice which were received from the HBoS economics team in this respect. 16 Therefore, the model provides an estimate of the influence of property characteristics with reference to a ‘standard’ house (Forrest et al. 1996). In this study our standard property in each city was determined on the basis of identifying the modal characteristics in each of the seven cities. Thus in all cities the standard house had full central heating and no garden while the excluded house types, house ages and ACORN types are reported in Table 3 below. The modal characteristics are excluded from our equation and the coefficients on the included dummy variables can be interpreted as a percentage premium or discount relative to the excluded modal characteristic. Table 3: Excluded house type, house age and ACORN code by city City House type House Age8 ACORN Birmingham Bristol Leeds Liverpool Greater London Greater Manchester Newcastle Semi-detached Terraced Terraced Semi-detached Flat Terraced Semi-detached 1960+ Pre 1919 1960 1960+ Pre 1919 1960+ 1960+ IK EFG IK IK D IK IK The regression analysis are presented in Tables 4a-g below for each of the cities in turn 8 1960+ denotes properties built after 1960 but not new build. 17 Table 4a: Birmingham Variable Coefficient Standard Error T-statistic Constant 10.482 0.007 1398.444** House Type Detached Terraced Bungalow Flat 0.157 -0.114 0.133 -0.200 0.005 0.004 0.012 0.006 30.731** -30.089** 11.459** -31.713** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.116 0.051 0.083 0.035 0.106 0.003 0.004 0.003 0.003 0.002 0.008 0.000 31.813** 18.532** 29.270** 22.201** 14.004** 72.675** Availability of Central Heating None Partial -0.066 -0.055 0.004 0.005 -17.616** -11.718** Age of Property Pre-1919 1919-1945 1945-1960 New 0.070 0.071 0.029 0.097 0.005 0.004 0.005 0.006 15.173** 18.879** 6.248** 16.021** Acorn Classification A B C D EFG H J 0.617 0.433 0.435 0.444 0.284 0.173 -0.035 0.007 0.006 0.008 0.007 0.004 0.004 0.005 83.179** 66.959** 57.806** 60.832** 71.109** 42.342** -6.402** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.234 0.417 0.515 0.580 0.624 0.669 0.006 0.005 0.006 0.005 0.005 0.005 41.514** 76.379** 93.308** 110.609** 119.508** 129.969** School Quality 0.001 0.000 18.133** Sample size Adjusted R² F-Statistic **Significant at the 5% or higher level of significance. 38,456 0.772 4348.164 18 Table 4b: Bristol Variable Coefficient Standard Error T-statistic Constant 10.938 0.011 1031.013** House Type Detached Semi Bungalow Flat 0.190 0.084 0.125 -0.073 0.008 0.006 0.013 0.008 24.540** 15.107** 9.278** -8.813** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.134 0.061 0.089 0.034 -0.038 0.003 0.005 0.004 0.004 0.003 0.009 0.000 27.555** 14.417** 22.016** 13.584** -4.268** 56.701** Availability of Central Heating None Partial -0.014 -0.065 0.007 0.009 -2.098** -7.418** Age of Property 1919-1945 1945-1960 1960+ New -0.048 -0.117 -0.123 -0.103 0.007 0.008 0.006 0.009 -6.862** -14.913** -20.193** -11.172** Acorn Classification A B C D H IK J 0.252 0.116 0.103 0.188 -0.068 -0.224 -0.176 0.010 0.008 0.011 0.007 0.006 0.007 0.014 25.580** 15.137** 9.386** 25.879** -11.032** -34.156** -12.246** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.256 0.346 0.417 0.439 0.534 0.609 0.009 0.008 0.008 0.008 0.007 0.007 29.399** 41.816** 51.046** 56.215** 73.467** 83.455** School Quality 0.003 0.000 24.614** Sample size Adjusted R² F-Statistic **Significant at the 5% or higher level of significance. 13,698 0.774 1561.433 19 Table 4c: Leeds Variable Coefficient Standard Error T-statistic Constant 10.133 0.007 1466.668** House Type Detached Semi Bungalow Flat 0.230 0.102 0.217 0.042 0.005 0.004 0.007 0.006 43.328** 27.111** 30.926** 6.517** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.139 0.071 0.104 0.037 -0.025 0.003 0.004 0.003 0.003 0.001 0.006 0.000 38.986** 23.791** 38.990** 25.507** -4.177** 83.712** Availability of Central Heating None Partial -0.103 -0.074 0.003 0.006 -31.379** -12.351** Age of Property Pre-1919 1919-1945 1945-1960 News -0.005 0.014 -0.025 0.052 0.004 0.004 0.005 0.006 -1.300 3.660** -5.289** 8.580** Acorn Classification A B C D EFG H J 0.612 0.391 0.391 0.505 0.288 0.173 -0.082 0.007 0.006 0.007 0.007 0.004 0.004 0.007 84.666** 68.846** 52.240** 73.340** 77.070** 47.179** -11.656** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.211 0.402 0.571 0.686 0.756 0.824 0.005 0.005 0.005 0.005 0.005 0.005 40.816** 80.616** 112.998** 140.757** 160.369** 174.231** School Quality 0.002 0.000 27.721** Sample size Adjusted R² F-Statistic **Significant at the 5% or higher level of significance. 44,278 0.794 5681.224 20 Table 4d: Liverpool Variable Coefficient Standard Error T-statistic Constant 10.267 0.010 977.921** House Type Detached Terraced Bungalow Flat 0.125 -0.152 0.128 -0.034 0.008 0.006 0.013 0.008 15.994** -26.672** 9.581** -4.066** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.117 0.057 0.102 0.043 -0.056 0.003 0.005 0.004 0.005 0.003 0.007 0.000 21.849** 13.697** 22.469** 16.398** -8.352** 52.314** Availability of Central Heating None Partial -0.065 -0.012 0.006 0.005 -11.774** -2.249** Age of Property Pre-1919 1919-1945 1945-1960 New 0.070 0.130 0.039 0.110 0.007 0.006 0.007 0.008 10.153** 22.866** 5.570** 13.522** Acorn Classification A B C D EFG H J 0.598 0.416 0.470 0.452 0.330 0.224 0.030 0.013 0.010 0.011 0.011 0.006 0.006 0.013 44.689** 41.192** 42.314** 39.993** 56.030** 38.875** 2.257** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.158 0.386 0.625 0.739 0.783 0.814 0.008 0.008 0.008 0.007 0.007 0.007 20.013** 51.218** 80.198** 100.985** 109.475** 112.168** School Quality 0.001 0.000 12.589** Sample size Adjusted R² F-Statistic 19,506 0.772 2200.021 **Significant at the 5% or higher level of significance. 21 Table 4e: Greater London Variable Coefficient Standard Error T-statistic Constant 11.499 0.004 2940.455** House Type Detached Semi Terraced Bungalow 0.223 0.208 0.165 0.267 0.005 0.003 0.002 0.008 45.849** 67.335** 70.117** 34.091** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.254 0.064 0.035 0.012 0.048 0.004 0.002 0.002 0.002 0.001 0.002 0.000 137.899** 40.188** 17.343** 9.728** 22.272** 167.389** Availability of Central Heating None Partial -0.023 -0.029 0.002 0.004 -9.640** -7.933** Age of Property 1919-1945 1945-1960 1960+ New -0.100 -0.183 -0.211 -0.178 0.002 0.003 0.002 0.004 -44.586** -59.782** -96.259** -42.480** Acorn Classification A B C EFG H IK J 0.020 -0.126 -0.227 -0.294 -0.373 -0.483 -0.291 0.005 0.005 0.008 0.002 0.003 0.003 0.002 4.085** -27.624** -29.390** -124.190** -120.579** -138.289** -124.842** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.163 0.245 0.279 0.330 0.420 0.523 0.003 0.004 0.003 0.003 0.003 0.003 47.055** 69.459** 82.525** 107.994** 140.998** 178.558** School Quality 0.001 0.000 24.127** Sample size Adjusted R² F-Statistic **Significant at the 5% or higher level of significance. 167,807 0.699 13003.140 22 Table 4f: Greater Manchester Variable Coefficient Standard Error T-statistic Constant 10.082 0.006 1580.512** House Type Detached Semi Bungalow Flat 0.233 0.133 0.218 0.111 0.005 0.003 0.007 0.006 46.175** 38.038** 30.836** 20.015** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.153 0.054 0.087 0.061 -0.083 0.003 0.003 0.003 0.003 0.001 0.004 0.000 47.627** 20.702** 33.226** 41.786** -20.070** 94.968** Availability of Central Heating None Partial -0.036 -0.062 0.004 0.007 -10.072** -9.517** Age of Property Pre-1919 1919-1945 1945-1960 New 0.102 0.082 0.006 0.110 0.004 0.004 0.005 0.005 26.737** 22.602** 1.408 22.106** Acorn Classification A B C D EFG H J 0.712 0.449 0.437 0.508 0.337 0.191 -0.023 0.007 0.005 0.006 0.006 0.004 0.004 0.007 106.397** 93.784** 67.623** 81.769** 95.624** 52.921** -3.168** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.168 0.332 0.545 0.651 0.708 0.759 0.005 0.005 0.005 0.004 0.004 0.004 34.905** 70.920** 117.642** 147.466** 166.047** 180.704** School Quality 0.002 0.000 21.378** 60,502 Sample size Adjusted R² 0.776 7006.727 F-Statistic **Significant at the 5% or higher level of significance. 23 Table 4g: Newcastle Variable Coefficient Standard Error T-statistic Constant 10.509 0.012 856.103** House Type Detached Terraced Bungalow Flat 0.084 -0.089 0.102 -0.173 0.007 0.005 0.009 0.007 11.668** -16.156** 10.794** -23.150** Number of Bathrooms Number of Toilets Number of Garages Number of Garage Spaces Garden Size (in square metres) 0.144 0.052 0.121 0.035 -0.014 0.003 0.005 0.004 0.004 0.003 0.007 0.000 28.842** 13.255** 30.089** 11.565** -2.056** 55.719** Availability of Central Heating None Partial 0.017 -0.064 0.006 0.010 2.962** -6.671** Age of Property Pre-1919 1919-1945 1945-1960 New 0.114 0.062 0.016 0.093 0.006 0.006 0.006 0.008 17.712** 11.064** 2.555** 11.883** Acorn Classification A B C D EFG H J 0.569 0.348 0.350 0.465 0.270 0.151 0.071 0.012 0.009 0.010 0.009 0.005 0.006 0.011 47.837** 40.009** 33.478** 54.551** 49.393** 25.714** 6.552** Time Yr 2002 Yr 2003 Yr 2004 Yr 2005 Yr 2006 Yr 2007 0.237 0.382 0.527 0.575 0.611 0.663 0.010 0.009 0.009 0.009 0.009 0.009 23.525** 41.649** 58.073** 62.962** 68.039** 73.474** School Quality 0.001 0.000 3.566** 15,206 Sample size 0.729 Adjusted R² 1361.268 F-Statistic **Significant at the 5% or higher level of significance 24 Table 5 below reports the regression coefficient on the school performance variable in each of the seven major English cities that we have studied. The table also includes the adjusted R2 values and number of observations for each estimated equation. Table 5: Coefficient on school performance variable City Coefficient Birmingham Bristol Leeds Liverpool London Greater Manchester Newcastle 0.001 0.003 0.002 0.001 0.001 0.002 0.001 Adjusted R2 0.772 0.774 0.794 0.772 0.699 0.776 0.729 Observations 38,456 13,698 44,278 19,506 167,807 60,502 15,206 The above results suggest that in Birmingham, Liverpool, London and Newcastle, for every 10% point improvement in the average GCSE pass rate (% or more GCSEs at grades A*-C), property prices increase by 1%. This would imply that, all other things being equal, a school which had a pass rate of 80% would give rise to a local property price premium of 4% compared to properties where the local state-funded secondary school had a pass rate of 40%. In order to facilitate comparison across a number of studies, Gibbons and Machin (2008) suggest examination of the premium in local property prices created by a performance which is one standard deviation away from the mean performance in the local schooling area. Table 6 below reports these results for the seven cities/urban conurbations we have considered in this study. The table shows the average standard deviation of results over the period of this study (2001-2007) and the resulting premia based on the school performance coefficients we have calculated as part of this study. The results presented in Table 6 are in line with a range of both UK and international studies surveyed by Gibbons and Machin (2008). The depth and range of our study provides additional weight to the hypothesis that good school performance is capitalised into property prices and the extent of that capitalisation. At the same time, the results reported here suggest that school performance one standard deviation above the local average produces different results in different English cities. 25 For example, in Birmingham an additional one standard deviation of school performance increases residential property prices by 1.7% whereas in Bristol an additional standard deviation of school performance increases property prices by 5.4%. The table presents data on average school performance in all seven cities and the range of performance, indicating that in cities where the average school performance is higher and the range of average school performance scores narrower we might expect the residential price premium to be lower. In other words if there are few high performing schools in a particular city we would expect parents to rush to buy houses in areas which guaranteed access to that high performing school. Table 6: The residential house price premium for a local school with GCSE performance one standard deviation above the local average City Birmingham Bristol Leeds Liverpool London Greater Manchester Newcastle Coefficient 0.001 0.003 0.002 0.001 0.001 0.002 0.001 Average standard deviation of GCSE results House price premium for an additional standard deviation 17.31 18.07 18.33 21.08 18.64 15.96 16.06 +1.7% +5.4% +3.6% +2.1% +1.9% +3.2% +1.6% Table 7 below reports the percentage of students obtaining 5 or more GCSE’s at grades A* to C, in the seven cities studied, over the period 2001 to 2006. Students’ performance in 2007 is not reported in this table as our model suggests that house prices in any one year will be contingent upon the previous years GCSE performance of the nearest state school. A comparison of Table 7 and Table 6 shows that the top four performing cities in terms of secondary school performance, namely Greater London, Liverpool, Birmingham and Newcastle, all have low school performance coefficients of 0.001. The next two cities in terms of school performance, as measured by GCSE pass rates at grades A* to C - Greater Manchester and Leeds - have school performance coefficients of 0.002 and the worst 26 performing city in terms of school performance, Bristol, has the highest school performance coefficient of 0.003. Table 7: Percentage of students gaining five or more GCSE passes at grades A* to C (2001-2006) 2001 2002 2003 2004 2005 2006 Birmingham Mean 36.9 41.3 46.1 48.1 53.9 56.7 Bristol Mean 32.9 32.2 38 36.9 37.5 46.4 Leeds Mean 38 39.6 43.2 45.2 50.3 52.3 Liverpool Mean 36.7 39.5 41.7 45.3 51.6 57.2 G.London Mean 44.6 47.3 50.2 53 54.9 58.1 G.Manchester Mean 41.9 43.7 46 46.4 50.4 53.7 Newcastle Mean 39.8 41.9 41 45.2 59.6 56.1 Our results are essentially stating that in cities where state school performance is poor, the rate at which ‘good’ school performance is capitalised into local residential property values is the greatest. This is entirely in line with our a priori expectations. Therefore, Bristol which has the poorest state school performance of the seven cities in terms of percentage of students passing five or more GCSE’s at grades A* to C is the city in our sample where parents are willing to pay most to purchase a property which is close to a high performing school. 7. Conclusions The following conclusions follow from the results reported here: • The difference in state funded secondary school performance in GCSE examinations is consistently capitalised into residential property prices in all of the seven major 27 English cities/conurbations that we have studied, ie., residential properties which are located proximate to high performing state-funded secondary schools attract a price premium. • The extent of the price premium varies between different cities. In Greater London, Liverpool, Birmingham and Newcastle a 10% point differential in GCSE performance produces a 1% point differential in residential properties located close to the high performing school. In Greater Manchester and Leeds the same differential in school performance produces a 2% point increase in residential properties located close to the high performing school. Finally, in Bristol a 10% point differential in GCSE performance by a specific school produces a 3% point increase in residential properties located close to the high performing school. Note that this implies that in Bristol, a property where the closest school had a pass rate of 80% compared to a property where the closest school had a pass rate of 40% would attract a price premium of 12% points, all other things being equal. • Those properties which attracted the highest price premia for ‘good’ school performance were in cities where the average pass rate in GCSE examinations was the lowest. In other words, in those cities where the supply of good schools was lower, the price premium for a ‘good’ school, in terms of the rate at which school performance was capitalised into local property prices, was higher. • This last point has implications for students’ ability to access high performing schools, in so far as their parents have an inability to pay the price premium required to purchase a house which would guarantee access. The response of the current UK government to the paradox of pupils being denied access to state funded education due to their parents inability to pay a ‘shadow’ price that exists in the local residential property market is to introduce a lottery into the allocation of places at ‘oversubscribed’ schools. We would suggest that this is inappropriate in that it deals with the symptoms of the problem rather than the causes. We would argue that the government should focus on improving school quality as doing so would remove the extent of the price premium that ‘high performing’ schools attract, thereby reducing the extent to which students would be excluded from state funded secondary education because of their parents inability to ‘pay the price’ in local residential property markets. 28 • Finally, it may be the case that the private sector may be willing to fund improvements in state funded secondary schooling, as low performing schools will mean that they may find it difficult to attract workers with siblings of secondary school age to areas where secondary school performance is poor. In such circumstances workers may require wages which allow them to educate their children at private schools or, in extremis they may not move to a particular city. This point is worthy of further investigation. References Bartik, T.J. (1988) Measuring the benefits of amenity improvements in hedonic price models. Land Economics, Vol. 64, pp 172-183. Bogart, W.T. and Cromwell, B.A. (1997) How much is a good school district worth? National Tax Journal, Vol. 50, pp 215-232. Box, G.E.P. and Cox, D.R. (1964) An analysis of transformations. Journal of the Royal Statistical Society, Series B, Vol. 21, pp 1-43. Brasington, D. (2002) Edge versus center: Finding common ground in the capitalisation debate. Journal of Urban Economics, Vol. 52, pp 245-268. Brasington, D. and Haurin, D.R. (2006) Educational outcomes and house values: A test of the value-added approach. Journal of Regional Science, Vol. 46, No. 2, pp 245-268. CACI, (2006) The Acorn Users Guide, London Carroll, T.M., Clauretie, T.M. and Jensen, J. (1996) Living next to godliness: Residential property values and churches. Journal of Real Estate Finance and Economics, Vol.12, pp 319-330. Chay, K.Y. and Greenstone, M. (1998) Does air quality matter? Evidence from the housing market. NBER Working Paper 6826, December. 29 Cheshire, P. and Shepherd, S. (2004) Capitalising the value of free schools: the impact of supply characteristics and uncertainty. Economic Journal, Vol.114, pp 397-424. Clapp, J., Nanda, A. and Ross, S.L. (2007) Which school attributes matter? The influence of school district performance and demographic composition on property values. Journal of Urban Economics, Vol. 63, pp 451-466. Crone, T.M. (1998) House prices in the quality of public schools: what are we buying? Business Review Federal Reserve Bank of Philadelphia, (September/October), pp 3-14. Cropper, M. L., Deck, Leland B. and McConnell, Kenneth, E. (1988) On the Choice of Functional Form for Hedonic Price Functions. Review of Economics and Statistics, Vol. 70, No. 4, pp 668-675. Do, A.Q., Wilber, R.W. and Short, J.L. (1994) An empirical examination of the externalities of neighbourhood churches on housing values. Journal of Real Estate Finance and Economics, Vol. 9, pp 127-136. Downes, T.A. and Zabel, J.E. (2002) The impact of school characteristics on house prices: Chicago 1987-1991. Journal of Urban Economics, Vol. 52, pp 1-25. Elkins, T. and Elliott, J. (2004) Competition and control: the impact of government regulation on teaching and learning in English schools. Research Papers in Education, Vol. 19, No. 1, pp 15-30. Fleming, M.C. and Nellis, J.G. (1985) The Application of Hedonic Indexing Methods: A Study of House Prices in the United Kingdom. Statistical Journal of the United Nations, ECE 3, pp. 249-270. Forrest, D., Glen, J. and Ward, R. (1996) The impact of a light rail system on the structure of house prices: a hedonic longitudinal study. Journal of Transport Economics and Policy, Vol. 30, No. 1, pp 15-29. 30 Garrod, G.D. and Willis, K.G. (1992) Valuing goods’ characteristics: an application of the hedonic price method to environmental attributes. Journal of Environmental Management, Vol. 34, pp 56-76. Gibbons, S. and Machin, S. (2008) Valuing school quality, better transport, and lower crime: evidence from house prices. Oxford Review of Economic Policy, Vol. 24, No. 1, pp 99-119. Graves, P., Murdoch, D.C., Thayer M.A. and Waldman D. (1998) The Robustness of Hedonic Price Estimation: Urban Air Quality. Land Economics, Vol. 64, No. 3, pp 220-233. Haurin, D. and Brasington, D. (1996) School quality and real house prices: inter and intrametropolitan effects. Journal of Housing Economics, Vol. 5, pp 351-368. Hayes, K.J. and Taylor, L.L. (1997) Neighbourhood school characteristics: What signals quality to homebuyers? Federal Reserve Bank of Dallas Economic Review, Vol. 4, pp 2-9. Hilber, C.A.L. and Mayer, C. (2004) Why do households without children support local public schools? Linking house price capitalisation to school spending. Working Paper, No. 10804, NBER, October. Hoyt, W.H. (1999) Leviathan, local government expenditures, and capitalization. Regional Science and Urban Economics, Vol. 29, pp 155-171. Lambert, D. and Lines, D. (2000) Understanding assessment: Purposes, perceptions, practice London: Routledge Falmer. Leech, D. and Campos, E. (2003) Is comprehensive education really free? A case study of the effects of secondary school admissions policies on house prices in one local area. Journal of the Royal Statistical Society, Vol. 166, Part 1, pp 135-154. Levensque, T.J. (1994) Modelling the effects of airport noise on residential housing markets: A case study of Winnipeg International Airport. Journal of Transport Economics and Policy. Vol. 28, pp 199-210. 31 McCluskey, J.J and Rausser, G.C. (2000) Hazardous waste sites and housing appreciation rates, mimeo. University of California: Berkeley. Rosenthal, L. (2003) The value of secondary school quality. Oxford Bulletin of Economics and Statistics, Vol. 65, No. 3, pp 329-355. Starrett, D. (1981) Land value capitalization in local public finance. Journal of Political Economy, Vol. 89, pp 306-327. Taylor, L.L. (2005) Revealed-preference measures of school quality. In L. Stiefel, A.E. Schwartz, R. Rubinstein, J. Zabel (Eds), Measuring school performance and efficiency: Implications for practice and research. Eye on Education: Larchmont, NV, pp 163-183. Weimer, D.L. and Wolkoff, M.J. (2001) School performance and housing values using non contiguous district and incorporation boundaries to identify school effects. National Tax Journal, Vol. 45, pp 231-254. Wildasin, D.E. (1987) Theoretical Analysis of Local Public Economics. In E.S. Mills (Ed), Handbook of Regional and Urban Economics, Vol. II, North Holland, Amsterdam, pp 11321178. 32